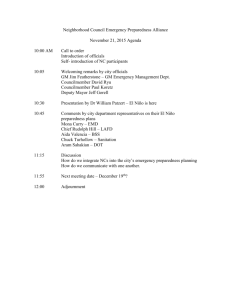

course syllabus - Birmingham City Schools

advertisement

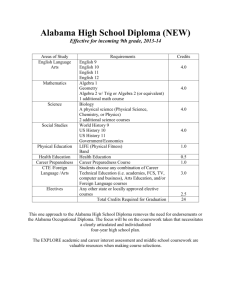

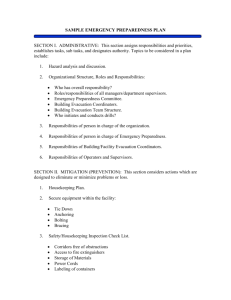

BUSINESS/MARKETING EDUCATION COURSE SYLLABUS CAREER PREPARENESS Mrs. Betty Gross Malone, Instructor Recommended Grade Level: 9 Length: One Year Prerequisite: None BUSINESS/MARKETING EDUCATION GOAL Provides students with the knowledge and skills necessary for economic success in the twenty-first century, The program prepares student for the accelerated changing taking place in the competitive business world. As students gain knowledge and professional experiences, they develop skills essential for success and build a strong foundation that enables them to become productive workers and citizens. The business/marketing supplements the usual high school courses including training in the basic competencies of math, language, reading, social studies, and scienc. COURSE DESCRIPTION The Career Preparedness course focuses on three integrated areas on instructionacademic planning and career development, financial literacy and technology. Course content ranges from college and career preparation to computer literacy skills to ways to manage personal finances and reduce personal risk. The area of technology is designed to be interwoven throughout course instruction. Mastery of the content standards provides a strong foundation for student acquisition of the skills, attitudes, and knowledge that enable them to achieve success in school, at work and across the life span. As part of preparing students to be college-and career ready, this course also equip students with the skills needed for business and industry, continuing education, and lifelong learning. PHILOSOPHY Students are expected to meet all course goals and apply knowledge through real-life situations. This course is heavily embedded with language and mathematics. A variety of teaching techniques such as group discussions, lecture, lab, and independent study will be used to integrate process skills such as decision making, problem solving, and critical thinking. Laboratory experiences are essential to the course and provide students with Page 2 Career Preparedness Course Syllabus opportunity to plan, organize and implement learning activities, applying principles, learning processes, and practice desired skills and behavior. Students will engage in activities, experiences, and assessments that deal with applying, synthesizing and evaluating knowledge and skills. COURSE GOALS Students will: 1. Demonstrate knowledge of a systematic approach to decision-making process (specifically, opportunity costs and trade-offs), including factors regarding academic planning and career development, financial literacy and technology. 2. Understand the effect of workplace behavior. 3. Analyze personal skills, interest, and abilities and relate them to current career opportunities. 4. Determine the correlation of personal preference, education, and training to the demands of the workforce. 5. Investigate the postsecondary/higher education admissions process, including completing admissions and financial aid applications (i.e., Free Application for Federal Student Aid (FAFSA), grants, loans, scholarships, personal financing). 6. Examine the employment process, including searching for a job, filling out a job application, writing a resume, developing and practicing interview skills, and completing required employment forms (i.e. ., W-4, I-9). 7. Generate an electronic portfolio using digital tools (i.e., Webpage, wikis, blogs, podcast), including a cover letter, a current resume, a completed job application, interest aptitude, and achievement results; curriculum samples (i.e., academic research educational projects); four-year high school educational plan; education/career preparedness checklist; and other examples of academic achievements (i.e., student organizations, club memberships, honors, credentials, certificates, awards, community service experiences, recommendations). 8. Diagnose problems with hardware, software, and advanced network systems. 9. Demonstrate advanced technology skills, including compressing, converting, importing, exporting, backing up files, and transferring data among applications. 10. Compare functions of various operating systems. 11. Analyze cultural, social, economic, environmental, and political effects, and trends of technology to assess emerging technologies and forecast innovations. 12. Demonstrate appropriate digital citizenship through safe, ethical, and legal use of technology systems and digital content. 13. Utilize an online learning –management system to engage in collaborative learning projects, discussions, and assessments beyond the traditional classroom that are goaloriented, focused, project-based, and inquiry-oriented. Page 3 Career Preparedness Course Syllabus 14. Explain specific steps that consumers can take to minimize exposure to identify theft, fraudulent schemes, unethical sales practices, and exorbitant service fees. 15. Develop a plan for managing earning, spending, saving, and giving using spreadsheets, online resources or commercial software. 16. Evaluate the effect of personal preferences, advertising, marketing, peer pressure, and family history on consumer choices and decision making in the marketplace. 17. Distinguish differences between the purpose of saving and the objectives associated with investing. 18. Analyze various types of financial institutions. 19. Demonstrate how to manageus checking and savings accounts, balance bank statements and use online financial services. 20. Determine advantages and disadvantages of using credit. 21. Examine why credit ratings and credit reports are important to consumers. 22. Determine the types of insurance associated with different types of risks, including automobile, personal and professional liability, home, apartment, property, health, life, long-term care, and disability. 23. Develop a plan for financial security in the event of disaster, including secure storage Financial records and personal documents, available cash reserve, household Inventory lists, and medical record retention. TEXTBOOKS AND REFERENCES Alabama Department of Education Career and Technical Education, Federal Reserve Bank of Atlanta, Alabama, Jump$tart Coalition, Alabama Career Information Network, Alabama Council on Econonic Education, Alabama Department of Labor, NEFE High School Financial Planning Program, INSTRUCTIONAL DELIVERY PLAN Everyone should be in their seats when the tardy bell rings. The content standards to be taught each day will be listed on the board. Instructions for the day’s learning experience(s) will be provided by the teacher. At times, the instruction will be teacher centered, student centered, and teacher-student centered. Students will work on class projects independently and sometimes in teams. Guildelines and criteria for evaluating each project will be discussed prior to starting to work on projects. Page 4 Career Preparedness Course Syllabus ASSESSMENT PLAN Course Evaluation Evaluation Criteria Daily Participation Projects Weekly Test Vocabulary, Reading, Math, Social Studies, etc. Final Exam Total Percentage Value 15 25 25 10 25 100 The following scale will be used in assessing the student’s knowledge and skills during the semester. Grading Scale 90-100 = A 89 – 80 = B 79 – 70 = C 69- 60 = D 59- Below = F COURSE OUTLINE FIRST SEMESTER Career Preparedness A (Standards 1, 2, 2a, 3, 3a, 3b, 6, 6a, 8, 9, 10, 11, 11a, 12, 12a, 12b, 12c, 12d, and 12b). I. Personal Decision Making A. Decision-Making Process II. Academic Planning and Career Development A. Workforce Behavior 1. Workplace Etiquette 2. Workplace Violence and Sexual Harassment and Appropriate Workplace Action 3. Diversity in the Workplace B. Personal Skills Interest and Abilities Related to Current Career Opportunities 1. Assessments that Identify Personal Areas of Interest and Aptitude 2. Career Options from the 16 National Career Clusters 3. Safety and Health Standards in the Workplace C. Personal Preference, Education, and Training to Demands of the Workplace 1. Personal Career Goal Based on Results of Assessments 2. Employee Benefits and Incentives Related to Career Choices 3. Calculate Net Pay from a Gross Salary 4. Advanced Database Features Used to Examine the Effect of Career Choice On Lifestyle. D. Postsecondary/Higher Education Admissions Process 1. Application for Admissions 2. Financial Aid Process E. The Employment Process 1. Job Searches 2. Completion of Job Application 3. Writing a Resume 4. Interview Skills 5. Completion of Required Employment Forms 6. Use of Word Processing Software to Write Correspondence Document III. F. Electronic Portfolio Using Digital Tools 1. Content of Portfolio a. Cover Letter b. Current Resume c. Completed Job Application d. Assessment Results e. Curriculum Samples f. Four-Year Plan g. Education/Career Preparedness Checklist h. Other: Examples of Academic and Career Preparedness Achievements 2. Advanced Features of Word Processing 3. Advanced Features of Multimedia Software to Create and Make Presentations Using Effective Communication Skills. Technology Skills Applications A. Diagnose Problems 1. Hardware 2. Software 3. Advanced Network Systems B. Advanced Technology Skills 1. Compressing 2. Converting 3. Importing 4. Backing up Files 5. Transferring Data Among Applications C. Functions of Various Operating Applications D. Emerging Technologies and Forecast Innovations 1. Use of Emerging Technology Resources Including Social Network, and Electronic Communications E. Digital Citizenship 1. Consequences of Illegal and Unethical Use of Technology Systems and Digital Content 2. Copyright Laws and Policies 3. Creating and Maintaining a Positive Digital Footprint 4. Critique Internet and Digital Information 5. Source of Digital Content Using a Style Manual F. Utilize an Online Learning Management System G. Minimize Exposure to Identity Theft, Fraudulent Schemes, Unethical Sales Practices, and Exorbitant Services Fees 1. Online Safety Precautions COURSE OUTLINE SECOND SEMESTER Career Preparedness B ( Standards 2b, 2c, 4, 4a, 4b, 4c, 5, 7, 7a, 7b, 13, 14, 14a, 15, 15a, 15b, 15c, 15d, 16, 16a, 16b, 17, 17a, 17b, 18, 18a, 19, 20, 20a, 21, 21a, 21b, 21c, 21d, 22, 22a, 22b, and 23. IV. Managing Finances and Budgeting A. Create and Utilize a Plan for Earning, Spending, Saving and Giving using Spreadsheets, Online Resources, or Commercial Software. 1. Create a Budget, Network Statement and Income Expense Statement 2. Utilize Spreadsheet Features 3. Types of Income other than Wages 4. Evaluate various methods of acquiring Major Purchases B. Impact of Personal Preferences, Advertising, Marketing, Peer Pressure, and Family History on Consumer Choices and Decisions making in the Marketplace 1. Compare Goods and Services to determine best value 2. Different Payment Methods V. Saving and Investing A. Differences in the Purpose of Saving and Objectives with Investing 1. Principles of Compound Interest and Rule 72 2. Buying and Selling Investments 3. Different Retirement Options VI. Banking and Financial Institutions A. Types of Financial Institutions 1. Services related to cost associated with Financial Institutions B. Managing Checking and Savings Accounts, Balance Bank Statements, and Online Financial Services. VII. Credit and Debit A. Advantages and Disadvantages of Using Credit 1. Credit Card offerings and the Impact on Personal Finances B. Why Credit Ratings and Credit Reports are Important to Consumers 1. Building and maintaining a good Credit Score 2. Implications of entering into Contracts and Binding Agreements 3. Legal and Illegal Types of Credit 4. Implication of Bankruptcy VIII. Risk Management and Insurance A. Types of Insurance Associated with Different Risks 1. Factors that reduce cost of insurance 2. Which perils are insurable? B. Develop a Plan for Financial Security in the event of Disaster.