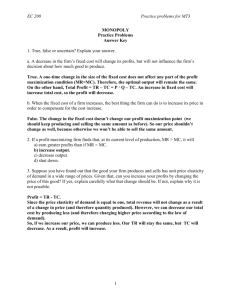

Wiki

advertisement

Production Costs Total Production cost – Includes the true economic costs of production (The sum of explicit and implicit costs). Economic costs of production not only include accounting costs but also the opportunity costs of producing each unit of output. Accounting costs are the explicit costs that appear on the income statement including variable and fixed costs. The opportunity costs consist of any implicit costs. In order to be profitable a business needs to look at all cost measures. Cost-cutting initiatives may end up harming a business’s future profitability if they are not careful. It is a good idea to base initiatives on eliminating waste or unprofitable activities in light of opportunity cost (Koch). Implicit costs – Do not include direct monetary payment, but the opportunity costs of giving up the best alternative. These costs are often times hard to measure, because they do not have a direct dollar value. Managers have to rely on resources to make informed decisions on implicit costs. These resources can include the company’s finance, marketing, or legal departments (Das). Example #1: Suppose you left your job as an accounting clerk at a factory with $40,000 salary in order to start up your own deli sub restaurant (Deli-mart). At the end of the first year, you determine the cost of running Deli-Mart to be $30,000 and revenues to equal $180,000. Your implicit cost of starting up DeliMart equals $40,000. Your implicit cost is $40,000, which is the amount you gave up in order to start up the deli business. Explicit costs – Are the accounting costs directly paid out-of-pocket (monetary) for the purchase of inputs or the hiring of labor needed for production. Explicit costs of production may include the cost of raw materials, equipment, and wages. Example #2: As stated in the previous example, the costs of running Deli-Mart are $30,000. These costs include food supplies and wages. These are the explicit costs of running Deli-Mart, because they are direct payments needed to make the deli’s subs. Long run average costs (LRAC)– In the long run all production costs are variable there are no fixed factors. Fixed factors do not exist, because the long time allows for all input quantities to change (Tucker). Firms can adjust their factors in the long run so that they can produce at a lower average cost. The long run average cost curve is called the planning curve, because of the modifications a firm makes to lower costs in the long run. Short run average costs (SRAC)– In the short run, costs include the sum of fixed and variable costs. Fixed costs are costs that do not vary with output, while variable costs do vary with each unit of output. Variable costs can be changed, while fixed costs are “stuck” with current inputs (Baye). Price SRACS SRACL SRACM LRAC Quantity of Output Figure 1 – Short vs. Long Run Curves Example #3: Suppose each of the SRAC curves in the figure above represents small, medium, and large building choices for Deli-mart. In the long run, you may choose anyone of these buildings for your Deli-mart operation, because this curve represents the lowest cost per unit in which Deli-mart can produce any number of sandwiches after you build any of the three buildings. Since, you are just starting out and do not have any prior deli experience you might choose the smaller building at SRACs for a lower cost per unit. A few years later, you may choose a larger building at SRACL. Average variable cost – Is the total variable cost divided by the quantity of output produced (TVC/Q). In figure 3 below, this average variable cost curve forms a u-shape. At the average variable cost’s minimum, you will see the marginal cost curve intersecting. Where marginal cost is below AVC, AVC is falling. When marginal cost is above AVC, AVC is rising (Arnold). Average total cost equals the sum of the average fixed costs and the average variable costs. In the figure below, you will see that as the average variable costs rise the average total cost gets closer and closer. In the long run AVC and ATC end up merging, because AFC do not exist. Price MC ATC AVC Quantity of Output Figure 2 – Average Variable Cost Example #4: Look at the table below; here you can see Deli-mart’s calculation of average variable cost at the given quantities of output. When producing 200 sandwiches a month Deli-mart’s average cost is $2.20 per sandwich. You will find this by taking the variable cost of $440 and dividing it by the quantity of output of 200. Table 1 Quantity Fixed Cost Variable Cost Total Cost Average Variable Cost 100 $1800 $260 $2060 $2.60 200 $1800 $440 $2240 $2.20 300 $1800 $600 $2400 $2.00 400 $1800 $800 $2600 $2.00 =(FC) =(VC) =(b+2Q) =VC/Q Calculation: =(Q) Marginal cost – Is the cost incurred from the product on of an additional unit of output (incremental cost). Marginal cost can be calculated by the change in cost from the additional unit of output divided by the change in quantity from the additional unit of output (=∆TC /∆Q). Marginal costs are associated with a specific output change (Koch). Initially, marginal cost output falls, levels out at a minimum, and then rises thus forming a j-shape (As shown below in figure 4) (Tucker). In the Science of Success, Charles Koch explains that most decisions should be made off of marginal analysis between costs and benefits. If a business can make decisions on the appropriate margins, it is more likely to eliminate waste. Price MC Quantity of Output Figure 3 – Marginal Cost Example #5: When looking at the table below, you can see Deli-mart’s accounting costs for the first month for the given quantities. In order to find the marginal cost of producing 200 sandwiches for the first month you will need to find the difference between the change in total costs and the additional units of output. In order to come up with a marginal cost of $1.80, you need to find the difference in total cost which equals $2240-$2060= $180. Next, you will divide $180 by the change in quantity, which is 100 sandwiches, and you will get $1.80. Table 2 Quantity Fixed Cost Variable Cost Total Cost Marginal Cost 100 $1800 $260 $2060 $2.60 200 $1800 $440 $2240 $1.80 300 $1800 $600 $2400 $1.60 400 $1800 $800 $2600 $2.00 =(b) =($4Q) =(b+2Q) Calculation: =(Q) =∆TC ∆Q Sunk costs – Are fixed costs, which are lost once they have been paid. There is no way to recover a sunk cost because it is lost forever. Therefore, sunk costs should be irrelevant to decision making once incurred, because there is no way to change the decision. Only variable costs are relevant for making decisions. A manager must make sure to ignore all sunk costs in order to maximize their firm’s profits (Baye). The natural resource industry for instance has high investment costs. These costs are inevitably sunk once paid. Therefore, the threat of new entrants to Koch Industries is low, because of the high cost of investment in machinery and equipment (Koch). Example 6: You decide to lease equipment for your new deli business. You have paid $1,800 a month for the last three months for the right to use this equipment. However, during the third month you had to close shop due to personal travel. In these three months, you incurred $5,400 worth of fixed costs. Even though you made the decision to close down for the third month, you are still required to pay the $1,800 payment for your lease of the equipment. Therefore, the third month’s $1,800 payment is a sunk cost. This cost was paid and was unrecoverable due to the terms of your lease. Example 7: However, what if your friend requested to use some of your equipment for her catering business that third month while you are on vacation. She knows that you are using high-tech equipment and would like to try it out while you are gone to see if she would like to make her own investment. In this case, your best decision would be to sublease your equipment to your friend while you are traveling for $800. Even though as stated above sunk costs are irrelevant to decision making, you will still affect your bottom line profit with your decision. With this example would you rather lose $1,800 due to your personal travel or only $800, because you because you made the optimal decision to sublease your equipment? Most informed managers would choose to sublease their equipment to maximize profits and incur the $1,000 sunk cost. Multiple Choice 1.) Explicit costs may include payments to? a. Employees b. Your supplier c. Your utility company d. All of the above *Answer = D. All are explicit costs, because they are direct monetary payments. 2.) Suppose you bought a two-storey building and decided to live on the top floor, and run Deli-mart on the first floor. If you had otherwise rented on the first floor to someone else, you would have received $20,000 in rental income. However, with the operation of Deli-mart you were able to cover your costs of $30,000 for the year by making a profit of $180,000. From the cost choices below, what do you call the cost of rental income ($20,000)? a. Variable cost b. Marginal cost c. Explicit cost d. Implicit cost *Answer = D. By using the first floor for your own deli business, you are losing the income that you could have received had you rented the first floor to someone else. 3.) Which cost curve does not contain fixed factors of production? a. Total cost curve b. Long-run average cost curve c. Total fixed cost curve d. Short-run average cost curve *Answer = B. Long-run average cost do not contain fixed factors, only variable. 4.) Suppose Deli-mart has a $1,000 fixed production cost for all quantities of output. The variable cost for 110 units of output equal $200. While, 150 sandwiches equal a $320 variable cost. What is the marginal cost of producing the 150th sandwich? a. $3.00 b. $3.20 c. $2.30 d. $3.40 *Answer = A. Calculation: =∆TC = (($1,000+$320)-($1,000+$200)) = (1320-1200) = $3.00 ∆Q (150 sandwiches-110 sandwiches) 40 5.) When making decisions managers should always try to avoid looking at? a. Sunk costs b. Fixed costs c. Variable costs d. Explicit costs *Answer = A. Once a sunk cost is incurred, there is no way to recover the cost. Bibliography Baye, Michael. R. (2009). Managerial Economics and Business Strategy, 6th Edition. St. Louis: McGraw-Hill Irwin. Das, S. P. (2007). Microeconomics for Business. Thousand Oaks: Sage Publications Arnold, R. A. (2008). Economics, 8th Edition. San Marcos: Thompson Learning Inc.. Tucker, I. B. (2008). Survey of Economics. Mason: South-Western CENGAGE Learning. Koch, Charles. G. (2007). The Science of Success. Hoboken: John Wiley & Sons, Inc.