PSC INDUSTRIES BERHAD

advertisement

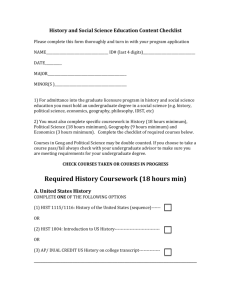

PSC INDUSTRIES BERHAD (Company No. 11106-V) (Incorporated in Malaysia under the Companies Act, 1965) NOTICE OF EXTRAORDINARY GENERAL MEETING NOTICE IS HEREBY GIVEN that an Extraordinary General Meeting of PSC Industries Berhad (“PSCI” or “the Company”) will be held at Anggerik Room, 4th Floor, Hotel Equatorial Kuala Lumpur, Jalan Sultan Ismail, 50250 Kuala Lumpur on Monday, 17 May 2004 at 9.30 a.m., or any adjournment thereof, for the purpose of considering and if thought fit, passing the following ordinary resolutions: ORDINARY RESOLUTION 1 - PROPOSED DEBT RESTRUCTURING (a) Proposed Conversion Of Approximately RM28,624,427 Of Bank Borrowings Owing To Bank Islam Malaysia Berhad (“BIMB”) Into Up To 4,543,560 New Ordinary Shares Of RM1.00 Each In PSCI (“PSCI Shares” or “Shares”) At The Conversion Price Of RM6.30 Debt Per Share At Par; (b) Proposed Conversion Of Approximately RM425,802,347 Of Bank Borrowings Owing To The Secured Bank Creditors (Including The Borrowings Which Have Been Acquired By Business Focus Capital Sdn Bhd (“BF Capital”) And The Investors To Be Identified (“Investors”)) Into Up To RM50,092,000 Nominal Value Of 8% Redeemable Convertible Loan Stocks A (“RCLS A”) At The Conversion Rate Of RM8.50 Debt To RM1.00 Nominal Value Of RCLS A To Be Issued At 100% Of The Nominal Value; (c) Proposed Conversion Of Approximately RM33,200,664 Of Bank Borrowings Owing To Unsecured Bank Creditors Into Up To RM3,904,000 Nominal Value Of 8% Redeemable Convertible Loan Stocks B (“RCLS B”) At The Conversion Rate Of RM8.50 Debt To RM1.00 Nominal Value Of RCLS B To Be Issued At 100% Of The Nominal Value; (d) Proposed Conversion Of: (i) Approximately RM20,036,800 Yield On RM50,092,000 Nominal Value Of RCLS A At The Coupon Rate Of 8% Per Annum For Five (5) Years From The Date Of Issuance Of The RCLS A Into up to 3,180,444 New PSCI Shares At The Conversion Rate Of RM6.30 Yield Per Share At Par; and (ii) Approximately RM1,561,600 Yield On The RM3,904,000 Nominal Value Of RCLS B At The Coupon Rate Of 8% Per Annum For Five (5) Years From The Date Of Issuance Of The RCLS B Into up to 247,873 New PSCI Shares At The Conversion Rate Of RM6.30 Yield Per Share At Par. (Collectively referred to as the “Proposed Debt Restructuring”) “THAT subject to and contingent upon the passing of Ordinary Resolution 2 and subject to the approvals of the relevant authorities being obtained, including the approval-in-principle of the Bursa Malaysia Securities Berhad (“Bursa Malaysia”) and subject to the Restated Debt Restructuring Agreement dated 6 December 2000 between the Company, certain of its subsidiaries and the secured and unsecured bank creditors of the PSCI Group under the Proposed Debt Restructuring (“Bank Creditors”), the Directors of the Company be and are hereby authorised and empowered to give effect to the Proposed Debt Restructuring as follows: (i) convert up to RM28,624,427 of bank borrowings from BIMB into up to 4,543,560 new PSCI Shares at the conversion price of RM6.30 debt per PSCI Share at par, credited as fully paid-up which will be issued to BIMB for the settlement of the outstanding debt owing to BIMB and the 4,543,560 new PSCI Shares arising from the conversion of debt into PSCI Shares credited as fully paid to be issued upon allotment and issue, rank pari passu in all respects with the existing PSCI Shares, except that they shall not be entitled to any dividends, rights and/or other distributions, the entitlement date of which is prior to the date of allotment of the new PSCI Shares; (ii) convert up to RM425,802,347 of bank borrowings from the secured Bank Creditors (including the borrowings which have been acquired by BF Capital and the Investors) into up to RM50,092,000 nominal value RCLS A at the conversion rate of RM8.50 debt into RM1.00 nominal value RCLS A in the Company and convertible for a period of five (5) years from the date of issue of the RCLS A at a coupon rate of 8% per annum, where the coupon payment will be paid upfront by way of conversion into new PSCI Shares at the conversion rate of RM6.30 debt into 3,180,444 new PSCI Shares at par. The RCLS A shall be secured and constitute direct, unconditional and secured obligations of the Company, ranking pari passu and rateably without discrimination or preference with all other present and future secured obligations of the Company. The salient terms and conditions governing the RCLS A are found in Section 2.1.1 of the Circular to the shareholders of the Company dated 30 April 2004 (“Circular”). (iii) convert up to RM33,200,664 of bank borrowings from unsecured Bank Creditors into up to RM3,904,000 nominal value RCLS B at the conversion rate of RM8.50 debt into RM1.00 nominal value RCLS B in the Company and convertible for a period of five (5) years from the date of issue of the RCLS B at a coupon rate of 8% per annum, where the coupon payment will be paid upfront by way of conversion into new PSCI Shares at the conversion rate of RM6.30 debt into 247,873 new PSCI Shares at par. The RCLS B shall be unsecured and constitute direct, unconditional and unsecured obligations of the Company, ranking pari passu and rateably without discrimination or preference with all other present and future unsecured obligations of the Company. The salient terms and conditions governing the RCLS B are found in Section 2.1.1 of the Circular. (iv) execute a Trust Deed pertaining to the RCLS A and RCLS B between the Company and the trustee appointed by the Company. AND THAT the Directors, on behalf of the Company, be hereby authorised to do all acts and things they consider necessary or expedient in the best interest of the Company to give effect to the said Proposed Debt Restructuring with full power and discretion to assent to any conditions, modifications, variations and/or amendments deemed necessary as may be required by the relevant authorities AND THAT the Directors, on behalf of the Company, subject to the approval of the relevant authorities, be hereby further authorised to approve any amendment or variation to the Proposed Debt Restructuring or the structure of the RCLS or the terms and conditions of the RCLS including but not limited to classes of RCLS, security arrangement, conversion price or repayment profile or the Trust Deed or any part thereof and to take all such steps and decisions and to execute, sign and deliver on behalf of the Company all such documents and do all such acts as they may in their absolute discretion deem necessary or expedient in order to finalise, implement and give full effect to and complete the Proposed Debt Restructuring with power to approve and assent to any amendment, alteration, modification and/or variation to the Proposed Debt Restructuring or the terms and conditions of the RCLS or the Trust Deed and/or such relevant documents (but always subject to the approval of the relevant authorities) provided always that the Directors shall at all times act in the best interests of the Company.” ORDINARY RESOLUTION 2 - PROPOSED RESTRICTED OFFER FOR SALE (a) Proposed Restricted Offer For Sale Of The Rights To The Allotment Of Up To 4,543,560 New PSCI Shares To Be Issued Pursuant To The Proposed Debt Restructuring By BIMB At An Indicative Offer Price Of RM6.30 Per Share On A Renounceable Basis To The Shareholders Of PSCI In Proportion To Their Shareholdings In PSCI Held At A Date To Be Determined; (b) Proposed Restricted Offer For Sale Of The Rights To The Allotment Of Up To 67,584,444 PSCI Shares Upon Conversion Of The RCLS A By The Secured Bank Creditors, BF Capital And The Investors At An Indicative Offer Price Of RM6.30 Per Share On A Renounceable Basis To The Shareholders Of PSCI In Proportion To Their Shareholdings In PSCI Held At A Date To Be Determined; And (c) Proposed Restricted Offer For Sale Of The Rights To The Allotment Of Up To 5,267,302 PSCI Shares Upon Conversion Of The RCLS B By The Unsecured Bank Creditors At An Indicative Offer Price Of RM6.30 Per Share On A Renounceable Basis To The Shareholders Of PSCI In Proportion To Their Shareholdings In PSCI Held At A Date To Be Determined. (Collectively referred to as the “Proposed Restricted Offer For Sale”) “THAT subject to and contingent upon the passing of Ordinary Resolution 1 and subject to the approvals of the relevant authorities being obtained, including the Directors of the Company, BF Capital, Bank Creditors and the Investors are hereby authorised and empowered to undertake and give effect to the Proposed Restricted Offer For Sale as follows: (i) pursuant to the issuance of up to 4,543,560 PSCI Shares to BIMB for the conversion of outstanding debt owing to BIMB of up to RM28,624,427 and in the event BIMB elects to participate in the Proposed Restricted Offer For Sale, the Company will undertake to make a restricted offer for sale of up to 4,543,560 new PSCI Shares on a renounceable basis on behalf of BIMB to the existing shareholders of the Company in proportion to their shareholdings in the Company within a period of one (1) month after the issuance of the Shares. (ii) pursuant to the issuance of up to RM50,092,000 nominal value of RCLS A and up to RM3,904,000 nominal value of RCLS B to the secured and unsecured Bank Creditors, respectively, BF Capital and the Investors and in the event the holders of the RCLS A and the RCLS B, respectively, elect to participate in the Proposed Restricted Offer For Sale, the Company will arrange for a restricted offer for sale of up to RM50,092,000 nominal value of RCLS A and up to RM3,904,000 of RCLS B on a renounceable basis to the existing shareholders of the Company in proportion to their shareholdings in the Company within a period of one (1) month after the issuance of the RCLS A and the RCLS B, respectively. AND THAT the Proposed Restricted Offer For Sale will be offered to the shareholders of PSCI whose names appear in the Record of Depositors, a record provided by the Malaysian Central Depository Sdn Bhd (“MCD”) to the Company under Chapter 24.0 of the Rules of the MCD on Book Closure Date AND THAT the Directors, on behalf of the Company, be hereby authorised to do all acts and things they consider necessary or expedient in the best interest of the Company to give effect to the said Proposed Restricted Offer For Sale with full power and discretion to assent to any conditions, modifications, variations and/or amendments deemed necessary as may be required by the relevant authorities AND THAT the Directors, on behalf of the Company, subject to the approval of the relevant authorities, be hereby further authorised to approve any amendment or variation to the Proposed Restricted Offer For Sale and to take all such steps and decisions and to execute, sign and deliver on behalf of the Company all such documents and do all such acts as they may in their absolute discretion deem necessary or expedient in order to finalise, implement and give full effect to and complete the Proposed Restricted Offer For Sale with power to approve and assent to any amendment, alteration, modification and/or variation to the Proposed Restricted Offer For Sale and/or such relevant documents (but always subject to the approval of the relevant authorities) provided always that the Directors shall at all times act in the best interests of the Company.” BY ORDER OF THE BOARD Company Secretary DATO’ R. RAJAKUMARAN A/L M. RAJADURAI (MAICSA 7003699) Dated 30 April 2004 Kuala Lumpur Notes: 1. A member of the Company entitled to attend and vote at the meeting is entitled to appoint a proxy to attend and vote in his stead. A proxy need not be a member of the Company. 2. 3. The instrument appointing a proxy shall be in writing under the hand of the appointer or of his attorney duly authorised in writing. If the appointer is a Corporation, the Form of Proxy must be executed under its Common Seal or under the hand of its officer or attorney duly authorised. The instrument appointing a proxy must be deposited at the Registered Office of the Company, 3rd Floor, Bangunan Ming, Jalan Bukit Nanas, 50250 Kuala Lumpur not less than forty-eight (48) hours before the time appointed for holding the meeting.