Job Descriptions for Claims Staff

advertisement

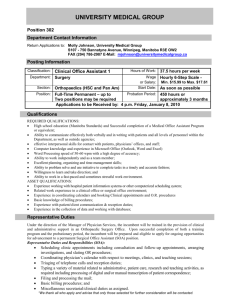

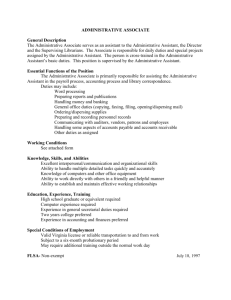

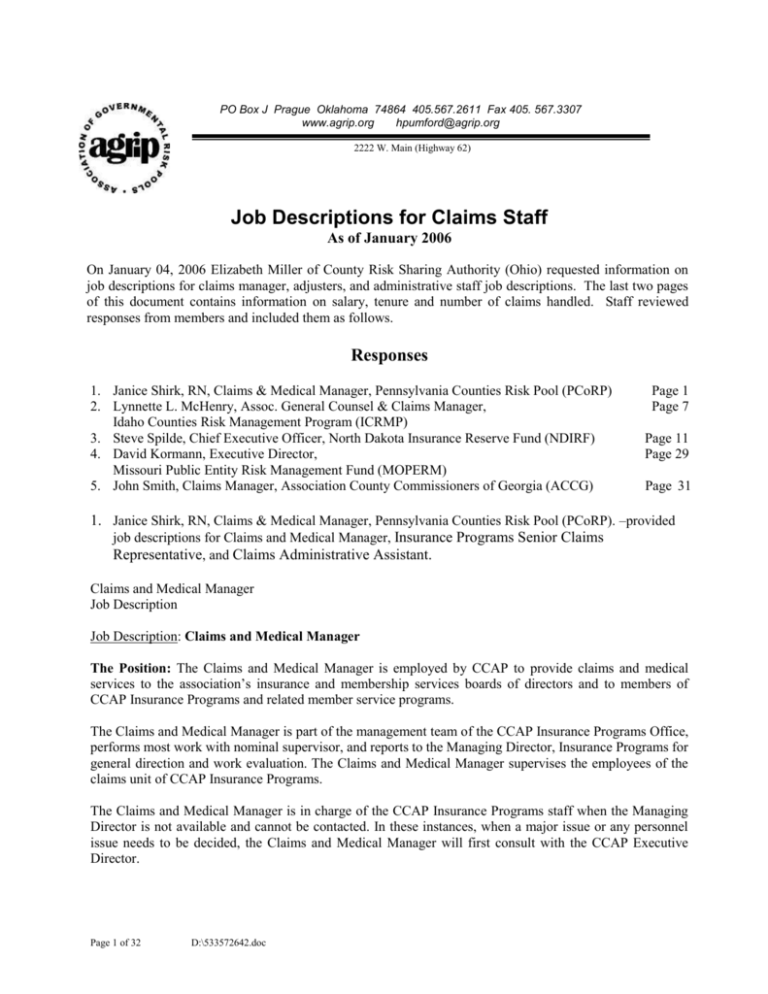

PO Box J Prague Oklahoma 74864 405.567.2611 Fax 405. 567.3307 www.agrip.org hpumford@agrip.org 2222 W. Main (Highway 62) Job Descriptions for Claims Staff As of January 2006 On January 04, 2006 Elizabeth Miller of County Risk Sharing Authority (Ohio) requested information on job descriptions for claims manager, adjusters, and administrative staff job descriptions. The last two pages of this document contains information on salary, tenure and number of claims handled. Staff reviewed responses from members and included them as follows. Responses 1. Janice Shirk, RN, Claims & Medical Manager, Pennsylvania Counties Risk Pool (PCoRP) 2. Lynnette L. McHenry, Assoc. General Counsel & Claims Manager, Idaho Counties Risk Management Program (ICRMP) 3. Steve Spilde, Chief Executive Officer, North Dakota Insurance Reserve Fund (NDIRF) 4. David Kormann, Executive Director, Missouri Public Entity Risk Management Fund (MOPERM) 5. John Smith, Claims Manager, Association County Commissioners of Georgia (ACCG) Page 1 Page 7 Page 11 Page 29 Page 31 1. Janice Shirk, RN, Claims & Medical Manager, Pennsylvania Counties Risk Pool (PCoRP). –provided job descriptions for Claims and Medical Manager, Insurance Programs Senior Claims Representative, and Claims Administrative Assistant. Claims and Medical Manager Job Description Job Description: Claims and Medical Manager The Position: The Claims and Medical Manager is employed by CCAP to provide claims and medical services to the association’s insurance and membership services boards of directors and to members of CCAP Insurance Programs and related member service programs. The Claims and Medical Manager is part of the management team of the CCAP Insurance Programs Office, performs most work with nominal supervisor, and reports to the Managing Director, Insurance Programs for general direction and work evaluation. The Claims and Medical Manager supervises the employees of the claims unit of CCAP Insurance Programs. The Claims and Medical Manager is in charge of the CCAP Insurance Programs staff when the Managing Director is not available and cannot be contacted. In these instances, when a major issue or any personnel issue needs to be decided, the Claims and Medical Manager will first consult with the CCAP Executive Director. Page 1 of 32 D:\533572642.doc Job responsibilities include the selection, installation and operation of a claims management computer system, and design of the positions and duties of the claims unit. The Claims and Medical Manager also provides support to the general operation of CCAP, including contribution of analyses and other background material for use in the CCAP lobbying effort, and other similar duties. The Claims and Medical Manager is responsible for supervision of the activities of claims personnel to investigate, process claims, establish reserves and settle claims as authorized, and to render prompt claims service and payment. The Claims and Medical Manager is the main CCAP staff liaison to the PIMCC Governing Board and the COMCARE Board, and is also involved in any other medical related member service of CCAP. Claims and Medical Manager Job Description General Responsibilities: The Claims and Medical Manager general responsibilities include: Supervision of the claim file handling of adjuster and claims supervisors to insure adherence to claims procedures. Provides guidance on claims, proper reserving and monitors files in litigation. Development and continued refinement of claims manual for CCAP Insurance Programs, and training of claims staff in policies and procedures. Participation in various contract and insurance policy negotiations. Reviews, negotiates, investigates and settles claim files. Management of selected workers’ compensation claims. Management of selected property/casualty claims. Acts as information source for the insurance programs staff, provides information to current members, prospective members, brokers, claims administrators and others concerning regulations, policies, coverage’s and procedures. Development and maintenance of a system to store appropriate claims historical information. Liaison to COMCARE Board and PIMCC Board and coordinator of services to be provided by CCAP to these programs. Management of the litigation performed by legal counsels for insurance program members, in conjunction with the Insurance Programs Legal Counsel. Liaison with outside vendors for peer review, utilization review, bill repricing, and other services. Preparation of required reports for insurance regulators. Preparation of reports for CCAP programs’ boards of directors and committees. Page 2 of 32 D:\533572642.doc Assistance with training and educational sessions for program board members and participants. Participation in the long range planning for CCAP insurance and member service programs. Performance of other assignments and routine business of the association. Qualifications: Demonstrated knowledge, skills and abilities in workers’ compensation and property/casualty insurance claims issues, management and analysis. Demonstrated knowledge of the Pennsylvania Political Subdivision Tort Claims Act, and experience with the defense of insurance claims filed against the state, counties and/or municipalities. Excellent oral and written communication skills, skill and experience in training others, better than average computer skills. Essential Physical Requirements: The essential physical requirements of this position relate to the requirement to be able to operate computer equipment essential to the completion of the position’s responsibilities. Periodic travel to CCAP members, insurance agents, board and committee meetings and CCAP workshops and conferences throughout Pennsylvania will be required. Periodic travel outside of Pennsylvania, and potentially overseas, for renewal meetings and training conferences. FLSA For purposes of the Fair Labor Standards Act this is an exempt position. Job Description: Insurance Programs Senior Claims Representative The Position: The Claims Representative is employed by CCAP to provide claims administration services to the association’s insurance programs. The Claims Representative is part of the team of the CCAP Insurance Programs Office, performs most work with some supervision, and reports to the Claims and Medical Manager for general direction, settlement authority and work evaluation. Job responsibilities include the investigation, evaluation, reserving, controlling expenses, monitoring vendors, resolution of claims, and some litigation management. The Claims Representative also provides support to the general operation of CCAP, including background material for use in the CCAP lobbying effort, and other similar duties. Page 3 of 32 D:\533572642.doc General Responsibilities: The Claims Representative general responsibilities include; management of workers’ compensation claims (medical only and some lost time). Claims investigation, evaluation, and resolution. Recognition of potential excess exposure and prompt reporting to the excess carriers and requesting authority from the Board of Directors. Acts in conjunction with other members of the claims department as an information source for the insurance programs staff, provides information to current members, brokers, and others concerning coverages, claims status and procedures. Assistance and participation in training and educational sessions for PCoRP board members , participants and CCAP claims personnel. Participation in short and long range planning for the CCAP claims unit and for CCAP insurance and member service programs. Perform tasks as required as back up for Senior Claims Representative and/or Claims and Medical Manager. Performance of other assignments and routine business of the association. Qualifications : Qualifications for the Claim Representative are: A college degree in business, insurance or related fields and 3 to 5 years experience as a workers’ compensation adjuster. Must have familiarity with computer claims management systems or Windows based programs. Must demonstrate a knowledge of the Pennsylvania Workers’ Compensation Act. Good to excellent oral and written communication skills, adequate computer skills. Essential Physical Requirements: The essential physical requirements of this position relate to the requirement to be able to operate computer equipment essential to the completion of the position’s responsibilities. Occasional travel to CCAP members, board meetings, committee meetings, CCAP workshops and conferences throughout Pennsylvania will be required. Possible travel outside of Pennsylvania for training conferences. FSLA For the purposes of the Fair Labor Standards Act this is an exempt position. Created April 1999 Job Description: Claims Administrative Assistant The Position: The Claims Administrative Assistant is employed by CCAP to provide claims reporting services for the association’s insurance programs. Page 4 of 32 D:\533572642.doc The Claims Administrative Assistant is part of the team of the CCAP Insurance Programs Office, performs most work with normal supervision and oversight, and reports to the Claims and Medical Manager for general direction and work evaluation. Job responsibilities include setting up, refining and monitoring, in conjunction with the Claims and Medical Manager, the check processing and financial components of the STARS claims management computer program including all financial aspects of the STARS claims computer system and the production of financial and loss reports. The Claims Administrative Assistant also inputs new claims into the STARS system and performs other claims related work as directed, including preparation of mailings and other clerical duties. The Claims Administrative Assistant also provides support to the general operation of CCAP, including specific projects assigned by the Claims and Medical Manager, and other similar duties. General Responsibilities: The Claims Administrative Assistant’s general responsibilities include: Printing, proofing, obtaining appropriate signatures and mailing all Pcomp, PCoRP and TPA claims checks, in a timely manner based on the parameters established by the CCAP Claims Manual. Matching the Eob’s with the appropriate check and the monitoring of recurring payments. Processing the deductible billings and mailing to the broker and county. Input the deductible payments into STARS under the appropriate claim. Developing and printing STARS claims systems reports for internal use of CCAP insurance programs staff, including loss information. Process and print the monthly aggregate reports. Process, print and mail the quarterly loss runs to the counties and brokers. Set up and maintain quarterly loss run notebooks for the entire insurance staff. Assist in the process of any adhoc reports requested by insurance staff or brokers. Run reports for and compile the aggregate excess report. Opening and distributing all daily mail for Pcomp and PCorp adjusters. Providing back up phone answering for the CCAP insurance programs office. Copying, collating, and preparing mailings to CCAP members. Filing, correspondence and other administrative duties. Performing other assignments and routine business of the association. Qualifications: Qualifications for the Claims Administrative Assistant The Claims Administrative Assistant position requires: A high school diploma, and 1 to 3 years experience. Must have familiarity with windows software or claims management system. Excellent oral, written communication, organizational and computer skills. Essential Physical Requirements: Page 5 of 32 D:\533572642.doc The essential physical requirements of this position relate to the requirement to be able to operate computer equipment essential to the completion of the position’s responsibilities. Periodic travel to board meetings, committee meetings, CCAP workshops and conferences throughout Pennsylvania may be required. FLSA For the purpose of the Fair Labor Standards Act this is a nonexempt position. Created January 2002 Revised November 2004 2. Lynnette L. McHenry, Associate General Counsel & Claims Manager, ICRMP – Provides job descriptions for Claims Assistant, Claims Technician ICRMP CLAIMS ASSISTANT Reports To: Claims Manager Supervises: Non-supervisory position Definition: Administrative support staff for the claims department along with direct administrative support to the Claims Manager Basic Job Responsibilities: a. Assist the Claims Manager and claims staff with various secretarial tasks, including computer-generated reports and drafting basic letters. b. Handle and route all calls, mail, emails, faxes and other correspondence for the claims department. c. Handle small first-party claims. d. Setup and distribute claims to all claims staff. e. Pay bills directly associated with claims, print checks and other reports as requested by claims staff and accounting department. f. File and maintain filing system. g. Copy, print photos and other duties as needed by the claims staff. h. Assist claims manager in administrative tasks as requested. Skills: 1. 2. 3. 4. 5. 6. 7. 8. Provide administrative support to manager and support the claims staff. Have experience in administrative and clerical procedures and responsibilities. Ability to handle multiple phone lines. Ability to communicate effectively with customers, members and co-workers. Must have current PC skills. Excellent customer service skills. Must be a cooperative team player. Excellent time management skills and have the ability to prioritize tasks. Page 6 of 32 D:\533572642.doc 9. 10. 11. 12. Excellent organizational skills in atmosphere with frequent interruptions. Ability to work well under pressure. Willingness to attend trainings and other events as requested. Willingness to perform other duties and responsibilities as needed. Page 7 of 32 D:\533572642.doc ICRMP Claims Technician Reports To: ICRMP Claims Manager Supervises: Non-supervisory position Definition: Manage first- and third-party Auto, Property, General Liability and occasional Law Enforcement and Errors & Omissions claims. Job Responsibilities: 2. Claims Investigation: a. Analyze and investigate claims and develop an action plan to facilitate dispositions. b. Correctly determine policy coverage, complete a thorough investigation of the claim and develop a clear understanding of all evidence relating to the claim. 3. Claim File Investigation: a. Evaluate and determine the degree of member’s liability or damages, claimant’s damages, and probable defense costs, and then set reserves based on most current information and analysis. b. Prepare and submit claim file reports in a timely manner. c. Review claim files and diaries in a timely manner and keep file notes up-to-date. d. Draft appropriate documents in a professional manner (declination letters, denial letters, claim files reports, etc.). 4. Resolution of Claims: a. Aggressively move a claim to either a denial or settlement by creative and proactive file handling. b. Maintain at minimum a 1:1 beginning to closing claim ratio. c. Negotiate settlements within authority limit. d. Arrange and attend settlement conferences, mediations, arbitration hearings and trials as needed. e. Coordinate and direct subrogation and recovery matters. 5. Management of Resources: a. Prioritize and organize workload effectively and keep claim diaries current. b. Must demonstrate strong communication and organizational skills. c. Direct and control outside services, including attorneys and independent adjusters. 6. Computer Competence: a. Must demonstrate competence in using computer systems and software to accomplish work assignments. 7. Teamwork/Customer Service: a. Work effectively with other ICRMP employees and members by being a team player. b. Strong communication skills required along with the ability to keep your composure in stressful situations. c. Excellent writing and verbal communication skills required. d. Must be able to effectively and pleasantly communicate with all ICRMP members. Page 8 of 32 D:\533572642.doc 8. Travel/Training: a. Ability to travel on occasion and be willing and able to attend various training sessions. b. Willingness to become proficient in local governmental law. c. Experience with public entity claims helpful but not required. CLAIMS MANAGER DUTIES REVIEW THE FOLLOWING: Micro: 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. Expense reserve – expense paid Reserve history dates Timely CFRs Litigation budget/plans Timely contact w/insured & claimant Coding: open-litigation; PL v. GL v. EO Subrogation possibilities Quality of file documentation Coverage Evaluation clear? Damage value x percentage of loss = reserve Plan of Action? W/target dates? Diaries Macro: 3. Review $100,000+ claims 4. Review 5 years or older DOL claims 5. Spot check small property claims Page 9 of 32 D:\533572642.doc CLAIMS SPECIALIST DUTIES Basic Job Responsibilities: 1. Analyze and investigate claims and develop an action plan to facilitate dispositions; 2. Prepare and submit claim file reports in a timely manner; 3. Place adequate reserves on files; 4. Maintain close contact with reinsurers, agents and members; 5. Direct and control outside services, including attorneys and independent adjusters; 6. Participate in resolving coverage issues; 7. Negotiate settlements within authority; 8. Arrange and attend settlement conferences, mediations, arbitration hearings and trials; 9. Provide proper guidance to members; 10. Coordinate and direct subrogation and recovery matters; 11. Maintain a good working relationship with members; 12. Review claim files and diaries in a timely manner and keep file notes up-to-date; 13. Attend training seminars as required; 14. Draft appropriate documents in a professional manner (declination letters, denial letters, claim files reports, etc.); 15. Have knowledge of the Idaho Tort Claims Act and other laws pertaining to governmental liability; and 16. Perform other duties as assigned. Page 10 of 32 D:\533572642.doc 3. Steve Spilde, Chief Executive Officer, North Dakota Insurance Reserve Fund (NDIRF), provides the following job descriptions, Claims Manager, Assistant Claims Manager, Outside Claims Adjuster, Inside Claims Adjuster Job Description Claims Manager EMPLOYEE NAME: _______________________________________________________________________ EXEMPT: Yes DEPARTMENT: Claims LOCATION: Bismarck, ND REPORTS TO: Chief Executive Officer PREPARED BY: Incumbent(s), CEO DATE: October 1996 APPROVED BY: DATE:____________ _______________________________________________________________________ 1. INTRODUCTION: The incumbent directs, manages, supervises and coordinates the claims processing function for the North Dakota Insurance Reserve Fund (NDIRF). Ensures that all claims are paid or settled in accordance with the goals and objectives of the NDIRF. The incumbent provides the highest caliber of professional advice, staff guidance, and support to the CEO and the NDIRF. This Job Description is not a contract and is subject to change. 2. SUPERVISORY CONTROLS: Work is performed under the supervision of the Chief Executive Officer (CEO). This is accomplished through delegation of authority, individual staff guidance, and expected compliance with established policies. Highly unusual or complicated problems may be referred to the CEO for further guidance or decision. Incumbent is expected to rely on his /her experience, judgment and knowledge to resolve problems. Performance is evaluated through direct observation, review of assigned work or projects, and compliance with established policies and procedures. *3. WORKING RELATIONSHIPS: Relationships with coworkers shall be guided by the following tenets: The incumbent is cooperative and, when appropriate, assists others. Works to promote teamwork within the department and throughout NDIRF. Shares information with peers. Resolves conflict through the use of tact and diplomacy. Accepts responsibility and works well when given responsibility. Accepts and is eager to learn new duties. Offers suggestions to improve the activities of the department and the operation of NDIRF. Continually strives to improve the proficiency of their job performance. Is a self-starter. Exhibits a positive image and outlook when interacting with coworkers and/or the public. Serves as a positive role model for others. DUTIES AND RESPONSIBILITIES: 1. DEPARTMENT MANAGEMENT (30%) ESSENTIAL FUNCTIONS; Page 11 of 32 D:\533572642.doc *a. Assumes management responsibility for all services and activities of the NDIRF Claims department. Directs, participates and advises in the development and implementation of goals, objectives, policies and priorities for assigned programs. Recommends and administers, within policy guidelines, appropriate service and staffing levels, policies and procedures. b. Selects, trains, motivates and evaluates claims staff. Provides or coordinates staff training and works with staff to correct deficiencies. Implements discipline and termination procedures, if necessary. *c. Exercises direct supervision of supervisory, professional, technical and support staff of the Claims department Plans, directs, coordinates and reviews the work plan for the NDIRF Claims department. Monitors and evaluates the efficiency and effectiveness of service delivery methods and procedures at all times. Identifies and develops strategies for the resolution of claims. Identifies opportunities for improvement in operations and reviews with the CEO. d. Works with the NDIRF departments in organizing joint activities and operations; coordinates with and provides assistance to other departmental programs, as necessary or appropriate. Provides responsible staff assistance to the CEO. Prepares and presents staff reports; provides status reports regarding loss information, reserves, significant claims and the progress and strategy involved for claims in litigation. e. Participates in marketing and public relations efforts of the NDIRF, including preparation of material for the newsletter, attendance at and participation in various conferences, workshops and seminars as a representative of the NDIRF. Provides technical support to members in the area of claims. Assists other NDIRF departments, as appropriate, to facilitate the overall operation of the Fund. 2. CLAIMS MANAGEMENT (45%) ESSENTIAL FUNCTIONS: *a. Meets with all Claims department staff to identify and resolve problems; assigns and prioritizes work activities, projects and programs; monitors work flow and administrative and support systems, including internal reporting relationships. Ensures the maintenance of adequate and appropriate reserves for all claims and reviews reserves on a regular basis, adjusting as necessary. Responds to and resolves difficult and sensitive inquiries or complaints; negotiates and resolves significant and controversial issues. b. Participates in the development and administration of the claims management program budget, including the forecast of funds needed for staffing, equipment, materials and supplies. Approves and monitors Claims' department expenditures and implements adjustments as necessary. OTHER DUTIES: c. Attends and participates in professional group meetings and seminars, to maintain an awareness and knowledge of current trends and innovations in the field of claims management. Page 12 of 32 D:\533572642.doc d. Participates in adjusting claims, including conduct of investigations to determine liability exposures and whether settlement is the most appropriate, cost-effective resolution of claims; negotiates settlements and monitors the status of all assigned claims. *3. CASE MANAGEMENT (25%) ESSENTIAL FUNCTIONS: *a. Monitors all claims involved in litigation; develops and maintains a list of independent adjusters and attorneys who are qualified to represent the NDIRF; authorizes the use of contract personnel as necessary and reviews and approves fees billed by contracted claims personnel; meets regularly with attorneys engaged to defend NDIRF to plan for litigation, attends depositions, settlement conferences, hearings and trials as appropriate to facilitate the claims management function. NOTE: Denotes Critical Performance Elements and/or Critical Tasks. Page 13 of 32 D:\533572642.doc POSITION QUALIFICATIONS STATEMENT Claims Manager _______________________________________________________________________ EXEMPT: Yes DEPARTMENT: Claims LOCATION: Bismarck, ND REPORTS TO: Chief Executive Officer PREPARED BY: Incumbent(s), CEO DATE: October 1996 APPROVED BY: DATE:____________ _______________________________________________________________________ QUALIFICATION REQUIREMENTS: To perform this job successfully, an individual must be able to perform each essential duty satisfactorily. The requirements listed below are representative of the knowledge, skill, and/or ability required. Reasonable accommodations may be made to enable individuals with disabilities to perform the essential functions. EDUCATION and/or EXPERIENCE: 1. A bachelor's degree or equivalent from an accredited college or university with major course work in public administration, business administration or a related field; and a. Seven years of increasingly responsible experience in handling multi-line claims, including two years of supervisory experience in the field of insurance claims management; or b. A combination of education and experience that would provide the required knowledge and abilities. LANGUAGE SKILLS: 1. Ability to read and interpret laws and regulations, standards and documents, such as policy/procedure manuals. 2. Ability to communicate clearly and concisely, both orally and in writing. MATHEMATICAL SKILLS: 1. Ability to add, subtract, multiply, and divide in all units of measure, using whole numbers, common fractions, and decimals. Ability to compute rate, ratio, and percent and to draw and interpret bar graphs. REASONING ABILITY: 1. Ability to analyze problems, identify alternative solutions, project consequences of proposed actions and implement recommendations in support of goals. 2. Ability to calculate the financial impact of damages and liability for the NDIRF. Page 14 of 32 D:\533572642.doc CERTIFICATES, LICENSES, REGISTRATIONS: 1. Certified Property and Casualty Underwriter (CPCU) and/or Associate in Claims (AIC) is/are desirable. 2. Possession of, or ability to obtain, a valid ND driver's license. OTHER SKILLS and ABILITIES: 1. Ability to select, train, supervise and evaluate staff and effectively administer a variety of claims management activities. 2. Ability to accurately estimate the potential for loss and the amount of reserves required and negotiate settlements. 3. Ability to prepare and administer budgets. 4. Ability to develop and conduct presentations for seminars and conferences. 5. Ability to establish and maintain effective working relationships with those contacted in the course of work. 6. Knowledge of, and ability to interpret and apply, federal, state and local laws, codes and regulations; and of local government organization and policies and procedures. 7. Knowledge of operational characteristics, services and activities of a claims management program, including negotiation and settlement principles, practices and documentation and insurance, claims and legal issues as they relate to claims management. 8. Knowledge of basic tort liability law and the coverages offered by the NDIRF. 9. Knowledge of modern and complex principles and practices of program development and administration and organization and management practices. 10. Knowledge of modern office procedures, methods and equipment including computers, computer software, and related equipment. PHYSICAL DEMANDS: The physical demands described here are representative of those that must be met by an employee to successfully perform the essential functions of this job. Reasonable accommodations may be made to enable individuals with disabilities to perform the essential functions. 1. While performing the duties of this job, the employee is regularly required to use hands to finger, handle, or feel objects, tools, or controls; reach with hands and arms; talk and hear. The employee frequently is required to sit. The employee is occasionally required to stand; walk; and stoop, kneel, crouch, or crawl. 2. The employee must occasionally lift and/or move up to 50 pounds. Specific vision abilities by this job include close vision, distance vision, color vision, peripheral vision, and the ability to adjust focus. Page 15 of 32 D:\533572642.doc WORK ENVIRONMENT: The work environment characteristics described here are representative of those an employee encounters while performing the essential functions of this job. Reasonable accommodations may be made to enable individuals with disabilities to perform the essential functions. 1. The work environment is typically an indoor business office environment however, while performing the duties of this job, the employee occasionally works in outside weather conditions. 2. The noise level in the work environment is usually moderate. 3. Occasional overnight travel is required. Job Description Assistant Claims Manager EMPLOYEE NAME: _______________________________________________________________________ EXEMPT: Yes DEPARTMENT: Claims LOCATION: Bismarck, ND REPORTS TO: Claims Manager PREPARED BY: Incumbent(s), Manager, CEO DATE: October 1996 APPROVED BY: DATE:___________ _______________________________________________________________________ 1. INTRODUCTION: The incumbent assigns, supervises, participates and reviews the work of North Dakota Insurance Reserve Fund (NDIRF) Claims Department Staff. Additionally, the Assistant Claims Manager is responsible for the adjustment and settlement of claims. The incumbent provides the highest caliber of professional advice, staff guidance, and support to the Claims Department Manager and the NDIRF. This Job Description is not a contract and is subject to change. 2. SUPERVISORY CONTROLS: Work is performed under the direct supervision of the Claims Department Manager. This is accomplished through delegation of authority and expected compliance with established claims handling procedures . Highly unusual or complicated problems may be referred to the Claims Department Manager for further guidance or decision. Incumbent is expected to rely on his /her experience, judgment and knowledge to resolve routine problems. Performance is evaluated through direct observation, review of assigned work or projects, and compliance with established policies and claims handling procedures. *3. WORKING RELATIONSHIPS: Relationships with coworkers shall be guided by the following tenets: The incumbent is cooperative and, when appropriate, assists others. Works to promote teamwork within the department and throughout NDIRF. Shares information with peers. Resolves conflict through the use of tact and diplomacy. Accepts responsibility and works well when given responsibility. Accepts and is eager to learn new duties. Offers suggestions to improve the activities of the department and the operation of NDIRF. Continually strives to improve the proficiency of their job performance. Is a self-starter. Exhibits a Page 16 of 32 D:\533572642.doc positive image and outlook when interacting with coworkers and/or the public. Serves as a positive role model for others. DUTIES AND RESPONSIBILITIES: *1. CLAIMS STAFF SUPERVISION (40%) ESSENTIAL FUNCTIONS; *a. Provides direct supervision of the professional and technical staff of the Claims Department. Plans, prioritizes, assigns, supervises and reviews the work of NDIRF claims staff, including review of all new loss notices for assignment to appropriate claims personnel and monitoring of all claims reserves, recommending adjustments to reserves as appropriate. Recommends and assists in the implementation of goals and objectives, establishes schedules and methods for providing claims management services and implements policies and procedures. Assists other NDIRF departments, as appropriate, to facilitate the overall operation of the Fund. *b. Meets regularly with claims staff to review progress in the administration and settlement of all claims. Determines when settlement is the most appropriate and costeffective approach for resolution of a claim. Also, assists NDIRF Risk Services staff, and provides appropriate and timely claims information. c. Participates in the selection of claims staff. Provides or coordinates staff training, evaluates performance, works with staff to correct deficiencies and implements discipline procedures, if necessary. Page 17 of 32 D:\533572642.doc 2. CLAIMS MANAGEMENT (60%) ESSENTIAL FUNCTIONS: *a. Supervises and participates in the NDIRF claims management function, acting in the capacity of a claims adjuster, as necessary or appropriate. Conducts investigations and analyzes contracts and evidence to determine liability exposures, the extent of coverage and liability. Prepares a variety of specialized reports and correspondence regarding operations of the claims department. b. Oversees the work of independent attorneys and claims adjusters, regularly reviewing progress and the status of each claim. Attends depositions, settlement conferences, trials and alternative dispute resolution meetings pertaining to assigned claims. OTHER DUTIES: c. Implements and supervises plans to make salvage and subrogation recoveries. d. Attends and participates in professional group meetings and seminars, to maintain an awareness and knowledge of current trends and innovations in the field of claims management. NOTE: * Denotes Critical Performance Elements and/or Critical Tasks. POSITION QUALIFICATIONS STATEMENT Assistant Claims Manager _______________________________________________________________________ EXEMPT: Yes DEPARTMENT: Claims LOCATION: Bismarck, ND REPORTS TO: Claims Manager PREPARED BY: Incumbent(s), Manager, CEO DATE: October 1996 APPROVED BY: DATE: ____________ _______________________________________________________________________ QUALIFICATION REQUIREMENTS: To perform this job successfully, an individual must be able to perform each essential duty satisfactorily. The requirements listed below are representative of the knowledge, skill, and/or ability required. Reasonable accommodations may be made to enable individuals with disabilities to perform the essential functions. EDUCATION and/or EXPERIENCE: 1. A bachelor's degree or equivalent from an accredited college or university with major course work in public administration, business administration or a related field; and a. Four years of increasingly responsible experience in handling multi-line claims, including at least one year of lead or supervisory experience in the field of insurance claims management; or b. A combination of education and experience that would provide the required knowledge and abilities. Page 18 of 32 D:\533572642.doc LANGUAGE SKILLS: 1. Ability to read and interpret laws, regulations, standards and documents, such as policy/procedure manuals. 2. Ability to communicate clearly and concisely, both orally and in writing. MATHEMATICAL SKILLS: 1. Ability to add, subtract, multiply, and divide in all units of measure, using whole numbers, common fractions, and decimals. Ability to compute rate, ratio, and percent and to draw and interpret bar graphs. REASONING ABILITY: 1. Ability to plan, organize, direct and coordinate the work of assigned staff. 2. Ability to analyze problems, identify alternative solutions, project consequences of proposed actions and implement recommendations in support of goals. 3. Ability to calculate the financial impact of liability and damages for the NDIRF. CERTIFICATES, LICENSES, REGISTRATIONS: 1. Certified Property and Casualty Underwriter (CPCU) and/or Associate in Claims (AIC) is/are desirable. 2. Possession of, or ability to obtain, a valid ND driver's license. OTHER SKILLS and ABILITIES: 1. Ability to select, supervise, train and evaluate staff. 2. Ability to negotiate settlements. 3. Establish and maintain effective working relationships with those contacted in the course of work. 4. Knowledge of operational characteristics, services and activities of a claims management program, including good faith settlement and negotiation principles, practices and documentation. 5. Knowledge of, and ability to interpret and apply, pertinent federal, state and local laws, codes and regulations; and of local government organization, and policies and procedures. 6. Knowledge of basic tort liability law and the various coverage’s offered by NDIRF. Page 19 of 32 D:\533572642.doc 7. Ability to accurately estimate the potential for loss and the amount of reserves required for claims. 8. Knowledge of modern office procedures, methods and equipment including computers, computer software, and related equipment. PHYSICAL DEMANDS: The physical demands described here are representative of those that must be met by an employee to successfully perform the essential functions of this job. Reasonable accommodations may be made to enable individuals with disabilities to perform the essential functions. 1. While performing the duties of this job, the employee is regularly required to use hands to finger, handle, or feel objects, tools, or controls; reach with hands and arms; talk and hear. The employee frequently is required to sit. The employee is occasionally required to stand; walk; and stoop, kneel, crouch, or crawl. 2. The employee must occasionally lift and/or move up to 50 pounds. Specific vision abilities required by this job include close vision, distance vision, color vision, peripheral vision, depth perception, and the ability to adjust focus. WORK ENVIRONMENT: The work environment characteristics described here are representative of those an employee encounters while performing the essential functions of this job. Reasonable accommodations may be made to enable individuals with disabilities to perform the essential functions. 1. The work environment is typically an indoor business office environment however, while performing the duties of this job, the employee occasionally works in outside weather conditions. 2. The noise level in the work environment is usually moderate. 3. Occasional overnight travel is required. Page 20 of 32 D:\533572642.doc Job Description Outside Claims Adjuster EMPLOYEE NAME: _______________________________________________________________________ EXEMPT: Yes DEPARTMENT: Claims LOCATION: Bismarck, ND REPORTS TO: Assistant Claims Manager PREPARED BY: Incumbent(s), Manager DATE: October 1996 APPROVED BY: DATE:___________ _______________________________________________________________________ 1. INTRODUCTION: The incumbent performs professional and technical work in the on-site appraisal, investigation and adjustment of claims for the North Dakota Insurance Reserve Fund (NDIRF); oversees the activities of contracted independent adjusters and law firms. *The incumbent serves as ambassador at large for the NDIRF, and conducts himself/herself in a professional manner at all times. This Job Description is not a contract and is subject to change. 2. SUPERVISORY CONTROLS: Work is performed under the general supervision of the Assistant Claims Manager. This is accomplished through delegation of authority and expected compliance with established NDIRF policies and standardized claims handling procedures. Highly unusual or complicated problems may be referred to the Assistant Claims Manager or Claims Department Manager for further guidance or decision. Incumbent is expected to rely on his /her experience, judgment and knowledge to resolve routine problems. Performance is evaluated through: direct observation; review of assigned work or projects; completed claim files; feedback received from agents, members, and claimants; and compliance with established NDIRF policies, procedures and claims management practices. *3. WORKING RELATIONSHIPS: Relationships with coworkers shall be guided by the following tenets: The incumbent is cooperative and, when appropriate, assists others. Works to promote teamwork within the department and throughout NDIRF. Shares information with peers. Resolves conflict through the use of tact and diplomacy. Accepts responsibility and works well when given responsibility. Accepts and is eager to learn new duties. Offers suggestions to improve the activities of the department and the operation of NDIRF. Continually strives to improve the proficiency of their job performance. Is a self-starter. Exhibits a positive image and outlook when interacting with coworkers and/or the public. Serves as a positive role model for others. Page 21 of 32 D:\533572642.doc DUTIES AND RESPONSIBILITIES: 1. CLAIMS ADJUSTING (75%) ESSENTIAL FUNCTIONS: a. Reviews loss notices, confirms coverage and monitors claims reserves as assigned. Assists in determining assignment of claims to contracted independent adjusters. *b. Conducts on-site investigations to inspect damage and determine liability exposures on a state-wide basis. Collects oral and written statements, records, documents, photographs from insured member(s) and claimant(s), and prepares diagrams which support or dispute claims. Continuously updates skills to remain current with trends and innovations in the claims management field. c. Supervises contracted outside adjusters and reviews invoices submitted by independent contractors to confirm material and labor costs and approves them for payment. 2. CLAIMS REPORTING (25%) ESSENTIAL FUNCTIONS: *a. Prepares memoranda and/or loss reports which support determinations regarding liability and/or damage and negotiates prompt, equitable, cost-effective settlements. b. Communicates regularly with agents and members regarding the status of claims. c. Reviews the status of assigned claims with the Assistant Claims Manager on a regular basis. Provides technical assistance to other NDIRF departments, as appropriate. NOTE: * Denotes Critical Performance Elements and/or Critical Tasks. Page 22 of 32 D:\533572642.doc POSITION QUALIFICATIONS STATEMENT Outside Claims Adjuster _______________________________________________________________________ EXEMPT: Yes DEPARTMENT: Claims LOCATION: Bismarck, ND REPORTS TO: Assistant Claims Manager PREPARED BY: Incumbent(s), Manager, DATE: October 1996 APPROVED BY: DATE:____________ _______________________________________________________________________ QUALIFICATION REQUIREMENTS: To perform this job successfully, an individual must be able to perform each essential duty satisfactorily. The requirements listed below are representative of the knowledge, skill, and/or ability required. Reasonable accommodations may be made to enable individuals with disabilities to perform the essential functions. EDUCATION and/or EXPERIENCE: 1. A bachelor's degree or equivalent from an accredited college or university with major course work in public administration, business administration or a related field; and a. Four to five years of increasingly responsible experience in handling multi-line claims; or b. A combination of education and experience that would provide the required knowledge and abilities. LANGUAGE SKILLS: 1. Ability to read and interpret laws, regulations, standards and documents, such as policy/procedure manuals. 2. Ability to communicate clearly and concisely, both orally and in writing. MATHEMATICAL SKILLS: 1. Ability to add, subtract, multiply, and divide in all units of measure, using whole numbers, common fractions, and decimals. Ability to compute rate, ratio, and percent and to draw and interpret bar graphs. REASONING ABILITY: 1. Ability to accurately estimate the potential for loss, the amount of reserves required for claims and the financial impact of liability and damages to the NDIRF. 2. Ability to interpret a variety of instructions furnished in oral, written, diagram or schedule form. CERTIFICATES, LICENSES, REGISTRATIONS: 1. Associate in Claims (AIC) desirable. Page 23 of 32 D:\533572642.doc 2. Possession of, or ability to obtain, a valid ND drivers license. OTHER SKILLS and ABILITIES: 1. Ability to negotiate settlements, make decisions and work independently in the absence of supervision. 2. Ability to establish and maintain effective working relationships with those contacted in the course of work. 3. Knowledge of good faith settlement tactics and the operational characteristics, services and activities of a claims management program, including negotiation and settlement principles and practices. 4. Knowledge of insurance, claims and legal issues, including basic tort liability law, as they relate to claims management. 5. Knowledge of general insurance principles, practices and terminology, including the various coverages offered by the NDIRF. 6. Knowledge of state and local government organization, and policies and procedures. 7. Knowledge of modern office procedures, methods and equipment including computers, computer software, and related equipment. PHYSICAL DEMANDS: The physical demands described here are representative of those that must be met by an employee to successfully perform the essential functions of this job. Reasonable accommodations may be made to enable individuals with disabilities to perform the essential functions. 1. While performing the duties of this job, the employee is frequently required to stand; walk; sit; use hands to finger, handle, or feel objects, tools, or controls; reach with hands and arms; climb or balance; stoop, kneel, crouch, or crawl; talk and hear; and taste or smell. 2. The employee must frequently lift and/or move up to 50 pounds. Specific vision abilities required by this job include close vision, distance vision, color vision, peripheral vision, depth perception, and the ability to adjust focus. Page 24 of 32 D:\533572642.doc WORK ENVIRONMENT: The work environment characteristics described here are representative of those an employee encounters while performing the essential functions of this job. Reasonable accommodations may be made to enable individuals with disabilities to perform the essential functions. 1. The work environment is typically an indoor business office environment however, while performing the duties of this job, the employee frequently works in outside weather conditions, wet/humid conditions; near moving, mechanical parts; in high, precarious places; fumes or airborne particles; and risk of electrical shock. 2. The noise level in the work environment is usually moderate. 3. Overnight travel is frequently required. Job Description Inside Claims Adjuster EMPLOYEE NAME: _______________________________________________________________________ EXEMPT: Yes DEPARTMENT: Claims LOCATION: Bismarck, ND REPORTS TO: Assistant Claims Manager PREPARED BY: Incumbent(s), Manager DATE: October 1996 APPROVED BY: DATE: ___________ _______________________________________________________________________ 1. INTRODUCTION: The incumbent adjusts multi-line claims for the North Dakota Insurance Reserve Fund (NDIRF), and provides both general and technical assistance to agents, members and the public regarding claims inquiries. This Job Description is not a contract and is subject of change. 2. SUPERVISORY CONTROLS: Work is performed under the general supervision of the Assistant Claims Manager. This is accomplished through delegation of authority and expected compliance with established NDIRF policies and standardized claims handling procedures. Highly unusual or complicated problems may be referred to the Assistant Claims Manager or Claims Manager for further guidance or decision. Incumbent is expected to rely on his/her experience, judgment and knowledge to resolve routine problems. Performance is evaluated through: direct observation; review of assigned work or projects; completed claim files; feedback received from agents, members, and claimants; and compliance with established NDIRF policies, procedures and claims management practices. *3. WORKING RELATIONSHIPS: Relationships with coworkers shall be guided by the following tenets: The incumbent is cooperative and, when appropriate, assists others. Works to promote teamwork within the department and throughout NDIRF. Shares information with peers. Resolves conflict through the use of tact and diplomacy. Accepts responsibility and works well when given responsibility. Accepts and is eager to learn new duties. Offers suggestions to improve the activities of the department and the operation of NDIRF. Continually strives to improve the proficiency of their job performance. Is a self-starter. Exhibits a positive image and outlook when interacting with coworkers and/or the public. Serves as a positive role model for others. Page 25 of 32 D:\533572642.doc DUTIES AND RESPONSIBILITIES: 1. MULTI-LINE CLAIMS ADJUSTMENT (75%) ESSENTIAL FUNCTIONS; *a. Processes and resolves claims which can be handled in house by telephone or written correspondence. This includes review of loss notices, confirmation of coverage, investigation to determine liability exposures, participation in settlement negotiations and monitoring reserves. Responsible for and has authority to adjust local claims within the same authority as an outside adjuster. b. Determines damages sustained by members and/or third-party claimants. For assigned claims, contracts and supervises independent adjusters retained to help establish liability and damages. c. Communicates regularly with agents and other appropriate parties regarding the status of claims and handles claims in a prompt, reasonable and cost-effective manner. d. Reviews the status of assigned claims with the Assistant Claims Manager. e. Analyzes contracts and evidence regarding assigned claims to determine if loss or defense of claim can be shifted to other parties. OTHER DUTIES: f. Performs a variety of administrative duties in support of the NDIRF claims function, including entry of data into established computer databases and preparation of correspondence. g. Performs salvage and subrogation recovery. Provides technical assistance to other NDIRF departments, as appropriate. *2. SCHOLASTIC CLAIMS ADJUSTMENT (25%) ESSENTIAL FUNCTIONS; *a. Processes scholastic injury claims, including establishment of reserves, determination of processing dates and claimant eligibility, review supplementation of files and prepare files for issuance of checks, as appropriate. NOTE: * Denotes Critical Performance Elements and/or Critical Tasks. Page 26 of 32 D:\533572642.doc POSITION QUALIFICATIONS STATEMENT Inside Claims Adjuster _______________________________________________________________________ EXEMPT: Yes DEPARTMENT: Claims LOCATION: Bismarck, ND REPORTS TO: Assistant Claims Manager PREPARED BY: Incumbent(s), Manager DATE: October 1996 APPROVED BY: DATE:____________ _______________________________________________________________________ QUALIFICATION REQUIREMENTS: To perform this job successfully, an individual must be able to perform each essential duty satisfactorily. The requirements listed below are representative of the knowledge, skill, and/or ability required. Reasonable accommodations may be made to enable individuals with disabilities to perform the essential functions. EDUCATION and/or EXPERIENCE: 1. A two year college degree or equivalent, or specialized training in claims administration; and a. Three to four years of experience in handling basic insurance claims; or b. A combination of education and experience that would provide the required knowledge and abilities. LANGUAGE SKILLS: 1. Ability to read and interpret laws, regulations, standards and documents, such as policy/procedure manuals. 2. Ability to communicate clearly and concisely, both orally and in writing. MATHEMATICAL SKILLS: 1. Ability to add, subtract, multiply, and divide in all units of measure, using whole numbers, common fractions, and decimals. Ability to compute rate, ratio, and percent and to draw and interpret bar graphs. REASONING ABILITY: 1. Ability to calculate the financial impact of liability and damages for the NDIRF and accurately estimate the potential for loss and amount of reserves required for claims. 2. Ability to interpret a variety of instructions furnished in oral, written, diagram or schedule form. CERTIFICATES, LICENSES, REGISTRATIONS: 1. Associate in Claims (AIC) desirable. 2. Possession of, or ability to obtain, a valid ND driver's license. OTHER SKILLS and ABILITIES: Page 27 of 32 D:\533572642.doc 1. Ability to work independently in the absence of supervision. 2. Knowledge of good faith settlement tactics and the operational characteristics, services and activities of a claims management program, including negotiation and settlement principles and practices. 3. Knowledge of state and local government organization, and policies and procedures, as well as basic insurance principles, practices and terminology. 4. Knowledge of basic tort liability law and of the various coverage’s offered by the NDIRF. 5. Ability to establish and maintain effective working relationships with those contacted in the course of work. 6. Knowledge of modern office procedures, methods and equipment including computers and related equipment. PHYSICAL DEMANDS: The physical demands described here are representative of those that must be met by an employee to successfully perform the essential functions of this job. Reasonable accommodations may be made to enable individuals with disabilities to perform the essential functions. 1. While performing the duties of this job, the employee is occasionally required to stand; walk; sit; use hands to finger, handle, or feel objects, tools, or controls; reach with hands and arms; climb or balance; stoop, kneel, crouch, or crawl; talk and hear; and taste or smell. 2. The employee must occasionally lift and/or move up to 10 pounds. Specific vision abilities required by this job include close vision, distance vision, color vision, peripheral vision, depth perception, and the ability to adjust focus. WORK ENVIRONMENT: The work environment characteristics described here are representative of those an employee encounters while performing the essential functions of this job. Reasonable accommodations may be made to enable individuals with disabilities to perform the essential functions. 1. The work environment is typically an indoor business office environment. 2. The noise level in the work environment is usually moderate. 4. David Kormann, Executive Director, Missouri Public Entity risk Management Fund (MOPERM), provides the following job descriptions, Risk Management Specialist I and II MOPERM’s job descriptions are the following two pages. Page 28 of 32 D:\533572642.doc STATE OF MISSOURI OFFICE OF ADMINISTRATION EMPLOYEE SIGNATURE__________________________ DATE ___________ DIVISION OF GENERAL SERVICES PERFORMANCE PLANNING AND PROGRESS DISCUSSION SUPERVISIOR SIGNATURE_________________________ DATE ___________ REVIEWER SIGNATURE____________________________ DATE ___________ TITLE/POSITION RISK MANAGEMENT SPECIALIST 1 NAME UNIT/SECTION Moperm DATE: January 1, 2003 HOW DOES YOUR JOB CONTRIBUTE TO THE STRATEGIC PLAN OF THE DIVISION? By providing cost effective liability coverages to Missouri public entities. ESSENTIAL FUNCTION (KEY RESULT AREA) Claims Administration OUTCOME OR PRODUCT Efficient and economical claims administration, which complies with MOPERM’S quality and service standards. ACTIVITY OR TASKS WHICH WILL PRODUCE THE OUTCOME OR PRODUCT Conduct prompt and thorough investigation. Evaluate information and make decisions relative to coverage, liability and damages. Negotiate equitable settlements. Administrative Support Assistance to Management Career Development Continued development of knowledge and skills essential to competent job performance Complete special projects as assigned. Attend Risk Management/Claims seminars and conferences as they become available Read professional/trade periodicals Stay current on judicial, legislative, industry and policy changes Continue to improve computer skills. Focus on customer needs Staff and Public Relations Customer satisfaction Professional and productive work environment Enhanced image and reputation of MOPERM Page 29 of 32 D:\533572642.doc Establish positive, constructive working relationships with co-workers, members, agents, and vendors. Maintain effective communications and project competency and professionalism. HELP NEEDED TO COMPLETE THE ACTIVITY OR TASK DISCUSSION DATES STATE OF MISSOURI OFFICE OF ADMINISTRATION EMPLOYEE SIGNATURE__________________________ DATE ___________ DIVISION OF GENERAL SERVICES PERFORMANCE PLANNING AND PROGRESS DISCUSSION TITLE/POSITION Risk Management Specialist II NAME SUPERVISIOR SIGNATURE_________________________ DATE ___________ REVIEWER SIGNATURE____________________________ DATE ___________ UNIT/SECTION MOPERM DATE: January 2, 2003 HOW DOES YOUR JOB CONTRIBUTE TO THE STRATEGIC PLAN OF THE DIVISION? By providing cost effective liability coverages to Missouri public entities. ESSENTIAL FUNCTION (KEY RESULT AREA) Claims and Litigation Management OUTCOME OR PRODUCT Cost effective and efficient claims Adjustment Control litigation costs and obtain positive resolution of lawsuits ACTIVITY OR TASKS WHICH WILL PRODUCE THE OUTCOME OR PRODUCT Continuous monitoring and analysis of open claims count, reserves and amounts paid, customer satisfaction and work product of department employees and outside personnel Continuous monitoring of litigation files and frequent communication with defense counsel Provide semi-annual claim trend analysis to Executive Director Review claims procedures and duties of all department employees to increase efficiency and implement cross training of staff Attend trials and other court proceedings Analyze Member’s claims and provide evaluation of loss history to Loss Control and Member Services Staff Risk Management Reduce Losses Complete special projects as assigned Attend seminars and conferences that pertain to topical issues Administrative Support Assistance to Executive Director Career Development Keep apprised of new developments in the industry Keep apprised of developments in case law MOPERM membership will be better served Public Relations Page 30 of 32 D:\533572642.doc Read trade journals and various newsletters Maintain positive and professional working relationship with staff, members, potential members, agents, outside adjusters and contracted attorneys HELP NEEDED TO COMPLETE THE ACTIVITY OR TASK DISCUSSION DATES CLAIMS DEPARTMENT PAY AND TENURE 2005-2005 PooI A Claims Mgr / Attorney Claims Technician Claims Assistant Claims Technician Sr. Claims Technician Claims Specialist Sr. Claims Specialist Sr. Claims Specialist Pay Type of Claims 2005 Number of Claims $86,076.48 $15,061.06 $32,047.67 $40,314.20 $46,106.95 $47,934.66 $50,488.66 $53,207.06 Property Liability 787 895 Pool B Inside Adjuster Outside Adjuster Assistant Claims Manager Claims Manager Current Pay $47,400.00 $60,350.00 $71,900.00 $96,600.00 Pay Range $32,400.00 $41,200.00 $52,200.00 $71,400.00 Pay Range $52,200.00 $63,200.00 $79,700.00 $104,400.00 Tenure 1@ 19 yrs 1@ 19 yrs 1@ 14 yrs 1@ 18 yrs Current Pay Pay Range Pay Range Tenure $38,230.00 $51,800.00 $25,595.00 $31,000.00 $51,000.00 $22,000.00 $44,000.00 $62,000.00 $28,000.00 3@ 4 yrs 1@ 2 yrs 3@ 2.5 yrs Pool C Ppty Casualty Claims Reps Claims Supervisor Administrative Assistant Page 31 of 32 D:\533572642.doc 2005 Number Type of Claims of Claims Property Casualty 1600 CLAIMS DEPARTMENT PAY AND TENURE 2005-2005 Pool D Pay Range Claim Examiner Sr Claim Examiners Claims Assistants Claims Supervisor $41,000 - $54,000 $55,000 - $66,000 $26,000 - $34,000 $65,000 - $80,000 Tenure Claims Manager Mbrshp Svcs Coordinator Claims Supervisor Senior Examiners Claim Examiners Claim Assistants 6 years 2 years 6 years 2 at 6 years 1 at 4 years 2 @ less than 1 yr, 1 @ 3 yrs Type of Claims 2005 Number of Claims Property Liability 409 1028 Type of Claims 2005 Number of Claims Property Liability 98 1432 1@6yrs 1@4yrs 1@2yrs 1@1yr Pool E Average Pay Pay Range Tenure $50,340.00 $39,288.00 $23,376.00 $37,812 - $55,848 $33,792 - $48,300 1 @ 18 2@ 5 1@ 2 Manager Adjuster Claims Clerk Page 32 of 32 D:\533572642.doc