Quick Books Record keeping Lesson Plan

advertisement

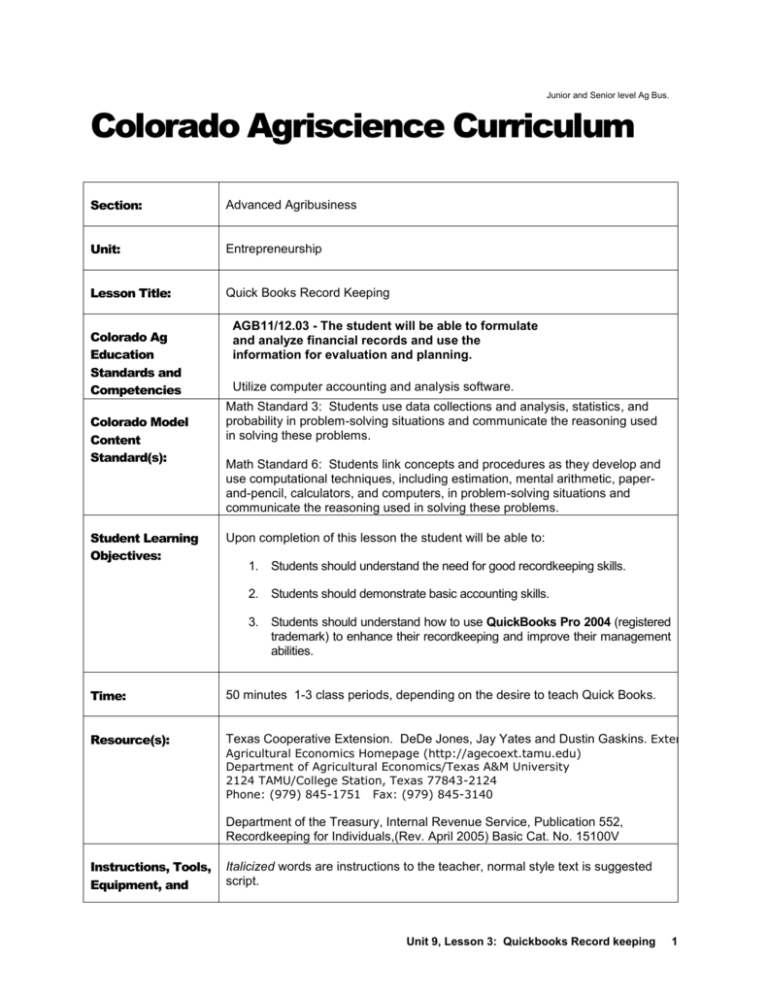

Junior and Senior level Ag Bus. Colorado Agriscience Curriculum Section: Advanced Agribusiness Unit: Entrepreneurship Lesson Title: Quick Books Record Keeping Colorado Ag Education Standards and Competencies Colorado Model Content Standard(s): Student Learning Objectives: AGB11/12.03 - The student will be able to formulate and analyze financial records and use the information for evaluation and planning. Utilize computer accounting and analysis software. Math Standard 3: Students use data collections and analysis, statistics, and probability in problem-solving situations and communicate the reasoning used in solving these problems. Math Standard 6: Students link concepts and procedures as they develop and use computational techniques, including estimation, mental arithmetic, paperand-pencil, calculators, and computers, in problem-solving situations and communicate the reasoning used in solving these problems. Upon completion of this lesson the student will be able to: 1. Students should understand the need for good recordkeeping skills. 2. Students should demonstrate basic accounting skills. 3. Students should understand how to use QuickBooks Pro 2004 (registered trademark) to enhance their recordkeeping and improve their management abilities. Time: 50 minutes 1-3 class periods, depending on the desire to teach Quick Books. Resource(s): Texas Cooperative Extension. DeDe Jones, Jay Yates and Dustin Gaskins. Extension Agricultural Economics Homepage (http://agecoext.tamu.edu) Department of Agricultural Economics/Texas A&M University 2124 TAMU/College Station, Texas 77843-2124 Phone: (979) 845-1751 Fax: (979) 845-3140 Department of the Treasury, Internal Revenue Service, Publication 552, Recordkeeping for Individuals,(Rev. April 2005) Basic Cat. No. 15100V Instructions, Tools, Equipment, and Italicized words are instructions to the teacher, normal style text is suggested script. Unit 9, Lesson 3: Quickbooks Record keeping 1 Supplies: Note: This lesson is very in-depth and will take some preparation by the teacher outside of class. Objective 1 is just verbal, while objectives 2 and 3 suggests the use of Quick Books. It is not essential for teaching, but for the sake of comprehension, it is highly recommended. Copies of Quick Book Pro 2004.ppt, one per student. Projector to run PowerPoint or copies of slides for overheads Suggested software: Quick Books (not necessary but it would help with comprehension. 15 balloons Print two copies of Quick Book Test Areas found at the end of the curriculum. One copy will be put into the balloons. The other will be used for test purposes. Interest Approach: Cut up a copy of the Quick Book Test Areas and give each student or group of students an item. Hand out a balloon to each student(s). Instruct the students to stuff the item in the balloon and blow it up without tying it. On the count of three, tell the students to let go of the balloon. As the balloons fly around the room, have the students catch them. Each student or group of student(s) should end up with a balloon/item. Tell the student to look at their item and sit down and listen. Within the Power Point, there are test questions that relate to the “test Items”. As each test question comes up, ask the student(s) who have the corresponding “item” in their balloon to answer the problem. Note: The instructor should remember to use only the “test items” he/she plans on covering in the lecture. Also remind the students they will be tested on all the material at the end of the recordkeeping unit. Objective 1: Students should understand the need for good recordkeeping skills. When we think of farming and ranching we usually think of driving a tractor or pulling a calf. Rarely do we picture a farmer/rancher sitting in front of a computer screen entering data. But, the most important part of being a good ag. manager is data collecting and recordkeeping. Before we can make sound management decisions, we need to have facts and data to analyze. The quality of our decisions are directly related to our ability to gather and organize this data. Today we are going to look at ways of organizing this data so that we can use it, whether it be for paying bills, calculating our taxes, allocating enterprise expenses, or analyzing our financial reports. We are jumping head first into computerized recordkeeping in the agriculture industry! I can not stress enough the importance of accuracy when keeping records. In fact, lack of data is better than incorrect data. Also, it is important to organize it so you can find it quickly. Filing cabinets are essential farm equipment. A fire-proof safe is worth the money for protecting important, irreplaceable documents and data. If you are audited you need to be able to find historical records. A PDF from the IRS (IRS recordkeeping p552.pdf) is included with this curriculum. The Instructor may review and use. In this day and age, an ag. manager needs a computer to keep track of information and data. Also, remember, it is also very important to back up your computer data and wise to keep hard copies of some information. There are numerous computer programs that can be used to store, sort and analysis data. A list of some are included in the word document Computer Software Unit 9, Lesson 3: Quickbooks Record keeping 2 Information.doc. to be used at the instructors discretion. Today we are going to look at one of the more popular computer recordkeeping software applications, Quick Books (reg trade mark) Pro 2004. Objective 2: Students should demonstrate basic accounting skills. Instructor should review the Quick Book Pro 2004.ppt and determine what part of the curriculum he/she would like to use. The files include a brief accounting explanation. Also include are E-moments in the notes portion of Power Point for certain slides. These E-moments are not found in the PDF. Objective 3: Students should understand how to use QuickBooks Pro 2004 (registered trademark) to enhance their recordkeeping and improve their management abilities. Instructor should review the Quick Book Pro 2004.ppt and determine how much of the curriculum he/she would like to use. These files include step by step illustrations of how to use Quick Book Pro and also practice problems. Also included are E-moments in the notes portion of certain slides in the Power Point only. Lesson 3 starts on slide 75. Activity Attached at the bottom of this document is an eight page summary of various record-keeping software programs. This is merely to promote other computerized record-keeping systems outside of Quick Books. There are some great scenarios. Review/Summary: Contained within objectives two and three. Application-Extended Classroom Activity: Bring in a tax accountant to show practical skills using Quick Books above and beyond what you taught in class. Application--FFA Activity: Encourage students to participate in the FRBM CDE. Encourage the chapter treasurer to create a budget and keep all accounts in Quick Books. Application--SAE Activity: Encourage students to keep their production SAE records in Quick Books. Evaluation: Print off the list of Quick Book areas found at the end of the curriculum. Instructor may need to create more test areas depending on the size of the class. Cut the list up and put in a container. Have each student or a group of student() draw out an item. Ask the student(s) to create a “how to” scenario Unit 9, Lesson 3: Quickbooks Record keeping 3 about that portion of the program. Tell the students they are creating a test question. The student(s) must provide the “step by step’’ answer to the scenario. Compile the scenarios and give as a test (the instructor may have to add information gained from the previous test question to help the test flow). The instructor may want to include questions on the accounting and recordkeeping section also. Students will probably have to work with the program to help them build their answers. Each instructor will have to determine the best way to give the test depending upon what is available for use i.e. a computer lab with Quick Books loaded, only the instructor’s computer available, open book test, do orally in class with just certain students answering the questions by going through the steps so the class can see. An example of a scenario would be : The item drawn is “Create a New Account”. The test question is: Give “step by step” instructions on how to build an asset account. Answer: Step 1: Click on “List” on the tool bar. Step 2: Click on “Chart of Accounts”. Step 3. Click on “Account” at bottom of window Step 4. Click on “New” Step 5. Fill in the “Type Box” with “Fixed Asset”, “Name” the asset, “Description” add a description, “Opening Balance” a reasonable valuation of the asset and “as of Date” today’s date. Step 6. Click “OK” Evaluation Answer Key: Students will provide the answer to each question. Unit 9, Lesson 3: Quickbooks Record keeping 4 Quick Book Pro Test Areas (cut up one copy for students and their balloons) Create a new account Add a sub account Merge two expense accounts Inactivate and reactive an account Add a class Write a check Enter a bill Pay a bill Enter a deposit Memorize and recall a transaction Reconcile an account Purchase a tractor – no down payment or trade-in Set up a loan for a tractor Set up a loan payment for a tractor note. Filter a report Unit 9, Lesson 3: Quickbooks Record keeping 5 Computer Software Information Free Software Marketing Cull Cows - This template was written for cull cow owners to help them evaluate the possibility of retaining ownership until a later date. Microsoft Excel is required to run this template. To save this document, follow the instructions below: - Right click on the link above. - Select "Save As" - Save the file to a folder on your computer. - You will then be able to open this file on your own computer. After you have saved this program to your computer, you must reset the "Macro Security Settings" in Microsoft Excel to "Low". This will enable the macros within the file to run. Vineyard Establishment and Wine Grape Production Budget Generator - This template was written for vineyard owners to help them determine the establishment and yearly operating budget. Microsoft Excel is required to run this template. To save this document, follow the instructions below: - Right click on the link above. - Select "Save As" - Save the file to a folder on your computer. - You will then be able to open this file on your own computer. After you have saved this program to your computer, you must reset the "Macro Security Settings" in Microsoft Excel to "Low". This will enable the macros within the file to run. Bid Price per Head for Beef Cow Herd Template - This template was written for beef cattle producers to help them analyze the situation of what they can pay for a replacement heifer. Microsoft Excel is required to run this template. To save this document, follow the instructions below: - Right click on the link above. - Select "Save As" Unit 9, Lesson 3: Quickbooks Record keeping 6 - Save the file to a folder on your computer. - You will then be able to open this file on your own computer. Commodity Option Analyzer - This program was written for producers wishing to evaluate option strategies when used as a risk management tool. Information supplied to the program is used to determine the various potential outcomes that may arise from option strategies. Beef Cattle Backgrounding Management Decision Aid - This program facilitates the collecting and analysis of data for projection and actual evaluation of the backgrounding or preconditioning activity. This decision aid also generates data that can be used to support a backgournding benchmark data base being developed for the state of Texas. Click here for a printable order form or to order online. The following free software is found at http://www.ranchers.net/. Once at this site, select Software. Calf Projection Spreadsheet - This spreadsheet helps calculate the costs and breakeven price when buying calves in the fall to run as yearlings or to push and sell in the early winter or spring. Montana State University - This site contains spreadsheets and programs designed to assist you perform tasks ranging from financial record keeping to keeping production information. University of Missouri - This site contains spreadsheets and programs designed to assist you perform tasks ranging from financial record keeping to keeping production information. Software for Purchase (Prices for the software listed below were current as of April 19, 2000). Cow-Calf SPA Software and Handbook (Cow-Calf SPA) - SPA software generates the SPA reports including (1) description, (2) reproduction and production, (3) grazing, and (4) the integrated financial and production performance information including, among other measures, cost of weaned calf production and enterprise return on assets (ROA). These are stand-alone programs that run under Windows. They are compatible with either the 3.1 or windows 9x* systems. The SPA Handbook is a series of fact sheets and worksheets that address specific SPA implementation issues for the cow-calf enterprise. Click here for a printable order form or to order online. FINYEAR and Farm and Ranch Managerial Accounting (FINYEAR) - This handbook has been developed for training CPA's, accountants, and producers on how to prepare financial statements, set up the chart of accounts, and address specific accounting issues that enable preparation of managerial accounting information for users. This is a publication in teaching courses as well as a reference. The FINYEAR software is included with the handbook follows the Farm Financial Standards Guidelines and Unit 9, Lesson 3: Quickbooks Record keeping 7 calculates the sixteen financial ratios. This is a stand-alone program that runs under Windows. It is compatible with either the Windows 3.1 or Windows 9x* system. Click here for a printable order form or to order online. Beef Cattle and Forage Business Management Spreadsheet Decision Aids (BCBA) - A set of 30 spreadsheet decision aids to facilitate budgeting, data collection, and investment evaluation that complements the Cow-Calf SPA and Stocker/Feeder Retained Ownership software. There is also a set of ten spreadsheet decision aids that address issues of forage enterprise budgeting, own or custom hay harvest, hay storage cost, hay value based on quality analysis, fencing cost, and brush control investments. Click here for a printable order form or to order online. Part-time Cattle Ranch Decision Aids (PT) - These decision aids have been developed in recognition that 90% of the cow-calf producers are part-time producers. Many have an opportunity to use business analysis approaches to reduce cost. These 23 decision aids assist in data collection, budgeting, breakeven analysis, investment analysis, and use of IRS data to calculate cost of production. Collecting and using your own data and doing the "figuring" with the assistance of the computer spreadsheet will lead to reducing the cost of owning a part-time cattle herd. Click here for a printable order form or to order online. Can You Afford a part-time Ranch (AFFORD) - Investment in a part-time ranch is much more like buying a residence than making an investment in a business expected to generate a profit. This decision aid helps summarize investment requirements, project cow-calf operating costs, and returns and analyzing repayment capacity of the part-time cow-calf enterprise. Non-ranch earnings are considered to calculate total cash available (repayment capacity) and the feasibility of purchasing or owning a part-time ranch. Click here for a printable order form or to order online. Stocker/Feeder SPA Retained Ownership Decision Aids (RETAIN) - This is a set of ten spreadsheets based decision aids for projecting the performance and summarizing actual closeouts for (1) backgrounding (preconditioning), (2) stocker, and (3) custom feeding enterprises. The methodology used follows the Stocker/Feeder SPA Guidelines. A market decision aid helps evaluate using the future and options marketing alternatives. Click here for a printable order form or to order online. Unit 9, Lesson 3: Quickbooks Record keeping 8 Ranch Business Planning Decision Aid (RPLAN) - This provides the guide, work sheet, and decision aids to develop a long-term (10 years) ranch business plan. Investment requirements, costs returns, and borrowing options are easily changed to facilitate "what if" analysis. This software is particularly useful after the cow-calf SPA analysis is completed and a good production and financial position of the current ranch business is documented. This decision aid package is also useful for initial investment analysis for those producers evaluating the ranch investment opportunity. Click here for a printable order form or to order online. AgCHEK - Windows based financial software that allows you to record transactions in a check-type format. Developed by Red Wing Accounting Software. Livestock Management Module - works with AgCheck for Windows and allows you to: • Set up each group of livestock separately. Quantities and expenses are tracked for producing each group. • Track and automatically update inventory, cost of sales, and inventory values. • Allocate pre-paid expenses as used. • Generate a Cost of Production Report for each livestock enterprise, lot, or group (shows projected and actual expenses). • Set up a budget and monitor your progress against it. • Generate other reports such as: hedges and contracts journal, feeder livestock position, cost sensitivity, and production efficiency. Cost: $695 ($1,085 with Livestock Management module) Brisco Software - Accounting program developed by Brisco Charolais & Software. Takes more of an accounting approach (transactions are not recorded in a check-type format). Basic Accounting Package - Suitable for most farm operations - capable of producing simple invoice with automatic posting to accounts. Cattleman’s Calculator - PC Software collection of programs that will calculate various forms of breakevens and profits and losses for a broad base of cattle production ability: Includes the following programs: Feedlot Break-Even Grazing or Pasture Break-Even Feedlot Profit & Loss Grazing Profit & Loss Cow Herd Profit & Loss Purchase Price Unit 9, Lesson 3: Quickbooks Record keeping 9 Each of the programs can be utilized alone or in combination with the others. For example, a cow calf producer may decide to retain ownership of the calves once they are weaned. In this case the cost associated with those animals can be input into the Grazing Profit & Loss programs and added with the variables of running cattle for a grazing season. Cattleman’s Calculator = $189.95 Rancher’s Version = $189.95 Market Manager = $189.95 PC Software = $99.95 (Includes: Cattleman’s Calculator & Ranchers Version) Cost: CropPro - Interactive software that analyzes user-supplied information to determine net returns, expenses, and break-even prices for a row crop operation. Also generates budgets. Cost: $50.00 (Note: The BudPro package includes both the CropPro and StockPro programs.) Microsoft Money - There are many Microsoft Money products on the market. Below is a list and description of each. MICROSOFT MONEY - Microsoft's base product addresses basic financial tasks: paying bills online, bugeting, and investing. Also bundled with PC's and in banks' online checking packages. Cost: $25 MICROSOFT MONEY DELUXE - It includes everything in Money 2000 Standard to help you manage day-to-day finances, PLUS all the comprehensive investing, financial planning, and tax saving tools you need to plan for long-term goals. Cost: $64.95 MONEY 2000 BUSINESS & PERSONAL - combines Money 2000 Deluxe personal finance features and business management tools. This edition is designed for sole proprietors to help them manage both business and personal finances. Cost: $94.95 MICROSOFT OFFICE SMALL BUSINESS EDITION - This suite includes Small Business Financial Manager for Microsoft Excel 97, which lets Excel users analyze accounting data. Also includes Micrsoft Word, Excel, Outlook, Publisher, Expedia Streets and MSN. Cost: $500 Peachtree First Accounting - Designed for the small to medium-sized business. Supports a simple 'Point & Click' of the mouse and intelligent hot keys and shortcut keys for 100% keyboard use. Also includes Windows-style drop down menus provide easy navigation throughout the program. The screens Unit 9, Lesson 3: Quickbooks Record keeping 10 include a status bar so you always know where you are in the program, the name of the company you are working in, the current date and the current time. Can also support conversions from Quicken® 98/99, and Quicken® Home and Business Cost: $69.00 Ranch Vision - Menu driven, point & click Windows program with a Help system as well as technical support. Integrates and analyzes the information you provide to create a computer model of your ranch business. Your operation’s future economic, financial, and management conditions are then projected into the future. You can perform "what if" scenarios such as: cost/benefit analyses. Cost: $345 Standardized Performance Analysis (SPA) - The Standardized Performance Analysis (SPA) provides ranchers an opportunity to analyze their ranch operation from both a production and financial side. SPA facilitates the comparison of an operation's performance between years, producers, production regions and production systems. SPA is intended to be an annual tool for the cow-calf producer. This is an intensive workshop with the intent being ranchers completing the analysis for the 1999 calf crop. Registered operators will be sent forms to organize data before the conference. Confidentiality of producers will be maintained. Individual conferences will be held with producers. Each ranch will be provided an assistant and a computer. Cost: $150.00 per ranch (includes the software, educational materials, meals, and refreshments). $100 per ranch is available for ranches which have completed the analysis in the past. StockPro - Interactive software that analyzes user-supplied information to determine net returns, expenses, and break-even prices for a stocker cattle operation. Also generates budgets for stocker operations. Cost: $50.00 (Note: The BudPro package includes both the CropPro and StockPro programs.) Quicken - Windows based financial software that allows you to record transactions in a check-type format. There are many Quicken products out on the market. Below is a list and brief description of each. QUICKEN BASIC - Intuit's entry-level product lets you balance your checkbook, pay your bills online, and see where your money and investments are going. This version is also bundled with PC's, and offered in banking software. Cost: $90; upgrade,$70. QUICKEN DELUXE - In addition to the basics, Deluxe provides information on mortgages and planning. Unit 9, Lesson 3: Quickbooks Record keeping 11 Cost: $60; upgrade, $40. QUICKEN SUITE - This comprehensive pack comes with Quicken Deluxe as well as Quicken Financial Planner 3.0 and Quicken Family Lawyer Deluxe. Cost: $90; upgrade,$70. QUICKEN HOME & BUSINESS - Think of this package as Quicken Deluxe, plus features for small business-such as invoices and business reports as well as tracking of reimbursable expenses. Cost: $90; upgrade,$70. Quickbooks - Windows based financial software that allows you to record transactions in a check-type format. Complete familiar forms such as checks and invoices onscreen. QUICKBOOKS - Entry-level product that calculates sales tax, tracks records for income, payroll, and sales tax, alerts you to make your quarterly and monthly tax payments, manages your payroll, accept credit card payments, bank online, keep track of inventory, and generate graphs and reports. Cost: $119.95 QUICKBOOKS PRO - All the features of Quickbooks but also allows you to track employee time, job costing and invoicing, as well as integration with Microsoft Word and Excel. Cost: $219.95 Unit 9, Lesson 3: Quickbooks Record keeping 12