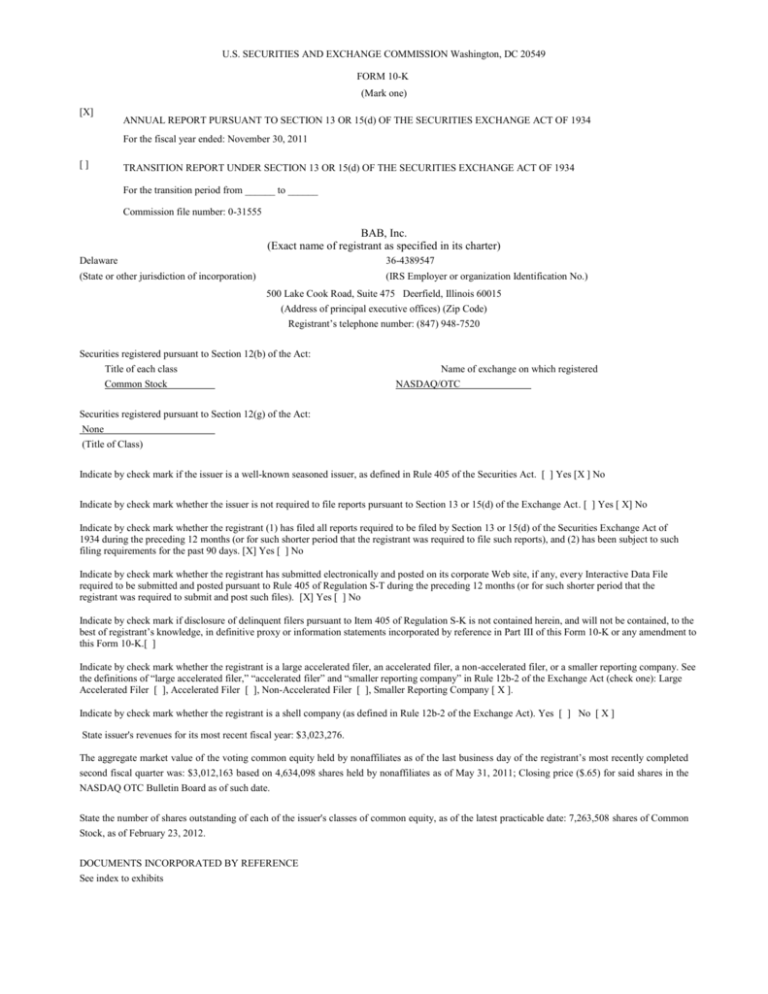

BAB, Inc - Big Apple Bagels

advertisement