08/05/02 - the Montana Telecommunications Association

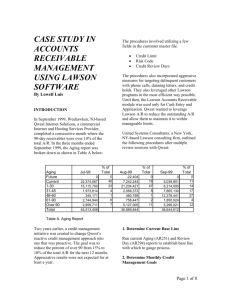

advertisement

THE CONNECTION August 5, 2002 2002, MONTANA TELECOMMUNICATIONS ASSOCIATION Helena, Montana www.telecomassn.org Deadlines: August 1. Montana Department of Transportation requested deadline for statewide implementation of “511” dialing access for traveler information. August 1. Form 499-Q. Telecommunications Reporting Worksheet due at FCC. August 6. Reply comments on FCC cable modem NPRM due re: appropriate regulatory treatment for broadband access to the Internet over cable facilities. August 15. Slamming Complaint Report due at FCC. August 27. Auction date for lower 700 MHz (C&D blocks only) auction, postponed from June 19. September 1. Local competition and broadband reporting form (Form 477) filing deadline for carriers with 10,000 lines or more or broadband providers that serve at least 250 lines. September 18. Auction of 66 licenses within spectrum bands: 1390-92 MHz; 1392-95 MHz; 1432-35 MHz; 1670-75 MHz; and 2385-90 MHz. October 1. Customer deposit rates change to 6%. October 16. FCC public forum on rights of way management. December 20. Short form applications due for multichannel video distribution and data service (MCDDS) licenses. Auction on February 12, 2003. January 14, 2003. Upper 700 MHz auction. March 1, 2003. New deadline for 50% Phase II implementation of E911 for Tier II wireless carriers (more than 500,000 subscribers). Network-based implementation must be 100% complete by March 1, 2004, or within 18 months of a PSAP request. Handset-based solutions must be 95% deployed by 12/31/05. Deadlines for Tier III carriers (qualifying as small businesses) are September 1, 2003 for 50% deployment (or 6 months after PSAP request) for network-based solutions; and September 1, 2004 for 100% deployment (or 18 months after PSAP request). For handset solutions, the deadlines are 9/1/03 and 12/31/05. State Regulatory Review: D2001.7.98. Clark Fork Non-Rate Tariff. MTA filed testimony in May as an intervenor in this docket. MTA argues Qwest selectively deploys obsolete Feature Group C trunking technology in a manner that prevents independent local exchange carriers (LECs) from accurately measuring and billing for traffic that terminates on their networks. Qwest served MTA with several data requests, to which MTA responded in part and objected in part in a June reply. The Commission, in a June 25 Notice, generally sustained MTA’s objections to data requests that MTA contended were unreasonable. On July 16, MTA filed supplemental responses pursuant to the Commission’s Notice. Qwest then moved on July 22 to strike MTA’s testimony, in a legal maneuver MTA likens to restricting its rights to free speech and assembly. MTA filed its response opposing Qwest’s motion on August 2. In a related matter, at its July 23 work session, the Commission voted 5-0 to grant a protective order (PO) for Qwest regarding its feature group D deployment. Qwest contends such information is confidential to carriers purchasing service. Staff noted the Commission customarily protects such information. Qwest also wanted a broadly worded PO to avoid repeated future applications. “We’re beyond that,” given recent developments, staff noted. Broadly worded PO’s are “out.” WorldCom Bankruptcy. The largest bankruptcy in U.S. history threatens to wipe hundreds of thousands of dollars of uncollected receivables off the books (and out of the revenue stream) of LECs in Montana. The FCC and WorldCom have assured consumers that they will continue to receive long distance service from the company during its bankruptcy proceedings. However, they have not assured carriers that they will receive payment for uncollected pre-bankruptcy petition access payments. Nor has there been any assurance that WorldCom’s pre-petition universal service support payments will be honored. As for post-petition transactions, it remains to be seen how access payments to carriers will be treated. (Remember, universal service support and access payments comprise as much as 80 percent of rural, high cost carriers’ revenues; and WorldCom is a substantial access customer.) WorldCom wants to treat LECs like “utilities,” a classification that diminishes its obligations to pay pre- and post-petition debts. Meanwhile, bankruptcy protects WorldCom from a variety of remedies that LECs might otherwise be able to effect. Little attention is given to well-run companies left standing after others like WorldCom and Global Crossing crash and burn. It appears to MTA that bankruptcy actually is a reward for poorly run companies. Those who benefit the most from bankruptcy are the bankrupt companies themselves. L-02.1.1-RUL. Hot Springs Tel Hearing on Customer Deposits. At the Commission’s July 2 work session, Staff attorney Martin Jacobson reviewed the comments received at the Commission’s hearing on the Commission’s rules pertaining to customer deposit rates. (MTA testified at the hearing, recommending a market-based interest rate, which more accurately reflects consumers’ opportunity costs of capital.) MCC favored no change (i.e., 12% per year). Hot Springs favored a 3% fixed rate. Most utilities/associations favored pegging rates to a national standard, adjusted annually. Staff recommended adopting fixed rate at somewhere between 3% and 6%. Alternatively, a national standard would be acceptable, but that would present a greater administrative burden. Staff further recommended keeping the existing (12%) rate until the new rule takes effect on 10/1/02. Staff indicated it initially thought 3% was appropriate, but “after discussions” found that 6% was better. Commissioner Brainard noted that a consumer’s opportunity cost of deposit funds is a passbook savings rate at 1.5%, at best; 6% seems high. But Commissioner Anderson equated deposits to “customer-loaned capital.” Commissioners voted, 5-0, to establish a rate at 6%, effective October 1. (See ARM 38.5.1107.) 2 D2002.7.87. Cost-Based Wholesale Prices for the Remainder of Qwest’s Network Elements. First, there was D2000.6.89, in which Qwest, Montana Wireless, Avista, Touch America and others agreed to stipulated rates for certain unbundled network elements (UNEs). Then, on July 9, the Commission acted on a request by Qwest to approve revisions in D2000.6.80, Qwest’s Generally Available Terms and Conditions (SGAT). The SGAT revisions were made pursuant to Qwest’s 271 proceedings in D2001.5.70. Attached to the SGAT filing were a host of new UNE rates, which were “benchmarked” to UNE rates in Colorado. The new benchmarked rates altered (lowered, according to Qwest) the UNE rates which were stipulated in D2000.6.89. The Commission allowed the new Colorado benchmarked rates to go into effect on July 10, but retained its jurisdiction to review the rates and/or issues raised by CLECs, the Commission or other parties as provided under Sec. 252(f) of the Telecommunications Act. Now comes this application, which includes extensive cost models and other data pertaining to network elements that were not “costed and priced” in D2000.6.89 or other elements not found in, or revised from the current SGAT. Requests to intervene were received by July 30. A procedural schedule was developed discussed on August 2. D2000.5.70. Qwest Sec. 271 Application to Provide in-Region Long Distance Service. Consultative Report. On July 23, staff reviewed the final step in the Qwest 271 proceeding: producing the Commission’s report to the FCC to accompany Qwest’s application to offer in-region long distance services. Commissioner Rowe expressed concerns with tying Qwest’s refusal to provide “reverse line sharing” (RLS) as referenced under Checklist Item #4, to the public interest (PI) report. (RLS allows a customer to take data service from Qwest, but voice from an alternative carrier.) The Commission’s Report on Checklist Item #4 (emerging services) cited RLS as a barrier to entry; and as such it is a public interest concern. Staff asserted that the issue best belongs as a public interest matter; but the FCC may reverse the Commission if they so choose. Staff further noted their belief that Qwest’s refusal to provide RLS is clear entry barrier. States are encouraged in the 271 process to develop their own reports and orders. Antonuk’s report notes that states may reach own conclusions regardless of what other states may or may not have done. After voting 5-0 to approve the final consultative report, Rowe noted he would write a dissenting opinion. QPAP. Qwest initially notified the Commission that it wouldn’t comply with the Commission-ordered Qwest performance assurance plan (QPAP). On 6/18, Qwest filed a “largely compliant” PAP, according to a staff analysis provided during the Commission’s 7/2 work session. Staff identified areas where the PAP is still not in compliance with the Commission’s earlier order. Qwest then filed a new PAP on 6/30. Except for 2 provisions, the latest filing complied with the Commission’s final report. The two provisions had not been reviewed by the Commission or other parties, even though other states have adopted similar or identical provisions that allow for automatic SGAT changes. Staff recommended temporary approval of the “new” provisions, and reserved a place for them as “exceptions” on the agenda for the Commission’s first 6-month review under the PAP process. Staff also reported that Q offered a “sweetener:” it would provide an advance not to exceed $50,000 to be deposited in a Tier II account for use in 3 Commission-initiated audits or multistate QPAP initiatives. Commissioners adopted staff recommendations on July 2 on a 5-0 vote. Public Interest. Also on July 2, the Commission discussed its public interest (PI) report following review of several revisions by Qwest to its performance assurance plan (PAP). (See above.) Staff reiterated the Commission’s earlier findings that Qwest enjoys a price squeeze wherein it effectively charges itself for access to its own network (once granted entry into the long distance market) while its competitors need to purchase the same access from Qwest. In response to lengthy discussions of carrier access charges and the price squeeze “finding,” the PI report notes that Qwest could fail to meet the Commission’s public interest standard if fails to file a revenue requirements and rate design case by 10/2. Staff further reminded Commissioners that the PI report concludes that Qwest’s application to enter long distance market does not meet PI since Qwest has refused to provide reverse line sharing. Regarding Qwest’s illegal offering of its WinBack promotion, staff noted that the PI Report already addresses WinBack as part of a future retail rate proceeding. Commissioners adopted the final PI report, 5-0, on July 2. Wrap-Up Issues. PSC staffer, Kate Whitney, summarized final wrap-issues at the Commission’s July 2 work session: OSS. Of over 500 OSS (Operations Systems Support) measurements, Qwest failed 11 tests; KPMG was unable to determine 25 test results; and Qwest passed the rest. The comprehensive ROC (Regional Oversight Committee) OSS testing demonstrates that Qwest meets the FCC’s OSS requirements. Staff “takes note” of two issues. First, regarding manuallyprocessed orders, staff indicated that a performance indicator (PID) in Qwest’s performance assurance plan (PAP) should handle this. Second, regarding accuracy of performance results, staff noted that KPMG was unable to determine whether a pseudo-CLEC (competitive local exchange carrier), which was set up to test Qwest’s wholesale performance, accurately measured actual performance results. Unresolved Final Report Issues: 1) change management process (CMP). Staff observed that Qwest’s CMP meets FCC’s requirements despite the fact that Qwest’s CMP plan is still being drafted and therefore is difficult to determine “with finality” whether it meets FCC requirements. 2) Checklist Item #14, Resale. Staff found that Qwest provides complete, accurate and timely billing information to CLECs. Therefore, Qwest satisfied resale requirements. Miscellaneous issues. Kate found that CLECs have appropriate access to OSS. CLECs also have appropriate commercial access to UNE-P (combined unbundled elements). She noted that wholesale billing addressing recently has been a “problem,” with Qwest missing measures in the last 3 months; but this can/will be addressed in PAP, subject to penalty/payments. She noted that measurements of premature disconnects need to be improved or developed. She recommended inserting PAP language to require Qwest not to prematurely disconnect a CLEC when a request is timely filed. Regarding 911, Qwest fails to notify Intrado (the database administrator for 911 4 information) in a timely manner when customers move to CLECs. Kate noted that Qwest would file new SGAT provisions to address this situation. (See above.) Commissioners approved the Wrap-Up Report, 5-0. N2002.7.85 & 86. Clark Fork and Lincoln POs. At the Commission’s 7/16 Work Session, staff noted that companies can file generic protective orders to cover Annual Reports, subject to proper application by companies. N2002.5.51. Qwest Tariff (Meet Point Billing). Staff economist, Marla Larson, reminded Commissioners at the 7/9 work session that these Tariff changes are designed to conform Qwest’s meet point billing tariffs to FCC guidelines. Staff wasn’t sure what effect of some of the amendments may have on carrier-to-carrier relationships. So the Commission noticed the amendments to ensure ample opportunity for parties to intervene, if appropriate. No comments had been received as of the Notice’s 7/1 deadline; therefore Commissioners approved the Tariff amendments on a 5-0 vote. D2002.3.29. Integretel Cramming. Motion for Reconsideration. Integretel requested reconsideration of the Commission’s Order requiring credits to be given to consumers who had been “crammed” for services not rendered. Integretel wanted more time in which provide a response to the Commission’s Order. The company also expressed concern about the precedential consequences of providing full credits without a formal (i.e., judicial) judgement having been lodged against them. Staff argued at the 7/9 work session that the Commission deny Integretel’s motion regarding jurisdiction, and grant the motion regarding a procedural schedule. Staff recommended a 10-day schedule for Integretel to offer its proposal to settle the issue, or to file a motion on the merits of the complaint. Commissioners adopted staff recommendations: 5-0. D2002.2.14 & .22. Local Carrier Freeze Option. Motion for Reconsideration. Earlier this year, the Commission acknowledged that Qwest’s local carrier freeze option conforms to Commission Rules. (MTA filed comments in this docket, opposing Qwest’s proposed local freeze option as anticompetitive in the face of little or no competition.) However, the Commission suspended implementation for 18 months, after which time Qwest could ask the Commission to revisit its decision. Qwest’s motion for reconsideration argues that the Commission’s action is wrong both substantively and procedurally. The Commission Order violates Qwest’s due process rights, according to Qwest’s motion. It violates the Commission’s own notice procedures. Staff noted at the Commission’s 7/9 work session that the process in this matter was “goofy to begin with.” Qwest never applied for Commission approval of a freeze. Instead, Qwest just sent a letter to the Chairman. Staff nevertheless agrees with Qwest’s procedural arguments and therefore recommended granting Qwest’s motion. Commissioners voted, 5-0 to direct Qwest to submit a tariff filing, with notice, intervention, etc. D99.5.129. Project Tel EAS Reserved Issue. Earlier this year, the Commission granted EAS (extended area service) into Billings for most of Project’s exchanges, but reserved consideration of granting EAS for two Wyoming exchanges interested in joining the Billings area exchanges. Project conducted a poll of affected customers in WY. 55% of 5 282 customers responded to poll. 60% of these were opposed to EAS. Staff noted that this is very high opposition percentage (usually opposition runs in the 5% range). Consequently staff recommended not approving EAS for these exchanges. Commissioners voted, 5-0, on 7/9 to close the docket, without prejudice. D2001.11.147. Mid-Rivers EAS. M-R and parties agreed to stipulate to earlier Phase I “community of interest” findings as still valid. Staff recommended at the Commission’s July 2 work session to adopt previous Phase I findings and moving directly to Phase II. Commissioners agreed: 5-0. D2002.2.55, 56, 57. BTC, CFT, RTC Disaggregation Plans. At its July 9 work session the Commission approved the disaggregation plans of Blackfoot, Clark Fork and Ronan, pursuant to the Commission’s responsibilities under FCC rules. These carriers were the only ones to opt for plans requiring Commission review. Blackfoot and Clark Fork sought approval for Plans dividing their service territories into two density zones; Ronan’s Plan includes three zones. Staff indicated the filings appear to be in accordance with FCC requirements. Commissioners adopted the plans, 5-0, without further analysis. (See Protective Order Nos. 6429, 6430, and 6431.) L-02.6.3-RUL. Protective Orders. Commissioners voted, 5-0, at their July 2 work session to adopt new rules pertaining to protective orders. The new rule doesn’t significantly alter the current process, according to staff. The new rule clarifies the option of noticing PO applications/requests. (See ARM 38.2.5007.) D2002.6.71, 72, and 73. Mid-Rivers Petitions for Designation as an Eligible Telecommunications Carrier (ETC) in Glendive, Miles City, and Sidney. Notice of Application and Intervention Deadline, issued July, 7; deadline: August 7. Interconnection Agreements: D2002.3.28. Qwest/VoiceStream Wireless. Interconnection Agreement. Final Order No. 6426. 7/17/02. D2002.3.32. Qwest/Network Services. Interconnection Agreement. Final Order No. 6427. 7/17/02. D2002.3.37. Qwest/KMC Telecom V. Interconnection Agreement. Final Order No. 6428. 7/17/02. D2002.7.84. Qwest/ICG Telecom Group. Notice of Application for Approval of Interconnection Agreement. 7/12/02. D2002.7.83. Qwest/GANOCO (d.b.a. American Dial Tone). Notice of Application for Approval of Interconnection Agreement. 7/12/02. D2002.7.91. Qwest/Excel Telecommunications. Notice of Application for Approval of SGAT for Interconnection, UNEs, Resale, etc. 7/19/02. PSC Legislation. On 7/16, Commissioners discussed the up-coming Legislative Special Session. No bills being considered at the time were perceived to have an affect on Commission activity. However, Commissioner Brainard had asked staff to look into cramming/slamming enforcement legislation, both from the perspective of providing additional Commission enforcement authority as well as from a budget/revenue 6 standpoint. Monica Tranel (staff attorney) noted that California law provides enforcement authority against any party that bills the end user, not just the company that initiates a call. Brainard argued that companies that bill for others (who are defrauding the public) are themselves participating in fraud. To the extent that 3rd party billers are profiting, those monies should be captured. He also contends the Commission should be able to prosecute slammers/crammers in criminal proceedings. Commissioners discussed whether the Special Session was the appropriate forum in which to introduce such legislation, noting that there was little time in which to find a sponsor, and it was questionable whether such a bill would be considered a revenue bill for purposes of the Special Session. Legislative Ledger Special Session. (For a detailed listing of bills proposed and introduced in the Special Session, and for bill status summaries, go to the Legislature’s web site at: http://laws.leg.state.mt.us/pls/lawsss/LAW0200W$.startup) Following is a partial listing of bills of particular interest to MTA and its independent telco members: SB 5. Introduced by Sen. Sam Kitzenberg (R-Glasgow). This bill would establish an employer payroll tax of 0.8% and an employee payroll tax of 0.32%. SB 13. Introduced by Sen. Dan Harrington (D-Butte). This bill would make taxable any software that is depreciable or amortizable under the federal internal revenue code. Current law treats all software as intangible, exempt from business personal property tax. SB 16. Introduced by Sen. Jon Ellingson (D-Missoula). Increase business equipment tax from 3% to 6% on property valued between $450,000 and $4.5 million; and to 9% for property over $5 million. LC0078. Sen. Chris Christiaens (D-Great Falls). Transfer universal service access funds (approx. $250,000) from the PSC to the general fund. Other Matters: (E-)911. MTA helped organize an ILEC videoconference meeting with Montana 911 Program Director, Jenny Hansen, and her staff on July 18. Hansen noted she’s seeking a federal appropriation of $3 million, $1.2 million of which she hopes to use in accelerating deployment of E-911 to selected areas of the State. Meanwhile, the Montana Sheriffs and Police Officers Association (MSPOA) is seeking $2 million to initiate a “reverse 911” program. Hansen mentioned she intends to work with other agencies in developing GIS or other location/addressing information, and to help counties coordinate trunk usage to/from selective routers. Other issues involve facilitating coordination between local exchange carriers (LECs) and public service answering points (PSAPs), and treatment (i.e., non-disclosure) of data by all parties. Hansen shared w/MTA a model RFP and model data contract for companies to use in developing E-911 deployment strategies. Meanwhile, the FCC ruled in July that the selective router is the demarcation point for allocation of 911 costs between LECs and PSAPs. 7 511 Service. As reported in the last edition of The Connection, the Montana Department of Transportation (MDT) requested statewide implementation of a threedigit “511” travel advisory number for motorists traveling in Montana. The department requested an implementation deadline of August 1. Historic Easements. MTA participated in a briefing by DNRC on 7/1. Lisa Axline, RoW coordinator, (444. 2074). Axline reviewed historic easement rules, which apply only to easements prior to 1997. Under the Department’s historic easement policy, upgrades would disqualify easements from treatment as historic easements. Replacing copper with fiber, for example, would require new easements, even though a company may use the same area/easement for the new facilities. Companies need to file separate applications for each section of state land crossed. If providing service to a homestead on state lands, which is the end of the line (i.e., the facility goes no further than to provide service to that end user), then there’s no need to file an application, as that is already covered in the land lease agreements. DNRC described a variety of documentation the department prefers in demonstrating existence of easements. Axline noted the department aims for a 60-90 day approval time frame, assuming other issues (i.e., MEPA, environmental assessments) do not intervene. (MTA notes that its members have encountered delays of more than a year in obtaining easements. In comments before the State Land Board, MTA noted that the historic easement process is one that should be “modeled” statewide.) As if to corroborate MTA’s concerns, Axline noted that DNR’s historic easement processes are different than others, including the department’s own “new” easement policies as well as those of FWP, MDT, Water Resources, et al. Right of Way. In addition to MTA’s comments in June before the State Land Board, MTA is consulting with both the Martz and Bush Administrations in Helena and Washington. In April, MTA visited Executive Branch agencies to deliver its message regarding the effect of current right of way policies (or lack thereof) on deployment of advanced telecommunications infrastructure. MTA has been invited to continue these discussions. Meanwhile, the U.S. House of Representatives passed H.R.3258, which clarifies how fair market value is determined for certain rights of way granted by the Interior and Agriculture Departments. On the other hand, the National Association of Regulatory Utility Commissioners (NARUC) blinked at its summer meeting, July 30. NARUC’s Telecommunications Committee decided to “carefully review” the issue. Spectrum. The National Telecommunications and Information Administration released a report in late July concluding that 90 megahertz (MHz) of spectrum can be freed up by government and non-government users to create enough wireless spectrum for third generation (3G) wireless telecommunications applications. (Meanwhile, 3G ventures in Europe are quickly scaling back their goals and ambitions…) Broadband Connections. A study by Pew Research Center finds 21% of U.S. Internet users have a broadband connection in their home, up from 6% in early 2000. (USTA Telecom Daily Lead, 7/11/02.) The FCC also released a statistical summary in July showing that high-speed (faster than 200 KBps) Internet connections to homes and businesses increased by 8 33% in the second half of 2001 to a total of 12.8 million connections. DSL lines increased by 47% to 3.9 million lines. Cable-modem lines increased 36% to 7.1 million lines. (Bennet Law’s Rural Spectrum Scanner, 7/26.) CLEC Penetration. The FCC released its July report on status of local competition in the U.S. CLECs have about 19.7 million (or 10.3%) of the nation’s roughly 192 million local telephone lines in service, compared to 17.3 million (7.7%) at the end of 2001. At least one CLEC exists in 62% of the nation’s zip codes, compared to 56% in 2001. (Bennet Law’s Rural Spectrum Scanner, 7/26.) Who’s News: Warren Taylor, a 19-year veteran of InterBel’s Board, and former Director of MTA, has resigned his post at InterBel and is moving south (to the Flathead Lake area) to be closer to his family. We wish Warren all the best in the South, and thank him for his leadership, commitment, and dedication to MTA, InterBel and Montana’s telecommunications industry. Art Isley won the MTA 2002 Distinguished Leadership Award at MTA’s Annual Meeting on July 12. In the 12 years since Art has been at the helm of 3 Rivers, the company has grown from 8,000 access lines to 21,000 access lines, and from $6 million in annual operating revenues to over $23 million. The company has grown in to a multifaceted telecommunications provider, offering local, long distance, competitive local exchange, wireless, and satellite broadband services. Congratulations Art! Bobbie Stoken, a director of InterBel Telephone Cooperative, was elected President of MTA by its Board of Directors on July 12 at the Annual Meeting. Conrad Eklund, general manager of Southern Montana Telephone Company, was elected Vice President, and Bud Johnson, a Director and past President of 3 Rivers Communications, is Secretary-Treasurer. Congratulations to Bobbie, Conrad, and Bud!!! MTA Matters: We’re gearing up for the Annual Showcase at the Billings Holiday Inn Grande Montana on December 4-5. MTA associate member/vendors already are making reservations, and MTA and its members are beginning to put the program together. Visit MTA’s web site at www.telecomassn.org for registration and/or more information! 9