Investing in Exchange Traded Funds (ETFs)

advertisement

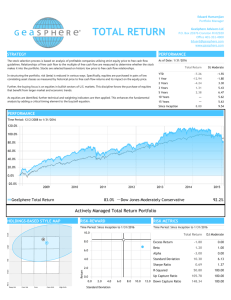

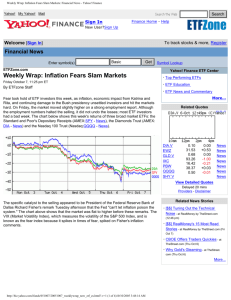

February 13, 2008 Investing in Exchange Traded Funds (ETFs): DIAMONDs, SPDRs, Qubes, HOLDRs, VIPERs, iShares They are simple and valuable investments with strange sounding names! Exchange Traded Funds (ETFs) essentially are mutual funds that trade like a stock. They are baskets of securities held in a trust (just like mutual funds) and can be traded as a listed security on a stock exchange (just like a stock). Differences between mutual funds and ETFs Securities held in most mutual funds are actively managed. Securities held in ETFs track an index established by a stock exchange. Selection of securities is predetermined (i.e. passively managed). Accordingly, the cost of managing Exchange Traded Funds and their corresponding Management Expense Ratios (MERs) are significantly less than mutual funds. Mutual funds are priced once a day based on their net asset value at the end of the trading day. ETFs are priced in the market during the trading day based on their tracking value of the index that they represent. Mutual funds hold securities that are actively bought and sold during the year by managers who are using their expertise and experience to improve portfolio returns. ETFs, by definition, hold securities that are infrequently changed, and therefore tend to have lower capital gains distributions at the end of the year. Differences between listed securities and ETFs Buying a diversified portfolio of individual securities, that approximately represents the market, can be time consuming and expensive. In contrast, buying an ETF, that holds a diversified portfolio of securities representing the market, can be completed easily in one trade. Transaction costs normally are lower for ETFs than for individual securities (particularly on broadly based ETFs) because bid/ask spreads for ETFs frequently are less. Why the strange sounding names? The names frequently are an acronym for an Exchange Traded Fund: SPDRs (also called SPDRS): Standard & Poor’s 500 index Deposit Receipts DIAMONDS: Dow Jones Industrial Average tracking unit. VIPERS: Vanguard Index Participation Equity Receipts Qubes: based on symbol for the NASDAQ 100 tracking units: QQQQ. HOLDRs: Holding Company Depositary Receipts An Example using SPDRs SPDRs are an Exchange Traded Fund that tracks the S&P 500 Index. SPDRs trade approximately at 1/10th the value of the Index. If the S&P 500 Index is trading at 1400, SPDRs (Symbol: SPY) will trade at almost exactly $140 per unit. The cost of 100 units will be $140 x 100 = $14,000 U.S.. If the S&P 500 Index rises to 1500, the price of SPDRs will increase to $150. The value of 100 units will improve to $15,000. Types of Indices Tracked by ETFs Six types are available: ETFs on broadly based indices (e.g. S&P 500 Index, Dow Jones Industrial Average, S&P/TSX 60 Index) ETFs on sector indices (e.g. health care, high tech, financial services) ETFs on style indices (e.g. growth, value, small cap, medium cap) ETFs on indices of countries or regions outside of North America (e.g. the Euro 350 Index, the EAFE Index) ETFs on bond indices. ETFs on commodities and currencies Leveraged, inverse and inverse leveraged ETFs Currently, 392 U.S. equity based ETFs, 33 U.S. bond based ETFs, 103 international, 18 commodity-based ETFs, 8 currency based ETFs, 52 Canadian equity based ETFs and 6 Canadian bond based ETFs trade on North American exchanges. A complete list is provided at the end to this report. Reasons to own ETFs Easy to understand and to follow. The media frequently comments on events that influence the performance of broadly based indices such as the S&P 500 Index, the Dow Jones Industrial Average and the S&P/TSX 60 Index. Their comments also apply to performance of ETFs that track broadly based indices. A convenient way to build a diversified portfolio. Each ETF owns a basket of securities. For example, iUnits in the S&P/TSX 60 Index holds a diversified portfolio of Canada’s top 60 companies. Risks associated with ownership of individual securities in the basket are reduced. A low Management Expense Ratio (MER) relative to actively managed investments. The average MER on a broadly based Canadian or U.S. mutual fund actively managed by a Canadian based investment firm is 2.50%. In contrast, the MER on iUnits on the S&P/TSX 60 Index is only 0.17% and the MER on SPDRs is only 0.10%. A list of MERs on ETFs is provided at the end of this report. More tax efficient than actively managed investments. Capital gains distributions at year-end from U.S. traded ETFs currently are nil due to their legal structure. Capital gains distributions at year-end from Canadian traded ETFs are low and frequently are nil. The reason: changes in indices are infrequent and, therefore, chances of realizing a capital gain for tax purposes due to index changes are low. In contrast, a portfolio of actively managed investments frequently is adjusted and is more likely to distribute taxable capital gains at the end of the year. Easily bought and sold (particularly ETFs on broadly based indices). SPDRs were the most actively traded equity security in the world in 2007 based on value of trading. Qubes were the most actively traded security in the world in 2007 based on the number of shares that traded. Volumes in both ETFs rose in 2007. Average daily volume in i60s, Canada’s most actively traded ETF was approximately 2.3 million per day in 2007. In addition, bid/ask spreads on broadly based ETFs frequently are $0.10 per unit or less. Better performers relative to most actively managed investments. History shows that most actively managed investments have been unable to exceed the performance of their benchmark index over an extended period of time. On January 1st 2008, Globe Investor released the annual performance of Canada’s top 180 mutual funds by assets. Once again, most of Canada’s mutual funds devoted to investments in Canadian equities underperformed the TSX Composite Index. The TSX Composite Index recorded a 9.3% total return in 2007. The list of 180 top funds was reduced to 108 to exclude fixed income funds, international funds and funds with unknown performance. Only 11 funds (including iShares on the TSX 60 Index) outperformed their benchmark in 2007. The cost of buying and selling ETFs Investors can choose between buying and selling ETFs in a transaction-based account or in a fee-based account. Costs in a transaction-based account will be the regular commission charged by your broker for completing an equity trade. Costs in a fee-based account in most cases will be zero for the transaction, but a fee based on the value of the portfolio will be assessed periodically. Investors, who make most of their own investment decisions, probably will prefer a transaction-based account. Investors, who rely on their broker to offer investment advice on a continuing basis, may prefer to complete transactions through a fee-based account. A fee of 1.5% per year for an equity account valued between $100,000 and $500,000 is approximately “the going rate” by Canadian investment dealers. Other features of ETFs The following information was obtained from publicly available web sites: ETFs listed on the Toronto Exchange are 100% eligible as Canadian content in tax deferred accounts (e.g. RRSPs and RRIFs). Most ETFs pay a quarterly dividend. Dividends paid by ETFs with Canadian equity content listed on the Toronto Exchange are eligible for the Dividend Tax Credit. Trading hours correspond with the regular trading hours of the Toronto Exchange and U.S. exchanges (normally 9:30 AM – 4:00 PM Eastern time). All ETFs have redemption features. Holders with large positions in ETFs are allowed to exchange their units for shares that underlie the unit. Net result: units consistently trade at or near their net asset value. Many ETFs have listed options and Long term Equity APpreciation Securities (LEAPS). A list of optionable ETFs is provided at the end of this report. Dividend re-investment (DRIP) programs on broadly based ETFs are available through selected brokers. ETFs are marginable. ETFs can be shorted. ETFs are sponsored by well-known financial institutions. Portfolio Strategies Core and satellite investing One of the more popular strategies! Investors place a large portion (i.e. the core) of their equity portfolio into Exchange Traded Funds. This portion acts as the anchor for the portfolio, ensuring that portfolio performance will approximate stock market returns. Size of the core depends upon the amount of stock market risk that the investor is willing to assume. Investors, who are satisfied with realization of returns that approximate “the market”, will place a larger portion of their portfolio into ETFs (say 40%-80%). Investors, who are willing to take more risk in order to improve chances of “outperforming the market”, will place a smaller portion into ETFs. The remainder of the portfolio is invested into “special situations” with the potential to outperform the market. Choices include attractive equities, specialty mutual funds, sector ETFs, hedge funds, etc. Portfolio Rebalancing ETF positions can be adjusted easily when equity, fixed income and cash weights in a portfolio need to be rebalanced due to changing market conditions. With one trade in an ETF of a broadly based index, equity positions can be increased or reduced. Sector Investing Investors can choose, when timely, to over weight sectors that have better potential. Investors can choose between six Canadian sector ETFs and over 60 U.S. sector ETFs. Seasonal Trend Investing North American, European and Japanese equity markets tend to be strongest from the end of October to the end of March /April. Investors can take advantage by owning broadly based ETFs during the period of seasonal strength and by switching into treasury bills during the remainder of the year. Sectors in equity markets also have seasonality and can be traded accordingly. See the Special Report section at www.dvtechtalk.com for background. Risks By definition, an investor holding an Exchange Traded Fund will never outperform the market. The investor will track the market (less a small MER). Some ETFs have a high percent of their portfolio invested either in a sector or an individual security. Concentrations can influence the volatility and performance of the ETF. A small number of ETFs hold a basket of securities that are known to be volatile. Most of these hold high tech securities with a history of significant price swings. Monitoring ETFs through the Internet The following web sites are useful for investors who are looking for more information about ETFs: Sites for a quick overview and description of ETFs that trade on U.S. exchanges: www.nasdaq.com www.amex.com www.nyse.com ETF content and weights: IShares U.S. information: www.ishares.com iShares Canadian information: www.ishares.ca Select sector SPDRs information: www.spdrindex.com StreetTracks ETF information: www.streettracks.com Merrill Lynch HOLDRs information: www.holdrs.com Vanguard ETF information: www.vipers.vanguard.com/etf PowerShares ETF information: www.powershares.com FT Portfolios ETF information: www.ftportfolios.com Proshares ETF information: www.proshares.com Rydex Funds ETF information: www.rydexfunds.com Wisdomtree ETF information: www.wisdomtree.com Claymore Investments ETF information: www.claymoreinvestments.ca XShares ETF information: www.xshares.com ETF information: www.exchangetradedfunds.com Index providers: S&P indices: www.standardandpoors.com Dow Jones indices: www.djindexes.com MSCI International indices: www.msci.com Russell indices: www.russell.com Wilshire indices: www.wilshire.com FTSE group indices: www.ftse.com Index universe: www.indexuniverse.com ETF Information and opinion sources www.exchangetradedfunds.com www.indexfund.com www.globeinvestor.com www.finance.yahoo.com/etf www.etfguide.com www.thestreet.com www.marketwatch.com www.morningstar.com www.currencyshares.com Exchange Traded Fund List Equity Index Units Traded in Canada Name SymbolMER Opt. Volume (%) Daily 3 months Jan. 2008 (000) IShares S&P/TSX 60 Index XIU 0.17 yes 4,000 IShares Composite Cdn. Eq Capped Index XIC 0.25 no 50 IShares S&P 500 C$ Index Fund XSP 0.25 no 150 IShares International C$ Index Fund XIN 0.50 no 150 iSharesDividend Index XDV 0.50 no 50 IShares S&P/TSX Canadian Capped Energy Index XEG 0.55 yes 350 ISharesS&P/TSX Canadian Capped Financial Index XFN 0.55 yes 250 ISharesS&P/TSX Canadian Capped Gold Index XGD 0.55 yes 500 iShares Income Trust Sector Index XTR 0.55 no 100 IShares S&P/TSX Canadian Capped Info.Tech. XIT 0.55 yes 80 iSharesMaterials Sector Index XMA 0.55 yes 150 IShares S&P/TSX Canadian Capped Midcap Index XMD 0.55 no 40 ISharesS&P/TSX Canadian Capped REIT Index XRE 0.55 no 150 iShares Cdn. Value Index Fund XCV 0.50 no 5 iShares Cdn. Growth Index Fund XCG 0.50 no 10 iShares Cdn. Janzi Social Index Fund XEN 0.50 no 4 iShares Cdn. Small Cap Index Fund XCS 0.55 no 10 iShares Cdn. Russell 2000 Index Fund XSU 0.35 no 10 Merrill Lynch CP HOLDRS HCH * no 1 Claymore FTSE RAFI Canadian Index Fund CRQ 0.65 no 15 Claymore Cdn Dividend and Income Achievers CDZ 0.60 no 5 Claymore U.S. Fundamental Index (C$ hedged) CLU 0.65 no 10 Claymore Oil Sands sector CLO 0.60 no 10 Claymore BRIC CBQ 0.60 no 60 Claymore International Fundamental CIE 0.65 no 10 Claymore Preferred Shares CPD 0.45 no 20 Claymore Japan Fundamental CJP 0.65 no 5 Claymore Global Water CWW 0.60 no 10 Claymore Global Mining CMW 0.55 no 10 Claymore Global Balanced Income CBD 0.70 no 2 Claymore Global Balanced Growth CBN 0.70 no 2 Claymore Global Agriculture COW 0.65 no N/A Claymore Global Monthly Yield Hog CYH 0.65 no N/A Claymore AECO Natural Gas GAS 0.80 no N/A Claymore Cdn. Financial Services CEW 0.65 no N/A Horizon BetaPro 60 Bull + HXU 1.15 no 500 Horizon BetaPro 60 Bear + HXD 1.15 no 1500 Horizon BetaPro Financial Bull + Horizon BetaPro Financial Bear + Horizon BetaPro Energy Bull + Horizon BetaPro Energy Bear + Horizon BetaPro Gold Bull + Horizon BetaPro Gold Bear + Horizon BetaPro Crude Oil Bull+ Horizon BetaPro Crude Oil Bear + Horizon BetaPro Natural Gas Bull+ Horizon BetaPro Natural Gas Bear + Horizon BetaPro Comex Gold Bullion Bull+ Horizon BetaPro Comex Gold Bullion Bear + Horizon BetaPro S&P/TSX Global Mining Bull + Horizon BetaPro S&P/TSX Global Mining Bear + HFU HFD HEU HED HGU HGD HOU HOD HGU HGD HBU HBD HMU HMD 1.15 1.15 1.15 1.15 1.15 1.15 1.15 1.15 1.15 1.15 1.15 1.15 1.15 1.15 no no no no no no no no no no no no no no 100 50 50 50 300 400 N/A N/A N/A N/A N/A N/A N/A N/A Equity Index Units Traded in the U.S. Major Market ETFs Broad Market Total Stock Market VIPERs IShares Russell 3000 IShares DJ US Total Market IShares S&P 1500 Fidelity NASDAQ Composite Tracking Stock Extended Market VIPERs StreetTRACKS Total Market FTSE RAFI U.S. 1000 Dynamic MagniQuant SymbolMER Opt. Volume (%) Daily 3 months (000) Jan. 2008 VTI 0.07 yes 469 IWV 0.20 yes 472 IYY 0.20 yes 62 ISI 0.20 yes 48 ONEQ 0.30 yes 32 VXF 0.08 yes 65 TMW 0.20 yes 25 PRF 0.60 yes 210 PIQ 0.60 yes 28 Large-Cap Diamond Trust Series 1 NASDAQ 100 Index Tracking Stock IShares S&P 100 IShares S&P 500 IShares NYSE 100 IShares NYSE Composite Standard and Poors Depository Receipts IShares Russell 1000 Rydex S&P Equalweight Large Cap VIPERS Morningstar Large Core StreetTRACKS DJ Wilshire Large Cap First Trust NASDAQ 100 Equal Weight DIA 0.18 QQQQ0.20 OEF 0.20 IVV 0.09 NY 0.20 NYC 0.25 SPY 0.10 IWB 0.15 RSP 0.40 VV 0.07 JKD 0.20 ELR 0.20 QQEW0.60 yes yes yes yes yes yes yes yes yes yes yes yes yes 15,761 174,386 1,773 2,972 13 20 215,368 1,045 834 177 16 4 46 Rydex Russell Top 50 Dynamic Large Cap First Trust Large Cap Core AlphaDEX Vanguard Mega Cap 300 XLG PJF FEX MGC 0.20 0.60 0.70 0.13 yes yes no no 50 12 4 18 Mid-Cap IShares S&P MidCap 400 S&P Midcap 400 Depository Receipts IShares Russell Midcap Mid-Cap VIPERS Morningstar MidCore StreetTRACKS DJ Wilshire Mid Cap Dynamic Mid-Cap First Trust Mid Cap Core AlphaDEX IJH MDY IWR VO JKG EMM PJG FNX 0.20 0.25 0.20 0.13 0.25 0.25 0.60 0.70 yes yes yes yes yes yes yes no 539 5,764 321 150 12 7 11 3 Small Cap IShares S&P Small Cap 600 IShares Russell 2000 Small-cap VIPERS Morningstar SmallCore iShares Microcap StreetTRACKS DJ Wilshire Small Cap First Trust MicroCap Zacks Small Cap Zacks Micro Cap FTSE RAFI Small – Mid FT Dow Jones Select Microcap Dynamic Small Cap First Trust Small Cap Core AlphaDEX IJR IWM VB JKJ IWC DSC FDM PZJ PZI PRFZ FDM PJM FYX 0.20 0.20 0.10 0.25 0.60 0.25 0.60 0.60 0.60 0.60 0.60 0.60 0.70 yes yes yes yes yes yes yes yes yes no yes yes no 1,989 95,299 167 20 165 7 6 32 90 29 6 10 5 Broad Market Growth IShares Russell 3000 Growth First Trust Growth IWZ FPX 0.25 0.60 yes yes 127 8 Broad Market Value IShares Russell 3000 Value First Trust Equity Income First Trust Multi Cap Growth AlphaDEX First Trust Multi Cap Value AlphaDEX IWW FDL FAD FAB 0.25 0.60 0.70 0.70 yes yes no no 89 21 7 5 Large-Cap Growth IShares S&P 500/Barra Growth IShares Russell 1000 Growth StreetTRACKS DJ Wilshire Large Cap Growth IVW IWD ELG 0.18 0.20 0.20 yes yes yes 887 2,355 39 Style ETFs Growth VIPERS Morningstar Large Growth Dynamic Large Growth Rydex S&P 500 Growth First Trust Large Cap Growth AlphaDEX Vanguard Mega Cap Growth VUG JKE PWB RPG FTC MGK 0.15 0.25 0.60 0.35 0.70 0.13 yes yes yes yes no no 333 76 342 26 6 15 Large-Cap Value IShares S&P 500/Barra Value IShares Russell 1000 Value StreetTRACKS DJ Wilshire Large Cap Value Value VIPERS Morningstar Large Value Dynamic Large Value Rydex S&P 500 Value FT DB Strategic Value First Trust Large Cap Value AlphaDEX Vanguard Mega Cap Value IVE IWD ELV VTV JKF PWV RPV FDN FTA MGV 0.18 0.20 0.20 0.15 0.25 0.60 0.35 0.60 0.70 0.13 yes yes yes yes yes yes yes yes no no 565 2,355 14 244 60 85 21 49 3 48 Mid-Cap Growth IShares S&P MidCap 400/Barra Growth IShares Russell MidCap Growth Morningstar Mid Growth Dynamic Mid Growth StreetTRACKS DJ Wilshire Mid Cap Growth Rydex Midcap 400 Growth IJK IWP JKH PWJ EMG RFG 0.25 0.25 0.30 0.60 0.25 0.35 yes yes yes yes yes yes 166 498 36 236 8 13 Mid-Cap Value IShares S&P MidCap 400/Barra Value IShares Russell MidCap Value Morningstar Mid Value Dynamic Mid Value StreetTRACKS DJ Wilshire Mid Cap Value Rydex Midcap 400 Value IJJ IWS JKI PWP EMV RFV 0.25 0.25 0.30 0.60 0.25 0.35 yes yes yes yes yes yes 118 501 13 41 2 12 Small-Cap Growth IShares S&P SmallCap 600/Barra Growth IShares Russell 2000 Growth StreetTRACKS DJ SmallCap Growth Small-Cap Growth VIPERS Morningstar Small Growth Dynamic Small Growth Rydex Small Cap Growth IJT IWO DSG VBK JKK PWT RZG 0.25 0.25 0.25 0.22 0.30 0.60 0.35 yes yes yes yes yes yes yes 177 4,855 13 133 22 29 5 Small-Cap Value IShares S&P SmallCap 600/Barra Value IJS 0.25 yes 148 IShares Russell 2000 Value StreetTRACKS DJ SmallCap Value Small-Cap Value VIPERS Morningstar Small Cap Value Dynamic Small Cap Value Rydex Small Cap Value IWN DSV VBR JKL PWY RZV 0.25 0.25 0.22 0.30 0.60 0.35 yes yes yes yes yes yes 3,206 18 172 14 58 15 Consumer Discretionary Consumer Discretionary Select Sector SPDR IShares DJ US Consumer Cyclical Sector Retail HOLDRS Consumer Discretionary VIPERS Dynamic Leisure and Entertainment Dynamic Retail Dynamic Hardware and Consumer Electronics SPDR Retail Dynamic Consumer Discretionary Market Vector Environmental Services Rydex Equal Weight Consumer Discretionary XLY IYC RTH VCR PEJ PMR PHW XRT PEZ EVX RCD 0.26 0.48 0* 0.28 0.60 0.60 0.60 0.35 0.60 0.55 0.50 yes yes yes yes yes yes yes yes yes yes no 3,943 96 5,880 46 34 50 29 3,388 37 10 42 Consumer Staples Consumer Staples Select Sector SPDR IShares DJ US Consumer Non-Cyclical Sector Consumer Staples VIPERS Dynamic Food and Beverage FTSE RAFI Consumer Goods Dynamic Consumer Staples Rydex Equal Weight Consumer Staples First Trust Consumer Staples AlphaDEX XLP IYK VDC PBJ PRFG PSL RHS FXG 0.26 0.48 0.28 0.60 0.60 0.60 0.50 0.70 yes yes yes yes no yes no yes 3,199 35 56 34 1 6 2 1 Energy Energy Select Sector SPDR IShares DJ US Energy Sector Vanguard Energy VIPERs Oil Service HOLDRS Dynamic Energy Exploration and Production Dynamic Energy Sector Dynamic Oil and Gas Services iShares DJ Exploration & Production iShares DJ Oil Equipment SPDR Oil and Gas Equipment and Services SPDR Oil and Gas Exploration and Production FTSE RAFI Energy XLE IYE VDE OIH PXE PXI PXJ IEO IEZ XES XOP PRFE 0.26 0.60 0.28 0* 0.60 0.60 0.60 0.48 0.48 0.35 0.35 0.60 yes yes yes yes yes yes yes no no yes yes no 21,563 172 38 7,084 46 10 224 91 520 67 219 7 Sector ETFs Rydex Equal Weight Energy First Trust Energy AlphaDEX First Trust ISE Revere Natural Gas Market Vector Nuclear Energy RYE FXN FCG NLR 0.50 0.70 0.70 0.65 no yes yes no 9 2 20 82 Financials Financial Select Sector SPDR IShares DJ US Financial Sector IShares DJ US Financial Services Regional Bank HOLDRS Financials VIPERS StreetTRACKS KBW Bank StreetTRACKS KBW Capital Markets StreetTRACKS KBW Insurance Dynamic Insurance iShares DJ Broker Dealer iShares DJ Insurance iShares Regional Banks SPDR Regional Banking FTSE RAFI Financials Dynamic Banking Dynamic Financial Rydex Equal Weight Financials First Trust Financials AlphaDEX XLF IYF IYG RKH VFH KBE KCE KIE PIC IAI IAK IAT KRE PRFF PJB PFI RYF FXO 0.26 0.48 0.48 0* 0.28 0.35 0.35 0.35 0.60 0.48 0.48 0.48 0.35 0.60 0.60 0.60 0.50 0.70 yes yes yes yes yes yes yes yes yes yes no no yes no yes yes yes no 91,518 575 270 1,007 140 1,688 677 230 33 1,345 24 77 2,179 13 77 11 5 1 Health Care Biotech HOLDRS IShares NASDAQ Biotech iShares Biotech SPDRs Amex Biotech Dynamic Biotech and Genome Health Care Select Sector SPDR IShares DJ US Healthcare Sector iShares Pharmaceuticals iShares Healthcare Providers iShares Medical Devices Pharmaceutical HOLDRS Health Care VIPERS Dynamic Pharmaceutical SPDR Pharmaceutical FTSE RAFI Health Dynamic Healthcare Services Dynamic Healthcare Rydex Equal Weight Health Care HealthShares Cardio Devices HealthShares Diagnostics BBH IBB XBI FBT PBE XLV IYH IHE IHF IHI PPH VHT PJP XPH PRFH PTJ PTH RYH HHE HHD 0* 0.48 0.35 0.60 0.60 0.26 0.48 0.48 0.48 0.48 0* 0.28 0.60 0.35 0.60 0.60 0.60 0.50 0.75 0.75 yes yes yes yes yes yes yes no no no yes yes yes yes no yes yes no no no 208 1,301 36 36 42 2,511 71 27 73 74 761 44 22 5 3 44 29 13 1 29 HealthShares Emerging Cancer HealthShares Enabling Technology HealthShares Patient Care Services HealthShares Metabolic-Endocrine Disorder HealthShares Autoimmune-Inflammation HealthShares Cancer HealthShares Cardiology HealthShares Composite HealthShares GI/Gender Health HealthShares Respiratory/Pulmonary HealthShares Neuroscience HeathShares Ophthalmology HHJ HHV HHB HHM HHA HHK HRD HHQ HHU HHR HHN HHZ 0.75 0.75 0.75 0.75 0.75 0.75 0.75 0.75 0.75 0.75 0.75 0.75 yes no no no no no no no no no no no 5 6 3 1 1 8 1 3 1 3 1 1 HealthShares European Drug HealthShares Infectious Disease HealthShares Dermatology and Wound Care First Trust Health Care AlphaDEX HRJ HHG HRW FXH 0.75 0.75 0.75 0.70 no no no no 2 1 1 3 Industrials Industrial Select Sector SPDR XLI IShares DJ Transportation Average IYT IShares DJ US Industrial Sector IYJ Vanguard Industrials VIPERs VIS Dynamic Building and Construction PKB iShares Home Construction ITB Homebuilder SPDRs XHB Dynamic Aerospace and Defense PPA iShares Aerospace and Defence IHE FTSE RAFI Industrials PRFN Dynamic Industrials PRN Market Vector Steel SLX PowerShares Aerospace and Defense PPA Rydex Equal Weight Industrials RGI First Trust Industrials/Producer Durables AlphaDEXFXR 0.26 0.48 0.48 0.28 0.60 0.48 0.35 0.60 0.48 0.60 0.60 0.55 0.60 0.50 0.70 yes yes yes yes yes no yes yes no no yes yes yes no no 5,451 660 59 37 46 499 4,613 164 27 19 24 161 164 6 1 Information Technology – Broad Based IShares DJ US Technology Sector IShares Goldman Sachs Tech StreetTRACKS MS High-Tech 35 Technology Select Sector SPDR Information Technology VIPERS FTSE RAFI Telecom and Technology Dynamic Technology Rydex Equal Weight Technology NYSE Arca Tech 100 First Trust Technology AlphaDEX 0.48 0.48 0.50 0.26 0.28 0.60 0.60 0.50 0.50 0.70 yes yes yes yes yes no no no no no 256 198 64 3,997 93 6 11 14 8 2 IYW IGM MTK XLK VGT PRFQ PTF RYT NXT FXL Information Technology – Internet Internet HOLDRS B2B Internet HOLDRS Internet Architecture HOLDRS Internet Infrastructure HOLDRS Dow Jones Internet HHH BHH IAH IIH FDN 0* 0* 0* 0* 0.60 yes yes yes yes yes 173 47 53 87 49 Information Technology – Other IShares Goldman Sachs Networking IShares Goldman Sachs Semiconductor IShares Goldman Sachs Software Broadband HOLDRS Semiconductor HOLDRS Software HOLDRS Dynamic Networking Dynamic Semiconductor Dynamic Software Lux Nanotech Semiconductor SPDRs First Trust NASDAQ 100 Equal Weight Tech IGN IGW IGV BDH SMH SWH PXQ PSI PSJ PXN XSD QTEC 0.48 0.48 0.48 0* 0* 0* 0.60 0.60 0.60 0.60 0.35 0.60 yes yes yes yes yes yes yes yes yes yes yes yes 177 226 211 107 9,846 250 13 165 17 39 42 35 Materials IShares DJ US Basic Materials Sector Materials Select Sector SPDR Materials VIPERS SPDR Metals and Mining FTSE RAFI Basic Materials Rydex Equal Weight Materials Dynamic Basic Materials First Trust Materials AlphaDEX Market Vector Steel IYM XLB VAW XME PRFM RTM PYZ FXZ SLX 0.48 0.26 0.28 0.35 0.60 0.50 0.60 0.70 0.55 yes yes yes yes no no yes yes yes 229 7,740 42 546 3 4 16 2 161 Natural Resources IShares Goldman Sachs Natural Resources IGE 0.48 yes 93 Real Estate IShares DJ US Real Estate IShares Cohen & Steers Realty Majors StreetTRACKS Wilshire REIT Vanguard REIT VIPERs First Trust S&P REIT iShares FTSE Industrial/Office iShares FTSE Mortgage REIT iShares Real Estate 50 IYR ICF RWR VNQ FRI FIO REM FTY 0.48 0.35 0.25 0.12 0.50 0.48 0.48 0.50 yes yes yes yes yes no no no 7,217 1,134 234 410 2 1 14 5 iShares Residential iShares Retail Adelante Re Composite Adelante Re Classics Adelante Re Growth Adelante Re Kings Adelante Re Yield Plus Adelante Re Shelter Adelante Re Value REZ RTL ACB ACK AGV AKB ATY AQS AVU 0.50 0.50 0.58 0.58 0.58 0.58 0.58 0.58 0.58 no no no no no no no no no 4 9 1 1 3 1 1 2 N/A Telecommunications IShares DJ US Telecom Sector Vanguard Telecommunication Services VIPERs Telecom HOLDRS Wireless HOLDRS Dynamic Media Dynamic Telecommunications IYZ VOX TTH WMH PBS PTE 0.48 0.26 0* 0* 0.60 0.60 yes yes yes yes yes yes 461 40 109 11 40 14 Utilities IShares DJ US Utilities Sector Utilities Select Sector SPDR Utilities HOLDRS Utilities VIPERS Dynamic Utilities FTSE RAFI Utilities First Trust Utilities AlphaDEX IDU XLU UTH VPU PUI PRFU FXU 0.48 0.26 0* 0.28 0.60 0.60 0.70 yes yes yes yes yes no no 87 5,347 76 39 11 3 1 DVY PEY SDY PEY PHJ DTN DLN DON DHS DES CVY LVL FDL 0.40 0.50 0.30 0.60 0.60 0.38 0.28 0.38 0.38 0.38 0.60 0.60 0.45 yes yes yes yes yes yes yes yes yes yes yes no yes 876 140 47 140 17 43 71 32 36 55 24 6 21 FVI 0.60 yes 4 Dividend ETFs IShares Dow Jones Select Dividend Power Shares Dividend Achievers Portfolio SPDR Dividend High Yield Equity Dividend Achievers Portfolio High Growth Rate Dividend Achievers Portfolio Dividend Top 100 Large Cap Dividend Mid Cap Dividend High Yielding Equity Small Cap Dividend Claymore Yield Hog Claymore/BBD High Income FT Morningstar Dividend Leaders Specialty ETFs FT ValueLine ValueLine Timeliness Select PIV 0.60 ValueLine Industry Rotation PYH 0.60 FT ValueLine 100 FVL 0.60 Water Resources PHO 0.60 Claymore Sector Rotation XRO 0.60 Claymore Sabrient Insider NFO 0.60 Claymore Sabrient Stealth STH 0.60 Claymore Spin-off CSD 0.60 Claymore/Sabient Defender DEF 0.60 Claymore/LGA Green GRN 0.60 Claymore/Ocean Tomo Patent OTP 0.60 Claymore/BIR Leaders 50 BST 0.60 Claymore/Ocean Tomo Growth OTR 0.60 Claymore/Zacks Growth and Income CZG 0.60 Claymore/BIR Leaders Mid-Cap Core BMV 0.60 Claymore/BIR Leaders Small-Cap Core BES 0.60 Claymore/Great Companies Large Cap Growth XGC 0.60 Claymore/Zacks Mid-Cap Core CZA 0.60 Claymore/IndexIQ Small Cap Value SCV 0.60 Claymore/Robeco Boston Partners Large Cap Value CLV 0.60 Claymore/Clear Mid-Cap Growth MCG 0.60 Claymore/KLD Sudan Free Large Cap Core KSF 0.50 Claymore Morningstar Manufacturing MZG 0.40 Claymore Morningstar Information MZN 0.40 Claymore Morningstar Services MZO 0.40 Claymore/Zacks Country Rotation CRO 0.65 Claymore/Zacks Sector Rotation XRO 0.60 PowerShares Dynamic Market Portfolio PWC 0.60 PowerShares Dynamic OTC Portfolio PWO 0.60 Powershares Private Equity PSP 0.69 Powershares CleanTech PZD 0.60 Powershare Aggressive Growth PGZ 0.60 Powershares Deep Value PVM 0.60 Powershares Buy Back Achievers PKW 0.60 Powershares Financial Preferred PGF 0.60 Powershares DWA Technical Leaders PDP 0.60 Powershares S&P 500 Buy Write PBP 0.75 Wilderhill Clean Energy PBW 0.60 Wilderhill Progressive Energy PUW 0.60 iShares KLD Select Social Index KLD 0.50 First Trust NASDAQ 100 Ex-Technology QQXT 0.60 First Trust NASDAQ Clean Edge QCLN 0.60 WisdomTree Earnings 500 Index EPS 0.28 WisdomTree Earnings Index EXT 0.28 WisdomTree Midcap Earnings Index EZM 0.38 WisdomTree Small Cap Earnings Index EES 0.38 yes yes no yes yes yes yes yes yes yes yes no no no no no no no no no no no no no no no yes yes yes yes yes yes yes no no no no yes yes yes no no no no no no 108 31 58 533 107 11 10 23 8 2 2 1 2 1 2 2 5 2 2 3 1 1 4 3 1 5 107 60 15 63 59 14 3 21 106 175 7 1,104 15 10 3 33 18 9 16 12 WisdomTree Top 100 Index WisdomTree Low P/E Index First Trust ISE Water Index Van Eck Agribusiness FocusShares ISE Homebuilders FocusShares ISE SINdex FocusShares ISE Homeland Security FocusShares ISE Wal-Mart Supplier Market Vectors Coal Market Vectors Gaming EEZ EZY FIW MOO SAQ PUF MYP WSI KOL BJK 0.38 0.38 0.60 0.65 0.35 0.60 0.60 0.60 N/A N/A no no yes yes yes yes yes yes no no 8 10 7 436 N/A 6 4 2 N/A N/A Broad Based – International IShares MSCI EAFE EFA 0.35 BLDRS Development Markets 100 ADR ADRD 0.30 IShares MSCI Emerging Markets Free EEM 0.75 BLDRS Emerging Markets 50 ADR ADRE 0.30 Claymore BRIC EEB 0.60 Claymore/Robeco Developed World Equity EEW 0.65 Claymore/Robeco Developed International Equity EEN 0.65 Vanguard FTSE All-World Ex U.S. VEU 0.25 SPDR S&P Emerging Markets GMM 0.60 Dynamic International Opportunities PFA 0.75 FTSE RAFI Developed Markets ex U.S. Small-Mid PDN 0.75 FTSE RAFI Emerging Markets PXH 0.85 International Listed Private Equity PFP 0.75 iShares MSCI BRIC BKF 0.75 iShares MSCI Small Cap EAFE Index SCZ 0.40 iShares S&P Global Infrastructure IGF 0.58 iShares MSCI Kokasai Index TOK 0.25 yes no yes yes yes no no yes yes no no yes yes no no no no 10,797 38 18,894 409 708 1 2 284 16 37 7 34 25 19 17 1 N/A Regional – International BLDRS Europe 100 ADR Europe 2001 HOLDRS Fresco Dow Jones STOXX 50 IShares S&P Europe 350 Fresco Dow Jones Euro STOXX 50 IShares MSCI EMU IShares MSCI Pacific ex-Japan BLDRS Asia 50 ADR IShares S&P Latin America 40 Vanguard Emerging Markets VIPERS Vanguard European VIPERS no no no yes yes no no yes yes yes yes 18 1 29 359 208 355 335 30 475 808 353 International ETFs ADRU 0.30 EKH 0* FEU 0.30 IEV 0.48 FEZ 0.30 EZU 0.59 EPP 0.50 ADRA 0.30 ILF 0.50 VWO 0.30 VGK 0.18 SPDR S&P Emerging Asia Pacific SPDR S&P China SPDR Emerging Europe SPDR Emerging Latin America SPDR Emerging Middle East and Africa First Trust ChIndia Dynamic Europe GMF GXC GUR GML GAF FNI PEH 0.60 0.60 0.60 0.60 0.60 0.60 0.75 yes yes no no yes yes no 31 228 24 24 29 105 5 Style/International ISharese MSCI EAFE Value IShares MSCI EAFE Growth EFV EFG 0.40 0.40 yes no 127 178 Asia/Pacific IShares MSCI Australia IShares MSCI Hong Kong IShares MSCI Japan IShares MSCI Malaysia (Free) IShares MSCI Singapore IShares MSCI South Korea IShares MSCI Taiwan IShares FTSE/Xinhuu China 25 iShares MSCI Japan Small Cap PowerShares Golden Dragon USX China Portfolio Vanguard Pacific VIPERS Streettracks Russell/Nomura Japan Prime Streettracks Russell/Nomura Japan Small Cap Dynamic Asia/Pacific FTSE RAFI Asia Pacific ex Japan Small-Mid S&P Asia EWA EWH EWJ EWM EWS EWY EWT FXI SCJ PGJ VPL JPP JSC PUA PDQ AIA 0.59 0.59 0.59 0.59 0.59 0.74 0.74 0.74 0.59 0.60 0.18 0.51 0.56 0.75 0.80 0.50 yes yes yes yes yes yes yes yes no yes yes yes yes no yes no 2,377 4,575 18,252 3,247 4,617 2,781 8,107 6,586 1 1,468 143 11 24 25 8 22 Europe IShares MSCI Austria IShares MSCI Belgium IShares MSCI France IShares MSCI Germany IShares MSCI Italy IShares MSCI Netherlands IShares MSCI Spain IShares MSCI Sweden IShares MSCI Switzerland IShares MSCI United Kingdom Van Eck Russia FTSE Europe Small-Mid EWO EWK EWQ EWG EWI EWN EWP EWD EWL EWU RSX PWD 0.54 0.54 0.54 0.54 0.54 0.54 0.54 0.54 0.54 0.54 0.69 0.75 yes yes yes yes yes yes yes yes yes yes yes no 185 130 388 1,443 162 147 375 353 197 767 405 3 Americas IShares MSCI Brazil EWZ 0.74 yes 14,731 IShares MSCI Canada IShares MSCI Mexico iShares MSCI Chile EWC 0.57 EWW 0.57 ECH 0.74 yes no no 1,391 3,769 38 EMEA IShares MSCI South Africa EZA 0.74 yes 251 Broad Based – Global StreetTRACKS DJ Global Titans IShares S&P Global 100 Market 2000+ HOLDRS iShares S&P World ex U.S. property DGT IOO MKH WPS 0.50 0.20 0* 0.48 yes yes no no 13 150 5 34 Sectors – Global IShares S&P Global Energy Sector IShares S&P Global Financial Sector IShares S&P Global Healthcare Sector IShares S&P Global Technology Sector IShares S&P Global Telecommunications Streettracks International Real Estate Market Vector Global Alternative Energy PowerShares Global Clean Energy PowerShares Global Water Claymore Global Water Claymore Global Exchanges, Brokers and Asset Claymore Vaccine Global Index Claymore/SVM Canadian Energy Income FTSE Global Real Estate ex U.S. FTSE Asia Real Estate FTSE Europe Real Estate FTSE Developed Small Cap ex North America IXC IXG IXJ IXN IXP RWX GEX PBD PIO CGW EXB JNR ENY IFGL IFAS IFEU IFSM O.65 0.65 0.65 0.65 0.65 0.60 0.55 0.75 0.75 0.74 0.65 0.65 0.65 0.48 0.48 0.48 0.48 yes yes yes yes yes yes no no no yes yes no no no no no no 46 48 125 62 58 205 83 83 126 103 42 1 18 12 8 2 6 International Dividend International Dividend Achievers Portfolio Pacific ex Japan Dividend Pacific ex Japan High Yielding Japan Total Dividend Japan High Yielding Equity DIEFA International Dividend Top 100 International Mid Cap Dividend DIEFA High Yielding Dividend International Small Cap Dividend Europe Total Dividend Europe High Yielding Equity Europe Small Cap Dividend PID DND DNL DXJ DNL DWM DOO DIM DTH DLS DEB DEW DFE 0.60 0.48 0.58 0.48 0.58 0.48 0.58 0.58 0.58 0.58 0.48 0.58 0.58 yes no no no no no no no no no no no no 283 81 9 7 9 75 57 33 24 67 14 11 13 Japan Small Cap Dividend Total International Dividend DFJ 0.58 DTD 0.28 no no 20 25 Double returns Ultra QQQ Ultra S&P 500 Ultra Dow 30 Ultra Mid Cap 400 Ultra Small Cap 600 Ultra Russell 1000 Growth Ultra Russell 1000 Value Ultra Russell MidCap Value Ultra Russell MidCap Growth Ultra Russell 2000 Ultra Russell 2000 Growth Ultra Russell 2000 Value Ultra DJ Basic Materials Ultra DJ Consumer Goods Ultra DJ Consumer Services Ultra DJ Financials Ultra DJ Health Care Ultra DJ Industrials Ultra DJ Oil and Gas Ultra DJ Real Estate Ultra DJ Semiconductors Ultra DJ Technology Ultra DJ Utilities Rydex 2x S&P 500 Rydex 2x S&P Midcap 400 Rydex 2x Russell 2000 QLD SSO DDM MVV SAA UVG UKF UVU UKW UWM UKK UVT UYM UGE UCC UYG RXL UXI DIG URE USD ROM UPW RSU RMM RRZ 0.95 0.95 0.95 0.95 0.95 0.95 0.95 0.95 0.95 0.95 0.95 0.95 0.95 0.95 0.95 0.95 0.95 0.95 0.95 0.95 0.95 0.95 0.95 0.70 0.70 0.70 no no no no no no no no no no no no no no no no no no no no no no no no no no 4,988 2,223 642 105 16 7 13 4 9 492 10 8 21 6 7 487 7 6 64 45 56 53 13 5 2 16 Inverse returns Short QQQ Short S&P 500 Short Dow 30 Short Mid Cap 400 Short Small Cap 600 Short Russell 2000 Short MSCI Emerging Market PSQ SH DOG MYY SBB RWM EUM 0.95 0.95 0.95 0.95 0.95 0.95 0.95 no no no no no no no 98 214 236 34 8 60 29 Double inverse returns Ultra Short QQQ Ultra Short S&P 500 QID SDS 0.95 0.95 no no 27,855 18,401 Leveraged ETFs Ultra Short Dow 30 Ultra Short Mid Cap 400 Ultra Short Small Cap 600 Ultra Short Russell 1000 Growth Ultra Short Russell 1000 Value Ultra Short Russell MidCap Growth Ultra Short Russell MidCap Value Ultra Short Russell 2000 Ultra Short Russell 2000 Growth Ultra Short Russell 2000 Value Ultra Short DJ Basic Materials Ultra Short DJ Consumer Goods Ultra Short DJ Consumer Services Ultra Short DJ Financials Ultra Short DJ Health Care Ultra Short DJ Industrials Ultra Short DJ Oil and Gas Ultra Short DJ Real Estate Ultra Short DJ Semiconductors Ultra Short DJ Technology Ultra Short DJ Utilities Ultra Short Emerging Markets Ultra Short FTSE/Xinhua China 25 Ultra Short MSCI Japan Rydex Inverse 2x S&P 500 Rydex Inverse 2x Midcap 400 Rydex Inverse 2x Russell 2000 DXD MZZ SDD SJF SFK SJL SDK TWM SKK SJH SMN SZK SCC SKF RXD SIJ DUG SRS SSG REW SDP EEV FXP EWV RSX RMS RRZ 0.95 0.95 0.95 0.95 0.95 0.95 0.95 0.95 0.95 0.95 0.95 0.95 0.95 0.95 0.95 0.95 0.95 0.95 0.95 0.95 0.95 0.95 0.95 0.95 0.70 0.70 0.70 no no no no no no no no no no no no no no no no no no no no no no no no no no no 3,348 798 61 9 9 9 5 5,528 34 57 161 21 37 2,430 2 18 1,048 974 21 38 12 293 1,367 15 405 2 16 SHY IEF TLT LQD AGG TIP SHV IEI TLH CSJ CIU CFT GVI GBF MBB 0.15 0.15 0.15 0.15 0.20 0.20 0.15 0.15 0.15 0.20 0.20 0.20 0.20 0.20 0.25 yes yes yes yes yes yes no no yes no no no no no yes 883 296 1,694 148 542 273 76 36 23 23 23 5 11 8 20 Fixed Income ETFs Fixed Income ETFs – U.S. IShares Lehman 1-3 Year Treasury IShares Lehman 7-10 Year Treasury IShares Lehman 20+ Year Treasury Ishares GS $InvesTop Corporate Ishares Lehman Aggregate IShares Lehman TIPS iShares Lehman Short Term Treasury Bond iShares Lehman 3-7 year Treasury Bond iShares Lehman 10-20 year Treasury Bond iShares Lehman 1-3 Year Credit Bond iShares Lehman Intermediate Credit Bond iShares Lehman Credit Bond iShares Lehman Intermediate Gov’t/Credit Bond iShares Government/Credit Bond iShares Lehman MBS Fixed Rate Bond iShares iBoxx $High Yield Corporate Bond HYG Vanguard Short Term Bond BSV Vanguard Intermediate Term Bond BIV Vanguard Long Term Bond BLV Vanguard Total Bond Market BND SPDR Lehman 1-3 Month T-Bill BIL SPDR Lehman Intermediate Term Treasury ITE SPDR Lehman Long Term Treasury TLO SPDR Barclays Capital Tips IPE SPDR Lehman Aggregate Bond LAG SPDR Lehman Municipal Bond TFI SPDR Lehman High Yield Corporate Bond JNK Ameristock 1 year Treasury GKA Ameristock 2 year Treasury GKB Ameristock 5 year Treasury GKC Ameristock 10 year Treasury GKD Ameristock 20 year Treasury GKE PowerShares VRDO Tax Free Weekly Portfolio PVI PowerShares Preferred PGX PowerShares Corporate Bond PHB Market Vectors Lehman AMT-free Int. Municipal ITM Market Vectors Lehman AMT-free Long Municipal MLN Fixed Income ETFs – Canada IShares on Canadian Short Bond Index IShares on the Scotia Mcleod Bond Index iShares Canadian Real Return Bond Index iShares Canadian Long Bond Index iShares Canadian Government Bond Index iShares Corporate Bond Index 0.50 0.11 0.11 0.11 0.11 0.13 0.18 0.13 0.13 0.13 0.20 0.40 0.15 0.15 0.15 0.15 0.15 yes yes yes yes yes yes yes yes yes no yes no no no no yes yes no no no no no 44 48 28 18 213 115 3 6 10 20 45 N/A 1 1 1 1 1 12 N/A 2 1 N/A XSB XBB XRB XLB XGB XCB 0.25 0.30 0.35 0.35 0.35 0.40 no no no no no no 100 100 25 10 10 15 GLD IAU IGT SLV DBC USO GDX GSG UCR DCR GCC DBE 0.40 0.40 0.40 0.50 0.75 0.50 0.55 0.75 1.60 1.60 N/A 0.60 no no no no no no yes no no no yes yes 7,977 226 2,328 508 468 3,469 124 14 49 37 N/A 40 Commodity Based ETFs World Gold Council Gold iShares COMEX Gold (U.S.) (TSX) iShares Silver Deutschebank Commodity Crude Oil Market Vectors Gold Miners IShares GSCI Commodity Index Claymore Crude Oil (Up) Claymore Crude Oil (Down) Greenhaven Cont. IDX PowerShares DB Energy PowerShares DB Oil Fund PowerShares DB Precious Metals PowerShares DB Gold PowerShares DB Silver PowerShares Base Metals PowerShares Agriculture United States Natural Gas DBO DBP DGL DBS DBB DBA UNG 0.60 0.60 0.60 0.60 0.60 0.60 0.77 yes yes yes yes yes yes yes FXE FXM FXS FXA FXB FXC FXF 0.40 0.40 0.40 0.40 0.40 0.40 0.40 no no no no no no no 32 20 20 53 682 1,324 1,435 Currency Based ETFs Rydex Euro Rydex Mexican Peso Rydex Swedish Krona Rydex Australian Dollar Rydex British Pound Rydex Canadian Dollar Rydex Swiss Franc 184 5 11 91 45 102 73 *Expenses for HOLDRS consist of a custody fee of $2 per round lot (100 shares) per quarter. However, the trustee will wave that portion of the fee, which exceeds the total cash distribution. Data Sources: Various website by sponsoring ETF distributors and exchanges as well as www.yahoo.com Comments on Exchange Traded Funds regularly appear at www.dvtechtalk.com Disclaimer: Comments and opinions offered in this report are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.