English - Bank Negara Malaysia

advertisement

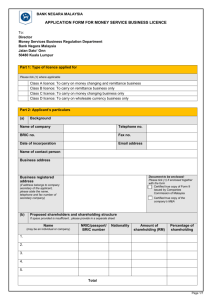

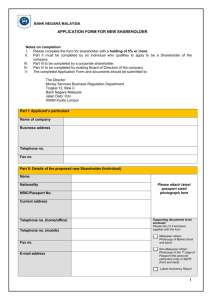

APPLICATION FORM FOR RENEWAL OF MONEY SERVICE BUSINESS LICENCE IMPORTANT: 1. Renewal application shall be made in writing to the Bank not later than 2 months before expiry of licence 2. All required items must be completed before the application can be considered. If an item is not applicable, please write “not applicable” or “none” as appropriate. DO NOT leave blank spaces. If the space in the form is not sufficient for explanation, any additional information may be given on separate sheet. 3. Bank Negara Malaysia may request for additional information as and when required. 4. The completed Application Form and documents should be submitted to: The Director Money Services Business Regulation Department Tingkat 12, Blok C Bank Negara Malaysia Jalan Dato’ Onn 50480 Kuala Lumpur Document Checklist: Item Company’s latest audited accounts (only if not yet submitted) Company’s latest management accounts Certified true copy of Form 24 issued by Companies Commission of Malaysia (only if there was capital injection after latest audited accounts date) Business Plan (if there is any expansion of business) Latest Insolvency Report of each director/shareholder/CEO or individual responsible for the day to day management of the business Appendix I: Attestation of the CEO and Board of Directors on the money changing business ( √ ) Yes ( X ) No Part 1: Applicant’s particulars (A) BACKGROUND Name of company Telephone no. BRIC no. Fax no. Name of contact person Designation Telephone (Mobile) Business address Name of Company Secretary (If applicable) Contact person Telephone no. (Office) Designation Telephone no. (Mobile) 1 (B) OTHER INFORMATION 1. Any proposed change in director/CEO? 2. Any proposed change in shareholders? 3. Any proposed change in premises/place of business 4. Any other changes? Please state briefly: (C) BUSINESS PLAN FOR THE NEXT 3 YEARS Tick (X) in appropriate column YES NO If there are changes in director/CEO, please submit form in Appendix II (a) Please provide (in separate sheet) if applicant intends to: Expand current scope of business (to be an MSB agent for another class of business);or Be a principal and to appoint MSB agents; or Open new/additional branches (provide proposed number and location (by state), reasons for expansion; or Use other distribution channels for remittance (e.g mobile remittance, prepaid cards) (b) Business Plan to include: Proposed customer/target market Cash flow projection for the next three years Source of funding for the intended expansion Organizational arrangement & manpower requirement (D) FINANCIAL INFORMATION a. b. c. d. e. f. Latest audited accounts (FYE: ____/____/___) Have you submitted the latest audited accounts? (YES/NO) If YES, date of submission:(____/____/____) If NO, please attach the audited accounts together with the renewal application Was there any additional capital injection during the tenure of licence? (YES/NO) If YES, Please attach certified true copy of Form 24 issued by Companies Commission of Malaysia (SSM). Amount of capital Injection: RM_________ Date of capital injection: (____/____/____) Source of funding: 2 Please complete the following table as per latest audited and management account ITEMS Audited as at (___/___/___) (RM mill) Management account as at (____/___/___) (RM mill) TURNOVER OF BUSINESS (includes turnover of business as an approved MSB agent) Part I –For Money Changing Business Total Sales in foreign currencies Total Purchases in foreign currencies Part II – For Remittance Service Business 1.Total Value of Inward transactions 2.Total Value of Outward transactions TOTAL (1 + 2) Paid-up Capital [Add] Reserves [Add/Minus] Retained Profits/ (Accumulated losses) [Add/Minus] Profit/(Loss) for the period (before tax) [Minus] (Loan, advances & investments given to shareholders, directors or other related parties) TOTAL : Capital Funds 3 Part 2. CONSENT FOR DISCLOSURE OF INFORMATION (a) BY COMPANY* As provided under item (1) of Schedule 11 made pursuant to section 134 of the Financial Services Act 2013 (FSA), item (1) of Schedule 11 made pursuant to section 146 of the Islamic Financial Services Act 2013 (IFSA) and section 120(1)(c) of the Development Financial Institutions Act 2002 (DFIA), I, on behalf of the company (as a shareholder) hereby authorise any licensed business under FSA, licensed business under IFSA and prescribed institutions under DFIA where the company (shareholder) maintains its accounts, or has financial liabilities, to disclose to Bank Negara Malaysia, any information relating to the company’s accounts and affairs including financial liabilities for the purpose of processing this application. *[Consent should be given by the director/CEO who is responsible of the management of the company] ____________________ Name in capital letters _________________ Designation _________________ Signature Company Stamp/Seal Date: 4 Part 2. CONSENT FOR DISCLOSURE OF INFORMATION (b) BY DIRECTORS, SHAREHOLDERS & CEO OF THE COMPANY As provided under item (1) of Schedule 11 made pursuant to section 134 of the Financial Services Act 2013 (FSA), item (1) of Schedule 11 made pursuant to section 146 of the Islamic Financial Services Act 2013 (IFSA) and section 120(1)(c) of the Development Financial Institutions Act 2002 (DFIA), I hereby authorise any licensed business under FSA, licensed business under IFSA and prescribed institutions under DFIA where the company (shareholder) maintains its accounts, or has financial liabilities, to disclose to Bank Negara Malaysia, any information relating to the company’s accounts and affairs including financial liabilities for the purpose of processing this application. NAME (CAPITAL LETTERS) IC/PASSPORT NUMBER DESIGNATION SIGNATURE 5 Appendix I ATTESTATION OF THE CEO AND BOARD OF DIRECTORS ON THE MONEY SERVICE BUSINESS NAME OF COMPANY: We have conducted a self-assessment on our business from _________________(Date of MSB licence issued) to ________________(Date of submission of renewal) and hereby declare that our Licence Class ______(A/B/C/D): Yes No Complies with all the provisions of the Money Service Business Act 2011, regulations, guidelines and circulars issued by the Bank; Is not involved in any illegal activity, including carrying out or facilitating the transmission of money or the transfer of illicit funds; Complies with the Anti-Money Laundering and Anti- Terrorism Financing Act 2001 and all relevant guidelines and circulars issued pursuant to it; Is not controlled or managed by any other individuals or third parties other than the shareholders, board of directors and the Chief Executive Officer/ Managing Director who has been approved by the Bank Is not using any personal bank account of directors, employees or any persons for the purpose of money service business activities or any other activities outside the scope of the money services business, on behalf of the licensee; and Uses the licensee’s bank account strictly for transactions relating to the activities of the money service businesses only We also declare that each shareholder, director, controller, chief executive officer and manager of our business complies with Money Services Business (Minimum Criteria of a “Fit and Proper” Person) Regulations 2012. We understand that should our declaration be found to be false or inaccurate, the Bank may refuse to renew the licence granted to _________________________(Name of Company) to conduct money service business. NAME (CAPITAL LETTERS) IC/PASSPORT NUMBER DESIGNATION SIGNATURE 6