Overview of the Government Procurement Card

advertisement

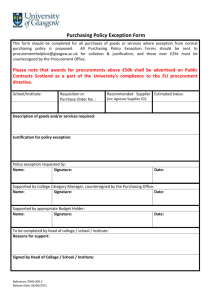

Purchasing Card Scheme Procedures and Guidelines For General Queries on your Procurement Card Please Contact Laura Wakefield – Project Manager, Ext.: 2899 Emergency Contact Details For Lost or Stolen cards Account balance Statement copies Account Assistance Contact Lloyds TSB Card Services on 0870 513 4588 (open 24 hours) Version: 2.0 Date:24th October 2005 Contents Overview of the Government Procurement Card .............................................................................. 3 Government Procurement Card Controls .....................................................................................................3 The Travel and Subsistence Card ...................................................................................................................3 Why introduce the Corporate Credit Card ...................................................................................................3 Card Holder Policies .......................................................................................................................... 4 Who May Become a Cardholder?...................................................................................................................4 Who May Not Become a Cardholder? ...........................................................................................................4 What are the Cardholders Responsibilities? .................................................................................................4 How to Apply for the Visa Purchasing Card? ...............................................................................................5 What can you buy with the Visa Purchasing Card? .....................................................................................5 How to Reduce the Risk of Fraud ...................................................................................................................7 Safeguarding of Cards .....................................................................................................................................7 Use of the Purchasing Card .............................................................................................................................8 Excluded Purchases ........................................................................................... Error! Bookmark not defined. Purchasing on the Internet ..............................................................................................................................9 Lost or Stolen Cards ........................................................................................................................................9 How the Government Procurement Card Program Works ............................................................ 10 Tracking your purchases ...............................................................................................................................12 Cardholder absence .......................................................................................................................................13 Approver absence ...........................................................................................................................................13 Cash advances and your PIN number ..........................................................................................................13 Increasing Card Limits ..................................................................................................................................13 Controls on the cards .....................................................................................................................................13 Damaged Cards ..............................................................................................................................................14 Card cancellations ..........................................................................................................................................14 Cardholder Cancellation Controls ...............................................................................................................14 Liability Waiver Insurance ...........................................................................................................................14 Value for Money .............................................................................................................................................15 Frequently asked questions .............................................................................................................. 16 Appendix A: Card Holder Limits Schedule ..................................................................................... 18 Appendix B: Example of Forms ...................................................................................................... 19 (Resignation Confirmation Letter – See HR).................................................................................. 19 Westminster City Council Card holders Agreement Form ........................................................................21 Government Procurement Card - cardholder application form ..................................................... 21 Government Procurement Card - cardholder application form ......... Error! Bookmark not defined. Procurement Card Incident Form ................................................................................................... 22 Appendix C:Disputed Transaction Letter to Lloyds........................................................................ 24 2 Overview of the Government Procurement Card The Government Procurement Card (GPC) is essentially a credit card that holds additional controls to allow government organisations to purchase high volume, low value goods and services with relatively low risk. Government Procurement Card Controls A number of controls are available with the card, these include: Ability to limit the category of purchasing (For example, a cardholder in a building maintenance role may only be authorised to make purchases from hardware suppliers); Ability to obtain general ledger information, including VAT, etc on a cardholder’s monthly credit card statement; Credit limits e.g. weekly or monthly limits on expenditure Cash withdrawal blocking Overseas transaction blocking Time of Day restrictions e.g. Purchasing may only be permitted from Monday to Friday 9am – 5pm Control flexibility e.g. Declining time of day restriction transactions or allowing them but raising an exception report The Travel and Subsistence Card The Travel and Subsistence Card is also a credit card with low allowable limits on transactions and low overall expenditure amounts. Unlike the Government Procurement Card the controls around category of spend are usually turned off to allow a wider variety of purchases as is usually required when claiming travel related expenses (E.g. Hotel and restaurant expenses). Why Introduce the Government Procurement Card and Travel and Subsistence Card throughout the City of Westminster Why introduce the Corporate Credit Card The use of the corporate credit card programme at Westminster City Council aims to: 3 Eliminate the need to raise manual purchase orders and consolidate multiple payments to multiple suppliers into one payment to the card issuer. This should reduce the number of back office transactions processed by Departments and Vertex; Reduce the amount of manually entered general ledger data; Reduce the amount of petty cash transactions and amount of personal expenditure requiring reimbursement to staff; Receive quicker delivery of goods; Allow field staff more effective options for quick turnaround purchases. For example Social Services staff in providing emergency assistance. Cardholder Policies Who May Become a Cardholder? Westminster City Council staff at any level who have responsibility for purchasing a high volume of goods or services may be issued with a Corporate Credit Card on approval by the Director, Finance. The Cardholder must be at least 18 years of age. Who May Not Become a Cardholder? Cards cannot be issued to temporary/agency staff. Cards cannot be issued to members of staff who have any history of fraud or dishonesty. What are the Cardholders Responsibilities? Your Purchasing Card is personal to you. No one else is authorised to use your card. Do not allow any other employee to use your card or quote its number when ordering. Cardholders must agree to the Cardholder Usage Guidelines of the City of Westminster and also to the usage guidelines of the card issuer. Cards are for authorised business use only. Budget funds must be available to cover all purchases. Cardholders will be issued with card limitations and restrictions as outlined in the Cardholder Limits schedule. Cardholders may purchase goods from a supplier through the following means: In person By phone or fax By mail Using the Internet Each month cardholders will receive a statement from Lloyds. Cardholders must sign the statement and attach all supporting documentation before passing to their Approver Statements must then be approved by the cardholder’s manager and then forwarded to the Procurement Card Programme Administrator The corporate Credit Card shall NOT be used for the following: Private expenses Withdrawal of cash/cash advances, unless approved by the Director, Finance Fines, penalties, late fees etc Splitting purchases to avoid purchasing policy requirements Cardholders are responsible for achieving best value for money. Cardholders are responsible for reporting its loss, theft or misuse to the Lloyds TSB Purchasing Card Helpdesk on 0870 5134588 and your Programme Administrator as soon as you notice your card is missing. Failure to adhere to these Guidelines may result in disciplinary action, withdrawal of the card or in extreme cases, prosecution. 4 How to Apply for the Visa Purchasing Card? Once you and your Manager have read through this booklet and the Lloyds Conditions of Use, you will need to complete the following forms: Cardholder Application Form; Cardholder Agreement Form and; Approvers’ Agreement Form. Once you have fully completed these forms you will need to send them to the Programme Administrator for processing. NB. For security reasons you shouldn’t keep a copy of your Application Forms. Please also note that incomplete forms cannot be processed and will be returned. When the card is received, the Programme Administrator will advise you and arrange for collection. Until the card is collected the Programme Administrator will keep it in a secure location. During this collection you will need to produce photo identification to confirm your identity and sign the card in front of the Programme Administrator. The Programme Administrator will also explain how to activate the card and give you training in the use of the online Procurement Card system (the Strategic Account Management or “SAM” system). This is the system used by cardholders to code their transactions each month. NB. The card cannot be used until the appropriate training is given. What can you buy with the Visa Purchasing Card? Cardholders must ensure that the e-Proc system is the now "first port of call" for all purchases and the Procurement Card should only be used if there is not a corporate contract or alternative payment system already in place. The above statement does not apply to those departments where Ariba has yet to be rolled out. Although the card is issued in your name, it is the property of Westminster City Council and should only be used for qualified business purchases. If you have a question about a specific purchase, then ask the Programme Administrator whether or not it qualifies for the Visa Purchasing scheme before completing the transaction. Some examples of types of purchases that may be made with the Procurement Card are as follows: 5 Example Purchases permitted NB. Stationery and office supplies (only if your department is not yet set up on the e-Proc system) Books, periodical subscriptions, video tapes, audio cassettes Training programmes, seminars Film and/or film processing Safety equipment or supplies Catering or small dining services Laundry of uniforms, lab coats, etc. Miscellaneous maintenance requirements Medical supplies Mail/delivery service Maintenance and Repair Example Purchases NOT permitted Cash advances Tokens of appreciation, congratulations or sympathy such as flowers Capital equipment Fuel, unless it relates to a hire car A product or service considered an inappropriate use of funds This list is not intended to be exhaustive. Payment of Invoices on the Procurement Card As one of the key benefits to the Government Procurement Card programme is a reduction in the manual processing of invoices, cardholders are able to pay invoices on the Procurement Card; however there are some circumstances where this is not acceptable. Cardholders should not use their Procurement Card to pay an invoice if: The value of the single invoice is above £2,000 The merchant is not Visa certified Alternative payment systems, such as the e-Procurement system, are in place for commodities such as agency, ICT, telecoms, legal and clothing. IT Purchases Cardholders must ensure that they follow the below guidelines in relation to the purchase of IT items on the Procurement Card. The following items may be purchased on the card, however cardholders should first check the cost on the e-Proc system to make sure that best value for money is achieved: 6 Laptop cases Screen and PC dust covers Printer ink cartridges/toner for flexible working or non-networked printers, provided they can be installed without raising a support call Corded mice (wireless mice are not included) The following items are not appropriate for the Procurement Card and must be purchased through the e-Proc system: External hard disk drives USB data keys CD-Roms DVD's Tape media Flash memory cards and drives Any type of laptop or desktop upgrade (either hardware or software) should be ordered through the e-Proc system or the SRD process Anything not included in the lists above should be purchased through the e-Proc system. Procedure for Reimbursement of “inappropriate” Expenditure At the end of each month, a number of reports are produced from the SAM system - this includes the High Risk Query which details transactions with certain "high risk" suppliers, for example, restaurants and eating places, tourist attractions, road fees and tolls, electronic sales, car rental agencies, etc. If the cardholder has not entered sufficient detail in SAM for the transaction then they and/or their approver will be asked to provide clarification. If this is not found to be sufficient then the matter will be escalated to the Director of Procurement and if the transaction is deemed "inappropriate" then the cardholder will be requested to reimburse the value of the transaction (s) to the City Council. The cardholder will be required to reimburse the money within 10 working days of the decision that a refund is applicable and then provide copies of the paperwork to the Procurement Team for audit purposes. How to Reduce the Risk of Fraud To reduce the risk of fraud cardholders should: Sign their new card immediately Activate their new card immediately by calling Lloyds TSB Corporate Card Services (the number on the red sticker on the front of the new card) Read carefully the Conditions of Use leaflet that accompanies the new card Keep their card in a safe place Never leave their card unattended Always check the total on the sales voucher is correct before they sign or enter their PIN for transactions Destroy the card by cutting off the bottom left hand corner through the smartcard chip if it is found after they have reported it stolen Do not leave receipts with card numbers on unattended Never lend the card or card number to anyone else Never send card details via e-mail Do not give out your PIN number to a third party Safeguarding of Cards In order for you to reduce the risk of fraud your Purchasing Card should be locked in a secure location when not in use. This location should only be accessible to you i.e. your lockable desk drawer. When possible the card shouldn’t be taken outside work premises after office hours i.e. weekends. 7 Use of the Card How to place an order by telephone Choose a supplier who accepts Visa cards If necessary, contact more than one supplier to obtain quotes. The price should include VAT and any postage or delivery charges. Ensure that you ask for any discount that applies to Westminster City Council. Once the supplier and the price are confirmed, and the supplier has confirmed the availability of the goods, tell the supplier that you are paying by Visa Purchasing Card, and quote the following details: Your name Your card number The card’s expiry date Delivery address Order number (if applicable) Ask the supplier to send you a VAT receipt and transaction slip for your records. If the supplier is VAT capable, they will not provide you with a VAT receipt, but will send an alternative document to enable you to check your purchase and the price charged. The supplier will seek authorisation for the transaction by their Bank. If the authorisation is declined, the supplier will advise you immediately. Ensure you record details of the order on your transaction log. This will enable you to reconcile your transaction log with your statement at the end of the month. If the goods are in stock, and the transaction authorised, the goods will be despatched by the supplier for your attention. If the goods are not in stock the supplier will advise you of the date when they will be available. The supplier will not charge you for any goods on your Purchasing Card until they are actually despatched. If only part of your order is available, the supplier will only charge your card for those goods. The remainder of the order will be debited to your card when the goods are in stock. When your Goods Inwards take delivery of the goods, they will direct them to you, using the order number (if applicable). When you receive the goods and receipt, ensure you update your transaction log. All documents should be retained for reconciliation with your Purchasing Card statement. If you receive any goods which are either incorrect or damaged, you must: 1) Contact the supplier and arrange for the goods to be replaced. Or 2) Contact the supplier and arrange for the goods to be returned. Ask the supplier to refund your Purchasing Card with the amount of the transaction and ensure you record this on your transaction log. 8 Purchasing on the Internet Cardholders should adhere to the following guidelines when purchasing goods using the internet – Only use websites of reputable companies for purchasing goods Look out for security symbols, for example, sites displaying the “padlock” symbol indicate that they are secure If you make regular orders such as stationery, consider lodging the account number with key suppliers so that you don’t need to quote it each time you order Be aware of your surroundings when using the card - don't allow other people to read details over your shoulder Don't save the card details on your PC Never respond to e-mails requesting your card details – these are called "phishing" e-mails Some sites ask for credit card details for ID or "age" verification - cardholders should not be using these sorts of sites anyway. This is another way of capturing your details. NB. Please contact the Programme Administrator if you require assistance or are unsure of the authenticity of a site. Lost or Stolen Cards 1. If you discover that your Purchasing Card has been lost or stolen, or that the card number has become known to a third party, you must contact Lloyds TSB Card Services Lost and Stolen helpline on: UK: 0870 513 4588 Overseas: +44 1908 544059 This service is available 24 hours a day, 365 days a year. 2. You should also contact your Programme Administrator and Approver as soon as possible. The Programme Administrator will ask you to complete the Procurement Card Incident Form (see the Appendices for an example of this form) and issue you with an Incident Number. The Incident Form should be completed as soon as possible and returned to the Programme Administrator who will investigate the matter further. A replacement card will be issued direct to the cardholder within 5 working days. 9 How the Government Procurement Card Programme Works Making a company related purchase with your Visa Purchasing Card is as simple as using any credit card. The chart below describes this process: You place an order for goods or services with the supplier either by e-mail, phone, fax or in person. The supplier processes the transaction requesting purchase authorisation from Lloyds TSB via the Visa network. Lloyds TSB verifies that the purchase is within the company and cardholder spending limits. Within seconds the supplier will receive an approval, decline or referral to Lloyds TSB. If you are at the supplier location, enter your PIN or sign the sales voucher, retaining a copy and obtain a copy of the invoice. You can either take your purchase with you or arrange to have it delivered, depending on the supplier and stock. If you make the purchase by e-mail, phone or fax the supplier will deliver your purchase and send the sales voucher and tax invoice to you. Be sure to tell the supplier to send the invoice for your attention. Note: According to Visa regulations, the supplier must ship the goods before a transaction is processed. Be sure the supplier is aware of this regulation. The Procurement Team receives a central monthly invoice from Lloyds TSB at the end of the period, which shows all cardholder transactions. You, the cardholder, will receive a Visa Purchasing monthly memo statement that you are required to reconcile. Check that: The goods on the statement have all been received There are no incorrect entries Log on to the SAM system and enter the appropriate cost centre, account code, etc and make sure that any VAT has been entered Run the Line Item Detail/Approver’s Report and print it off Simply attach all of the receipts/invoices and sign the statement. NB. If there are any discrepancies contact the supplier in the first instance or if the matter can’t be resolved contact the Programme Administrator. Your manager checks the statement against the receipts/invoices and authorises the statement. Your manager should check: All VAT receipts have been received and attached All purchases comply with the Westminster Procurement Code Costs are in accordance with expectation. The approved statement and all supporting documentation should then be forwarded to the Programme Administrator. 10 All transactions are uploaded into WIMS on a monthly basis. 11 Tracking your Purchases Accurate record keeping is essential to the success of the Visa Purchasing scheme. As with any system, you will want to follow procedures to protect the company and yourself. By following the guidelines described below, you can easily fulfil your cardholder responsibilities. Keep hold of the receipts/invoices for all purchases you make using your Purchase Visa Purchasing Card. If you purchase something via e-mail, phone or Invoices fax be sure to ask the supplier to send the invoice to you when the product is shipped. When you receive an invoice that has been paid with the Visa Purchasing Card you should mark this on the invoice to prevent it from being paid twice. Retaining receipts/invoices is important because you are responsible for matching the invoices with the transactions identified on your Visa Purchasing monthly memo statement. If an audit is conducted on your account, the company must have receipts/invoices as proof that the transaction took place. Also, these specify whether or not tax was paid on the purchases and provide the documentation needed if there is a VAT audit. Monthly Purchasing Card Transaction Log Disputed Items The Finance Department pays Visa Purchasing Card invoices. However you must reconcile the Purchasing Card Transaction Log with the Visa Purchasing monthly memo statement from Lloyds TSB. If all entries on the statement represent valid purchases, and are logged on the Purchasing Card Transaction Log, then forward your statement along with all relevant invoices/receipts to your manager/approver (remember to keep copies for your own files). Your manager should then approve all of your transactions and forward all paperwork to the Programme Administrator. If there is a discrepancy on the Visa Purchasing monthly statement, you should first contact the supplier to try to resolve the situation. If the dispute cannot be resolved with the supplier you will need to inform your Approver and contact the Programme Administrator. You should clearly indicate on your monthly statement that the particular transaction is in dispute prior to seeking the normal monthly approval process. The transaction should be coded in the SAM System as per the usual process (this is to allow the reversing credit to be recognised against this transaction). The Programme Administrator will complete the Disputed Transaction Log with the relevant information and will contact the Cardholder help line on 0870 513 4588. The administrator will write to Lloyds no later than 30 days after the date the error first appeared on a statement (Draft letter attached). If the supplier is found to be liable Lloyds are unable to credit the account with the amount until they receive an appropriate voucher or satisfactory confirmation from the supplier and as such it is not expected that any transactions will likely be resolved within the 10 day payment requirement. If the dispute is resolved, you should verify that the appropriate credit is received when the next monthly memo statement arrives. The Programme Administrator should finalise the transaction log and if necessary seek approval from the Authoriser. 12 Cardholder Absence There may be instances when the deadline for all coding and paperwork falls during a period of short-term absence, for example, annual leave. If you know that there is going to be a deadline while you’re away then you should make sure that you go into the system and complete all coding and forward all relevant paperwork to the Programme Administrator before you go. If the absence is likely to take you well beyond the deadline then temporary arrangements should be made. For example, a colleague should forward your statement and receipts once they have been received and the Programme Administrator should code your transactions for you – please note that this can only be done if the correct cost centres, account codes, etc are provided to the Programme Administrator. Approver Absence If your approver is absent and your statement and transactions need to be authorised then you must identify a temporary approver – this can be someone in your team/department who has the financial delegation to sign off invoices. Please make sure that you notify the Programme Administrator if this happens. Cash Advances and your PIN Number If requested by your Manager to do so, the Programme Administrator may permit the Card to be used by you to obtain cash advances at Automated Teller Machines. At present such permission is not normally given. All such cash advances will be debited to the Account. If cash advances are permitted they may only be used for authorised business purposes. Any excess cash held which is not required for business purposes in the short term should be returned to the Finance Department. You will be issued with a PIN for use with the Card once the Card Account is activated. This will be used to make purchases at the retail point of sale and to access PIN management services at Lloyds TSB cashpoints®. On receipt, you must memorise your PIN and then destroy the sheet on which it is printed. The PIN must be kept secret. You must not let anyone else know or use it. You must not write the PIN on the Card or anything left with the Card. If you do write it down do not write the PIN in a way that would enable someone else to recognise that it was a PIN. Increasing Card Limits If you find that the limits placed on your card are not sufficient then you are able to request a temporary or permanent increase to your single transaction or monthly limit. This must be authorised by your manager who must write/send an email to the Programme Administrator with the requested change. The Programme Administrator will then contact Lloyds to action it and will notify the cardholder and approver when it’s been done. If it’s a temporary increase then make sure that you notify the Programme Administrator once the transaction has been processed so that your limit can be returned to its normal value. Controls on the Card A number of limits may be place on the card. These include: 13 Single Transaction Limit Monthly Credit Limit Number of transactions per 24 hour period Merchant Category Blocking Management Information Customer Reference Indicator Damaged Cards If your Procurement Card has been damaged, you must contact the Programme Administrator who will issue you with an incident number and request that you complete the Procurement Card Incident Form. Once the Incident Form has been completed you will need to return it to the Programme Administrator and attach the card ensuring the bottom left-hand corner is cut off through the smartcard chip. The Programme Administrator will then cancel the card and arrange for a replacement to be issued which should take no longer than 5 working days. New cardholders must collect their card from the Programme Administrator, however replacement cards are issued direct to the cardholder. Card Cancellations When an employee is no longer required to hold a card, a Procurement Card Incident Form must be completed and an incident number can be obtained from the Programme Administrator. This should be done in advance and as soon as a cancellation date is known. Both you and your manager must sign the form and it should be returned to the Programme Administrator who will then be able to give advance notification to Lloyds TSB of the date of cancellation. Cardholders must cancel their cards if they: Are requested to do so; Leave the service of the Council; Transfer to a different Division where use of the card is not authorised for that position, unless approval is received from the Director, Finance to retain the card. NB. Limits must remain in accordance with the Cardholder Limits Schedule unless authorised. Cardholder Cancellation Controls In order to ensure any cards that need to be cancelled are done so in a timely manner the following controls have been put in place: The Manager is required to notify the Programme Administrator as soon as they become aware of an employee leaving the organisation (regardless of the circumstances); The Manager is required to sign off the cardholder’s Procurement Card statement within a maximum of three weeks from the date of issue of the statement. All statements not received will be followed up by the Programme Administrator; The “Confirmation of Resignation” (See Appendix B) letter issued to all departing employees has been amended to indicate that employees with a Westminster Procurement Card are required to return their card prior to leaving the organisation; The Programme Administrator receives a copy of the “Leavers Report” from HR and checks that any employees that have left the organisation have returned their Card. Liability Waiver Insurance Liability waiver insurance applies to Westminster City Council. Insurance is provided automatically when a new card is issued and is cancelled when the card is cancelled. 14 When can a claim be made? As soon as it is discovered that an unauthorised purchase has been made. ‘Unauthorised’ means if a cardholder, having bought something with his/her card that does not benefit the organisation – either directly or indirectly and dishonestly tries to get the Council to pay the bill. The card should be immediately suspended so it cannot be used again Maximum Claim The maximum claim under the Liability Waiver insurance is: £15,000 for each cardholder; £1million for your organisation overall. For further details check the Corporate Card Administrators Guide. Value for Money The overall aim of procurement is always to achieve best value for money (VFM). This means balancing direct and indirect costs against direct and indirect benefits, not simply appointing the supplier who offers the lowest price. Therefore, it is a requirement that when making purchases over £200 with the Government Procurement Card, that you obtain at least 1 written quotation where practicable. Number of Quotes Required Value Bands £200 to £10,000 Number of quotes required At least 1 written quotation £10,001 to £30,000 At least 2 written quotation *Extract taken from the WCC Procurement Code 2004 15 Frequently asked questions Below are answers to some frequently asked questions. Your Programme Administrator should be able to answer any further queries you may have. Who processes account changes? This is done by the Programme Administrator. What is my liability? You are authorised to use the Purchasing Card for legitimate business purchases only. The Company will pay for all legitimate Purchasing Card expenses. Do I have a credit limit? When you receive your Purchasing Card, you are assigned an individual credit limit, which is based on your individual purchasing needs. If, over time, you find that the limit is too low, you should speak with your manager about having your credit limit re-evaluated. Is there a transaction limit? A single transaction and a monthly limit are requested on the card application form. Limits are set by the Cardholder’s Approver depending on the type of transactions the cardholder will make (examples are set out in Appendix A). Amounts may vary in accordance with the authorisation of the Director, Finance. The transaction limit (net of VAT) is for each individual order with a supplier. Cardholders must not attempt to exceed this value by splitting the order. Cardholders must also be aware that they must spend within existing budgets. If you have a special need to exceed your individual limit, you should notify your manager. If the increase is approved, your manager will ask the Programme Administrator to contact Lloyds TSB to request the increase and this should take place with immediate effect. What if a transaction is declined? If you feel that it should not have been declined, contact Lloyds TSB Card Helpdesk on 0870 513 4588. A Customer Service Representative will be able to tell you why the transaction was declined. Alternatively, contact the Programme Administrator who will get in touch with Lloyds and find out why the card was declined. How are my purchases tracked? Each month you will receive a Purchasing Card monthly memo statement listing suppliers, purchases and purchase amounts. You are responsible for reconciling the monthly memo statement with the transaction log, which details the purchases you have made. Should I keep my Invoices? Invoices are very important - save them. Legislation and Westminster City Council policy require invoices for tax purposes and you will need them for reconciling your Purchasing Card monthly memo statement and Purchasing Card transaction log. If you misplace an invoice, try to get a duplicate from the supplier. If that isn’t possible, note the lost invoice on your Purchasing Card monthly memo statement and Purchasing Card transaction log. When invoices are received you need to ensure that the supplier has endorsed 'Paid Purchasing Card' and retain it with the transaction log. Will my purchases be reviewed? Each month you should submit a reconciled monthly statement from Lloyds along with all relevant invoices/receipts and the line item detail report (or approver’s report) to your manager who will review your purchases prior to submitting the paperwork to the Programme Administrator. This must be done within the deadline given by the Programme Administrator. In addition, your purchasing activity may be audited at any time to verify compliance. What should I do if I find an incorrect charge? 16 If you identify a problem on your monthly memo statement, you should try to resolve it directly with the supplier. If a credit is required, the supplier should be asked to make a credit transaction entry on their purchasing card terminal. This should be recorded on your transaction log. If you are not successful and believe the transaction to be in dispute then you must notify Lloyds TSB by telephone using the number listed on the monthly memo statement. Alternatively send an email to cpsfraud@ge.com detailing the date of the transaction, the amount, the supplier, etc and also a few lines to explain why you believe the transaction to be in dispute. The Fraud Department will then investigate the transaction. What if I find an unauthorised charge? Contact Lloyds TSB immediately to notify them of any unauthorised charges. Use the number listed on the monthly memo statement or the back of your card. Once you have notified Lloyds TSB you should also let your Programme Administrator know. Who pays the Purchasing Card transactions? The Procurement Team pays the overall monthly bill which is then recharged to the various cost centres and account codes provided by cardholders on the SAM system. When are suppliers paid? Typically, suppliers are paid within two to three days of your purchase. This is done electronically by Lloyds TSB, through the Visa System. Security Cardholders must take all reasonable precautions to prevent loss or misuse including the following: Do not allow any other person to use your card. Sign your card immediately on receipt. Keep your card in a locked draw, or on your person, and never leave it unattended. What happens if my card is lost or stolen? You are responsible for the security of your Purchasing Card and the transactions made with your card. If your card is lost or stolen, you should take these steps immediately: Call the Lloyds TSB Purchasing Card Helpdesk. A Customer Service Representative will block use of the card and order a replacement card with a new account number (Located on the cover page of this policy). Notify your Programme Administrator. Will the supplier increase the price of the goods if I pay by Procurement Card? It is extremely rare for a supplier to add an additional charge to cover their Merchant Services Charge (MSC) for accepting Government Procurement Card Visa. There are a number of benefits for the supplier in accepting payment via this option, including reduced administration cost, prompt payment and enhanced customer relationships. It is expected that the introduction of the Procurement Card will provide the opportunity to take advantage of a number of prompt payment discounts. 17 Appendix A: Card Holder Limits Schedule NB. This section will be updated as the Government Procurement Card is implemented in council. It is recognised that different Departments will have different requirements on the card. The following are standard limits however single transaction and monthly limits may vary greatly between departments. Government Procurement Card Approved Departmental Officers Approved Departmental Budget Officers Approved Department Managers & Chief Officers Transaction Limit £500 Card Limit £1,000 £1,000 £10,000 £5,000 £15,000 Card Limitations Cannot make cash withdrawals Cannot make cash withdrawals Cannot make cash withdrawals £500 represents approximately 70% of all Council procurements £15,000 represents the limit of the insurer’s liability Travel and Subsistence Card Approved Department Managers & Chief Officers 18 Transaction Limit £2,000 Card Limit £15,000 Card Limitations Cannot make cash withdrawals Appendix B – Example of Forms (Resignation Confirmation Letter – See HR) Direct Line: Resignation 01 – Confirmation of resignation Fax No: E-mail: Date: Personal & Confidential Dear _____________________ I have received a copy of your resignation informing me of your intention to leave the Council on _________________ On behalf of the Council, I would like to thank you for the work you have done since joining and wish you every success in the future. I would like to take this opportunity to bring the following points to your attention: 1. Identity Card/Security Pass If you are in possession of an Identity Card, Security Pass or Authorisation Wallet, please ensure that it is returned to your Manager, on your last working day. 2. Westminster Procurement Card If you are in possession of a Westminster City Council Procurement Card please ensure it is returned immediately (in accordance with the Agreement signed prior to issuing the card). 3. P45 Tax Form This will be forwarded to your home address. Your final salary will be paid into your bank account on the 20th of the month. If you have any queries regarding your P45 or your final salary please contact payroll services on ____________. 4. Outstanding Leave You are advised, if possible, to take any outstanding leave due to you as it is not the policy of the Council to pay employees for unused days unless there are exceptional circumstances. If you have exceeded your entitlement then the necessary adjustment will be made to your final salary. However, should you be leaving to join another local authority, it may be possible for you to transfer any outstanding leave to that authority. 19 5. Annual Season Ticket If you are in possession of a season ticket, please let Lorraine Hibbins (020 7641 3334) in Human Resources know if you intend to hand in your ticket or wish to retain it. If you wish to keep it then any outstanding balance is to be paid in full before your last working day. If you are moving to another local authority or to certain private organisations, there is a possibility that they operate a similar season ticket loan scheme to Westminster City Council and may be willing to purchase the season ticket from us on your behalf. It is up to you to make the necessary enquiries and obtain a letter from your new employer to this effect. 6. Pension Leavers Form This form is issued to all employees who work more than 30 hours per week and who are not retiring to pension. It should be completed in accordance with the notes attached and forwarded at the proper time to the Pension Liaison Team, 17th Floor, City Hall. 6. PRP If you are on performance-related pay and leave before the 31 March, you will not receive any bonus payment in respect of the current financial year. If there are any matters which require clarification or any other queries you may have, please do not hesitate to contact me on the above number. Yours sincerely Human Resources 20 Westminster City Council Cardholders Agreement Form Government Procurement Card Conditions of Use Cardholders must be at least 18 years of age Your Purchasing Card is personal to you. No one else is authorised to use your card. Do not allow any other employee to use your card or quote its number when ordering. Cardholders must agree to the Cardholder Usage Guidelines of the City of Westminster and also to the usage guidelines of the card issuer. Cards are for authorised business use only. Budget funds must be available to cover all purchases. Cardholders will be issued with card limitations and restrictions as outlined in the Cardholder Limits Schedule. Cardholders may purchase goods from a supplier through in person, by phone, fax, mail or the Internet Each month cardholders will receive a statement. Cardholders must complete the statement by completing all fields. A copy of supporting documentation must be attached. Statements must be signed by the Cardholder and approved by your manager, then forwarded to the nominated Card Supervisor responsible for the relevant area The corporate Credit Card shall NOT be used for the following: Private expenses e.g. gifts/tokens of appreciation such as flowers and cards Withdrawal of cash/cash advances, unless approved by the Director, Finance Fines, penalties, late fees etc Splitting purchases to avoid purchasing policy requirements You are responsible for achieving best value for money and ensuring compliance with the Westminster City Council Procurement Code. You are responsible for reporting its loss, theft or misuse to the LTSB Purchasing Card Helpdesk on 0870 5134588 and your Programme Administrator as soon as you notice your card is missing. Failure to adhere to these Guidelines may result in disciplinary action, withdrawal of the card or in extreme cases, prosecution. I, FIRST NAME SURNAME POSITION TITLE EMPLOYEE NUMBER DEPARTMENT Agree that I have read and understand the Westminster City Council Cardholder Usage Guidelines and acknowledge that I have read and fully understand the Conditions of Use (set out above), which govern the use of the Government Procurement Card issued to me by Lloyds TSB and Visa Card. My approved maximum individual transaction limit is: My monthly approved card limit is: £ £ / / Cardholder’s Signature Date / Name of Manager/Supervisor Signature of Manager/Supervisor Default Cost Centre = Principal Accountant’s Signature Please note that this form must be completed fully in order for it to be processed Complies with Cardholder Limits Schedule or Finance Manager’s Approval Attached 21 Programme Administrator’s Signature / Date Procurement Card Incident Form Cardholder Name: .................................................................................................................... Card Number: ......................................................... Department: ....................................... Approver’s Name: .................................................. Incident Number: ............................... Stolen/Lost Date Lloyds Notified:.............................................. Date of Incident: ................................. Please give explanation of events surrounding the loss/theft of the Procurement Card, this should include the last purchase which was made on your card: ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... Cancellation/Damaged Card Cancellation Date: ....................... Reason for Cancellation:................................................. ................................................................................................................................................... Request for New Card Reason: ..................................................................................................................................... ................................................................................................................................................... Please return old card to Program Administrator with this form. Please ensure the bottom left-hand corner is cut off through the smartcard chip before sending through the internal mail system. Cardholders Signature:.......................................... Date: ...................................................... Approver’s Signature: ............................................ Date: ...................................................... For Procurement Department Use Only Program Administrators Comments: ....................................................................................................... ...................................................................................................................................................................... ...................................................................................................................................................................... ...................................................................................................................................................................... Replacement Card Requested:....................................................... Date: ............................................... 22 Program Administrators Signature: .............................................. Date: ............................................... 23 Appendix C: Disputed Transaction Letter to Lloyds [PRINT ON WESTMINSTER CITY COUNCIL LETTERHEAD] [INSERT DATE] Lloyds TSB Corporate Services Trent House PO Box 700 Leeds LS99 2BD. To Whom It May Concern: Re: Disputed Procurement Card Transaction I wish to advise that the following transaction recently appeared on a personal procurement card statement and is in dispute: Cardholders Name: Last 8 digits of Card Number: Transaction Date: Transaction Reference Number: [INSERT NAME] [INSERT NUMBER] [INSERT DATE] [INSERT TRANSACTION REFERENCE NUMBER] Description of dispute: [BRIEFLY DESCRIBE THE CIRCUMSTANCES SURROUNDING THE DISPUTE] Please contact me directly should you require further information on [INSERT PHONE NUMBER OF PROCUREMENT CARD ADMINISTRATOR]. Yours sincerely [INSERT NAME] Procurement Card Administrator 24