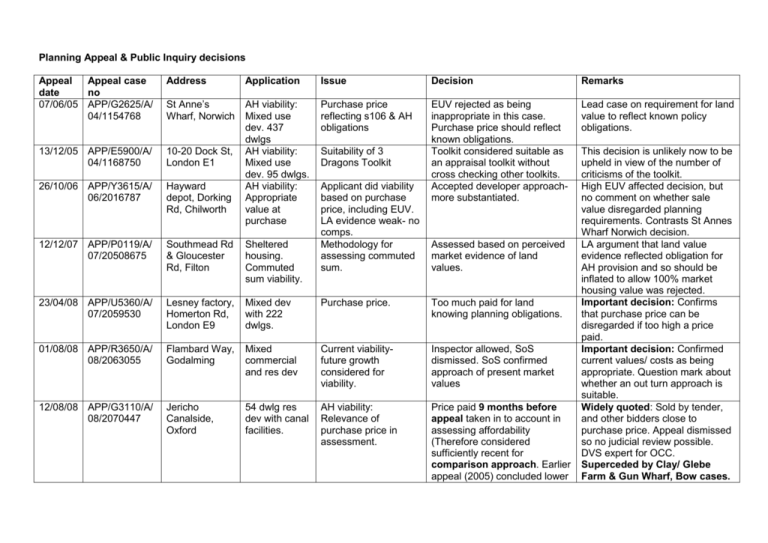

Planning Appeal & Public Inquiry decisions

advertisement

Planning Appeal & Public Inquiry decisions Appeal Appeal case date no 07/06/05 APP/G2625/A/ 04/1154768 Address Application Issue Decision Remarks St Anne’s Wharf, Norwich Purchase price reflecting s106 & AH obligations 10-20 Dock St, London E1 26/10/06 APP/Y3615/A/ 06/2016787 Hayward depot, Dorking Rd, Chilworth EUV rejected as being inappropriate in this case. Purchase price should reflect known obligations. Toolkit considered suitable as an appraisal toolkit without cross checking other toolkits. Accepted developer approachmore substantiated. Lead case on requirement for land value to reflect known policy obligations. 13/12/05 APP/E5900/A/ 04/1168750 AH viability: Mixed use dev. 437 dwlgs AH viability: Mixed use dev. 95 dwlgs. AH viability: Appropriate value at purchase 12/12/07 APP/P0119/A/ 07/20508675 Southmead Rd & Gloucester Rd, Filton Sheltered housing. Commuted sum viability. 23/04/08 APP/U5360/A/ 07/2059530 Lesney factory, Homerton Rd, London E9 Mixed dev with 222 dwlgs. Purchase price. Too much paid for land knowing planning obligations. 01/08/08 APP/R3650/A/ 08/2063055 Flambard Way, Godalming Mixed commercial and res dev Current viabilityfuture growth considered for viability. Inspector allowed, SoS dismissed. SoS confirmed approach of present market values 12/08/08 APP/G3110/A/ 08/2070447 Jericho Canalside, Oxford 54 dwlg res dev with canal facilities. AH viability: Relevance of purchase price in assessment. Price paid 9 months before appeal taken in to account in assessing affordability (Therefore considered sufficiently recent for comparison approach. Earlier appeal (2005) concluded lower Suitability of 3 Dragons Toolkit Applicant did viability based on purchase price, including EUV. LA evidence weak- no comps. Methodology for assessing commuted sum. Assessed based on perceived market evidence of land values. This decision is unlikely now to be upheld in view of the number of criticisms of the toolkit. High EUV affected decision, but no comment on whether sale value disregarded planning requirements. Contrasts St Annes Wharf Norwich decision. LA argument that land value evidence reflected obligation for AH provision and so should be inflated to allow 100% market housing value was rejected. Important decision: Confirms that purchase price can be disregarded if too high a price paid. Important decision: Confirmed current values/ costs as being appropriate. Question mark about whether an out turn approach is suitable. Widely quoted: Sold by tender, and other bidders close to purchase price. Appeal dismissed so no judicial review possible. DVS expert for OCC. Superceded by Clay/ Glebe Farm & Gun Wharf, Bow cases. 19/08/08 APP/P0119/A/ 08/2069226 67-73 Bath Rd, Longwell Green, Bristol 27/08/08 APP/F5540/A/ 08/2073381 1 Ivy Lane, Hounslow 11/02/09 APP/C3810/A/ 08/2086867 Fitzalan Rd, & Church St, Littlehampton 26/02/09 APP/G1580/A/ 08/2084559 Maunsell House, 154 160 Croydon Road, Beckenham 189 Streatham Rd, Mitcham 02/03/09 APP/T5720/A/ 08/2087666 Sheltered housing. Commuted sum viability. AH viability: Res dev 18 flats Purchase price v current values/ costs Sheltered housing. Commuted sum viability. New residential development Date of viability review. Mixed deve with 14 dwlgs. Date of assessment Emerging AH & S106 policy affecting viability. Uplift in site value above MV in existing use. AH provision was reasonabletaken in to account. Explicitly approves methodology of current sales, costs and land values using appraisal toolkit. Because of incorrect advice given, impact of this should be taken in to account in assessing viability. Taken as June/ Aug 2008after original planning application and purchase date, but not at date of appeal. Inspector accepted the principle of uplift in MV over existing (Offices) use to incentivise land owner to bring site forward. Taken as being current use value, using values at date of appeal. 30/04/09 APP/E2001/V/ 08/1203215 Land N of Flemingate, Beverley Multi phase mixed development Viability approach on multi-phase schemes Assessment of viability on multi-phases should be made as they come forward for detailed planning, not at the initial overall outline stage. 19/07/09 APP/J4423/E/0 9/2096569 Norton Church Hall, Sheffield New res development New LA SPD to be taken in to account at appeal. 05/08/09 APP/K5600/A/ 09/2097458 41-43 Beaufort Gardens, Conversion of hotel to 9 flats Build costs- day 1. Inspector accepted that new SPD adopted after planning application should be taken in to account in appeal consideration. Build costs specifically identified as being assessed at Toolkit used was HC/ Grimley model. Purchase price not considered. Purchaser misled by LA on policy requirement, resulting in overpayment for site. Limited impact because of unusual circumstances. Neither party updated appraisal to appeal date, and not commented by inspector. Limited application. Important decision: Inspector considered 20% uplift on a site value of ~£2m was reasonable in this case. Decision considers need to be pragmatic in current depressed market conditions to get development underway. Important decision: SoS review. Multi-phase scheme. Viability on schemes in the future should be addressed at that time when market conditions prevailing may differ to the current market. SPD related to AH requirement. Appeal allowed. Inspector reluctant to agree whose evidence London SW1 06/10/09 APP/P165/A/0 8/2082407 Land at Lydney Bypass, Lydney Large strategic dev site Whether an out-turn approach is the correct method 11/12/09 High Court hearing Wakefield DC LDP viability assessment Viability approach 25/02/10 APP/Q0505/A/ 09/2103599 Clay Farm & Glebe Farm, Shelford Rd, Cambridge Multi phase strategic res dev site Viability methodology. Use of price paid for land. 26/05/10 APP/N1215/A/ 09/2117195 Former Royal Hotel, Newbury, Gillingham Viability Methodology 10/03/10 APP/C1950/A/ 09/2113786 Roche buildings, Broadwater Road, Welwyn Garden City Viability Land valuation date & escalator mechanism 30/06/10 APP/G1630/A/ 09/2097181 West of Multi phase Innsworth Lane strategic res Viability reviews deferred if AH amount day 1, not mid point. Insp preferred Savills house sales evidence as based on Estate Agency knowledge Confirms that in multi-phase strategic sites developable over many years an out-turn approach is reasonable Barratts challenged report as being too optimistic based on current viability, showing 30% AH viability over the cycle of LDP period. Land price paid is irrelevant, as is developer’s accountancy method. Risk reflects market uncertainty and AH should not be the “flex”. Insp took account of economic cycle argument even though this was not raised by either expert. he preferred. Important decision: Specifically contrasted approach at Flambards Way, Godalming. Supported by SoS, Ct of Appeal & High Court. Case dismissed. The policy adopted did pay due regard to national policy Important decision: dealing with viability approach, use of land price paid etc. SoS decisiondiffered from PINS re use of Supplementary Planning Obligation to deal with delivery mechanics for AH. Considers delivery a short term problem and can be ignored in this case. LA argued discounts of LA sought discount of build cost, defaults because of “in house” prof fees, profit & interest cost. services available to developer. Insp preferred industry Arguments rejected by insp, “standards” in the absence of who preferred HCA EAT & good alternative evidence. BCIS data. Appellant argued land value as Insp reiterated the existing land purchase price to ensure value is correct approach. Developer carries risk not LA. delivery, and proposed escalator mechanism for commuted sum in lieu of AH/s106. Insp rejected bothLA should not carry the risk. Case supports the Beverley, lydney Similar arguments as Lydney. and HCA documents requirement to Insp did not appear to revisit viability in long phased & North of A40, Innsworth, Gloucester Gun Wharf, 241 Old Ford Road, London dev site is inadequate. understand IRR approach on multi-phase developments schemes Viability Methodology for site value Appellant sought to adopt write down from 2007 purchase price. LA argued policy compliant RLV basis 03/12/10 APP/G2713/A/ 10/2127485 1 Leeming Lane, Leeming Bar, Northallerton Viability Market evidence & profit levels P Lee (DVS) housing sales evidence felt to be more robust than that of Savills. Profit level at 15% based on market evidence accepted. PL used a % of GDV for interest Insp confirmed Clay Farm & Welwyn Garden City appeals approach was correct- RLV. Regard only to purchase price in contextual information. Appeal dismissed. Worth noting the preference of our evidence over Savills- in contrast to appeal inspector at 41-45 Beaufort Gardens 12/04/11 APP/V5570/E/ 10/2127802 Carlton Cinema, 161 Essex, London Enabling development. Approach to assessing viability Requirement for the appellant to demonstrate: 1. A business case for works. 2. That alternative options had been fully considered. 3. That the works proposed should not aim to recover original purchase price, but be sufficient to pay for the restoration works. 4. Use of the building will ensure future sustainability of the building. 5. That the development would be deliverable. 03/11/10 APP/E5900/A/ 10/2127467 Appeal dismissed. Appellant’s expert adopted a future growth approachNo comment made about this. Main concern was that the enabling works would not be done ‘til after the funding development had been completed- Lack of certainty and risk of enabling works being done because of this.