Chapter 6, Section 2 – Imperfectly Competitive Markets

advertisement

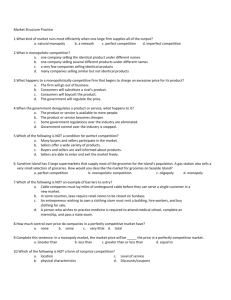

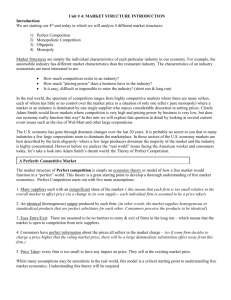

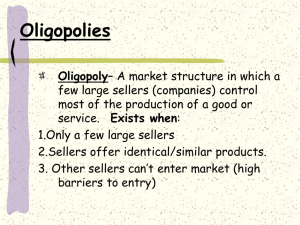

Chapter 6, Section 2 – Imperfectly Competitive Markets Oligopolies – market structure in which a few large sellers control most of the production of a good or service 3 conditions: only a few large sellers sellers offer identical or similar products other sellers can’t enter market easily Oligopolies at work (Oil Companies) Non-price Competition – differentiation through advertising; development of brand name loyalty Interdependent Pricing – responding to pricing actions by competitors in the market Examples: If one producer raises prices, others will follow If one producer offers a new model, others will follow Price Leadership – when one of the largest sellers in the market takes the lead by setting a price for its product, causing other producers to change their prices Price War – when sellers aggressively undercut each other’s prices in an attempt to gain market share. Collusion – when sellers secretly agree to set production levels or prices for their Products. It is illegal – destroys competition, causes prices to rise, leads to decrease in choices Cartels – when companies openly organize a system of price setting and market sharing It is illegal in the US, but we can’t control other countries. Example: OPEC (Organization of Oil Exporting Companies) controls oil production and pricing Monopolies – market structure where one seller dominates the market. No competition exists. 3 conditions: there is a single seller no close substitute goods are available other sellers can’t enter the market easily Types of monopolies Natural Monopoly – competition is inconvenient and impractical. One producer can provide a product or service more efficiently than many. Usually it is because of economies of scale – the seller’s size allows it to use its factors of production more efficiently and economically than if the same resources were divided among several smaller producers. Examples: public/private utilities (PG&E); cable TV service Very expensive start-up costs. If several power companies tried to compete for your business – each would have to have it’s own transmission lines, transformers, etc. Geographic Monopoly – exists when a market’s potential profit is so limited by its geographic location that only a single seller can make enough to stay in business. This is rare in America now. Because of communications, mobility of society, etc. Example: Mom and pop grocery store out in the country. Technological Monopoly – exists when a producer develops a new technology that changes the way an existing product is made or allows for the creation of a new product. Government grants a patent to the company. This protects the company’s investment in research and development for 17 years. Monopoly for 17 years. Example: Private companies that develop weapons systems for military. Government Monopoly – exists when government allows cities, etc. to monopolize things like water and sewer services. Also US government often monopolizes building and maintenance of roads, bridges, etc. Monopolies at Work Sellers who have a Monopoly have immense power to set production and price levels. But that power is not unlimited. Consumer Demand – If seller raises prices too high, at some point the consumer demand will reach zero. No sales, no profits. Potential Competition – If profits in a monopoly are high enough, other sellers will decide that it is worth it to come up with the high market entry costs to join the market. Government Regulation – Government will protect consumers from excessively high prices and the quality of the products being produced.