Time Value of Money

advertisement

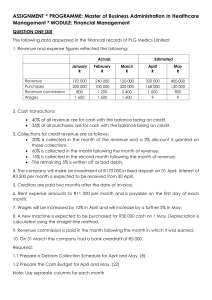

THE TIME VALUE OF MONEY The most important concept in finance is that of the time value of money. As we will see in the next section on valuation, the value of a project, a bond, a company, or anything in a financial sense is a function of the future cash flows that will be realized and the time value of money. The easiest place to start is with future value since everyone has had a bank account at one time or another. Future Value Place $100.00 in a bank earning 10% annually for three years. At the end of the first year, you will have $110.00 in the bank account. $100.00 * (1 .1) $110.00 Of this amount, $100 is the principal that you put in originally, while the other $10 represents the interest that you earned. Leaving all of the money in the bank for another year yields: $110.00 * (1.1) $121.00 The increase in value of $11 over the amount at the end of the first year includes another $10 (or 10%) of the original principal of $100 that you put in the bank. What is the 11th dollar? It is interest on the interest that you earned in the first year. Leaving the money in the account for a third year results in the bank account growing to $133.10 by the end of the third year: $121.00 * (1.1) $133.10 Recognizing that the $121 is just $110*(1.1) and that $110 is just $100*(1.1), we can simplify this process by writing it as $100.00 * (1.1)3 $133.10 The term (1.1)3 is referred to as the Future Value Interest Factor, in this case at 10% for 3 years. In general the Future Value Interest Factor can be defined as FVIFk %, n (1 k )n and the relationship between Present Value and Future Value is PV * FVIFk %, n FV If we look at the table at the back of the text entitled Future Value of $1 in the 10% column and the third period row, we will find the factor 1.331 – this is how the entire table is made up. Present Value Generally, we’re not as much interested in what a certain amount of money today will be worth in the future as we are interested in knowing what a future amount of money is worth today. One reason, of course is that we know what a dollar will buy today. Thus, with the exception of insurance companies (who need to know how much they will have to pay off policies at a future date) and certain pension funds (who need to have enough money for retirees in the future), we are generally more interested in Present Values. Present Value is the amount of money that would have to be placed in a bank today earning k% in order to have the future amount in n years. Determining the present value is called discounting. Discounting is just the opposite of compounding, just like addition is the opposite of subtraction and multiplication is the opposite of division. Rearranging the preceding equation to solve for the Present Value, we obtain PV FV * 1 FVIFk , n Or PV FV * PVIFk , n and PVIFk , n 1 FVIFk , n What is the present value of $133.10 three years from now if you can earn 10% interest in the bank? The answer, of course, is $100.00 as we just saw with future value. Mathematically, it would be determined as PV FV * 1 FVIF19%, 3 FV * PVIF10%, 3 $133.10 * .7513 $100.00 If you look at the table in the back of the text entitled Present Value of $1 in the 10% column and the third period row, you will see the factor 0.7513 which is just the reciprocal of the FVIF10%,3 of 1.331 and is how the entire table is calculated. Annuities An annuity is a series of equal payments that occurs every period. Suppose we wanted to determine the present value of an annuity of $100 per year for three years beginning in one year. Using the present value interest factors we could calculate the present value of each $100 and then add all of the present values together: 0 1 2 3 100 100 100 .9091 90.91 .8264 82.64 .7513 75.13 --------248.68 The value of an annuity of $100 per year for three years when discounted at 10% is $248.68 in today’s dollar terms. Looking at our calculation mathematically, we could factor out the common element of $100 and simplify the calculation 100 (.9091) + 100 (.8264) + 100 (.7513) = 100 (.9091 + .8264 + .7513) = 100 (2.4868) = 100 * PVIFA10%,3 As indicated, the sum of the individual present value factors is what we call the Present Value Interest Factor of an Annuity. The table in the back of the text entitled Present Value of an Annuity of $1 is constructed simply by adding successive Present Value factors for successive years of an annuity. Notice that the PVIFA for a one-year annuity is the same as the PVIF for one year since they are the same. You will also notice in the annuity table that the factor for 10% and 3 periods is 2.4869 which is just slightly different than what we got since we have a little rounding error involved. How would you explain to someone what you mean by saying that the present value of an annuity of $100 per year for three years at 10% is $248.68? What do you mean by present value? Remember that it is just the amount that you would have to put in the bank today in order to have those future cash flows. Suppose we put $248.68 in a bank today that pays 10% interest: $248.68 Initial deposit 24.87 Interest for the first year $273.55 Amount at end of first year - 100.00 Withdrawal at end of first year $ 173.55 Remaining balance at end of first year 17.36 Interest for the second year $ 190.91 Amount at end of second year - 100.00 Withdrawal at end of second year $ 90.91 Remaining balance at end of second year 9.09 Interest for the third year $100.00 Amount at end of third year - 100.00 Withdrawal at end of third year -0- Account is empty Notice that the value of the three-year annuity of $100 is only $248.68 today. It is NOT $300 because we would be ignoring the time value of money. Think about the lottery. It is paid in 25 annual payments with the first one being paid immediately and equal payments in each of the following 24 years. The winner of a $25 million jackpot would, technically, receive $25 million but it would not be worth that much. In fact, if you were the winner and chose the cash option for payment, you would only receive about $13 million today. This is equivalent to discounting the 25 payments of $1 million to a present value using about a 6% rate of interest, probably about right given the cost of debt to the state when it has to borrow. The same thing is true with these athletic contracts where $50 million is paid for a five-year contract. The fact is, the player may receive $5 million per year during the five years in which they are playing, while the balance is paid out over the following ten years. It only adds up to $50 million if you ignore the time value of money (I’d still like 10% as the agent). Would you rather have $100 at the end of each of the next three years or $100 at the beginning of each of the next three years? At the beginning, of course. Why? Because you can start earning interest sooner. 0 100 1 2 100 100 3 .9091 90.91 .8264 82.64 --------273.55 273.55 - 248.68 = 24.87 The difference in value of $24.87 is the present value of the additional interest ($10 per year) that can be earned. Since we have essentially moved the $100 in year 3 to today, we can earn an extra $10 per year of interest on that amount. What is the present value of $10 of additional interest each year for three years? $10*(2.4868) = $24.87 When an annuity is paid at the beginning of each period, it is referred to as an annuity due. Feeling pretty comfortable with annuities? What is the present value of an annuity of $100 per year beginning in three years? 0 1 2 3 4 100 100 5 100 Solution #1 0 0' 2 1 1' 3 2' 4 3' 5 100 100 100 2.4869 $ 248.69 .8264 $ 205.52 Would you rather have $205.52 today or $248.69 in two years? Or $100 at the end of years 3, 4 and 5? The answer is “they are all the same thing”. But don’t call it $300 because you are ignoring the time value of money and comparing apples with oranges! Solution #2 0 1 2 3 100 4 5 100 100 3.7908 - 1.7355 = 2.0553 $ 205.53 PVIFA5 - PVIFA2 This approach is taking advantage of the fact that we know the annuity factors are just the summation of the individual present value factors. Thus, by subtracting the 2-year factor from the 5-year factor we are isolating the years 3 – 5. Periods shorter than 1 year Would you rather have $100 at the end of each of the next three years or $50 every six months for the next three years? Take the $50 every six months. Why? Because you can start earning interest sooner. 0 1 50 50 $ 253.79 PVIFA5%,6 = 5.0757 2 50 50 3 50 50 Note now, however, that our periods are no longer years but half-years. We therefore had to convert our interest rate to the same basis. Unless otherwise stated, an interest rate is virtually always expressed in annual terms. Thus, for half-year periods we need to divide our 10% annual rate of interest in half to match the number of half-year periods in one year. Similarly, quarterly payments would require we divide the annual interest rate by four while monthly payments would have us divide the per annum rate by twelve. Compound Interest vs. Simple Interest 1½% * 12 = 18% APR (simple interest) (1.015)12 = 1.196 or 19.6% (compound interest) Finding Growth Rates and Lengths of Time How long will it take to double your money if you can earn 8% interest? 0 ? 1,000 2,000 Utilizing the Present Value Factors, PV = FV * PVIFk,n 1,000 = 2,000 * PVIF8%,n .5 = PVIF8%,n Looking at the Present Value of $1 table, we can see that there are several elements that are equal to .5000; the question is “Which one is the right one?” What we know, however, is that we should be looking in the 8% column since we are earning an 8% rate of interest. Looking down the column we find the factor .5000 in only one row which we can now identify as belonging to period 9. n=9 Thus, it will take 9 years to double our money if we are earning an 8% rate of interest. The tables can similarly be used to determine interest rates and rates of growth. Moreover, the compound average rate of growth that is determined by such an approach is the only correct method of doing so. Arithmetic Average vs. Geometric Average To illustrate the proper means of determining an average rate of return or average growth rate, consider putting $1,000 into a mutual fund that had the following year-end values: Year 0 1,000 Year 1 2,000 Year 2 1,000 +100% - 50% 50%/2 = 25% average per year In the first year, we doubled our money, or earned a +100% rate of interest. In the second year, we lost half of our money, or earned a –50% rate of return. When individual growth rates are added up and divided by the number of years, we obtain what is called an arithmetic average. In this example, it implies that we earned, on average, a 25% rate of return. It is obvious that we did not. In fact, we averaged a zero rate of return since we ended up with the same amount of money that we started with. This does not occur when Present Value/Future Value factors are employed. PV * FVIF = FV 1,000 * (1 + k)2 = 1,000 1 + k = 1.00 or 0% This type of average is referred to as a geometric average and indicates the true rate of return that was earned. Although other methods of determining the geometric average exist, the use of Present Value/Future Value factors is, by far, the simplest means of doing so.