Statistics 101 - Wharton Statistics Department

advertisement

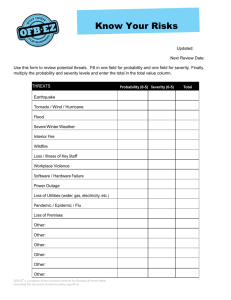

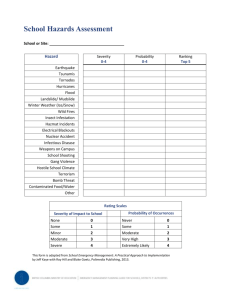

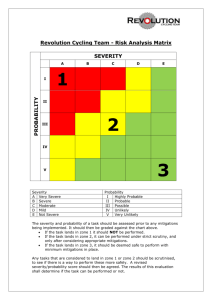

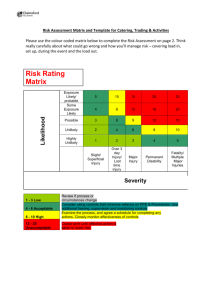

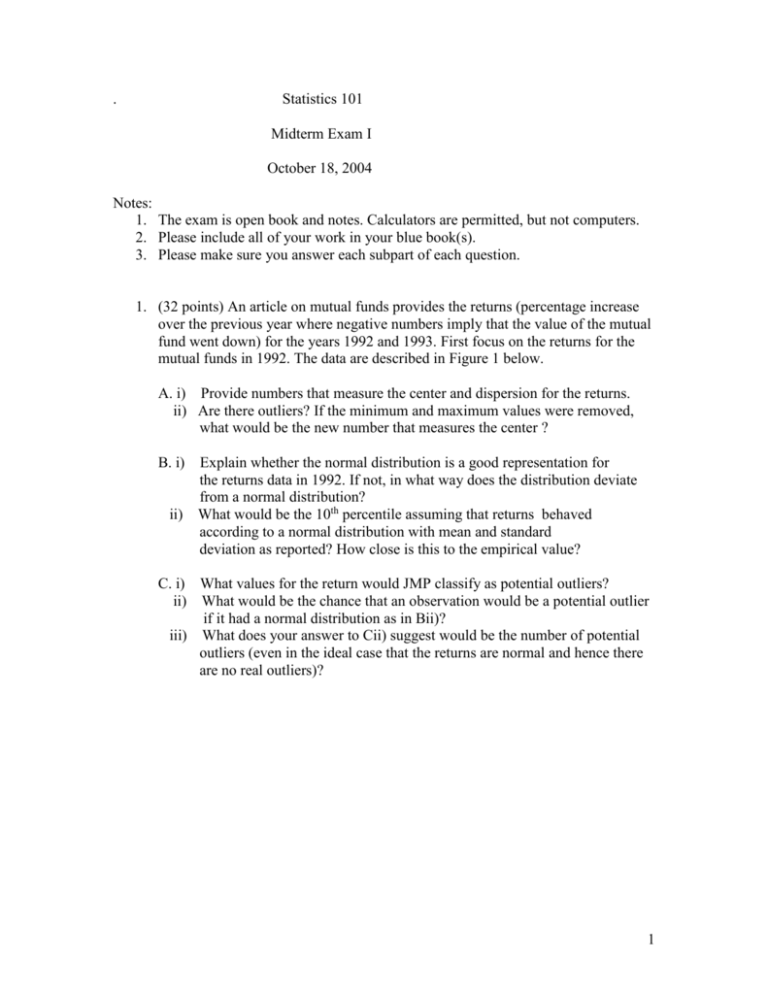

. Statistics 101 Midterm Exam I October 18, 2004 Notes: 1. The exam is open book and notes. Calculators are permitted, but not computers. 2. Please include all of your work in your blue book(s). 3. Please make sure you answer each subpart of each question. 1. (32 points) An article on mutual funds provides the returns (percentage increase over the previous year where negative numbers imply that the value of the mutual fund went down) for the years 1992 and 1993. First focus on the returns for the mutual funds in 1992. The data are described in Figure 1 below. A. i) Provide numbers that measure the center and dispersion for the returns. ii) Are there outliers? If the minimum and maximum values were removed, what would be the new number that measures the center ? B. i) Explain whether the normal distribution is a good representation for the returns data in 1992. If not, in what way does the distribution deviate from a normal distribution? ii) What would be the 10th percentile assuming that returns behaved according to a normal distribution with mean and standard deviation as reported? How close is this to the empirical value? C. i) What values for the return would JMP classify as potential outliers? ii) What would be the chance that an observation would be a potential outlier if it had a normal distribution as in Bii)? iii) What does your answer to Cii) suggest would be the number of potential outliers (even in the ideal case that the returns are normal and hence there are no real outliers)? 1 Figure 1 Returns of Mutual Funds in 1992 Distributions Return 92 60 50 40 30 20 10 0 -10 -20 -30 -40 -50 -60 .001 .01 .05.10 .25 .50 .75 .90.95 .99 .999 -4 -3 -2 -1 0 1 2 3 4 Normal Quantile Plot Quantiles 100.0% 99.5% 97.5% 90.0% 75.0% 50.0% 25.0% 10.0% 2.5% 0.5% 0.0% Maximum Quartile Median Quartile Minimum 57.83 39.63 22.73 15.96 9.96 7.94 5.53 0.038 -10.37 -21.63 -60.71 Moments Mean Std Dev Std Err Mean upper 95% Mean lower 95% Mean N 7.6917873 7.9009323 0.2017935 8.0876081 7.2959666 1533 2 D. The mean and standard deviation of the returns in 1993 are found to be 14.86 and 13.68 respectively. The correlation between 1992 and 1993 returns is -.2835. i) What fraction of the variability of returns in 1993 is accounted for by the returns in 1992? ii) What would be the predicted return in 1993 for the most promising mutual fund in 1992 (i.e., the one with return of 57.83%)? 2. (24 points) Seismology data collected from all over the world show quite clearly that the average number of shocks per year, Y, is related to the severity, X, of earthquakes in units on the Richter scale. The following data are collected in southern California: X: 4.0 4.5 5.0 5.5 6.0 6.5 7.0 Y:33.0 11.5 3.4 1.4 0.5 0.2 .09 Refer to Figure 2a below in answering Part A. A regression is run to predict the number of shocks per year Y, from the severity, X. A. i) What is the predicted number of shocks per year at a severity level of 8.0 on the Richter scale? ii) Be specific as to the output you are relying on in commenting on whether this analysis is appropriate 3 Figure 2a Shocks per year by severity Biv a riate Fit of Shoc ks /yr By Se v e rity Shocks/yr 40 30 20 10 0 3 4 5 6 7 8 Severity Linear Fit Linea r Fit Shocks/yr = 55.960357 - 8.8735714 Severity Summary of Fit RSquare RSquare Adj Root Mean Square Error Mean of Response Observations (or Sum Wgts) 0.628745 0.554494 8.067918 7.155714 7 Para me te r Estimate s Term Intercept Severity Estimate Std Error t Ratio 55.960357 -8.873571 17.04659 3.049386 3.28 -2.91 Prob>| t| 0.0219 0.0334 Residual 15 10 5 0 -5 -10 3 4 5 6 7 8 Severity B. Figure 2b provides the output for predicted natural log of frequency versus severity. i) What is the predicted number of shocks per year at a severity level of 8? ii) How likely would it be for the number of shocks per year to exceed .0125 (that is once in 80 years) at a severity level of 8? Hint: If the number of shocks per year is to exceed .0125, what does that imply about the natural logarithm of the number of shocks per year? 4 Figure 2b Natural log of Shocks per year by severity Biv a riate Fit of Shoc ks /yr By Se v e rity Shocks/yr 40 30 20 10 0 3 4 5 6 7 8 Severity Transformed Fit Log Tra ns formed Fit Log Log(Shocks/yr) = 11.293809 - 1.9809894 Severity Summary of Fit RSquare RSquare Adj Root Mean Square Error Mean of Response Observations (or Sum Wgts) 0.99676 0.996112 0.133641 0.398367 7 Para me te r Estimate s Term Intercept Severity Estimate Std Error t Ratio 11.293809 -1.980989 0.282368 0.050512 40.00 -39.22 Prob>| t| <.0001 <.0001 Fit Me as ure d on Original Sc a le Residual Sum of Squared Error Root Mean Square Error RSquare Sum of Residuals 16.288177 1.8048921 0.9814197 3.8832776 5 4 3 2 1 0 -1 3 4 5 6 7 8 Severity C i) Which model fits better, the one in part A or in part B? Write a few sentences supporting your answer. ii) Are you satisfied with that model you chose in part Ci)? If yes, explain. If not, indicate what modification(s) you would make and why. 5 3. (28 points) An analysis is performed to predict the price of diamonds (in Singapore dollars). Clearly the price of a diamond depends on its weight. A regression is run with this aim. The results appearing in Figure 3a. Ai) Explain carefully what the value of the slope means in the context of this problem. ii) Based on the results below, do you have any issues with the analysis? Be specific. Bi) Someone is selling a diamond that weighs .25 carats for $700. Is this a good deal? Explain. ii) Based on the results below (and the assumption of normality), what proportion of diamonds of .25 carats would sell for more than $700? Figure 3a Price of diamonds versus weight Price (Singapore dollars) Bivariate Fit of Price (Singapore dollars) By Weight (carats) 1100 1000 900 800 700 600 500 400 300 200 .1 .15 .2 .25 .3 .35 Weight (carats) Linear Fit Linear Fit Price (Singapore dollars) = -259.6259 + 3721.0249 Weight (carats) Summar y of Fit RSquare RSquare Adj Root Mean Square Error Mean of Response Observations (or Sum Wgts) 0.978261 0.977788 31.84052 500.0833 48 Parameter Estimates Term Intercept Weight (carats) Estimate Std Error t Ratio -259.6259 3721.0249 17.31886 81.78588 -14.99 45.50 Prob>| t| <.0001 <.0001 Residual 100 50 0 -50 -100 .1 .15 .2 .25 .3 .35 Weight (carats) 6 C. The price of diamonds depends not only on its size, but also on its clarity. The residuals are saved from the regression of Y (price) versus X (weight). These residuals are then analyzed below in Figure 3b by fitting Y (residuals) versus X (clarity). i) What would you expect the average residual to be for each level of clarity if clarity had no effect? ii) It is decided to adjust the prediction in the regression in Figure 3a either up or down by adding the average residual for the level of clarity. Would this be a reasonable thing to do if the average increase in price per unit increase in weight depended on clarity? Explain. D. Does the model that adjusts for clarity (by adding the average residual for the appropriate level of clarity) predict prices for diamonds more accurately than the model that ignores clarity? Explain. Figure 3b Residuals of the regression on Clarity Residuals Price (Singapore dollars) 2 Onew ay Analysis of Residuals Price (Singapore dollars) 2 By Clarity 100 50 0 -50 -100 High Low Middle Clarity Means and Std Dev iations Level High Low Middle Number Mean Std Dev Std Err Mean Lower 95% Upper 95% 13 14 21 36.105 -28.613 -3.276 20.1230 23.3127 17.4319 5.5811 6.2306 3.8040 23.95 -42.07 -11.21 48.27 -15.15 4.66 7 4. (16 points) A survey is taken of 810 individuals, to see what age is the best to market to in promoting a new palm pilot. The results of the survey are summarized below in Figure 4a. A. i) Based on the results reported in Figure 4a, explain briefly what age group appears to be the best target market in terms of having the largest proportions of buyers. ii) It is realized that the survey was done randomly within age group, but in the upper age group more individuals were chosen than reflected in the population. In fact, the low aged people represent 40%, the middle aged 40% and upper aged 20% of the population. If the criterion to be used is the proportion of buyers in each age group, how, if at all, would your answer to i) change? iii) If the criterion to be used is number of potential buyers in the age group, what would you suggest is the best test market taking into account the true population proportions for the age groups as indicated in ii). Figure 4a. Age versus likelihood of buying Contingency Table Age Buy Count NO YES Total % Col % Row % LOW 208 65 25.68 8.02 35.02 30.09 76.19 23.81 MIDDLE 208 72 25.68 8.89 35.02 33.33 74.29 25.71 UPPER 178 79 21.98 9.75 29.97 36.57 69.26 30.74 594 216 73.33 26.67 273 33.70 280 34.57 257 31.73 810 8 B. It is decided to get a more refined look at who is likely to purchase the new palm pilot, income should also be included in the analysis. Figures 4b, 4c and 4d redo the analysis for low income, middle income and upper income respectively. Assume as in Ai) that the criterion is to find the subpopulation that has the largest proportion of potential buyers. Also ignore the fact that the survey might have favored certain age groups over other age groups. Comment on the best age group within each of the three income classes. Compare your answers in B with Ai) and explain whether income is changing the picture and why. Be specific. Figure 4b. Age versus likelihood of buying for low income individuals Contingency Table Age Buy Count NO YES Total % Col % Row % LOW 130 32 43.05 10.60 51.18 66.67 80.25 19.75 MIDDLE 87 13 28.81 4.30 34.25 27.08 87.00 13.00 UPPER 37 3 12.25 0.99 14.57 6.25 92.50 7.50 254 48 84.11 15.89 162 53.64 100 33.11 40 13.25 302 9 Figure 4c. Age versus likelihood of buying for middle income individuals Age Contingency Table Buy Count NO YES Total % Col % Row % LOW 73 25 23.93 8.20 30.17 39.68 74.49 25.51 MIDDLE 88 23 28.85 7.54 36.36 36.51 79.28 20.72 UPPER 81 15 26.56 4.92 33.47 23.81 84.38 15.63 242 63 79.34 20.66 98 32.13 111 36.39 96 31.48 305 Figure 4d. Age versus likelihood of buying for upper income individuals Contingency Table Buy Count NO Total % Col % Row % LOW Age MIDDLE UPPER 5 2.46 5.10 38.46 33 16.26 33.67 47.83 60 29.56 61.22 49.59 98 48.28 YES 8 3.94 7.62 61.54 36 17.73 34.29 52.17 61 30.05 58.10 50.41 105 51.72 13 6.40 69 33.99 121 59.61 203 10