CH2.STUDENT COPY

advertisement

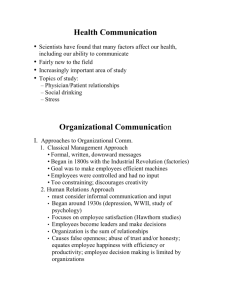

COM 442 CHAPTER TWO Corporate Strategy Decisions DECISIONS ABOUT THE ORGANIZATION’S SCOPE OR MISSION, ITS OVERALL GOALS AND OBJECTIVES, AVENUES OF FUTURE GROWTH, RESOURCE DEPLOYMENTS AND POTENTIAL SOURCES OF SYNERGY ACROSS BUSINESS UNITS ARE THE ESSENTIAL COMPONENTS OF CORPORATE STRATEGY 1. SCOPE / MISSION/INTENT CLEARLY STATED ANSWERS TO FUNDAMENTAL QUESTIONS o WHAT IS OUR BUSINESS? o WHO ARE OUR CUSTOMERS? COMM 442…1 o WHAT KINDS OF VALUE CAN WE PROVIDE TO THEM? o WHAT SHOULD OUR BUSINESS BE IN THE FUTURE? PEPSICO ”MARKETING SUPERIOR QUALITY FOOD AND BEVERAGE PRODUCTS FOR HOUSEHOLDS AND CONSUMERS DINING OUT.” DIVEST PIZZA HUT & TACO BELL “THE WORLD WIDE MARKETING OF SUPERIOR BEVERAGE PRODUCTS.” FACTORS INFLUENCING THE CORPORATE MISSION A MISSION SHOULD REFLECT ITS INTERNAL CHARACTERISTICS, RESOURCES AND COMPETENCIES AND ITS EXTERNAL OPPORTUNITIES AND THREATS. COMM 442…2 SOCIAL VALUES & ETHICAL PRINCIPLES A UNIQUE CORPORATE CULTURE = A REFLECTION OF INTERNAL CHARACTERISTICS, HISTORICAL ACCOMPLISHMENTS, MANAGERIAL PREFERENCES, SHARED VALUES, MYTHS & SYMBOLS = DEFINE THE SOCIAL & ETHICAL BOUNDARIES OF THEIR STRATEGIC DOMAIN. CULTURAL SPECIFICITY OF SOCIAL & ETHICAL CONDUCT CODES MAKES THIS A PHILOSOPHICAL CHALLENGE FOR GLOBAL ORGANIZATIONS. USA – PROPRIETORY INFO CDN – CONSERVATION EURO – WORKPLACE SAFETY THE MISSION STATEMENT SHOULD REFLECT INTERNAL RESOURCES, COMPETENCIES & SYNERGIES PROVIDE DIRECTION FOR POSITIVE PRODUCT-MARKET ASSOCIATIONS. DIMENSIONS FOR DEFINING THE CORPORATE MISSION COMM 442…3 STRATEGIC SCOPE (GET IT RIGHT!) PENN CENTRAL RR “THE RAILROAD BUSINESS” BURLINGTON NORTHERN “TO PROVIDE LONG-DISTANCE TRANSPORTATION FOR LARGE VOLUME PRODUCERS OF LOW VALUE, LOW DENSITY PRODUCTS, SUCH AS COAL OR GRAIN.” FOCUS ON: THE FUNCTIONAL CUSTOMER NEED AND THE PHYSICAL MEANS OF SATISFYING THEM VISION OR STRATEGIC INTENT: A MOTIVATIONAL VIEW OF THE CORPORATE MISSION COMM 442…4 STRATEGIC INTENT OR VISION GET THE TROOPS MOVING “BEAT BENZ!” SET AN ENDURING GOAL WORTHY OF EMPLOYEE COMMITMENT KEEP THE MEANS FLEXABLE COMM 442…5 2. CORPORATE OBJECTIVES FORMAL OBJECTIVES PROVIDE DECISION CRITERIA THAT GUIDE AN ORGANIZATION’S BUSINESS UNITS AND EMPLOYEES TOWARD SPECIFIC DIMENSIONS & LEVELS OF PERFORMANCE. EACH OBJECTIVE SHOULD CONTAIN FOUR COMPONENTS: A PERFORMANCE DIMENSION OR ATTRIBUTE SOUGHT A MEASURE OR INDEX FOR EVALUATING PROGRESS A TARGET OR HURDLE LEVEL TO BE ACHIEVED. A TIME FRAME WITHIN WHICH THE TARGET IS TO BE ACCOMPLISHED. COMM 442…6 THE ULTIMATE OBJECTIVE: ENHANCING SHAREHOLDER VALUE MEASURED BY DIVIDENDS MUST ALSO PLACATE THE REMAINING CORPORATE CONSTITUENCIES (EMPLOYEES, CUSTOMERS, SUPPLIERS, DEBTHOLDERS & STOCKHOLDERS). HENCE THE REQUIREMENT TO GENERATE ADEQUATE CASH MANAGEMENT’S PRIMARY OBJECTIVE SHOULD BE o TO PURSUE CAPITAL INVESTMENTS, o ACQUISITIONS & BUSINESS STRATEGIES THAT WILL PRODUCE SUFFICIENT FUTURE CASH-FLOWS TO RETURN POSITIVE VALUE TO ITS SHAREHOLDERS = TARGET RETURN ON SHAREHOLDER EQUITY ECONOMIC OR MARKET VALUE ADDED (MVA) = DEBT + MARKET VALUE OF STOCK – CAPITAL INVESTED IN THE COMPANY (+ #’s = WEALTH CREATED) PURSUE MULTIPLE OBJECTIVES SOME ASPECT OF PROFITABLY GROWTH OR MARKET SHARE NEED TO ENSURE COMPATIBILITY OF OBJECTIVES COMM 442…7 BUSINESS UNIT & PRODUCT-MARKET OBJECTIVES NEED TO BE CONSISTENT YET REFLECT THEIR PARTICULAR MARKET CHARACTERISTICS EG. COMPETITIVE POSITION, STAGE IN LIFE CYCLE, ETC. 3. CORPORATE DEVELOPMENT STRATEGY WHERE WILL FUTURE GROWTH COME FROM? SENIOR MANAGEMENT NEEDS TO DEVELOP A STRATEGY TWO BASIC CHOICES: EXPANSION OR DIVERSIFICATION a. EXPANSION MARKET PENETRATION a) IMPROVE EXISTING MARKET SHARE THRU: PRODUCT / SERVICE IMPROVEMENTS OUTSPEND COMPETITION PROMOTIONAL ACTIVITY (CONSUMER, TRADE, PRICE) COMM 442…8 b) INCREASE PRODUCT USEAGE: 1) MORE, 2) MORE OFTEN, 3) DIFFERENT OCCASIONS PRODUCT DEVELOPMENT a) PRODUCT LINE EXTENSIONS: ARM & HAMMER FROM BKING SODA TO LAUNDRY DETERGENT, OVEN CLEANER, and CARPET CLEANER – BASED ON IMAGE AS AN EFECTIVE DEODERIZER. b) MARKET DEVELOPMENT (LARGEST POTENTIAL) o ENTER NEW MARKETS GO GLOBAL b. DIVERSIFICATION RISKER REQUIRES LEARNING NEW CORE COMPETENCIES & NEW CUSTOMER NETWORK A. VERTICAL INTEGRATION FORWARD INTEGRATION: FIRM EXPANDS DOWN STREAM IN TERMS OF PRODUCT FLOW (DOWN THE DISTRIBUTION CHANNEL – TOWARD THE CONSUMER) BACKWARD INTEGRATION: UP THE DISTRIBUTION CHANNEL (TOWARD INGREDIANT SUPPLIERS) MORE EGGS ($) IN ONE BASKET (INDUSTRY) COMM 442…9 B. REALATED DIVERSIFICATION NEW PRODUCT & CUSTOMERS COMPLEMENTS INTERNAL SYNERGIES (MKTING, PROD, R&D, ETC.) C. UNRELATED DIVERSIFICATION FINANCIALLY MOTIVATED NOT OPERATIONAL HAVE CASH SURPLUS OR EXISTING INDUSTRY IS IN THE DECLINING STAGE BRAND NEW UNRELATED BUSINESS VENTURE D. DIVERSIFICATION THRU ORGANIZATIONAL RELATIONSHIPS OR PARTNERSHIPS THE ULTIMATE ‘BUSINESS COOP’ KIERETSU OR CHAEBOL OFTEN BASED AROUND A LARGE TRADING COMPANY (TO ACCESS GLOBAL MARKETS) COALITION MEMBERS PROVIDE SPECIFIC GOODS OR SERVICES COMPLEMENTING THE TOTAL PRODUCT-MIX OFFERING COMM 442…10 4. CORPORATE RESOURCE ALLOCATION TREAT EXISTING SBU’s AS A PORTFOLIO OF INVESTMENT OPPORTUNITIES NEED TO EVALUATE IN TERMS OF SBUs’ FINANCIAL ATTRACTIVENESS (MARKETSHARE GROWTH RATE) INDUSTRY POTENTIAL (MARKET GROWTH RATE) GROWTH-SHARE MATRIX MODELS USED TO FACILITATE ASSESSING AND COMPARING SBU POTENTIALS (ATTRACTIVENESS) GRAPH QUADRANTS QUESTION MARKS: HIGH GROWTH MARKET / SBU – LOW MARKETSHARE STARS: HIGH GROWTH MARKETS / LEADING SHARE (NET USERS OF CASH NEEDED TO FUEL & MAINTAIN PERFORMANCE) CASH COWS: LOW GROWTH MARKET (STABLE) / HIGH SHARE (PRIMARY GENERATORS OF PROFIT & CASH FOR QUESTION MARKS & STARS0 DOGS: LOW SHARE / LOW GROWTH (HARVEST OR DIVEST) COMM 442…11 LIMITATIONS OF MATRIX MODELS ONLY CAPTURES TWO VARIABLES MAY NOT TELL THE WHOLE INDUSTRY STORY (LOW ENTRY COSTS, BUBBLE PERFORMANCE, GATEWAY TO…) MARKETSHARE REFLECTS HISTORY NOT FUTURE USING THE CORRECT MEASUREMENT CRITERIA IS KEY (GARBAGE IN, GARBAGE OUT) MUST NOT BIAS SBU COMPARISONS PROVIDES DIRECTION BUT NO KEY ON HOW TO GET THERE. DOESN’T ACCOUNT FOR INTERNAL SYNERGIES (DOG SUPPLIES STAR, ETC.) ALTERNATIVE PORTFOLIO MODELS ‘INDUSRTY ATTRACTIVENESS-BUSINESS DECISION MATRIXES’ OR ‘DIRECTIONAL POLICY MATRIXES’ ATTEMPT TO MEASURE MORE VARIABLES (MULTIFACTORS) BECOMES SUBJECTIVE & AMBIGUOUS EVALUATE DIFFERENT INDUSTRIES WITH THE SAME NORMS? COMM 442…12 TECHNOLOGY MATRIX: USES FIRM’S DEVELOPMENT LEVEL VISA-VIE TOTAL TECHNOLOGY FIELD AN ALTERNATIVE TO PORTFOLIO MATRIXES: VALUE-BASED PLANNING: ASSESSING THE SHAREHOLDER VALUE A GIVEN STRATEGY IS LIKELY TO CREATE. BY 1. ASSESSING THE CASHFLOWS LIKELY TO BE GENERATED 2. SUBTRACT FROM CAPITAL REQUIRED (RISK-FACTORED) TO FINANCE THE STRATEGY 3. = AN ECONOMIC VALUE ADDED (MVA) MEASURE (+ IS GOOD) COMM 442…13 DISCOUNTED CASH FLOW MODEL (USED MOST OFTEN) THE SHAREHOLDER VALUE THAT A STRATEGY CREATES IS DETERMINED BY: THE CASHFLOW THAT IT GENERATES THE FIRM’S COST OF CAPITAL THE MARKET VALUE OF THE ASSIGNED DEBT FUTURE CASHFLOWS IMPACTED BY: o SIX ‘VALUE DRIVERS’ 1. RATE OF SALES GROWTH 2. OPERATING PROFIT MARGIN 3. TAX RATE 4. INVESTMENT LEVEL OF WORKING CAPITAL (DAY TO DAY) 5. INVESTMENT LEVEL OF FIXED CAPITAL (FULL TIME PERIOD) 6. DURATION OF VALUE GROWTH (YRS. WITH A + MVA) NEED TO ALSO FACTOR IN o THE LENGTH OF TIME STRATEGY WILL BE USED o RESIDUAL VALUE OF STRATEGY ACTIVITY LIMITATIONS OF VALUE-BASED PLANNING AS GOOD AS THE FORECASTING USED IN THE PLANNING ASSUMPTIONS FORECASTED NUMBERS TAKE ON A ‘LIFE’ (ASSUMED VALIDITY) OF THEIR OWN. COMM 442…14 REALITY CHECK A. MANAGERS MUST FULLY CONSIDER THE COMPETITIVE CONTEXT OF CASH FLOWS AND ENSURE THAT CASH FLOW PROJECTIONS ARE DIRECTLY TIED TO COMPETITIVE ANALYSIS PROJECTIONS. B. THEY MUST QUESTION WHETHER THE CASH FLOWS CONTRIBUTE TO COMPETITIVE ADVANTAGE, AND TO WHAT EXTENT CASH FLOWS ARE DEPENDENT ON THOSE ADVANTAGES. C. SPECIFICALLY, I. THEY SHOULD BROADEN THE RANGE OF STRATEGY ALTERNATIVES, II. CHALLENGE THE INHERENT SOUNDNESS OF EACH ALTERNATIVE, III. TEST THE SENSITIVITY OF EACH ALTERNATIVE TO CHANGES IN CASH INFLOWS AND OUTFLOWS. 5. SOURCES OF SYNERGY A. KNOWLEDGE BASED: TRANSFER OF COMPETENCIES, R&D, BRAND EQUITY, ETC. B. OPERATIONAL RESOURCES: MATERIALS HANDLING, PROCESSING, ADMINISTRATION. COMM 442…15 KEY ELEMENTS OF CORPORATE STRATEGY CONSIDERATIONS 1. SCOPE / MISSION/INTENT 2. CORPORATE OBJECTIVES 3. CORPORATE DEVELOPMENT STRATEGY 4. CORPORATE RESOURCE ALLOCATION 5. SOURCES OF SYNERGY COMM 442…16