TaxInformationforInternation

advertisement

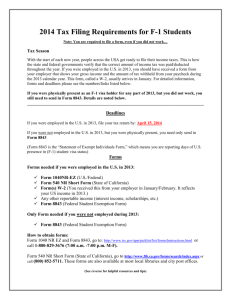

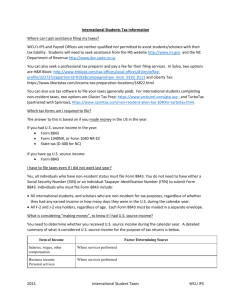

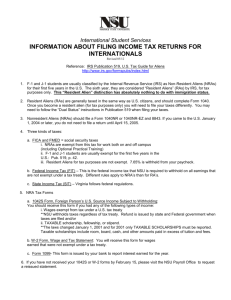

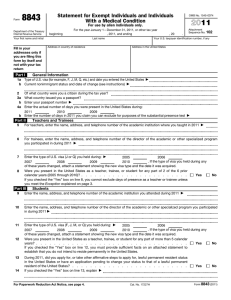

TAX INFORMATION FOR INTERNATIONAL (F-1 VISA) STUDENTS Attention all international (F-1 visa) students! Did you know that the Internal Revenue Service (IRS) requires ALL F, J, and M visa holders (and their dependents) to file an income tax return if they worked in the U.S. last year (2009)? Even if you didn't work, the IRS still requires ALL F, J and M visa holders (and their dependents) to complete IRS Form 8843. If you worked in the U.S. in 2009, you are required to file your income tax return BEFORE April 15, 2010. If you did not work in the U.S. you are still required to file INS Form 8843 BEFORE June 15, 2010. The following tax links and material will give important filing information for International Students: 1. 2. 3. 4. http://www.utexas.edu/international/taxes it will give you step-by-step filing instructions and will guide you in how to check if you meet the "substantial presence test" http://www.utexas.edu/international/taxes/faq.html Frequently asked questions including the deadlines www.irs.gov You can find International Revenue Services Forms, publications and instructions (F1 students most of the time use 1040NR or 1040NR-EX and 8843 (instructions and forms) Toll Free IRS Telephone Assistance: General Tax Questions: 1-800-829-1040 1-800-829-1040 Forms and Publications: 1-800-829-3676 1-800-829-3676 The staff of the International Student Center is not equipped to answer tax questions. For any questions about taxes please visit the above web-sites or call to the above listed numbers. Additional Information on Tax Forms www.utexas.edu/international/taxes/ This site contains step-by-step instructions for determining which forms are required. Users do not have to sign on or log in to access the web site. In addition, users are not required to attend or be affiliated with the University of Texas at Austin in order to use the site.