Dr Paul Latimer - Submission to ARC judicial review inquiry

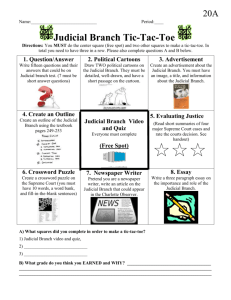

advertisement