GPO 04-2014 - Project Exports Promotion Council of India

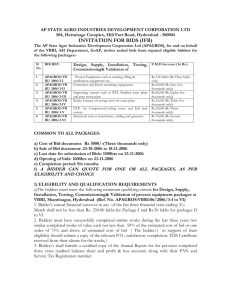

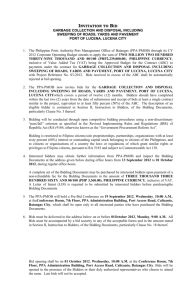

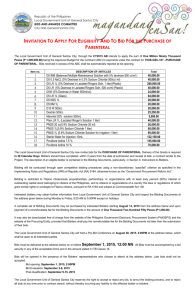

advertisement