Investment Policy Statement, NCMA Restricted Reserve Fund

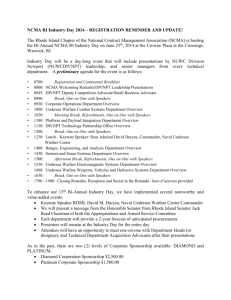

advertisement

NCMA Restricted Reserve Fund ` NCMA Restricted Reserve Fund INVESTMENT POLICY STATEMENT This investment policy statement was adopted by the NCMA Asset Management Committee. Date: April 21, 2007 1 NCMA Restricted Reserve Fund TABLE OF CONTENTS I Summary Data II Purpose III Statement of Objective IV Access Policy V Duties and Responsibilities VI Investment Policy and Guidelines VII Guidelines for Portfolio Holdings VIII Control Procedures: 2 NCMA Restricted Reserve Fund I – SUMMARY DATA Fund Name: Investment Time Horizon: Risk Tolerance: Portfolio Type: Trustee: Custodian: Investment Advisor: Fund Administrator: NCMA Restricted Reserve Fund 5-10 Years Moderate Moderate Growth and Income NCMA Asset Management Committee Wachovia Trust Wachovia Charitable Services W. Todd Ripley, CTFA II - PURPOSE This document establishes the Investment Policy Statement for the NCMA Restricted Reserve Fund and is designed to assist in effectively supervising, monitoring, and evaluating the investment of the Moderate Growth & Income portfolio assets. A thorough investment program is defined throughout this document to achieve the following: Document NCMA Restricted Reserve Fund's investment objectives, performance expectations, and investment guidelines for Fund assets. Establish an appropriate investment strategy for managing all Fund assets, including an investment time horizon, risk tolerance ranges and asset allocation. The goal of this strategy is to provide sufficient diversification and overall return over the long-term time horizon of the Fund. Establish investment guidelines to control overall risk and liquidity, within the agreed upon investment strategy. Establish periodic performance reporting requirements that will effectively monitor investment results and ensure that the investment policy is being followed. Comply with fiduciary, prudence, due diligence, and legal requirements for Fund assets. NCMA Asset Management Committee has arrived at this Investment Policy through careful study of the returns and risks associated with alternative investment strategies in relation to the current and projected access policies and fund raising requirements of the Fund. This policy has been chosen as the most appropriate policy for achieving the objectives of the Fund, which are described in the Objectives section of this document. III - STATEMENT OF OBJECTIVE The objective of the NCMA Restricted Account shall be defined as: To preserve and enhance the purchasing and earning value of the funds held in the NCMA Restricted Reserve Fund . To seek an average annual real rate of return of 2.0%, or total return of CPI plus 2.0%. This objective shall be measured over 5-10 year time frame, with the intent of this objective to preserve, over time, the principal value of the assets as measured in real, inflation adjusted terms. To seek competitive investment performance versus appropriate or relative benchmarks. This objective shall be measured primarily by comparing investment results, over 5-10 year time period. IV - ACCESS POLICY The Access Policy for the NCMA Restricted Account as set forth by NCMA Asset Management Committee shall be as follows: This account is designated as a "Restricted Reserve Account" which has been established to protect the organization from unforeseen financial circumstances or hardship as determined by the Board of Directors. NCMA Restricted Reserve Fund It shall be the responsibility of NCMA Asset Management Committee to periodically review the access policy to make adjustments necessary to preserve the purchasing power of the NCMA Restricted Account. Further, it shall be the responsibility of NCMA Asset Management Committee to promptly communicate any changes in the spending policy to the Investment Advisor. It is the policy of NCMA that access to the Restricted Reserve Fund account(s) shall be accompanied by a duly executed NCMA Board of Directors corporate resolution bearing the signatures of the NCMA National President and the Executive Director. Board of Directors approval shall be supported by a letter of justification prepared by the NCMA National President/ Executive Director that has been coordinated with the NCMA NVP & Treasurer and the Chair of the NCMA Asset Management Committee prior to Board action. The letter of justification shall provide a detailed business case to support the use of restricted reserve funds. The NCMA CFO shall retain a copy of all documentation to support the audit trail for use of NCMA restricted reserve funds for a long enough period of time to support any audits or financial reviews. V - DUTIES AND RESPONSIBILITIES NCMA Asset Management Committee is responsible for managing the investment process in a prudent manner with regard to preserving principal while providing reasonable returns. In carrying out these duties, the NCMA Asset Management Committee has retained an Investment Advisor, Wachovia Trust, to assist in managing the assets of the Fund. The Investment Advisor's role is to provide guidance to the Committee on matters pertaining to the investment of Fund assets including investment policy, investment selection, monitoring Fund performance and compliance with the Investment Policy. All decisions pertaining to the investment policy and guidelines for the policy's implementation shall be implemented by NCMA Asset Management Committee as approved by the NCMA Board of Directors. NCMA Asset Management Committee: Retain a qualified Investment Advisor to assist in the development and implementation of the investment policy, (e.g., goals, objectives, and guidelines). Establish the investment policy of the Fund. This includes, but is not limited to, allocation between equity and fixed income assets, selection of acceptable asset classes and investment performance expectations. 4 NCMA Restricted Reserve Fund Investment Advisor Regularly review investment performance of the Fund to assure the policy is being followed and progress is being made toward achieving objectives. Assist the NCMA Asset Management Committee in establishing the investment policy and guidelines contained in this Investment Policy Statement. Determine an investment strategy and coordinate the asset allocations through the investment provider of the mutual funds. This strategy shall be within investment policy guidelines as set forth in this statement, and as otherwise provided by the NCMA Asset Management Committee. Monitor asset allocation among all asset classes and verify on a quarterly basis to the NCMA Executive Director that allocations are within targets defined by this investment policy statement and approved by the NCMA Asset Management Committee. Monitor the investment performance of the Funds and provide quarterly and yearly, as mutually agreed upon, performance advisory reports to the NCMA Asset Management Committee. Report in a timely manner to the NCMA Executive Director substantive developments that may affect the management of Fund assets. Brief the Finance and Budget Committee and the Board of Directors once every year at the first meeting of the new Program Year (traditionally the July meeting). Any additional briefings should be coordinated among the AMC, CFO, ED and President on an as-needed basis. VI - INVESTMENT POLICY AND GUIDELINES The Portfolio Fund assets will be held in an investment portfolio with an active strategic asset allocation strategy. This portfolio will be invested exclusively in mutual funds. As a result, assets held in this portfolio will be well diversified and highly liquid. The investment adviser for the portfolio is responsible for managing the assets of each fund in accordance with the stated objectives and policies of that fund as set forth in each prospectus. The NCMA Asset Management Committee should read this information carefully before investing. Investment Level Targets The aggregate target amount of NCMA reserve fund assets (both Restricted and Unrestricted) should be 40% of any given year’s Operating Budget. The target amount for Unrestricted Reserve Funds shall be 10% of the aggregate reserve funds. For example, if aggregate reserve funds are $2 million, then unrestricted should be $200,000. Fund Replenishment Replenishment plans should be developed any time $10,000 or more is withdrawn from the NCMA Restricted Fund. Time Horizon Fund objectives are based on 5-10 year, investment horizon, so that interim fluctuations should be viewed with the appropriate perspective. The NCMA Restricted Reserve Fund has adopted this investment horizon such that the chances and duration of investment losses are carefully weighed against the potential for appreciation of assets. 5 NCMA Restricted Reserve Fund Diversification Investments shall be diversified with the intent to minimize the risk of large losses to the Fund. Consequently, the total portfolio will be constructed and maintained to provide prudent diversification with regard to the concentration of holdings in individual issues, corporations, or industries. Diversification occurs at several levels. NCMA Asset Management Committee realizes a significant portion of the mutual funds comprising the Portfolio is allocated to U.S. equity securities, including allocations to both large and small cap equities. Moderate exposure to developed international equity may be permitted. Mutual funds comprising the fixed income portion of the Portfolio are allocated to predominately high quality U.S. bonds. Moderate exposure to developed international and high yield bonds may be permitted. Financial research has demonstrated that price volatility can be further reduced by lengthening the investment time horizon. The portfolio is managed in accordance with the diversification and industry concentration restrictions set forth in the Investment Company Act of 1940, as amended (the "1940 Act"). Pursuant to the provisions of the 1940 Act, diversified mutual funds may not, with respect to 75% of their assets, (i) purchase securities of any issuer (except securities issued or guaranteed by the United States Government, its agencies or instrumentalities) if, as a result, more than 5% of its total assets would be invested in the securities of such issuer; or (ii) acquire more than 10% of the outstanding voting securities of any one issuer. Certain mutual funds in which the Fund may be invested are considered non-diversified for 1940 Act purposes. These non-diversified funds are not required to follow this procedure. In addition, no mutual fund may purchase any securities which would cause more than 25% of its total assets to be invested in the securities of one or more issuers conducting their principal business activities in the same industry, provided that this limitation does not apply to investments in securities issued or guaranteed by the United States Government, its agencies or instrumentalities. 6 NCMA Restricted Reserve Fund Asset Allocation Academic research indicates that the decision to allocate total account assets among various asset classes will far outweigh security selection and other decisions that impact portfolio performance. The NCMA Asset Management Committee believes that to achieve the greatest likelihood of meeting fund objectives and the best balance between risk and return for optimal diversification, the Fund should allocate assets in accordance with the targets for each asset class as stated below: Portfolio: Moderate Growth & Income Portfolio Objective: Balanced Growth & Income Asset Classes Normal Weightings Fixed Income - U.S. 59% Equity - U.S. 40% Cash 1% Asset Allocation Limitations: Sector Target Range Domestic Large-Cap Equity Mid-Cap Equity Small-Cap Equity International Equity Fixed Income Cash Equivalent 20% -- 30% Strategic Target 28% 5% – 12.5% 5% – 12.5% 5% – 15% 20% – 40% 1% – 5% 10% 8% 14% 38% 2% Rebalancing Procedures From time-to-time, market conditions may cause the Portfolio's investment in various mutual funds to vary from the established allocation. To remain consistent with the asset allocation guidelines established by this Statement, each mutual fund in which the Portfolio invests will be reviewed on a monthly basis at minimum and rebalanced back to the normal weighting if the actual weighting varies by 2% or more from the recommended weighting. In addition, the allocation of assets in the Portfolio may deviate from the normal allocation within the permitted range when market conditions warrant. Such deviations are designed primarily to reduce overall investment risk in the long term. The NCMA Asset Management Committee recognizes that rebalancing is inherent to the element of diversification, where the goal is to create a portfolio that balances the appropriate levels of risk and return. That balance, once achieved, only can be maintained by periodically rebalancing to the preferred asset allocation guidelines. Policy will mandate annual rebalancing (minimum), though the Committee reserves the right to review quarterly as deemed prudent. In addition, the investment advisor will by policy seek to rebalance to strategic asset allocation guidelines when notified of any distributions or contributions. Risk Tolerances The NCMA Asset Management Committee recognizes that the objectives of the Portfolio cannot be achieved without incurring a certain amount of principal volatility. The Portfolio will be managed in a style-neutral manner that seeks to minimize principal fluctuations 7 NCMA Restricted Reserve Fund over the established time horizon and that is consistent with the Portfolio's stated objectives. The risk tolerances have been determined by polling the NCMA Board of Directors. The risk tolerances shall be reassessed every three years in the same manner. Performance Expectations Over the long-term, the investment objectives for this portfolio shall be to achieve an average total annual rate of return, which consists of the Consumer Price Index (CPI) plus 2.0% for the aggregate investments under this Investment Policy Statement. Returns may vary significantly from this target year to year. 8 NCMA Restricted Reserve Fund VII - GUIDELINES FOR PORTFOLIO HOLDINGS As described in the Investment Advisory Agreement, the Investment Advisor implements this Investment Policy through investments in mutual funds and other pooled asset portfolios. Such investments are acceptable investments provided they conform to the diversification restrictions set forth below. Domestic Equity The Domestic Equity asset class may be comprised of mutual funds and other pooled asset portfolios that are invested principally in equity securities of U.S. companies. These securities may be listed on registered exchanges, or actively traded in the over-the-counter market, or considered to be restricted securities (provided that the percentage of the fund's assets invested in such securities conform to the Fund's prospectus). Domestic Fixed Income The Domestic Fixed Income asset class may be comprised of mutual funds and other pooled asset portfolios that are invested principally in fixed income securities that are rated investment grade or better, i.e., rated in one of the four highest rating categories by an NRSRO at the time of purchase, or if not rated, are determined to be of comparable quality by the Investment Advisor or a mutual fund sub-Advisor. Cash Equivalent Reserves Cash equivalent reserves shall consist of money market mutual funds that comply with Rule 2a-7 under the 1940 Act. 9 NCMA Restricted Reserve Fund VIII - CONTROL PROCEDURES Review of Liabilities The NCMA Asset Management Committee will review all policies, objectives and guidelines annually. This review will focus on an analysis of major differences between the Fund's assumptions and actual experience. Review of Investment Objectives Investment performance will be reviewed annually by the Investment Advisor to determine the continued feasibility of achieving the investment objectives and the appropriateness of the investment policy for achieving these objectives. In addition, the validity of the stated objective will be reviewed annually. It is not expected that the investment policy will change frequently. In particular, short-term changes in the financial markets should not require an adjustment in the investment policy. Review of Investment Advisor The Investment Advisor will report on a quarterly basis to review the total Fund investment performance. In addition, the Investment Advisor will be responsible for keeping NCMA advised of any material change to access policy, investment strategy, or other pertinent information potentially affecting performance of all investments. Review of Investment Performance Manager performance will be evaluated in terms of an appropriate market index (e.g. the S&P 500 stock index for large-cap domestic equity manager) and the relevant peer group (e.g. the large-cap growth mutual fund universe for a large-cap growth mutual fund), as more particularly set forth in the following table. Asset Class Large-Cap Equity Blend Growth Value Mid-Cap Equity Small-Cap Equity International Equity Fixed Income Intermediate-term Bond Money Market Index Peer Group S&P 500 Russell 1000 Growth Russell 1000 Value Russell Mid Cap Russell 2000 MSCI EAFE Large-Cap Blend Large-Cap Growth Large-Cap Value Mid-Cap Blend Small-Cap Blend Foreign Stock Lehman Brothers Gov’t/Credit Intermediate 90 day T-Bills Intermediate-Term Bond Money Market Database Proxy Statements Proxy statements will be voted in accordance with the terms of the Investment Advisory Agreement. Investment Advisor & Fund Manager(s) The Investment Advisor serves at the pleasure of the NCMA Asset Management Committee and Executive Director. NCMA may at any time direct the Investment Advisor on the means and methods of all investment instruments and instrumentalities in accordance with applicable laws and rules and regulations as well as policies set forth herein 10 NCMA Restricted Reserve Fund ADOPTION OF INVESTMENT POLICY STATEMENT The NCMA Asset Management Committee has reviewed, approved, and adopted this Investment Policy Statement, dated April 21, 2007. NCMA Executive Director Date Wachovia Trust Charitable Services Group Date 11 11