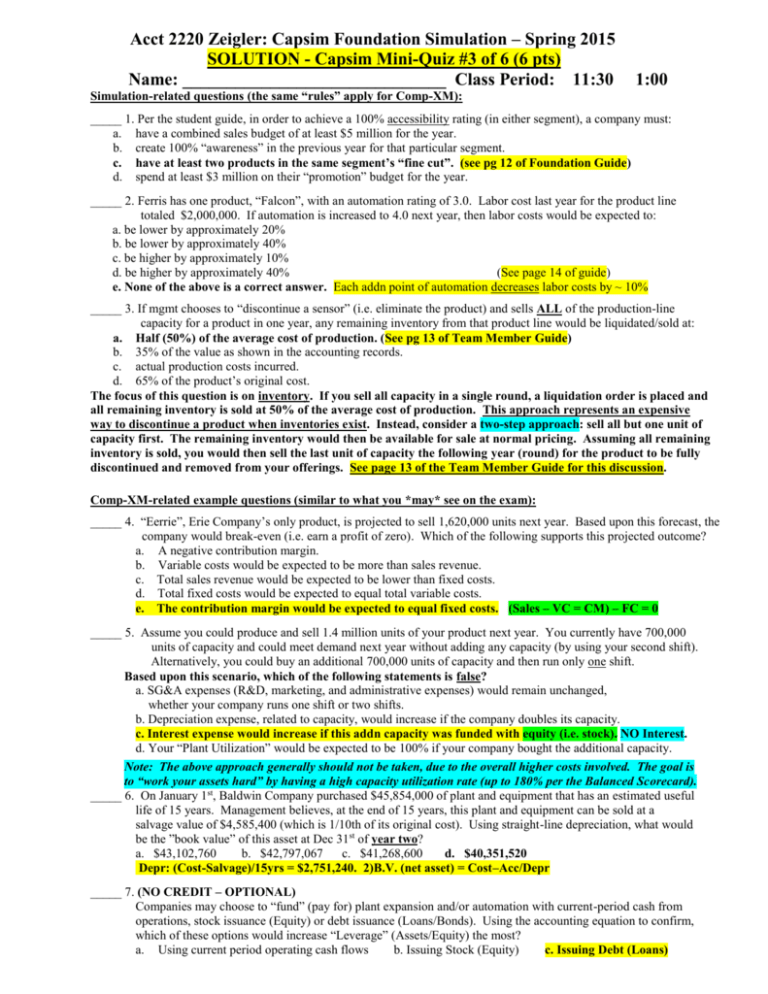

Acct 2220 Zeigler: Capsim Foundation Simulation – Spring 2015

advertisement

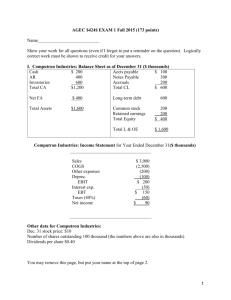

Acct 2220 Zeigler: Capsim Foundation Simulation – Spring 2015 SOLUTION - Capsim Mini-Quiz #3 of 6 (6 pts) Name: ______________________________ Class Period: 11:30 1:00 Simulation-related questions (the same “rules” apply for Comp-XM): _____ 1. Per the student guide, in order to achieve a 100% accessibility rating (in either segment), a company must: a. have a combined sales budget of at least $5 million for the year. b. create 100% “awareness” in the previous year for that particular segment. c. have at least two products in the same segment’s “fine cut”. (see pg 12 of Foundation Guide) d. spend at least $3 million on their “promotion” budget for the year. _____ 2. Ferris has one product, “Falcon”, with an automation rating of 3.0. Labor cost last year for the product line totaled $2,000,000. If automation is increased to 4.0 next year, then labor costs would be expected to: a. be lower by approximately 20% b. be lower by approximately 40% c. be higher by approximately 10% d. be higher by approximately 40% (See page 14 of guide) e. None of the above is a correct answer. Each addn point of automation decreases labor costs by ~ 10% _____ 3. If mgmt chooses to “discontinue a sensor” (i.e. eliminate the product) and sells ALL of the production-line capacity for a product in one year, any remaining inventory from that product line would be liquidated/sold at: a. Half (50%) of the average cost of production. (See pg 13 of Team Member Guide) b. 35% of the value as shown in the accounting records. c. actual production costs incurred. d. 65% of the product’s original cost. The focus of this question is on inventory. If you sell all capacity in a single round, a liquidation order is placed and all remaining inventory is sold at 50% of the average cost of production. This approach represents an expensive way to discontinue a product when inventories exist. Instead, consider a two-step approach: sell all but one unit of capacity first. The remaining inventory would then be available for sale at normal pricing. Assuming all remaining inventory is sold, you would then sell the last unit of capacity the following year (round) for the product to be fully discontinued and removed from your offerings. See page 13 of the Team Member Guide for this discussion. Comp-XM-related example questions (similar to what you *may* see on the exam): _____ 4. “Eerrie”, Erie Company’s only product, is projected to sell 1,620,000 units next year. Based upon this forecast, the company would break-even (i.e. earn a profit of zero). Which of the following supports this projected outcome? a. A negative contribution margin. b. Variable costs would be expected to be more than sales revenue. c. Total sales revenue would be expected to be lower than fixed costs. d. Total fixed costs would be expected to equal total variable costs. e. The contribution margin would be expected to equal fixed costs. (Sales – VC = CM) – FC = 0 _____ 5. Assume you could produce and sell 1.4 million units of your product next year. You currently have 700,000 units of capacity and could meet demand next year without adding any capacity (by using your second shift). Alternatively, you could buy an additional 700,000 units of capacity and then run only one shift. Based upon this scenario, which of the following statements is false? a. SG&A expenses (R&D, marketing, and administrative expenses) would remain unchanged, whether your company runs one shift or two shifts. b. Depreciation expense, related to capacity, would increase if the company doubles its capacity. c. Interest expense would increase if this addn capacity was funded with equity (i.e. stock). NO Interest. d. Your “Plant Utilization” would be expected to be 100% if your company bought the additional capacity. Note: The above approach generally should not be taken, due to the overall higher costs involved. The goal is to “work your assets hard” by having a high capacity utilization rate (up to 180% per the Balanced Scorecard). _____ 6. On January 1st, Baldwin Company purchased $45,854,000 of plant and equipment that has an estimated useful life of 15 years. Management believes, at the end of 15 years, this plant and equipment can be sold at a salvage value of $4,585,400 (which is 1/10th of its original cost). Using straight-line depreciation, what would be the ”book value” of this asset at Dec 31st of year two? a. $43,102,760 b. $42,797,067 c. $41,268,600 d. $40,351,520 Depr: (Cost-Salvage)/15yrs = $2,751,240. 2)B.V. (net asset) = Cost–Acc/Depr _____ 7. (NO CREDIT – OPTIONAL) Companies may choose to “fund” (pay for) plant expansion and/or automation with current-period cash from operations, stock issuance (Equity) or debt issuance (Loans/Bonds). Using the accounting equation to confirm, which of these options would increase “Leverage” (Assets/Equity) the most? a. Using current period operating cash flows b. Issuing Stock (Equity) c. Issuing Debt (Loans)