Дайджест

advertisement

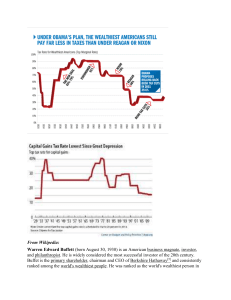

Warren Buffett - about world financial crisis 20072008 Дайджест статей 7 марта 2016 г. Дайджест статей 2 СОДЕРЖАНИЕ WARREN BUFFETT: ON THE CREDIT CRISIS, HIS BUSINESS HEROES AND MARRIAGE ....................................................................................................................... 3 BERKSHIRE VICE CHAIRMAN: 'STUPID THINGS' LED TO FINANCIAL CRISIS 3 BUFFETT: FALLOUT FROM CREDIT CRISIS NOT OVER YET ............................... 4 WARREN BUFFETT – WHAT THE TIDE REVEALED ............................................... 4 BUFFETT: BANKS ARE TO BLAME FOR SUBPRIME DEBT CRISIS ...................... 5 HOW THE CRUNCH IS PLAYING OUT ........................................................................ 6 MORTGAGE CRISIS PERPLEXES EVEN SHREWD INVESTOR WARREN BUFFETT ........................................................................................................................... 8 BUFFETT SAYS CREDIT CRUNCH CREATES BUY OPPORTUNITIES .................. 9 WHAT WARREN THINKS... ........................................................................................... 9 BUFFETT VS. BERNANKE: THE INFLATION SHOWDOWN ................................. 13 BUFFETT SEES CREDIT CRISIS EASING .................................................................. 13 SUBPRIME CRISIS NOT BIG THREAT ....................................................................... 14 MARKING TO MYTH .................................................................................................... 15 Дайджест статей Дайджест статей 3 ТЕКСТЫ СТАТЕЙ WARREN BUFFETT: ON THE CREDIT CRISIS, HIS BUSINESS HEROES AND MARRIAGE www.telegraph.co.uk 20.05.2008 Warren Buffett, one of the world's richest men, has kickstarted a European tour by addressing the international media in Frankfurt. Before his hunt for potential acquisitions begins, the 77 year-old billionaire investor gave his view on the credit crisis, spoke about life at his company, Berkshire Hathaway, and revealed what has made him the man he is today. "It's a deferred shopping trip, to make sure Berkshire Hathaway is understood by people who might look to do something in the future." "I think most of the effects in terms of the Wall Street crisis are probably over. The Fed's actions and Bear Stearns largely saw to that. But I don't think we're halfway through or even a quarter way through in terms of the effects on the economy. The initial effects are felt by people who did the silliest things, but the ripple effect is felt by people who might have done quite sound things." BERKSHIRE VICE CHAIRMAN: 'STUPID THINGS' LED TO FINANCIAL CRISIS ABB.com (www.abb.com) 05.05.2008 A record 31,000 trekked to Omaha over the weekend to attend Berkshire Hathaway Inc.'s annual meeting and hear Warren Buffett's take on the financial crisis. "The idea of financial panic -- that has been pretty much taken care of," Buffett said, crediting the Federal Reserve's move to bail out Bear Stearns (NYSE: BSC) by orchestrating its sale to J.P. Morgan Chase (NYSE: JPM) as stemming a run on other investment banks. During more than five hours of questions from shareholders, Berkshire Vice Chairman Charles Munger criticized some of the financial "innovation" that led to today's financial crisis. "Some stupid things were done," Munger said "Alan Greenspan overdosed a little on Ayn Rand" in his enthusiasm to trust the marketplace. "Even if it was an ax murderer, it was a positive development," Munger said. The engineers of recent financial innovation, he said, make the Internet moguls of the dot-com bubble years look smart. "I wish we had those brilliant people back that gave us Webvan," Munger said. The annual meeting May 3 drew a crowd shortly after sunrise to see performance artist Michael Israel paint a portrait of Warren Buffett, with the company's Benjamin Moore paints, of course. The main event started at 8:30 with a one-hour movie in which Munger quickly rejected Buffett's idea to invest in Internet stocks. Дайджест статей Дайджест статей 4 An interesting premise, given that Microsoft Chairman Bill Gates and Yahoo President Susan Decker spent the day together in the seating area for Berkshire directors. (Later that day, Microsoft (NASDAQ: MSFT) dropped its pursuit of Yahoo (NASDAQ: YHOO) when the two companies could not agree on price.) The company's annual meeting included an exhibit area for many of Berkshire's corporate interests. Mars and Wrigley (NYSE: WWY) held a prominent location, offering free gum, candy bars and M&M's featuring a likeness of Buffett. Berkshire is helping to finance Mars' $23 billion purchase of the Chicago gum maker. The exhibition underscored Berkshire Hathaway's (NYSE: BRK.A) (NYSE: BRK.B) diverse corporate interests. Dairy Queen was hawking Dilly Bars for a buck for charity, while other exhibitors pitched World Book encyclopedias, Shaw carpeting and NetJets' private planes. Asked to expand on his outlook for the stock market, Buffett replied, "I'd like to expand but I couldn't answer. It's just not our game." BUFFETT: FALLOUT FROM CREDIT CRISIS NOT OVER YET Reuters 05.05.2008 The fallout from the global credit crisis is not over yet, billionaire investor Warren Buffett said Monday. "I'll talk about the United States. I don't think the effects of the credit crunch are far from over at all," he told a news conference in response to a question. "I think there will be rippling secondary, tertiary effects ... It is really more an effect of the residential real estate bubble which led to the credit crunch in some degree," he said. WARREN BUFFETT – WHAT THE TIDE REVEALED CNBC 14.04.2008 Day 4 of the Warren Buffett European offensive, and expectations of an imminent bid have been managed down. Mr Buffett says he is not stalking targets, he wants companies that meet his criteria to call him. He even gave out his phone number on a number of occasions during the Lausanne press conference. He's a man who knows how to charm a room and the European press seem to have overlooked a lack of detail and fallen for him. Such was the frenzy of the press pack waiting to welcome him in Madrid that a drinks waiter who brought his customary coca-cola into the briefing room minutes before the man himself arrived, was set upon by photographers. They soon realized the startled waiter was not Mr Buffett and he was free to pass. The Spanish press welcomed him with a list of companies that they thought he should take a look at. (B Buffett seemed more excited about his meeting with the Spanish King!), whilst the Italians focused on his view of the currency markets. He's no dollar bull, that's for sure. Дайджест статей Дайджест статей 5 And that seems to be part of the reason that he is here. He admits that he should have been shopping in Europe earlier, but not just because currencies have moved against him in recent years. He says he likes to look through cycles and won't be drawn on the state of the European economy right now. On the US he is on safer ground and says the worst of the credit crisis might be over but now we need to focus on the secondary effects on the broader economy. Oil has been in focus this week with new record prices on NYMEX seemingly every day. Mr Buffett plays down the idea that it is speculators who are sending prices higher; it's about supply and demand for the 'sage of Omaha'. But would he invest in banks? He says banking CEOs need to be Chief Risk Officers and he laments the way that many banks got caught up in products they didn't understand. "You don't know who has been swimming naked until the tide goes out" he has said previously about the sector. "Well the tide's gone out and it's revealed some pretty ugly bodies!" was this week's clarification. Now there's an image! Posted By:Anna Martin BUFFETT: BANKS ARE TO BLAME FOR SUBPRIME DEBT CRISIS Reuters 25.05.2008 Blame for the sub-prime crisis lies at the feet of banks who took too many risks in mortgage lending, U.S. billionaire investor Warren Buffett told newspaper El Pais in an interview published on Sunday. "The banks exposed themselves too much, they took on too much risk .... It's their fault. There's no need to blame anyone else," he said. Buffett, dubbed the world's richest person by Forbes magazine, said he believed the situation in financial markets would not deteriorate further. "I don't think the situation will get worse in financial markets. General conditions in the business world will get worse, but it will only last a while," he said, adding he had no idea when an upturn would come. Buffett gave the interview on a recent visit to Madrid, as part of a European tour including Switzerland, Germany, Italy and Spain on the look out for new investments. He said the idea of the trip was to increase awareness amongst European businesses of his holding company Berkshire Hathaway He said he wanted business owners to think of him when they were looking to sell. "We want to buy big companies that earn at least 50 million euros ($78.6 million) before taxes, and there's more of those in Europe than in other parts of the world," he said. He would not be drawn on what companies in particular he was looking at, other than saying he was not interested in distressed businesses. Дайджест статей Дайджест статей 6 The day before, Buffett was quoted in the German magazine Der Spiegel as saying the US is already in a recession and that it will be longer as well as deeper than many people expect. He said the United States was "already in recession" and added: "Perhaps not in the sense that economists would define it" with two consecutive quarters of negative growth. "But the people are already feeling the effects," said Buffett, the world's richest man. "It will be deeper and last longer than many think." But he said that won't stop him from investing in selected companies and said he remained interested in well-managed German family-owned companies. "If the world were falling apart I'd still invest in companies," he said. Buffett also renewed his criticism of derivatives trading. "It's not right that hundreds of thousands of jobs are being eliminated, that entire industrial sectors in the real economy are being wiped out by financial bets even though the sectors are actually in good health." Buffett complained about the lack of effective controls. "That's the problem," he said. "You can't steer it, you can't regulate it anymore. You can't get the genie back in the bottle." HOW THE CRUNCH IS PLAYING OUT Reuters 11.12.2007 Predictions of the demise of bond insurers could be premature, particularly if they succeed in securing lifelines from a deep-pocketed insurance salesman in Omaha, Neb. Warren Buffett, chairman of Berkshire Hathaway Inc., stands to cash in from the turmoil sweeping the credit markets and the worries surrounding the financial strength of bond insurers, including Ambac Financial Group Inc. and MBIA Inc. Flush with more than $45 billion in cash on its books, a triple-A credit rating and decades of experience insuring other insurers against catastrophic losses, Berkshire Hathaway is in a strong position to help provide relief to some of these companies and could get into the bondinsurance business itself, people familiar with the matter said. [W Warren Buffett] In recent weeks, every major bond insurer has reached out to Berkshire -- owner of a range of companies including reinsurer General Re Corp. and auto insurer Geico -- as a source of capital relief while their financial strength comes under scrutiny by ratings firms and investors, according to these people. In the process of pleading their cases with Berkshire, these companies provide Mr. Buffett with opportunities to size up their businesses. Дайджест статей Дайджест статей 7 "F Fear has moved away from hurricanes and is now moving into the financial markets," said Glenn Tongue, a partner at T2 Partners LLC, a New York hedge fund that owns Berkshire Hathaway shares. "W Warren Buffett can make a lot of money from fear," he said. Bond insurers, which guarantee the interest and principal payments on bonds in the event of default, are the latest casualty of the subprime-credit crisis. Shares of Ambac have fallen 58% since the end of September, and MBIA's are down 42%, indicating investors are questioning whether Ambac and MBIA deserve their triple-A credit ratings. While the bulk of the financial guarantors' business is insuring securities such as municipal bonds, they have also insured some $100 billion of riskier collateralized debt obligations, or CDOs, most of which are pools of mortgage loans to borrowers with spotty credit histories. Only about 5% of the risky policies on that debt have been ceded to reinsurers. Increases in the underlying loans' delinquency and default rates have prompted credit-ratings firms to downgrade more of these CDOs, causing the value of policies underwritten by the bond insurers, in the form of credit-default swaps, to fall in value on their balance sheets. While the insurers emphasize that downgraded CDOs don't necessarily translate into losses, Fimalac SA's Fitch Ratings and Moody's Corp.'s Moody's Investors Service last week announced that they are re-evaluating whether the bond insurers have sufficient capital to support them in the event of worse-than-expected losses. This is a bad time to raise capital through the stock or debt markets, where most investors are trying to steer clear of any exposure to subprime risk. This is where Mr. Buffett comes in. Berkshire, as the only triple-A-rated reinsurer in the world, has long been willing to write insurance policies on risks that nobody else will touch. "Using reinsurance is clearly a way the industry can help improve their capital positions," Thomas Abruzzo, managing director at Fitch, said about bond insurers. He said buying reinsurance could be enough to save the ratings of bond insurers that have only minimal shortfalls in capital. Berkshire isn't the only option available. The insurers also can seek commitments of capital, for a fee, from cash-flush sources such as private-equity or hedge funds. These days, however, few funds have much appetite to provide this "contingent capital," analysts said. It isn't likely the bond insurers would seek coverage from Berkshire or other reinsurers on CDOs backed by risky mortgage debt. However, they could reinsure other structured credits, such as those backed by auto-financing or commercial assets. "You don't necessarily need to reinsure the business that is less attractive from the risk perspective," said Sean Leonard, chief financial officer of Ambac. He said 85% of its $556 billion portfolio isn't mortgage related and Ambac would seek to reinsure some of that if it was necessary and inexpensive enough. He declined to comment about whether Ambac had approached Berkshire. Mr. Buffett wouldn't shy away from picking through some of the bond insurers' riskier mortgage-related CDO portfolios, including the subprime-backed "mezzanine CDOs," to find loans that have been "mispriced" due to the market panic. Berkshire likely would charge bond insurers hefty premiums to reinsure such risks. Mezzanine CDOs are securities backed by belowinvestment-grade structured loans, most of which are subprime mortgages. Дайджест статей Дайджест статей 8 As Mr. Buffett has done in the past, he has been betting that investors are overestimating the risks in certain credit assets. Berkshire recently disclosed that it collected premiums of $2.5 billion this year from the sale of derivative contracts. While it is unclear whether some of those contracts were for CDOs, it signals that Mr. Buffett is starting to sniff out opportunities in the credit markets. Another way Berkshire could help bond insurers is to provide "cut-through" policies to their customers. In the event of a default, owners of bonds insured by the guarantors could "cut through," or go directly to, Berkshire to collect payments. In exchange, Berkshire could receive fees from the bond insurers or the premiums directly. Finally, Berkshire could enter the bond-insurance business, said people familiar with the matter. While it is unlikely Berkshire would acquire a bond insurer outright, it is possible Mr. Buffett could set up a financial guarantor that, like its reinsurance business, takes advantage of high prices and pulls back when prices become unfavorable. By KAREN RICHARDSON MORTGAGE CRISIS PERPLEXES EVEN SHREWD INVESTOR WARREN BUFFETT ABC News (abcnews.go.com) 12.12.2007 Even the great Warren Buffett scratches his head over the complex financial instruments that underlie the nation's foreclosure crisis. "You can't turn a financial toad into a prince by securitizing it," he said to Hillary Rodham Clinton at a fundraising lunch in San Francisco on Tuesday. The 77-year-old billionaire admitted that even after scrutinizing funds that package up mortgages, he found them confusing. Buffett and Clinton took the stage at the Hilton San Francisco in front of 1,500 people who had paid from $100 to $2,300 each to hear the Democratic presidential candidate ask questions of the legendary investor - and put in a few pitches for her own ideas. The event was expected to raise $1 million. On the issue of the securitized mortgages, Buffett said one can make more money "selling toxic waste to customers," but that doesn't mean it's a good idea. "Wall Street started believing its own PR on this - they started holding this stuff themselves, maybe because they couldn't sell it. It worked wonderfully until it didn't work at all." Now, "Wall Street is reaping what they've sown," Buffett said. "It will sort itself out over time with a fair amount of pain. We have an economy that can take it." Spinning his trademark folksy analogies, Buffett addressed a range of topics brought up by Clinton and audience members who submitted questions in advance. Дайджест статей Дайджест статей 9 BUFFETT SAYS CREDIT CRUNCH CREATES BUY OPPORTUNITIES Reuters 31.12.2007 NEW YORK (Reuters) - Billionaire investor Warren Buffett said on Friday the global credit crunch has created some acquisition opportunities for his Berkshire Hathaway insurance and investment company. Speaking on Fox Business Network, Buffett also said he had gotten "feelers" about investing in the struggling financial services industry, and would have considered them had the terms been different. "Obviously the credit crunch has created some opportunities that wouldn't have been there seven or eight months ago," Buffett said. "But there's nothing planned about our actions." In the last two months, such companies as Citigroup Inc (C.N: Quote, Profile, Research, Stock Buzz), Merrill Lynch & Co (MER.N: Quote, Profile, Research, Stock Buzz) and Morgan Stanley (MS.N: Quote, Profile, Research, Stock Buzz) have received multibillion dollar investments from funds affiliated with sovereign investors. Omaha, Nebraska-based Berkshire said it ended September with $47.08 billion (23.59 billion pounds) of cash, and until this week had had a quiet year for acquisitions. But on Tuesday, it agreed to pay Chicago's Pritzker family $4.5 billion for 60 percent of Marmon Holdings Inc, which makes such things as railroad tank cars, pipes, wiring and water treatment products. Then on Friday, Dutch financial services company ING Groep NV (ING.AS: Quote, Profile, Research, Stock Buzz) (ING.N: Quote, Profile, Research, Stock Buzz) said it would sell Berkshire its NRG NV reinsurance unit for about 300 million euros (221 million pounds). Also Friday, Berkshire said it would start a municipal bond insurance unit. "I just sit around here hoping the phone will ring, and that there will be a good idea at the other end," Buffett said in the Fox interview. "We're ready to move anytime, and then it just has to be the right thing." WHAT WARREN THINKS... Reuters 14.04.2008 With Wall Street in chaos, Fortune naturally went to Omaha looking for wisdom. Warren Buffett talks about the economy, the credit crisis, Bear Buffett says he 'got a call' about Bear Stearns, but bailing out the investment bank with only two days for due diligence, he says, 'took some guts that I didn't want to match.' If Berkshire Hathaway's annual meeting, scheduled for May 3 this year, is known as the Woodstock of Capitalism, then perhaps this is the equivalent of Bob Dylan playing a private show in his own house: Some 15 times a year Berkshire CEO Warren Buffett invites a group Дайджест статей Дайджест статей 10 of business students for an intensive day of learning. The students tour one or two of the company's businesses and then proceed to Berkshire (BRKA, Fortune 500) headquarters in downtown Omaha, where Buffett opens the floor to two hours of questions and answers. Later everyone repairs to one of his favorite restaurants, where he treats them to lunch and root beer floats. Finally, each student gets the chance to pose for a photo with Buffett. In early April the megabillionaire hosted 150 students from the University of Pennsylvania's Wharton School (which Buffett attended) and offered Fortune the rare opportunity to sit in as he expounded on everything from the Bear Stearns (BSC, Fortune 500) bailout to the prognosis for the economy to whether he'd rather be CEO of GE (GE, Fortune 500) - or a paperboy. What follows are edited excerpts from his question-and-answer session with the students, his lunchtime chat with the Whartonites over chicken parmigiana at Piccolo Pete's, and an interview with Fortune in his office. Buffett began by welcoming the students with an array of Coca-Cola products. ("B Berkshire owns a little over 8% of Coke, so we get the profit on one out of 12 cans. I don't care whether you drink it, but just open the cans, if you will.") He then plunged into weightier matters: Before we start in on questions, I would like to tell you about one thing going on recently. It may have some meaning to you if you're still being taught efficient-market theory, which was standard procedure 25 years ago. But we've had a recent illustration of why the theory is misguided. In the past seven or eight or nine weeks, Berkshire has built up a position in auctionrate securities [bonds whose interest rates are periodically reset at auction; for more, see box on page 74] of about $4 billion. And what we have seen there is really quite phenomenal. Every day we get bid lists. The fascinating thing is that on these bid lists, frequently the same credit will appear more than once. Here's one from yesterday. We bid on this particular issue - this happens to be Citizens Insurance, which is a creature of the state of Florida. It was set up to take care of hurricane insurance, and it's backed by premium taxes, and if they have a big hurricane and the fund becomes inadequate, they raise the premium taxes. There's nothing wrong with the credit. So we bid on three different Citizens securities that day. We got one bid at an 11.33% interest rate. One that we didn't buy went for 9.87%, and one went for 6.0%. It's the same bond, the same time, the same dealer. And a big issue. This is not some little anomaly, as they like to say in academic circles every time they find something that disagrees with their theory. So wild things happen in the markets. And the markets have not gotten more rational over the years. They've become more followed. But when people panic, when fear takes over, or when greed takes over, people react just as irrationally as they have in the past. Do you think the U.S. financial markets are losing their competitive edge? And what's the right balance between confidence-inspiring standards and ... ... between regulation and the Wild West? Well, I don't think we're losing our edge. I mean, there are costs to Sarbanes-Oxley, some of which are wasted. But they're not huge relative to the $20 trillion in total market value. I think we've got fabulous capital markets in this country, and they get screwed up often enough to make them even more fabulous. I mean, you don't want a capital market that functions perfectly if you're in my business. People continue to do foolish things no matter what the regulation is, and they always will. There are significant limits to what regulation can accomplish. As a dramatic illustration, take two of the biggest accounting disasters in the past ten years: Freddie Mac and Fannie Mae. We're talking billions and billions of dollars of misstatements at both places. Дайджест статей Дайджест статей 11 Now, these are two incredibly important institutions. I mean, they accounted for over 40% of the mortgage flow a few years back. Right now I think they're up to 70%. They're quasigovernmental in nature. So the government set up an organization called OFHEO. I'm not sure what all the letters stand for. [Note to Warren: They stand for Office of Federal Housing Enterprise Oversight.] But if you go to OFHEO's website, you'll find that its purpose was to just watch over these two companies. OFHEO had 200 employees. Their job was simply to look at two companies and say, "Are these guys behaving like they're supposed to?" And of course what happened were two of the greatest accounting misstatements in history while these 200 people had their jobs. It's incredible. I mean, two for two! It's very, very, very hard to regulate people. If I were appointed a new regulator - if you gave me 100 of the smartest people you can imagine to work for me, and every day I got the positions from the biggest institutions, all their derivative positions, all their stock positions and currency positions, I wouldn't be able to tell you how they were doing. It's very, very hard to regulate when you get into very complex instruments where you've got hundreds of counterparties. The counterparty behavior and risk was a big part of why the Treasury and the Fed felt that they had to move in over a weekend at Bear Stearns. And I think they were right to do it, incidentally. Nobody knew what would be unleashed when you had thousands of counterparties with, I read someplace, contracts with a $14 trillion notional value. Those people would have tried to unwind all those contracts if there had been a bankruptcy. What that would have done to the markets, what that would have done to other counterparties in turn - it gets very, very complicated. So regulating is an important part of the system. The efficacy of it is really tough. At Piccolo Pete's, where he has dined with everyone from Microsoft's Bill Gates to the New York Yankees' Alex Rodriguez, Buffett sat at a table with 12 Whartonites and bantered over many topics. How does the current turmoil stack up against past crises? Well, that's hard to say. Every one has so many variables in it. But there's no question that this time there's extreme leveraging and in some cases the extreme prices of residential housing or buyouts. You've got $20 trillion of residential real estate and you've got $11 trillion of mortgages, and a lot of that does not have a problem, but a lot of it does. In 2006 you had $330 billion of cash taken out in mortgage refinancings in the United States. That's a hell of a lot - I mean, we talk about having $150 billion of stimulus now, but that was $330 billion of stimulus. And that's just from prime mortgages. That's not from subprime mortgages. So leveraging up was one hell of a stimulus for the economy. If that was one hell of a stimulus, do you think the $150 billion government stimulus plan will make an impact? Well, it's $150 billion more than we'd have otherwise. But it's not like we haven't had stimulus. And then the simultaneous, more or less, LBO boom, which was called private equity this time. The abuses keep coming back - and the terms got terrible and all that. You've got a banking system that's hung up with lots of that. You've got a mortgage industry that's deleveraging, and it's going to be painful. The scenario you're describing suggests we're a long way from turning a corner. I think so. I mean, it seems everybody says it'll be short and shallow, but it looks like it's just the opposite. You know, deleveraging by its nature takes a lot of time, a lot of pain. And the Дайджест статей Дайджест статей 12 consequences kind of roll through in different ways. Now, I don't invest a dime based on macro forecasts, so I don't think people should sell stocks because of that. I also don't think they should buy stocks because of that. Your OFHEO example implies you're not too optimistic about regulation. Finance has gotten so complex, with so much interdependency. I argued with Alan Greenspan some about this at [Washington Post chairman] Don Graham's dinner. He would say that you've spread risk throughout the world by all these instruments, and now you didn't have it all concentrated in your banks. But what you've done is you've interconnected the solvency of institutions to a degree that probably nobody anticipated. And it's very hard to evaluate. If Bear Stearns had not had a derivatives book, my guess is the Fed wouldn't have had to do what it did. Do you find it striking that banks keep looking into their investments and not knowing what they have? I read a few prospectuses for residential-mortgage-backed securities - mortgages, thousands of mortgages backing them, and then those all tranched into maybe 30 slices. You create a CDO by taking one of the lower tranches of that one and 50 others like it. Now if you're going to understand that CDO, you've got 50-times-300 pages to read, it's 15,000. If you take one of the lower tranches of the CDO and take 50 of those and create a CDO squared, you're now up to 750,000 pages to read to understand one security. I mean, it can't be done. When you start buying tranches of other instruments, nobody knows what the hell they're doing. It's ridiculous. And of course, you took a lower tranche of a mortgage-backed security and did 100 of those and thought you were diversifying risk. Hell, they're all subject to the same thing. I mean, it may be a little different whether they're in California or Nebraska, but the idea that this is uncorrelated risk and therefore you can take the CDO and call the top 50% of it super-senior - it isn't super-senior or anything. It's a bunch of juniors all put together. And the juniors all correlate. If big financial institutions don't seem to know what's in their portfolios, how will investors ever know when it's safe? They can't, they can't. They've got to, in effect, try to read the DNA of the people running the companies. But I say that in any large financial organization, the CEO has to be the chief risk officer. I'm the chief risk officer at Berkshire. I think I know my limits in terms of how much I can sort of process. And the worst thing you can have is models and spreadsheets. I mean, at Salomon, they had all these models, and you know, they fell apart. What should we say to investors now? The answer is you don't want investors to think that what they read today is important in terms of their investment strategy. Their investment strategy should factor in that (a) if you knew what was going to happen in the economy, you still wouldn't necessarily know what was going to happen in the stock market. And (b) they can't pick stocks that are better than average. Stocks are a good thing to own over time. There's only two things you can do wrong: You can buy the wrong ones, and you can buy or sell them at the wrong time. And the truth is you never need to sell them, basically. But they could buy a cross section of American industry, and if a cross section of American industry doesn't work, certainly trying to pick the little beauties here and there isn't going to work either. Then they just have to worry about getting greedy. You know, I always say you should get greedy when others are fearful and fearful when others are greedy. But that's too much to expect. Of course, you shouldn't get greedy when others get greedy and fearful when others get fearful. At a minimum, try to stay away from that. Дайджест статей Дайджест статей 13 By your rule, now seems like a good time to be greedy. People are pretty fearful. You're right. They are going in that direction. That's why stocks are cheaper. Stocks are a better buy today than they were a year ago. Or three years ago. But you're still bullish about the U.S. for the long term? The American economy is going to do fine. But it won't do fine every year and every week and every month. I mean, if you don't believe that, forget about buying stocks anyway. But it stands to reason. I mean, we get more productive every year, you know. It's a positive-sum game, long term. And the only way an investor can get killed is by high fees or by trying to outsmart the market. By Nicholas Varchaver BUFFETT VS. BERNANKE: THE INFLATION SHOWDOWN CNN 26.06.2008 The billionaire investor says inflation is 'exploding,' but the Fed believes commodity price shocks should subside. Even Warren Buffett is wrong some of the time. Federal Reserve chairman Ben Bernanke is hoping this is one of them. Buffett, the billionaire investor behind Berkshire Hathaway (BRKA, Fortune 500), fingered "exploding" inflation Wednesday as the biggest risk to the economy. "I think inflation is really picking up," Buffett said on CNBC. "It's huge right now, whether it's steel or oil," he continued. "We see it everywhere." Indeed, the prices of gasoline and milk have shot past $4 a gallon, and Dow Chemical (DOW, Fortune 500) has announced twice in the past month that it's raising prices to offset soaring commodity costs. Yet Bernanke's Fed signaled Wednesday that, after nine months of interest rate cuts and expansive lending to the financial sector, it isn't eager to reverse course and push rates higher to try to tamp down rising prices. Why? Because the Fed remains skeptical that high commodity prices will ripple through the economy, leading to broad price hikes and big wage increases. "The committee expects inflation to moderate later this year and next year," the Federal Open Market Committee said in holding the fed funds rate steady at 2%, though it did note that "uncertainty" remains high and suggested inflation concerns could rise. BUFFETT SEES CREDIT CRISIS EASING 09.07.2008 Forbes magazine ranks Warren Buffet as the world's richest man Дайджест статей Дайджест статей 14 Investment guru Warren Buffett says the worst of the global credit crunch is over for Wall Street, but not for the man or woman on the street. The chief executive of Berkshire Hathaway said there would be "a lot of pain to come" for mortgage holders. He made the comments as Berkshire Hathaway's annual meeting got under way in Omaha, Nebraska, attended by a record 31,000 people. The meeting has become known as "Woodstock for Capitalists". Mr Buffet's investment decisions often go against the market and are followed religiously by many. However, Berkshire Hathaway, the company Mr Buffet took over in 1965, has not escaped the credit crisis. It saw its first quarter profit tumble 64%, hurt by losses tied to derivatives contracts and a steep slide in insurance premiums. "The worst of the crisis in Wall Street is over," Mr Buffett told Bloomberg Television shortly before the weekend meeting began. "In terms of people with individual mortgages, there's still a lot of pain left to come," he added. Succession fears Mr Buffett, ranked the world's richest man by Forbes magazine, praised the Federal Reserve's rescue of Bear Stearns. He said the move avoided financial market chaos. "I think the Fed did the right thing in stepping in on Bear Stearns," Mr Buffett said. "Just imagine the thousands of counterparties around the world having to undo contracts." The central bank helped broker the buyout by JP Morgan, after financial institutions became reluctant to lend to Wall Street's fifth-largest investment bank. At the meeting, Mr Buffett also tried to reassure shareholders that Berkshire Hathaway would be fine once he had gone, but the 77-year-old billionaire offered few new details of the company's succession plan. Berkshire Hathaway has stakes in American Express, Coca-Cola, Wal-Mart Stores and Tesco. SUBPRIME CRISIS NOT BIG THREAT MarketWatch 05.05.2007 Rising delinquencies and defaults in the subprime mortgage business probably won't be a big threat to the U.S. economy, Warren Buffett said on Saturday. Дайджест статей Дайджест статей 15 Still, the Berkshire Hathaway chairman said some of the company's construction-related businesses are being hit by the slowdown in home building, and that could continue "for quite a while." House prices fell at their fastest pace in 13 years in February, according to the S&P/Case-Shiller home price index, which was released in late April. The slowdown, combined with an increase in interest rates in recent years, has triggered turmoil in the subprime mortgage business, which lends to poorer home buyers with blemished credit records. Borrowers and lenders in the subprime mortgage business were betting that house prices would go up in future, Buffett said. Now that delinquencies and foreclosures are increasing there's extra supply of homes for sale, which changes the dynamics of the real estate market, he explained. "You'll see plenty of misery in that field. You've already seen some," Buffett said. "I don't seen a big impact on the economy though." The situation has been exacerbated by securization, in which the loans are packaged up and sold on again to investors as mortgage-backed securities, he added. "Once you package those things and sell them through major investment banks, discipline leaves the system," Buffett said. Subprime borrowers have been missing their first and second monthly payments recently, he noted. "That shouldn't happen. Securitization has made the problem worse," he added. Legislators have been discussing possible new regulations to deal with the crisis, including making investors in mortgage-backed securities more responsible for future delinquencies. The subprime shakeout probably isn't going to cause big trouble for the economy, but in certain areas of the country, the real estate market will take longer to recover, Buffett said. Berkshire owns one of the largest networks of real estate agencies in the U.S. and several construction-related businesses, including carpet maker Shaw Industries and building products companies Acme Building Brands, Benjamin Moore, Johns Manville and MiTek. Shaw revenue fell 11% in the first quarter. Sales and profit are likely to be "significantly" lower for the rest of 2007, Berkshire warned on Friday. Alistair Barr is a reporter for MarketWatch in San Francisco. By Alistair Barr, MarketWatch MARKING TO MYTH Business recorder http://www.brecorder.com/ 09.07.2008 Many institutions that publicly report precise market values for their holdings of CDOs and CMOs are in truth reporting fiction. They are marking to model rather than marking to market. The recent meltdown in much of the debt market, moreover, has transformed this process into marking to myth. Because many of these institutions are highly leveraged, the difference between "model" and "market" could deliver a huge whack to shareholders' equity. Indeed, for a few institutions, the difference in valuations is the difference between what purports to be robust health and insolvency. For these institutions, pinning down market values would not be difficult: They should simply sell 5% of all the large positions they hold. That kind of sale would establish a true value, though one still higher, no doubt, than would be realized for 100% of an oversized and illiquid holding. In one way, I'm sympathetic to the institutional reluctance to face the music. I'd give a lot to mark my weight to "model" rather than to "market." Дайджест статей Дайджест статей Дайджест статей 16 Дайджест статей 17 СПИСОК ИСТОЧНИКОВ TXT_204829, 09.07.2008, Buffett sees credit crisis easing ABB.com (www.abb.com),, 05.05.2008, Berkshire vice chairman: 'Stupid things' led to financial crisis ABC News (abcnews.go.com),, 12.12.2007, Mortgage crisis perplexes even shrewd investor Warren Buffett Business recorder http://www.brecorder.com/, , 09.07.2008, Marking to myth cnbc,, 14.04.2008, Warren Buffett – What the Tide Revealed CNN, 26.06.2008, Buffett vs. Bernanke: The inflation showdown MarketWatch, 05.05.2007, Subprime crisis not big threat Reuters, 05.05.2008, Buffett: Fallout From Credit Crisis Not Over Yet Reuters, 25.05.2008, Buffett: Banks Are to Blame For Subprime Debt Crisis Reuters, 11.12.2007, How the Crunch Is Playing Out Reuters, 31.12.2007, Buffett says credit crunch creates buy opportunities Reuters, 14.04.2008, What Warren thinks... www.telegraph.co.uk, 20.05.2008 16:18:22, Warren Buffett: On the credit crisis, his business heroes and marriage Дайджест статей Дайджест статей СТАТИСТИКА ВСТРЕЧАЕМЫХ КЛЮЧЕВЫХ СЛОВ СПИСОК ОБЪЕКТОВ ИНТЕРЕСА 1. Ambac Financial Group Inc.: 1 2. Bear Stearns: 4 3. Berkshire Hathaway (BRKa) (USA): 9 4. Glenn Tongue: 1 5. Hillary Clinton: 1 6. ING Groep NV: 1 7. Marmon Holdings Inc: 1 8. MBIA Inc.: 1 9. Mortgage crisis: 12 10. NYMEX: 1 11. T2 Partners LLC: 1 12. Warren Buffett: 12 Дайджест статей 18 Дайджест статей 19 СПИСКИ ССЫЛОК НА СТАТЬИ, СГРУППИРОВАННЫЕ ПО КЛЮЧЕВЫМ СЛОВАМ Mortgage crisis: Warren Buffett: On the credit crisis, his business heroes and marriage (www.telegraph.co.uk) ....................................................................................................... 3 Berkshire vice chairman: 'Stupid things' led to financial crisis (ABB.com (www.abb.com)) ................................................................................................................. 3 Buffett: Fallout From Credit Crisis Not Over Yet (Reuters) .............................................. 4 Warren Buffett – What the Tide Revealed (cnbc) .............................................................. 4 Buffett: Banks Are to Blame For Subprime Debt Crisis (Reuters) .................................... 5 How the Crunch Is Playing Out (Reuters) .......................................................................... 6 Mortgage crisis perplexes even shrewd investor Warren Buffett (ABC News (abcnews.go.com)).............................................................................................................. 8 Buffett says credit crunch creates buy opportunities (Reuters) .......................................... 9 What Warren thinks... (Reuters) ......................................................................................... 9 Buffett vs. Bernanke: The inflation showdown (CNN) .................................................... 13 Buffett sees credit crisis easing () ..................................................................................... 13 Subprime crisis not big threat (MarketWatch) ................................................................. 14 Warren Buffett: Warren Buffett: On the credit crisis, his business heroes and marriage (www.telegraph.co.uk) ....................................................................................................... 3 Berkshire vice chairman: 'Stupid things' led to financial crisis (ABB.com (www.abb.com)) ................................................................................................................. 3 Buffett: Fallout From Credit Crisis Not Over Yet (Reuters) .............................................. 4 Warren Buffett – What the Tide Revealed (cnbc) .............................................................. 4 Buffett: Banks Are to Blame For Subprime Debt Crisis (Reuters) .................................... 5 How the Crunch Is Playing Out (Reuters) .......................................................................... 6 Mortgage crisis perplexes even shrewd investor Warren Buffett (ABC News (abcnews.go.com)).............................................................................................................. 8 Buffett says credit crunch creates buy opportunities (Reuters) .......................................... 9 What Warren thinks... (Reuters) ......................................................................................... 9 Buffett vs. Bernanke: The inflation showdown (CNN) .................................................... 13 Buffett sees credit crisis easing () ..................................................................................... 13 Subprime crisis not big threat (MarketWatch) ................................................................. 14 Berkshire Hathaway (BRKa) (USA): Warren Buffett: On the credit crisis, his business heroes and marriage (www.telegraph.co.uk) ....................................................................................................... 3 Berkshire vice chairman: 'Stupid things' led to financial crisis (ABB.com (www.abb.com)) ................................................................................................................. 3 Buffett: Banks Are to Blame For Subprime Debt Crisis (Reuters) .................................... 5 How the Crunch Is Playing Out (Reuters) .......................................................................... 6 Buffett says credit crunch creates buy opportunities (Reuters) .......................................... 9 What Warren thinks... (Reuters) ......................................................................................... 9 Buffett vs. Bernanke: The inflation showdown (CNN) .................................................... 13 Buffett sees credit crisis easing () ..................................................................................... 13 Subprime crisis not big threat (MarketWatch) ................................................................. 14 Дайджест статей Дайджест статей 20 Bear Stearns: Warren Buffett: On the credit crisis, his business heroes and marriage (www.telegraph.co.uk) ....................................................................................................... 3 Berkshire vice chairman: 'Stupid things' led to financial crisis (ABB.com (www.abb.com)) ................................................................................................................. 3 What Warren thinks... (Reuters) ......................................................................................... 9 Buffett sees credit crisis easing () ..................................................................................... 13 NYMEX: Warren Buffett – What the Tide Revealed (cnbc) .............................................................. 4 MBIA Inc.: How the Crunch Is Playing Out (Reuters) .......................................................................... 6 Ambac Financial Group Inc.: How the Crunch Is Playing Out (Reuters) .......................................................................... 6 Glenn Tongue: How the Crunch Is Playing Out (Reuters) .......................................................................... 6 T2 Partners LLC: How the Crunch Is Playing Out (Reuters) .......................................................................... 6 Hillary Clinton: Mortgage crisis perplexes even shrewd investor Warren Buffett (ABC News (abcnews.go.com)).............................................................................................................. 8 Marmon Holdings Inc: Buffett says credit crunch creates buy opportunities (Reuters) .......................................... 9 ING Groep NV: Buffett says credit crunch creates buy opportunities (Reuters) .......................................... 9 Перейти к содержанию СПИСКИ УПОМИНАНИЯ КЛЮЧЕВЫХ СЛОВ В СМИ Mortgage crisis: www.telegraph.co.uk - 1 ABB.com (www.abb.com) - 1 Reuters - 5 cnbc - 1 ABC News (abcnews.go.com) - 1 CNN - 1 -1 MarketWatch - 1 Warren Buffett: www.telegraph.co.uk - 1 ABB.com (www.abb.com) - 1 Reuters - 5 cnbc - 1 ABC News (abcnews.go.com) - 1 CNN - 1 -1 MarketWatch - 1 Berkshire Hathaway (BRKa) (USA): www.telegraph.co.uk - 1 Дайджест статей Дайджест статей ABB.com (www.abb.com) - 1 Reuters - 4 CNN - 1 -1 MarketWatch - 1 Bear Stearns: www.telegraph.co.uk - 1 ABB.com (www.abb.com) - 1 Reuters - 1 -1 NYMEX: cnbc - 1 MBIA Inc.: Reuters - 1 Ambac Financial Group Inc.: Reuters - 1 Glenn Tongue: Reuters - 1 T2 Partners LLC: Reuters - 1 Hillary Clinton: ABC News (abcnews.go.com) - 1 Marmon Holdings Inc: Reuters - 1 ING Groep NV: Reuters - 1 Перейти к содержанию Дайджест статей 21