The accounts have been prepared under the historical

advertisement

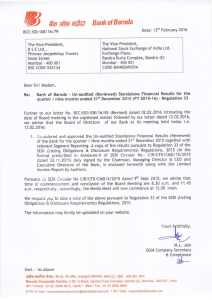

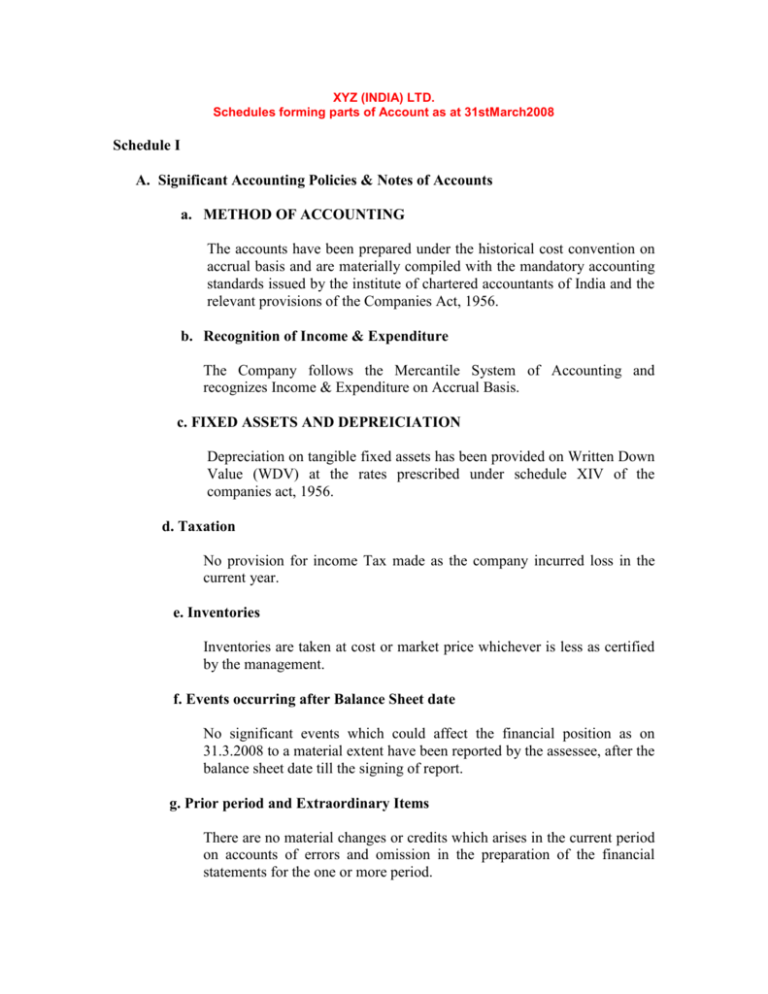

XYZ (INDIA) LTD. Schedules forming parts of Account as at 31stMarch2008 Schedule I A. Significant Accounting Policies & Notes of Accounts a. METHOD OF ACCOUNTING The accounts have been prepared under the historical cost convention on accrual basis and are materially compiled with the mandatory accounting standards issued by the institute of chartered accountants of India and the relevant provisions of the Companies Act, 1956. b. Recognition of Income & Expenditure The Company follows the Mercantile System of Accounting and recognizes Income & Expenditure on Accrual Basis. c. FIXED ASSETS AND DEPREICIATION Depreciation on tangible fixed assets has been provided on Written Down Value (WDV) at the rates prescribed under schedule XIV of the companies act, 1956. d. Taxation No provision for income Tax made as the company incurred loss in the current year. e. Inventories Inventories are taken at cost or market price whichever is less as certified by the management. f. Events occurring after Balance Sheet date No significant events which could affect the financial position as on 31.3.2008 to a material extent have been reported by the assessee, after the balance sheet date till the signing of report. g. Prior period and Extraordinary Items There are no material changes or credits which arises in the current period on accounts of errors and omission in the preparation of the financial statements for the one or more period. h. Related Party Transactions(AS-18) As per provisions of Accounting Standard 18 issued by the Chartered Accountants’ of India ,the details of related party transactions are not applicable. i. Borrowing Cost Borrowing cost are recognized as expenses in the year in which they are incurred. j. Overall Valuation Policy The account have been prepared on historical cost basis and on going concern. k. Retirement Benefits No provision have been made in the accounts for PPF, FPF, Gratuity and Retirement Benefits for the employees . Management inform that this above provision is not applicable to the company hence no such provision made during the year. l. Foreign Exchange Transactions There are no foreign currency transactions made during the year. m. Preliminary Expenses Preliminary Expenses are written off over a period of 10 years in equal proportion from the date of commercial activity. n. Deferred Income Tax During the period , no timing differences arises between taxable income and accounting income ,hence no Deferred Tax Assets or Liabilities has been recognized. B. Notes Forming part of Accounts a. Sales are recorded inclusive of excise duty and sales tax if any but after deducting discount, rebate, rate difference and sales return. b. Purchase includes purchase of raw material after deducting purchase return ,discount ,rebate, and incentives. c. In the opinion of the Board the Current Assets, Loans & Advances are approximately of the value stated and realizable in the ordinary course of business. The Provision for all known liabilities is adequate. d. Sundry Debtors, Sundry Creditors & Loans & Advances balances are subject to confirmation. e. Auditor’s Remuneration Particulars 2007-2008(in Rs) Audit Fees 10000 Service Tax 1236 Total 11236 2006-2007(in Rs) 20000 2472 22472 f. Additional Information Pursuant to the Provision of Part II of the Schedule VI of the Companies Act 1956. A. Quantitative Information i) Installed Capacity : ii) License Capacity : iii) Production /Sales of Stocks: (In Qty) Finished Goods (In Pcs.) a) b) c) Opening Stock Purchased N.A N.A N.A Sales Closing C.I.F Value of Imports, Expenditure and Earnings in Foreign Companies 2007-08 (In Rs) 2006-07(in Rs) C.I.F Value Of Imports N .A N.A Expenditure In Foreign N.A N.A Companies. Earning in Foreign Exchange N.A N.A -F.O.B Value of Exports - Interest Received g. This being the second year of the operation of the Company. h. On this basis on information furnished to us the Company does not have any amount due (inclusive of interest ) to as Small Scale Industrial Undertaking. Signatures To Schedule A to I For.XYZ & CO. Chartered Accountants’ CA NAME Mem No.Place: Date : 5th September,2008 For and on Behalf of the Board Director Director