2011-36BWG_Modified - National Association of Insurance

advertisement

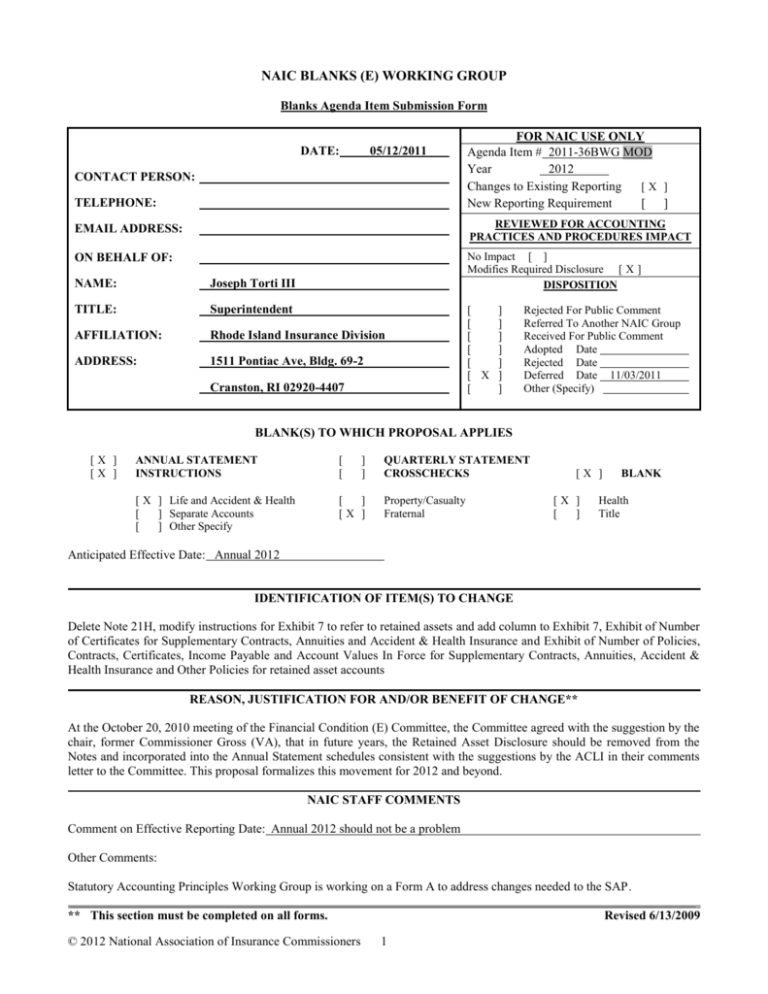

NAIC BLANKS (E) WORKING GROUP Blanks Agenda Item Submission Form DATE: 05/12/2011 CONTACT PERSON: TELEPHONE: FOR NAIC USE ONLY Agenda Item # 2011-36BWG MOD Year 2012 Changes to Existing Reporting [X ] New Reporting Requirement [ ] EMAIL ADDRESS: REVIEWED FOR ACCOUNTING PRACTICES AND PROCEDURES IMPACT ON BEHALF OF: No Impact [ ] Modifies Required Disclosure [ X ] DISPOSITION NAME: Joseph Torti III TITLE: Superintendent AFFILIATION: Rhode Island Insurance Division ADDRESS: 1511 Pontiac Ave, Bldg. 69-2 Cranston, RI 02920-4407 [ ] [ ] [ ] [ ] [ ] [ X ] [ ] Rejected For Public Comment Referred To Another NAIC Group Received For Public Comment Adopted Date Rejected Date Deferred Date 11/03/2011 Other (Specify) BLANK(S) TO WHICH PROPOSAL APPLIES [X ] [X ] ANNUAL STATEMENT INSTRUCTIONS [ [ ] ] [ X ] Life and Accident & Health [ ] Separate Accounts [ ] Other Specify [ ] [X ] QUARTERLY STATEMENT CROSSCHECKS Property/Casualty Fraternal [X ] [X ] [ ] BLANK Health Title Anticipated Effective Date: Annual 2012 IDENTIFICATION OF ITEM(S) TO CHANGE Delete Note 21H, modify instructions for Exhibit 7 to refer to retained assets and add column to Exhibit 7, Exhibit of Number of Certificates for Supplementary Contracts, Annuities and Accident & Health Insurance and Exhibit of Number of Policies, Contracts, Certificates, Income Payable and Account Values In Force for Supplementary Contracts, Annuities, Accident & Health Insurance and Other Policies for retained asset accounts REASON, JUSTIFICATION FOR AND/OR BENEFIT OF CHANGE** At the October 20, 2010 meeting of the Financial Condition (E) Committee, the Committee agreed with the suggestion by the chair, former Commissioner Gross (VA), that in future years, the Retained Asset Disclosure should be removed from the Notes and incorporated into the Annual Statement schedules consistent with the suggestions by the ACLI in their comments letter to the Committee. This proposal formalizes this movement for 2012 and beyond. NAIC STAFF COMMENTS Comment on Effective Reporting Date: Annual 2012 should not be a problem Other Comments: Statutory Accounting Principles Working Group is working on a Form A to address changes needed to the SAP. ___________________________________________________________________________________________________ ** This section must be completed on all forms. Revised 6/13/2009 © 2012 National Association of Insurance Commissioners 1 ANNUAL STATEMENT INSTRUCTIONS – LIFE, FRATERNAL AND HEALTH NOTES TO FINANCIAL STATEMENTS Detail Eliminated To Conserve Space 21. Other Items Instruction: Detail Eliminated To Conserve Space Illustration: Detail Eliminated To Conserve Space Detail Eliminated To Conserve Space © 2012 National Association of Insurance Commissioners 2 ANNUAL STATEMENT INSTRUCTIONS – LIFE AND FRATERNAL EXHIBIT 7 – DEPOSIT-TYPE CONTRACTS This exhibit is intended to capture information about the activity, before and after any reinsurance, for deposit-type contracts. Include supplementary contracts without life contingencies, annuities certain, retained assets, income settlement options, premium and deposit funds, and other contracts as defined in SSAP No. 52, Deposit-Type Contracts. Detail Eliminated To Conserve Space Line 7 – Net Surrender or Withdrawal Payments Include: The net proceeds paid or payable (after deduction for surrender charges) to the contract holder. Amount of retained asset accounts transferred to state unclaimed property funds during the year. Detail Eliminated To Conserve Space ANNUAL STATEMENT INSTRUCTIONS –HEALTH (LIFE SUPPLEMENT) EXHIBIT 7 – DEPOSIT-TYPE CONTRACTS To be filed on or before March 1. This exhibit is intended to capture information about the activity, before and after any reinsurance, for deposit-type contracts. Include supplementary contracts without life contingencies, annuities certain, retained assets, income settlement options, premium and deposit funds, and other contracts as defined in SSAP No. 52, Deposit-Type Contracts. Detail Eliminated To Conserve Space Line 7 – Net Surrender or Withdrawal Payments Include: The net proceeds paid or payable (after deduction for surrender charges) to the contract holder. Amount of retained asset accounts transferred to state unclaimed property funds during the year. Detail Eliminated To Conserve Space © 2012 National Association of Insurance Commissioners 3 ANNUAL STATEMENT INSTRUCTIONS – LIFE EXHIBIT OF NUMBER OF POLICIES, CONTRACTS, CERTIFICATES, INCOME PAYABLE AND ACCOUNT VALUES IN FORCE FOR SUPPLEMENTARY CONTRACTS, ANNUITIES, ACCIDENT AND HEALTH AND OTHER POLICIES Detail Eliminated To Conserve Space Supplementary Contracts Line 2 – Issued During Year Include: Line 3 – number of retained asset accounts issued/added during the year. Reinsurance Assumed Provide number of all cases involved whether reinsured on a case-by-case basis, assumption reinsurance assumed (100%) or a percent of a block is assumed. Detail Eliminated To Conserve Space © 2012 National Association of Insurance Commissioners 4 ANNUAL STATEMENT BLANK – LIFE EXHIBIT OF NUMBER OF POLICIES, CONTRACTS, CERTIFICATES, INCOME PAYABLE AND ACCOUNT VALUES IN FORCE FOR SUPPLEMENTARY CONTRACTS, ANNUITIES, ACCIDENT & HEALTH AND OTHER POLICIES SUPPLEMENTARY CONTRACTS 1. In force end of prior year ............ 2. Issued during year....................... 3. Reinsurance assumed .................. 4. Increased during year (net) ......... 5. Total (Lines 1 to 4) ..................... Deductions during year: 6. Decreased (net) ........................... 7. Reinsurance ceded ...................... 8. Totals (Lines 6 and 7) ................. 9. In force end of year ..................... 10. Amount on deposit ..................... 11. Income now payable ................... 12. Amount of income payable Ordinary Group 1 2 3 4 5 6 Involving Life Not Involving Life Retained Asset Involving Life Not Involving Life Retained Asset Contingencies Contingencies Accounts Contingencies Contingencies Accounts ............................................................... ............................................................... ............................................................... .............................................................. ............................................................... ............................................................... ............................................................... ............................................................... ............................................................... .............................................................. ............................................................... ............................................................... ............................................................... ............................................................... ............................................................... .............................................................. ............................................................... ............................................................... ............................................................... ............................................................... ............................................................... .............................................................. ............................................................... ............................................................... ............................................................... ............................................................... ............................................................... .............................................................. ............................................................... ............................................................... ............................................................... (a)........................................................... (a) ........................................................... .............................................................. (a)........................................................... (a) ........................................................... ............................................................... ............................................................... ............................................................... .............................................................. ............................................................... ............................................................... (a) (a) (a) (a) (a) (a) ANNUITIES Ordinary Group 1 2 3 4 Immediate Deferred Contracts Certificates 1. In force end of prior year ............ ............................................................... ............................................................... ............................................................... ............................................................... 2. Issued during year....................... ............................................................... ............................................................... ............................................................... ............................................................... 3. Reinsurance assumed .................. ............................................................... ............................................................... ............................................................... ............................................................... 4. Increased during year (net) ......... 5. Totals (Lines 1 to 4).................... Deductions during year: 6. Decreased (net) ........................... ............................................................... ............................................................... ............................................................... ............................................................... 7. Reinsurance ceded ...................... 8. Totals (Lines 6 and 7) ................. 9. In force end of year ..................... ............................................................... ............................................................... ............................................................... ............................................................... Income now payable: 10. Amount of income payable ......... (a) XXX XXX (a) Deferred fully paid: 11. Account balance ......................... XXX (a) XXX (a) Deferred not fully paid: 12. Account balance XXX (a) XXX (a) ACCIDENT AND HEALTH INSURANCE Group 1 2 Certificates Premiums in Force 1. In force end of prior year ................................................................................. .................................. 2. Issued during year............................................................................................ .................................. 3. Reinsurance assumed ....................................................................................... .................................. 4. Increased during year (net) ............................................ XXX 5. Totals (Lines 1 to 4)....................................................... XXX Deductions during year: 6. Conversions ..................................................................................................... XXX 7. Decreased (net) ................................................................................................ XXX 8. Reinsurance ceded ......................................................... XXX 9. Totals (Lines 6 to 8)....................................................... XXX 10. In force end of year (a) Credit 3 4 Policies Premiums in Force ................................. .................................. ................................. .................................. ................................. .................................. XXX XXX Other 5 6 Policies Premiums in Force .................................. .................................. .................................. .................................. .................................. .................................. XXX XXX XXX ................................. XXX .................................. XXX XXX XXX XXX (a) XXX XXX XXX XXX (a) DEPOSIT FUNDS AND DIVIDEND ACCUMULATIONS 1 2 Deposit Funds Dividend Accumulations Contracts Contracts 1. In force end of prior year .................................................................................................................................................................................................................................................................................... 2. Issued during year............................................................................................................................................................................................................................................................................................... 3. Reinsurance assumed .......................................................................................................................................................................................................................................................................................... 4. Increased during year (net) ....................................................... 5. Totals (Lines 1 to 4).................................................................. Deductions during year: 6. Decreased (net) ................................................................................................................................................................................................................................................................................................... 7. Reinsurance ceded .................................................................... 8. Totals (Lines 6 and 7) ............................................................... 9. In force end of year ................................................................... 10. Amount of account balance (a) (a) (a) See Paragraph 9 of the Annual Audited Financial Reports in the General section of the annual statement instructions. © 2012 National Association of Insurance Commissioners 5 ANNUAL STATEMENT BLANK – FRATERNAL EXHIBIT OF NUMBER OF CERTIFICATES FOR SUPPLEMENTARY CONTRACTS, ANNUITIES AND ACCIDENT & HEALTH INSURANCE 1 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. In force end of prior year .................................. Issued during year ............................................ Reinsurance assumed ....................................... Increased during year (net) ............................... Totals (Lines 1 to 4) ......................................... Deductions during year: Decreased during year (net) .............................. Reinsurance ceded ............................................ Totals (Lines 6 and 7) ....................................... In force end of year (Line 5 minus Line 8) ....... Amount on deposit ........................................... Income now payable: Amount of income payable............................... Deferred: fully paid: Deferred: fully paid - account balance .............. Deferred: not fully paid: Deferred: not fully paid - account balance 2 3 4 5 Supplementary Supplementary Contracts Accident Contracts (Not Involving Retained and (Involving Life Life Asset Individual Health Contingencies) Contingencies) Accounts Annuities Insurance .................................................................. .................................. .................................. .................................. .................................................................. .................................. .................................. .................................. .................................................................. .................................. .................................. .................................. .................................................................. .................................. .................................. .................................. .................................................................. .................................. .................................. .................................. .................................................................. .................................. .................................. .................................. .................................................................. .................................. .................................. .................................. .................................................................. .................................. .................................. .................................. .................................................................. .................................. .................................. .................................. .................................................................. .................................. .................................. XXX .................................................................. .................................. .................................. XXX XXX XXX XXX XXX XXX © 2012 National Association of Insurance Commissioners 6 .................................. XXX XXX XXX ANNUAL STATEMENT BLANK – LIFE, FRATERNAL AND HEALTH (LIFE SUPPLEMENT) EXHIBIT 7 – DEPOSIT-TYPE CONTRACTS 1 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. Balance at the beginning of the year before reinsurance ............................................ Deposits received during the year ............................................................................. Investment earnings credited to the account .............................................................. Other net change in reserves ..................................................................................... Fees and other charges assessed ................................................................................ Surrender charges ..................................................................................................... Net surrender or withdrawal payments ...................................................................... Other net transfers to or (from) Separate Accounts ................................................... Balance at the end of current year before reinsurance (Lines 1+2+3+4-5-6-7-8) ....... Reinsurance balance at the beginning of the year ...................................................... Net change in reinsurance assumed ........................................................................... Net change in reinsurance ceded ............................................................................... Reinsurance balance at the end of the year (Lines 10+11-12) ................................... Net balance at the end of current year after reinsurance (Lines 9+13) 2 3 4 5 6 7 Guaranteed Retained Dividend Premium and Interest Annuities Supplemental Asset Accumulations Other Total Contracts Certain Contracts Accounts or Refunds Deposit Funds ................................................................................................................................................................................ ......................................... ............................... ................................................................................................................................................................................ ......................................... ............................... ................................................................................................................................................................................ ......................................... ............................... ................................................................................................................................................................................ ......................................... ............................... ................................................................................................................................................................................ ......................................... ............................... ................................................................................................................................................................................ ......................................... ............................... ................................................................................................................................................................................ ......................................... ............................... ................................................................................................................................................................................ ......................................... ............................... ................................................................................................................................................................................ ......................................... ............................... ................................................................................................................................................................................ ......................................... ............................... ................................................................................................................................................................................ ......................................... ............................... ................................................................................................................................................................................ ......................................... ............................... ................................................................................................................................................................................ ......................................... ............................... W:\QA\BlanksProposals\2011-36BWG_Modified.doc © 2012 National Association of Insurance Commissioners 7