Macroeconomic models used in the analysis of economic

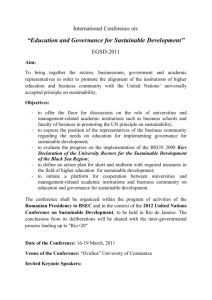

advertisement