1 - Ministry of Social and Family Development

advertisement

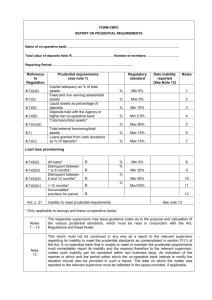

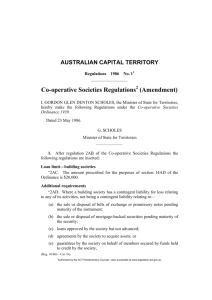

Version RCS150410 (final) Registry of Co-operative Societies Community Relations and Engagement Division Ministry of Community Development, Youth and Sports 510 Thomson Road, SLF Building, #14-03, Singapore 298135 Tel : 63548543 Fax : 62535028 Website : http://www.mcys.gov.sg/regcoop This form may take you 30 minutes to complete. You will need the following information to complete the form: Registered address of the credit society Credit society’s services, membership, operating policies and procedures, details of key personnel, committee of management and audit committee, as well as proposed maximum liabilities. Latest available financial figures of credit society FORM 5 APPLICATION FOR REGISTRATION AS CREDIT CO-OPERATIVE SOCIETY [Note: This form is applicable to a co-operative society which provides any financial services immediately before 20th October 2008] 1. The name of the credit society is: ----------------------------------------------------------------------------------------------------------------- 2. The registered office of the credit society is at : --------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------and its postal address (if different from the above) is: --------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------3. Membership (a) Total number of members: ----------------------------------------------------------------------------------------------------------------(b) State the nature of the pre-existing common bond of association or community of interest: --------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- 1 Version RCS150410 (final) 4. Existing and Proposed Financial Services (a) Please specify the financial services1 currently provided and those that the co-op intends or continues to provide after registration: Currently providing Intend/Continue to provide Receiving deposits Granting loans Others (b) Specify the other financial services to be provided. ------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- 5. Financial Information Provide the latest available financial figures as follows: ($) For FY ended __ Income Statement a) Surplus/(Deficit) before statutory contributions ($) As at __/__/__ Balance Sheet b) Subscription capital c) Members’ deposits d) Loans2 to members e) Restricted investments f) i) Equities ii) Bonds (excluding Singapore Government Securities and bonds issued by Singapore Statutory Boards) iii) Unit Trusts and Managed Funds iv) Equity in subsidiaries, joint-venture and associate entities that are not co-operatives3 Institutional capital (comprises accumulated surplus and general reserve fund) ‘financial services’ means receiving deposits, granting loans, or such other service of a financial nature as may be prescribed, other than in relation to the carrying on of insurance business within the meaning of the Insurance Act (Cap. 142). 2 This refers to the outstanding loans (excluding any interest payable). 3 Exclude shares currently held in co-operatives that are registered in Singapore. 1 2 Version RCS150410 (final) ($) As at __/__/__ g) Total assets h) Total liquid assets (comprises cash on hand, cash at bank and Singapore Government Securities) Ratios i) Capital Adequacy Ratio (CAR) = (f) / (g) % (NB: If CAR is less than 6%, please complete Q.6) j) Minimum Liquid Assets Ratio = (h) / [(b) + (c)] % k) 6. Restricted Investments Ratio = (e) / (g) % (NB: If more than 10%, please complete Q.7) Business Plan For credit co-ops that have negative CAR – Provide a business plan of not more than 3 pages on how the credit society intends to improve the financial health of the credit society (including but not limited to any undertaking by major institutional members, proposed timeframe and annual targets for net surpluses) in a separate attachment. 7. Investments Plan For credit co-ops that have Restricted Investments Ratio of 10% or more – Provide a plan of not more than 3 pages on how the credit society intends to reduce the level of restricted investments and focus on the core thrift and loan business (including but not limited to a proposed timeframe of not more than 5 years and annual targets for reducing the Restricted Investments Ratio) in a separate attachment. 8. Audit Committee Indicate the date in which the Audit Committee was formed or expected date that it will be formed. ----------------------------------------------------------------------------------------------------------------9. Proposed Maximum Liabilities State the proposed maximum liabilities which the credit society expects to incur in the next 3 years and provide the basis for the amounts: (a) loans from non-members ----------------------------------------------------------------------------------------------------------------- 3 Version RCS150410 (final) (b) loans and deposits from members and their immediate family members4 ----------------------------------------------------------------------------------------------------------------10. Credit Society’s By-laws – Please enclose one copy of the latest by-laws. 11. Any other information – Please provide any other information you may deem to be necessary to support your application. 12. Contact Person – The Registry of Co-operative Societies can contact the following person for any clarification: Name : _______________________________________________ Contact No. : _______________________________________________ Email address : _______________________________________________ Postal Address: _______________________________________________ _________________________________________________________________ 13. Submitted by Chairman and Secretary of Credit Society -- Name of Chairman : _________________________________________ Signature : _________________________________________ Name of Secretary : _________________________________________ Signature : _________________________________________ Dated the _______________ day of _____________ 2010 ‘Immediate family member’ means spouse, child, adopted child, step-child, parent, stepparent brother, step-brother, sister or step-sister of the member of the credit society. 4 4