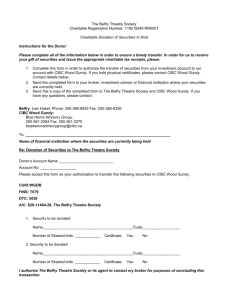

Sell Statement:

advertisement

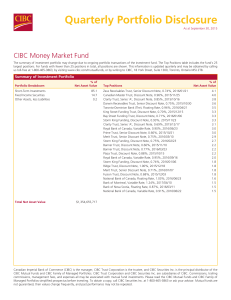

Job Title: Estate Planning Specialist SBU: Wealth LOB: WG Job Code: CF3603 Level: 8 CIBC is a leading Canadian-based global financial institution. Through our three major businesses – Retail and Business Banking, Wealth Management and Wholesale Banking – we provide a full range of financial products and services to 11 million individual, small business, commercial, corporate and institutional clients in Canada and around the world. We invest in our businesses, our clients, our people and our communities to deliver consistent and sustainable earnings to our shareholders. To learn more about CIBC’s Lines of Business, please visit our website. CIBC delivers access to career and development opportunities, safe and healthy workplaces, effective training, and positive work-life balance – so that employees are able to perform at their best, contribute to their communities and focus on cultivating deeper relationships with our clients. Every year, CIBC is recognized for its business successes, community commitment and employee initiatives. We are proud of these successes and are committed to creating an inclusive workplace and an environment where all employees can excel. CIBC Wealth Management is focused on providing excellence in relationship-based advice, service and product solutions that meet our clients' needs. We have a comprehensive offer that addresses the full spectrum of wealth building clients, from self-directed investors to high net worth private wealth individuals to institutional clients. Wealth Management is comprised of three areas — distribution, product and money management. Our distribution network includes our full-service brokerage, CIBC Wood Gundy, and CIBC Investor's Edge, our online brokerage. CIBC Wood Gundy offers in-depth investment expertise on a comprehensive range of investments including industry-leading managed solutions, securities (equities, bonds, trust units, mutual funds, alternative investments), as well as estate planning. CIBC Wood Gundy's extensively trained and accredited Investment Advisors help clients build and preserve their investment portfolios. To learn more about the CIBC Group of Companies please visit CIBC.com. Job Overview Working in conjunction with the Investment Advisor (IA), you will address the needs of CIBC Wood Gundy clients by providing comprehensive estate planning solutions through incorporating financial planning services and recommending solutions in the areas of estate planning, retirement income, succession planning and other corporate needs and philanthropy. You will also provide ongoing servicing of all insurance products (except segregated funds) held by the CIBC Wood Gundy clients for which they are responsible. What You’ll Be Doing Develop and maintain a portfolio of insurance clients with a focus on financial and estate planning Work with Investment Advisors, clients and prospects to analyze and identify insurance needs using appropriate products, planning methods and tools Motivate the Investment Advisors to assess and evaluate the appropriateness of life insurance products to meet CIBC Wood Gundy’s clients’ financial and estate planning objectives Develop the capability of all assigned Investment Advisors and Branch Offices to sell various life insurance concepts directly to their clients and prospects Keeping abreast of market conditions, trends, and changes to legislation and product platforms in an area that is subject to frequent change. This includes analyzing information/trends and applying it to individual client needs Use your entrepreneurial skills to achieve revenue targets and ongoing growth to the business Build relationships with Investment Advisors, educating and motivating them to assess and evaluate the appropriateness of solutions to meet CIBC Wood Gundy clients’ financial and estate planning objectives. Develop and implement a sales and marketing plan, adjusting as required to meet agreed-upon targets Maintain a portfolio of insurance clients with a focus on financial and estate planning, including an annual review of in-force policies Work with Investment Advisors, clients and prospects to analyze and identify insurance needs using appropriate products, planning methods and tools Develop life sales jointly with assigned Investment Advisors Consult with Investment Advisors regarding illustrations, product selection and application reviews prior to the completion of sales Participate in seminars for clients and prospects Ensure adherence to all CIBC Wood Gundy Financial Services policies and procedures, including maintenance of complete and accurate files for insurance clients What CIBC Can Offer You Flexible health benefits, stock purchase plan, competitive incentive pay and recognition programs Competitive salary and banking benefits Career growth, development and continuous learning opportunities Opportunity to be involved in CIBC events that help our communities Click to learn more about Rewards & Recognition, Learning & Development, and Employee Community Involvement What You Need To Know You must be legally eligible to work in Canada at the location(s) specified above and, where applicable, must have a valid work permit or study permit that allows the candidate to fulfill the requirements of the role Geographic region covered: Mississauga and surrounding areas What We’re Looking For Minimum five years of life insurance experience with previous finance/sales/entrepreneurial work experience and a proven track record of achieving results Life Insurance license (including Accident and Sickness) with current status is required Certified Financial Planner, Certified Life Underwriter, designations are an asset Canadian Securities Course is an asset Working knowledge of business/finance/economics acquired through the combination of a university degree within a related field/Industry related designation and/or relevant experience Excellent interpersonal/relationship building skills required to build strong, positive, trusting client relationships Communication skills: writing skills sufficient to prepare proposals and presentation/seminar materials; presentation skills to convey both factual and conceptual information and ideas to clients and Investment Advisors Supervisory skills required to manage staff (i.e. assigned Estate Planning Assistant is an asset Working knowledge of PC applications, including financial planning software Working knowledge of applications used by preferred insurance carriers