Attachment 12 c - SRV Part B Answers on performance indicators

advertisement

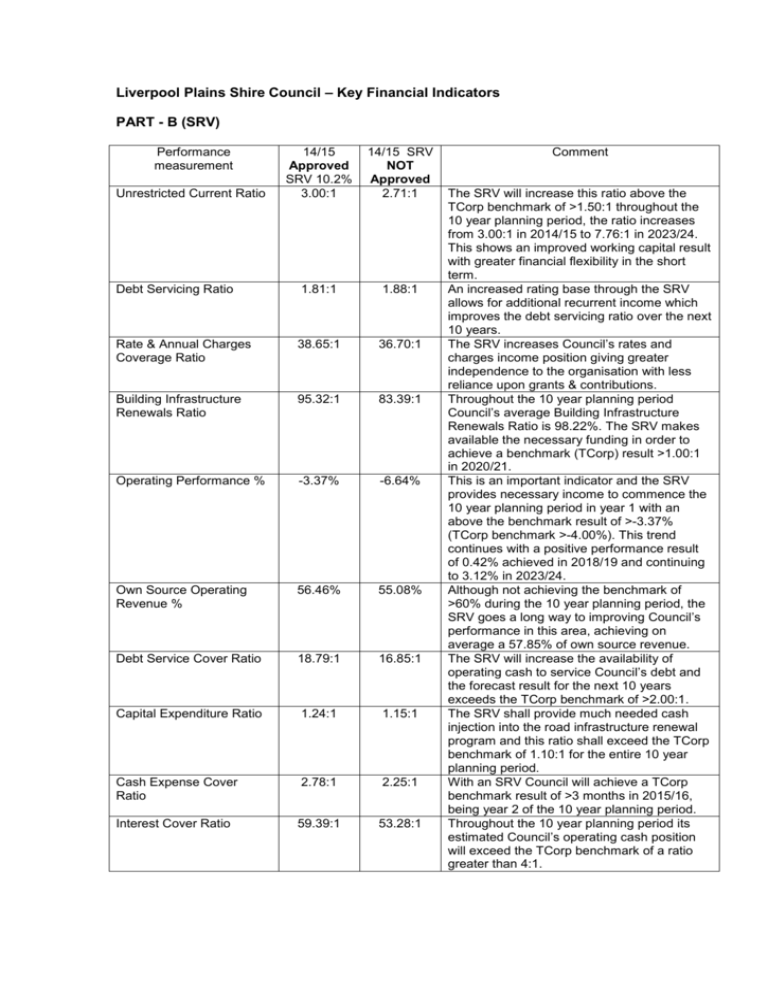

Liverpool Plains Shire Council – Key Financial Indicators PART - B (SRV) Performance measurement 14/15 Approved SRV 10.2% 3.00:1 14/15 SRV NOT Approved 2.71:1 Debt Servicing Ratio 1.81:1 1.88:1 Rate & Annual Charges Coverage Ratio 38.65:1 36.70:1 Building Infrastructure Renewals Ratio 95.32:1 83.39:1 Operating Performance % -3.37% -6.64% Own Source Operating Revenue % 56.46% 55.08% Debt Service Cover Ratio 18.79:1 16.85:1 Capital Expenditure Ratio 1.24:1 1.15:1 Cash Expense Cover Ratio 2.78:1 2.25:1 Interest Cover Ratio 59.39:1 53.28:1 Unrestricted Current Ratio Comment The SRV will increase this ratio above the TCorp benchmark of >1.50:1 throughout the 10 year planning period, the ratio increases from 3.00:1 in 2014/15 to 7.76:1 in 2023/24. This shows an improved working capital result with greater financial flexibility in the short term. An increased rating base through the SRV allows for additional recurrent income which improves the debt servicing ratio over the next 10 years. The SRV increases Council’s rates and charges income position giving greater independence to the organisation with less reliance upon grants & contributions. Throughout the 10 year planning period Council’s average Building Infrastructure Renewals Ratio is 98.22%. The SRV makes available the necessary funding in order to achieve a benchmark (TCorp) result >1.00:1 in 2020/21. This is an important indicator and the SRV provides necessary income to commence the 10 year planning period in year 1 with an above the benchmark result of >-3.37% (TCorp benchmark >-4.00%). This trend continues with a positive performance result of 0.42% achieved in 2018/19 and continuing to 3.12% in 2023/24. Although not achieving the benchmark of >60% during the 10 year planning period, the SRV goes a long way to improving Council’s performance in this area, achieving on average a 57.85% of own source revenue. The SRV will increase the availability of operating cash to service Council’s debt and the forecast result for the next 10 years exceeds the TCorp benchmark of >2.00:1. The SRV shall provide much needed cash injection into the road infrastructure renewal program and this ratio shall exceed the TCorp benchmark of 1.10:1 for the entire 10 year planning period. With an SRV Council will achieve a TCorp benchmark result of >3 months in 2015/16, being year 2 of the 10 year planning period. Throughout the 10 year planning period its estimated Council’s operating cash position will exceed the TCorp benchmark of a ratio greater than 4:1.