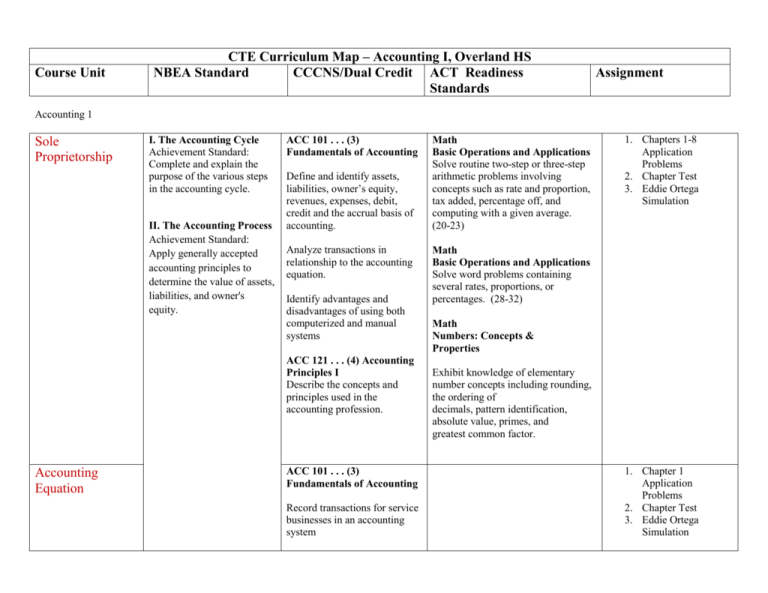

CTE Curriculum Map – Accounting I, Overland HS Course Unit

advertisement

Course Unit CTE Curriculum Map – Accounting I, Overland HS NBEA Standard CCCNS/Dual Credit ACT Readiness Standards Assignment Accounting 1 Sole Proprietorship I. The Accounting Cycle Achievement Standard: Complete and explain the purpose of the various steps in the accounting cycle. II. The Accounting Process Achievement Standard: Apply generally accepted accounting principles to determine the value of assets, liabilities, and owner's equity. ACC 101 . . . (3) Fundamentals of Accounting Define and identify assets, liabilities, owner’s equity, revenues, expenses, debit, credit and the accrual basis of accounting. Analyze transactions in relationship to the accounting equation. Identify advantages and disadvantages of using both computerized and manual systems ACC 121 . . . (4) Accounting Principles I Describe the concepts and principles used in the accounting profession. Accounting Equation ACC 101 . . . (3) Fundamentals of Accounting Record transactions for service businesses in an accounting system Math Basic Operations and Applications Solve routine two-step or three-step arithmetic problems involving concepts such as rate and proportion, tax added, percentage off, and computing with a given average. (20-23) 1. Chapters 1-8 Application Problems 2. Chapter Test 3. Eddie Ortega Simulation Math Basic Operations and Applications Solve word problems containing several rates, proportions, or percentages. (28-32) Math Numbers: Concepts & Properties Exhibit knowledge of elementary number concepts including rounding, the ordering of decimals, pattern identification, absolute value, primes, and greatest common factor. 1. Chapter 1 Application Problems 2. Chapter Test 3. Eddie Ortega Simulation Course Unit CTE Curriculum Map – Accounting I, Overland HS NBEA Standard CCCNS/Dual Credit ACT Readiness Standards Assignment Accounting 1 Analyzing transactions into debit and credit parts Recording Transactions in a journal Posting from a journal to a ledger Preparing cash control systems Preparing a worksheet for a service business II. The Accounting Process Achievement Standard: Apply generally accepted accounting principles to determine the value of assets, liabilities, and owner's equity. II. The Accounting Process Achievement Standard: Apply generally accepted accounting principles to determine the value of assets, liabilities, and owner's equity. II. The Accounting Process Achievement Standard: Apply generally accepted accounting principles to determine the value of assets, liabilities, and owner's equity. II. The Accounting Process Achievement Standard: Apply generally accepted accounting principles to determine the value of assets, ACC 101 . . . (3) Fundamentals of Accounting Record transactions for service businesses in an accounting system ACC 101 . . . (3) Fundamentals of Accounting Record transactions for service businesses in an accounting system ACC 101 . . . (3) Fundamentals of Accounting Account for cash transactions and prepare bank reconciliations. ACC 101 . . . (3) Fundamentals of Accounting Record transactions for service businesses in an accounting 1. Chapters 2-3 Application Problems 2. T-accounts project 3. Chapter Test 4. Eddie Ortega Simulation 1. Chapter 4 Application Problems 2. Candy demo 3. Chapter Test 4. Eddie Ortega Simulation 1. Chapter 5 Application Problems 2. Chapter Test 3. Eddie Ortega Simulation 1. Chapter 6 Application Problems 2. Chapter Test 3. Eddie Ortega Course Unit CTE Curriculum Map – Accounting I, Overland HS NBEA Standard CCCNS/Dual Credit ACT Readiness Standards Assignment Accounting 1 liabilities, and owner's equity. Preparing financial statements for a service business Completing endof-period financial work Processing III. Financial Statements Achievement Standard: Prepare, interpret, and analyze financial statements using manual and computerized systems for service, merchandising, and manufacturing businesses. II. The Accounting Process Achievement Standard: Apply generally accepted accounting principles to determine the value of assets, liabilities, and owner's equity. III. Financial Statements Achievement Standard: Prepare, interpret, and analyze financial statements using manual and computerized systems for service, merchandising, and manufacturing businesses IV. Special Applications system Complete end-of-period work including preparing adjusting entries, financial statements, and closing entries ACC 101 . . . (3) Fundamentals of Accounting Record transactions for service businesses in an accounting system Complete end-of-period work including preparing adjusting entries, financial statements, and closing entries ACC 101 . . . (3) Fundamentals of Accounting Record transactions for service businesses in an accounting system Simulation 1. Chapter 7 Application Problems 2. Chapter Test 3. Eddie Ortega Simulation 1. Chapter 8 Application Problems 2. Chapter Test 3. Eddie Ortega Simulation Complete end-of-period work including preparing adjusting entries, financial statements, and closing entries ACC 101 . . . (3) 1. Chapters 9-16 Course Unit CTE Curriculum Map – Accounting I, Overland HS NBEA Standard CCCNS/Dual Credit ACT Readiness Standards Assignment Accounting 1 accounting cycles for proprietorship Achievement Standard: Apply appropriate accounting principles to payroll, income taxation, managerial systems, and various forms of ownership. Fundamentals of Accounting Utilizing special journals for a merchandising corporation V. Interpretation and Use of Data Achievement Standard: Use planning and control principles to evaluate the performance of an organization and apply differential analysis and present-value concepts to make decisions II. The Accounting Process Achievement Standard: Apply generally accepted accounting principles to determine the value of assets, liabilities, and owner's equity. ACC 101 . . . (3) Fundamentals of Accounting IV. Special Applications Achievement Standard: Apply appropriate accounting principles to payroll, income taxation, managerial systems, and various forms of ownership ACC 101 . . . (3) Fundamentals of Accounting Posting to general and subsidiary ledgers Preparing payroll records and reports Record transactions for a merchandising business in an accounting system using special journals. Record transactions for a merchandising business in an accounting system using special journals ACC 101 . . . (3) Fundamentals of Accounting Record transactions for a merchandising business in an accounting system using special journals Record transactions for a merchandising business in an accounting system using special journals Application Problems 2. Chapter Test 3. Zenith Global Imports Simulation 1. Chapters 9-10 Application Problems 2. Chapter Test 3. Zenith Global Imports Simulation 1. Chapter 11 Application Problems 2. Chapter Test 3. Zenith Global Imports Simulation 1. Chapters 1213 Application Problems 2. Chapter Test 3. Zenith Global Imports Simulation Course Unit CTE Curriculum Map – Accounting I, Overland HS NBEA Standard CCCNS/Dual Credit ACT Readiness Standards Assignment Accounting 1 Preparing a worksheet for a merchandising business IV. Special Applications Achievement Standard: Apply appropriate accounting principles to payroll, income taxation, managerial systems, and various forms of ownership III. Financial Statements Achievement Standard: Prepare, interpret, and analyze financial statements using manual and computerized systems for service, merchandising, and manufacturing businesses. ACC 101 . . . (3) Fundamentals of Accounting Record transactions for a merchandising business in an accounting system using special journals Complete end-of-period work including preparing adjusting entries, financial statements, and closing entries. ACC 101 . . . (3) Fundamentals of Accounting Record transactions for a merchandising business in an accounting system using special journals 1. Chapters 14 Application Problems 2. Chapter Test 3. Zenith Global Imports Simulation 1. Chapters 15 Application Problems 2. Chapter Test 3. Zenith Global Imports Simulation Complete end-of-period work including preparing adjusting entries, financial statements, and closing entries. II. The Accounting Process Achievement Standard: Apply generally accepted accounting principles to determine the value of assets, liabilities, and owner's ACC 101 . . . (3) Fundamentals of Accounting Record transactions for a merchandising business in an accounting system using 1. Chapter 14-16 Application Problems 2. Chapter Test 3. Zenith Global Imports Simulation Course Unit CTE Curriculum Map – Accounting I, Overland HS NBEA Standard CCCNS/Dual Credit ACT Readiness Standards Assignment Accounting 1 equity. special journals III. Financial Statements Achievement Standard: Prepare, interpret, and analyze financial statements using manual and computerized systems for service, merchandising, and manufacturing businesses. Complete end-of-period work including preparing adjusting entries, financial statements, and closing entries. 1. Chapter 16 Application Problems 2. Chapter Test 3. Zenith Global Imports Simulation