Solution to Assignment 2

advertisement

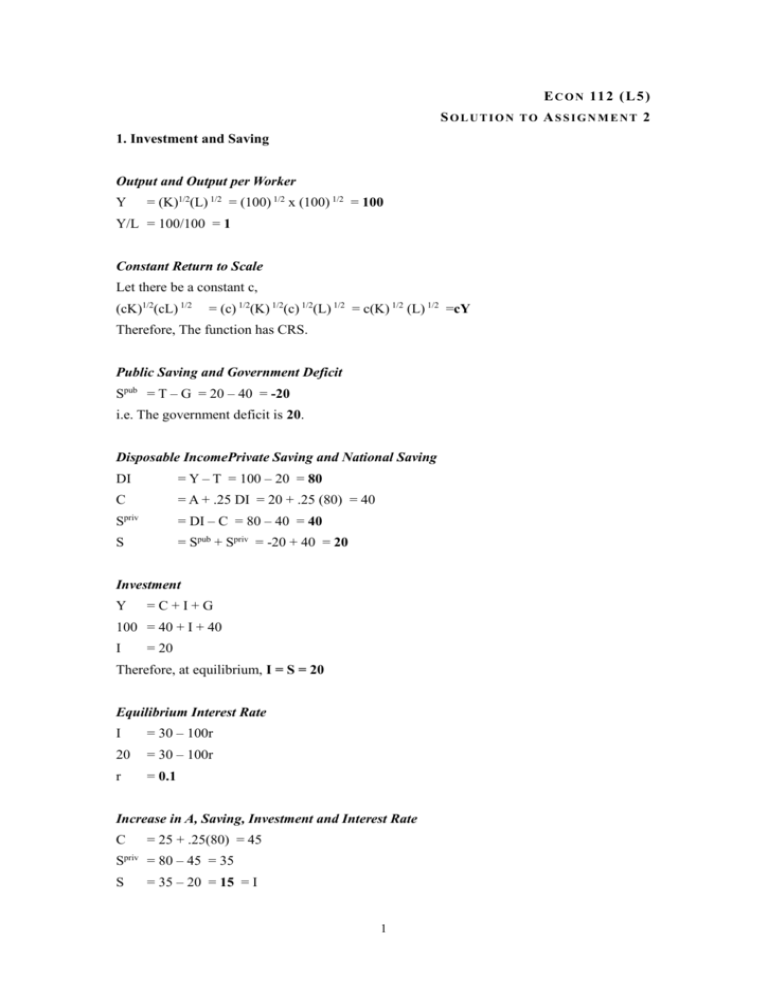

E C O N 11 2 ( L 5 ) SOLUTION TO ASSIGNMENT 2 1. Investment and Saving Output and Output per Worker Y = (K)1/2(L) 1/2 = (100) 1/2 x (100) 1/2 = 100 Y/L = 100/100 = 1 Constant Return to Scale Let there be a constant c, (cK)1/2(cL) 1/2 = (c) 1/2(K) 1/2(c) 1/2(L) 1/2 = c(K) 1/2 (L) 1/2 =cY Therefore, The function has CRS. Public Saving and Government Deficit Spub = T – G = 20 – 40 = -20 i.e. The government deficit is 20. Disposable IncomePrivate Saving and National Saving DI = Y – T = 100 – 20 = 80 C = A + .25 DI = 20 + .25 (80) = 40 Spriv = DI – C = 80 – 40 = 40 S = Spub + Spriv = -20 + 40 = 20 Investment Y =C+I+G 100 = 40 + I + 40 I = 20 Therefore, at equilibrium, I = S = 20 Equilibrium Interest Rate I = 30 – 100r 20 = 30 – 100r r = 0.1 Increase in A, Saving, Investment and Interest Rate C = 25 + .25(80) = 45 Spriv = 80 – 45 = 35 S = 35 – 20 = 15 = I 1 Therefore, 15 = 30 – 100r r = 0.15 Graphically, I S1 S0 r 0.15 0.1 I,S 15 20 Saving function can be treated as the supply of fund while the investment function can be treated as the demand. The exogenous variables of the model include output level, tax rate, government spending, and consumption. The effects of the exogenous variables are summarised as follows (ceteris paribus): Variable Effect to Saving C -ve G -ve T +ve Y +ve The reduction in thriftness when A increases means there is an increase in consumption. With a given level of output, the saving, and thus funds available for investment, decreases. The interest rate therefore increases to restore the equilibrium of loan market. Tax Increase and Change in Interest Rate Zero budget deficit implies that public saving equal to zero, and that T = G = 40 (i.e. increased by 20) Then, C = 20 +.25(100 – 40) = 35 S = (100 – 40) – 35 = 25 S = 25 + 0 = 25 = I priv Therefore, 2 25 = 30 – 100r r = (30-25) / 100 = 0.05 By raising the tax, people’s disposable income, and thus private saving, decrease. The increase in public saving is greater than the decrease in private saving. In some sense, the nation is “forced” to save more in form of public saving. Investment in equilibrium thus increases as well. The increase in investment then drives down the interest rate that clear the capital market. 2. Factor Prices and Technology Growth Production Function Yt K t Lt Et Yt Lt Et ~ yt K t Lt Et Lt Et Kt LE ~ ~ t t kt 1 kt Lt Et Lt Et The Steady State I t sYt It sYt Lt Et Lt Et ~ ~ ~ it syt 0.2 k t ~ ~ 0.2 k t (0.076 0.02 0.01)k t ~ k t 3.56 Therefore, The graphical presentation of the steady state is given by ~ er(0.076 0.02 0.01)kt ~ 0 .2 k t ~ kt 3.56 3 gY = n + gE = 0.02 + 0.01 = 0.03 gY/L = gE = 0.01 Factor Income Growth At equilibrium, w=MPL. Therefore, gw =gY-n = 0.03 – 0.02 = 0.01 Similar, r=MPK. Thus, gr = gY – gK = gY –(n+gE) = 0.03 – 0.03 = 0 3. Labor Markets Natural Rate of Unemployment U t 1 (1 f )U t sE t rOt U t 1 (1 f )U t sE t rOt (U t 1 U t ) fU t sE t rOt fU t sE t qEt fU t E ( s q) t Lt Lt Ut sq Lt f sq In example 1, Ut 0.01 0.01 0.0909 Lt 0.2 0.01 0.01 In example 2, Ut 0.01 0.05 0.2308 Lt 0.2 0.01 0.05 i.e. When q increases, natural rate of unemployment increases. When the teenagers’ quit rate is high in a country where teenagers makeup a large portion of the labor force, q would be significantly high. From the above example, we can see that a higher natural rate of unemployment will be resulted. 4