Financial Statement for Fiscal Year ending 2015

advertisement

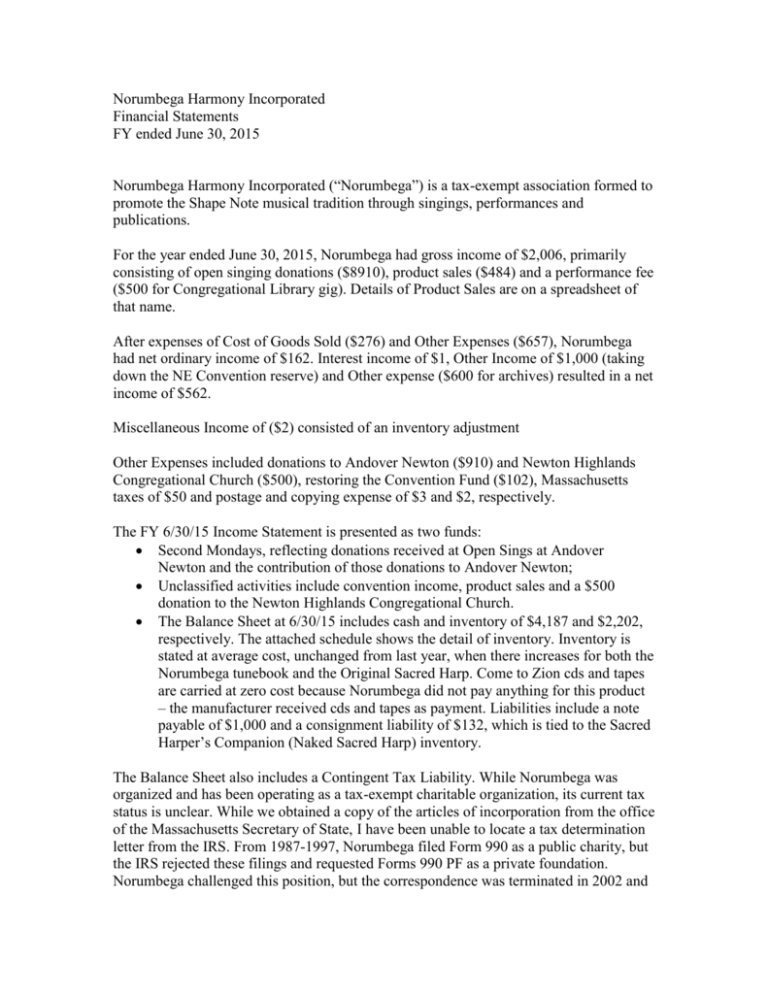

Norumbega Harmony Incorporated Financial Statements FY ended June 30, 2015 Norumbega Harmony Incorporated (“Norumbega”) is a tax-exempt association formed to promote the Shape Note musical tradition through singings, performances and publications. For the year ended June 30, 2015, Norumbega had gross income of $2,006, primarily consisting of open singing donations ($8910), product sales ($484) and a performance fee ($500 for Congregational Library gig). Details of Product Sales are on a spreadsheet of that name. After expenses of Cost of Goods Sold ($276) and Other Expenses ($657), Norumbega had net ordinary income of $162. Interest income of $1, Other Income of $1,000 (taking down the NE Convention reserve) and Other expense ($600 for archives) resulted in a net income of $562. Miscellaneous Income of ($2) consisted of an inventory adjustment Other Expenses included donations to Andover Newton ($910) and Newton Highlands Congregational Church ($500), restoring the Convention Fund ($102), Massachusetts taxes of $50 and postage and copying expense of $3 and $2, respectively. The FY 6/30/15 Income Statement is presented as two funds: Second Mondays, reflecting donations received at Open Sings at Andover Newton and the contribution of those donations to Andover Newton; Unclassified activities include convention income, product sales and a $500 donation to the Newton Highlands Congregational Church. The Balance Sheet at 6/30/15 includes cash and inventory of $4,187 and $2,202, respectively. The attached schedule shows the detail of inventory. Inventory is stated at average cost, unchanged from last year, when there increases for both the Norumbega tunebook and the Original Sacred Harp. Come to Zion cds and tapes are carried at zero cost because Norumbega did not pay anything for this product – the manufacturer received cds and tapes as payment. Liabilities include a note payable of $1,000 and a consignment liability of $132, which is tied to the Sacred Harper’s Companion (Naked Sacred Harp) inventory. The Balance Sheet also includes a Contingent Tax Liability. While Norumbega was organized and has been operating as a tax-exempt charitable organization, its current tax status is unclear. While we obtained a copy of the articles of incorporation from the office of the Massachusetts Secretary of State, I have been unable to locate a tax determination letter from the IRS. From 1987-1997, Norumbega filed Form 990 as a public charity, but the IRS rejected these filings and requested Forms 990 PF as a private foundation. Norumbega challenged this position, but the correspondence was terminated in 2002 and never resolved. My understanding is that Norumbega filed for a tax-exempt status when it was incorporated in 1986, but did not file the returns necessary to establish it as a public charity. Accordingly, its status defaulted to Private Foundation. Form 990-PF has been filed for FY 2008-2014, which should establish that Norumbega should be treated as a public charity. Special Funds include the following: Fire Fund, $170. This amount is carried as an emergency reserve for members. There was no activity during the year. National Convention, $500. The purpose of this reserve is to assist attendance at the Sacred Harp national convention. NE Convention, $0. Last year this fund was at $1,000, an amount carried forward from the last time Norumbega hosted the New England Convention in the October 2005. It was reduced from $2,794 to $1,000 in FY13 and eliminated in FY 15. Retreats, $400. The October 2009 Annual Meeting set this amount at $400, none of which was drawn upon since that time. The last spreadsheets lay out the 6/30/15 inventory and FY 2015 sales by item. James Harper Treasurer September 3, 2015