ACF 103 – Fundamentals of Finance

advertisement

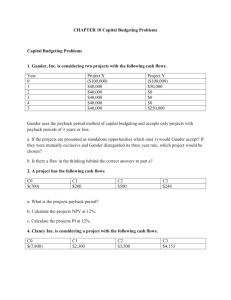

ACF 103 – Fundamentals of Finance Tutorial 8 - Solutions Chapter 13 1. Your firm is considering two mutually exclusive projects, code-named A and B, that would each require an initial cash outflow of $10,000. They would generate the following incremental, after-tax, operating cash flows: Project A $5,000 4,000 3,000 Year 1 Year 2 Year 3 A. B. C. * D. Project B $3,000 4,000 6,000 If the firm's required rate of return is 14%, which would you select? Project A because it has the shorter payback period. Project A because it has the higher net present value. Project B because it has the higher internal rate of return. Neither project because neither adds value to the firm. Proof: Project A CF Year ) -$10,000 Year 1 $5,000 Year 2 4,000 Year 3 3,000 Net Present Value PVIF14%,3 1.0000 0.8772 0.7695 0.6750 PV Project B CF PVIF14%,3 PV -$10,000 -$10,000 1.0000 -$10,000 4,386 $3,000 0.8772 2,632 3,078 4,000 0.7695 3,078 2,025 6,000 0.6750 4,050 -511 -240 2. A strip mine will have an initial cash outflow of $25 million and expected after-tax, operating cash inflows of $5 million per year over its 10-year economic life. However, the Environmental Protection Agency requires repair and replanting of mined areas every five years. This will result in additional after-tax outflows of $6 million in years five and ten. Based on this scenario, which of the following statements is true? A. The project's payback period is five years. B. The value of this project today can be calculated as the sum of the cash inflows minus the cash outflows. C. A profitability index cannot be calculated for this project because there are negative cash flows in some years. * D. This project may have more than one internal rate of return. 3. A firm is considering two mutually exclusive investment alternatives, both of which cost $5,000. The firm's hurdle rate is 12%. The after-tax cash flows associated with each investment are: Year 1 2 3 4 Investment A $2,000 1,500 1,500 1,000 Investment B $1,000 1,500 2,000 3,000 ACF 103 HAUT 2014 Tutorial Solns 1 For each alternative, calculate the payback period, the net present value, and the internal rate of return. Which alternative (if any) should be selected? Answer: Alternative A: Payback: $2,000 + $1,500 + $1,500 = $5,000 (3 years) NPV at 12% = ($2,000)(0.893) + ($1,500)(0.797) + ($1,500)(0.712) + ($1,000)(0.636) - $5,000 = -$314.50 IRR = 8.6% Alternative B: Payback: $1,000 + $1,500 + $2,000 + $500 = $5,000 (3 + 500/3000 = 3.167 years) NPV at 12 percent = ($1,000)(0.893) + ($1,500)(0.797) + ($2,000)(0.712) + ($3,000)(0.636) - $5,000 = $420.50 IRR = 15.3% Option B is the BEST alternative as it INCREASES shareholder wealth. 4. The Cardinal Machine Tool Company is considering the purchase of a new drill press to replace the one currently being used. The present machine is expected to last another seven years and have no salvage value. The drill press in current use has a book value of $700 and can be sold today for $400. Cardinal pays $300 a year maintenance on the press. The new drill press will cost $1,500. It is expected to last seven years, at which time it will be sold for $100. The maintenance cost of the new machine is expected to be $150 a year. Cardinal depreciates its assets on the straight-line basis and pays 40% taxes. If its opportunity cost of funds is 10%, should it buy the new machine? Answer: Initial cost = $1,500 - $400 + ($700 - $400)(0.40) = $980 Annual savings after tax = ($300 - $150)(0.60) = $90 Change in depreciation = ($1,500 - $100)/7 - $700/7 = $100 per yr Tax saving on depr. change = ($100)(0.40) = $40 NPV at 10% = ($90 + $40)(4.868) + ($100)(0.513) - $980 = -$295.86 Since the NPV is negative, we would REJECT this project at this time. 5. A firm is considering the following projects, all of which are independent of one another. Available funds are limited to $2 million in this capital budgeting period, but future periods will have no capital budget constraints. Present Value of Project Initial Outlay Cash Inflows 1 $1,300,000 $1,200,000 ACF 103 HAUT 2014 Tutorial Solns 2 2 3 4 5 6 7 8 1,000,000 800,000 600,000 500,000 400,000 300,000 100,000 1,250,000 900,000 700,000 550,000 470,000 280,000 105,000 Which projects should be accepted without exceeding the budget? Answer: Project Profitability Index Cumulative Investment 2 1,250,000/1,000,000 = 1.25 $1,000,000 6 470,000/400,000 = 1.18 1,400,000 4 700,000/600,000 = 1.17 2,000,000 3 900,000/800,000 = 1.13 2,800,000 5 550,000/500,000 = 1.10 3,300,000 8 105,000/100,000 = 1.05 3,400,000 7 280,000/300,000 = 0.93 Reject 1 1,200,000/1,300,000 = 0.92 Reject Projects 2, 6, and 4 should be accepted; they exhaust the budget. 6. Text book Ch 13, problem # 8 (p.348) Answer: a. Selecting those projects with the highest profitability index values would indicate the following: Project Amount PI Net Present Value* 1 $500,000 1.22 $110,000 3 350,000 1.20 70,000 $850,000 $180,000 * NPV = (Amount x PI) - Amount = (500,000 x 1.22) – 500,000 = 110,000 However, utilizing “close to” full budgeting will be better. Project Amount PI Net Present Value 1 $500,000 1.22 $110,000 4 450,000 1.18 81,000 $950,000 $191,000 b. No. The resort should accept all projects with a positive NPV. If capital is not available to finance them at the discount rate used, a higher discount rate should be used, which more adequately reflects the costs of financing. ACF 103 HAUT 2014 Tutorial Solns 3