directors and paye

advertisement

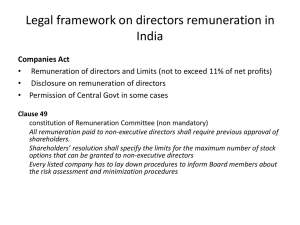

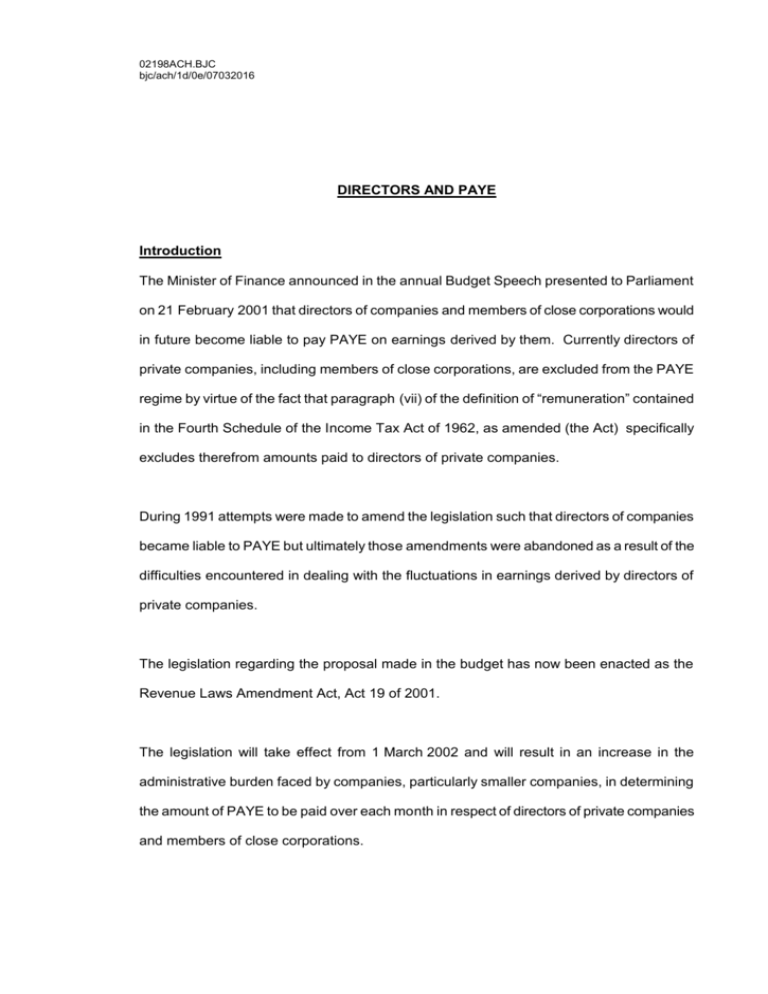

02198ACH.BJC bjc/ach/1d/0e/07032016 DIRECTORS AND PAYE Introduction The Minister of Finance announced in the annual Budget Speech presented to Parliament on 21 February 2001 that directors of companies and members of close corporations would in future become liable to pay PAYE on earnings derived by them. Currently directors of private companies, including members of close corporations, are excluded from the PAYE regime by virtue of the fact that paragraph (vii) of the definition of “remuneration” contained in the Fourth Schedule of the Income Tax Act of 1962, as amended (the Act) specifically excludes therefrom amounts paid to directors of private companies. During 1991 attempts were made to amend the legislation such that directors of companies became liable to PAYE but ultimately those amendments were abandoned as a result of the difficulties encountered in dealing with the fluctuations in earnings derived by directors of private companies. The legislation regarding the proposal made in the budget has now been enacted as the Revenue Laws Amendment Act, Act 19 of 2001. The legislation will take effect from 1 March 2002 and will result in an increase in the administrative burden faced by companies, particularly smaller companies, in determining the amount of PAYE to be paid over each month in respect of directors of private companies and members of close corporations. 02198ACH.BJC bjc/ach/1d/0e/07032016 Page 2 Two Categories of Director It is important, in my view, to distinguish between two main categories of directors namely, the so-called salaried director who is in reality in employment, but because of the current definition of “remuneration” is not liable to pay PAYE on a monthly basis. The second category relates to those persons who can be regarded as the owner managers of the company or close corporation and whose earnings are determined only once the financial statements of the entity in question are finalised by the accountants or auditors. Management Service Companies Many of the large groups in South Africa formed management service companies such that the directors of the group were remunerated by the management services company so that the directors could obtain the cashflow advantage of not having to pay PAYE on a monthly basis. This was in accordance with the strict provisions of the legislation in force at the time. It is possible in my view that many of these group management services companies will be collapsed as they will no longer confer any advantage on the directors in question. Definition of Remuneration The legislation enacted on 27 July 2001 seeks to deal with the PAYE consequences facing both salaried directors and owner/manager directors. The exclusion from remuneration contained in paragraph (vii) referred to above will be withdrawn with effect from 1 March 2002. The removal of paragraph (vii) from the exclusions contained in the definition of “remuneration” means that any amount of salary, allowances or indeed any fringe benefits made available to a director of a company will, with effect from 1 March 2002, become liable 02198ACH.BJC bjc/ach/1d/0e/07032016 Page 3 to PAYE. The distinction between directors and normal employees will therefore fall away from 1 March next year. Owner/Manager Director The legislation now contains a new paragraph namely, paragraph 11C, introduced to deal with the PAYE consequences facing the owner/manager director. The owner/manager category of directors is more difficult to deal with in that generally such persons do not receive a monthly salary. Such persons will draw an amount out of the company each month on loan account. When the financial statements are finalised the actual salary and bonuses etc will be determined. Paragraph 11C of the Fourth Schedule prescribes a formula that must be used in determining the amount of remuneration to be subject to PAYE in the hands of such directors. Deemed Remuneration The law prescribes that every director of a private company shall be deemed to have received from that private company during any month an amount of remuneration determined in accordance with the formula: Y= where - T N 02198ACH.BJC bjc/ach/1d/0e/07032016 Page 4 Y represents the amount to be determined T represents the amount of remuneration paid to that director by the company in respect of the last year of assessment after deducting therefrom any contribution made by the employee to any pension fund or retirement annuity fund. This amount generally represents the amount that would normally be subjected to PAYE in the hands of an employee. In addition any amounts paid to the director in respect of loss of office or lump sums payable by any pension fund, retirement annuity fund or provident fund or amounts received in commutation of amounts due under any contract of employment shall be disregarded in determining T. Any amounts that have been included in the director’s previous assessment as a result of the exercise of options in terms of section 8A shall also be ignored. N represents the number of completed months which the director was employed during the previous year of assessment by the company in question. By virtue of the fact that the annual financial statements of the company or close corporation may not have been finalised and hence the director has not been assessed for the previous year of assessment, the amount referred to as T in the formula will be based on the balance of the remuneration paid to the director in respect of the year of assessment preceding that last year of assessment increased by an amount equal to 20%. In the event that the preceding year of assessment has not yet been assessed the company will be obliged to request a directive from the Commissioner as to the quantum of remuneration which is deemed to have been received for the purposes of paragraph 11C. An example in respect of an owner/manager director is set out below : Example : Owner/Manager Director Assume income for tax year 1 March 2001 to 28 February 2002 is not yet finalised. 02198ACH.BJC bjc/ach/1d/0e/07032016 Page 5 Director’s remuneration for tax year 1 March 2000 to 28 February 2001 amounted to R300 000. Calculate the amount on which PAYE must be deducted for the tax year 1 March 2002 to 28 February 2003. Income per last year of assessment Increase by 20% Deemed remuneration for 2003 R300 000 R 60 000 R360 000 T N R360 000 = 12 = R 30 000 Y= Apply the formula : PAYE would be required to be deducted, according to the tables, from an amount of R30 000 per month. Registration as Employer Those companies that are not currently registered as employers for employee’s tax purposes by virtue of the fact that amounts are only paid to the directors of such companies will be obliged to register for PAYE purposes with effect from 1 March 2002. The administrative burden faced by such companies will increase in that calculations will have to be done in conformity with the formula dealt with above so as to arrive at the amount of remuneration liable to PAYE on a monthly basis. Salaried Director 02198ACH.BJC bjc/ach/1d/0e/07032016 Page 6 The one concern that must be raised regarding the legislation is the fact that a salaried director may, in certain circumstances, be worse off than a normal employee. If one assumes that a salaried director is in receipt of a salary as well as an incentive bonus, dependent upon the individual’s performance and also the company’s financial results and such person received a bonus say in the 2002 tax year it will be necessary that PAYE be deducted from the amount of salary actually paid to the director in question with effect from 1 March 2002. In addition thereto PAYE will, with effect from 1 March 2002, be required to be deducted from the bonus paid to the individual in the 2002 tax year even though there is no certainty that such person will receive a bonus in the 2003 tax year. The Commissioner has indicated that where it is believed that the director’s remuneration will be lower than the previous year’s remuneration a directive can be obtained in accordance with the general provisions contained in the Fourth Schedule of the Act. This will result in an increase in the administrative burden faced by both employers and the Commissioner: South African Revenue Service. This may not be a practical solution to the difficulties identified earlier. The new provisions are best illustrated by way of examples which are set out below. Example : Salaried Director Tax Year 1 March 2001 to 28 February 2002 Salary Bonus Gain on share options exercised Gross remuneration Less: pension contributions Taxable income R120 000 R 90 000 R 50 000 R260 000 R 9 000 R251 000 Tax Year 1 March 2002 to 28 February 2003 Assume salary of R144 000 for the year, paid at a rate of R12 000 per month. Salary Bonus Gross remuneration Less: pension contributions Taxable income R144 000 R NIL R144 000 R 10 800 R133 200 02198ACH.BJC bjc/ach/1d/0e/07032016 Page 7 PAYE must be deducted from the salary paid to the director each month after deducting therefrom the allowable pension contributions. Salary, net of pension, per month subject to PAYE thus : R11 100. Paragraph 11C applies : Deemed monthly remuneration T N R201 000 * = 12 Y= Actual remuneration per month Deemed remuneration liable to PAYE Total amount subject to PAYE each month R16 750 R11 100 R 5 650 R16 750 * R251 000 less R50 000 in respect of the gain on share options exercised. The salaried director will be subject to the normal rules pertaining to PAYE as well as paragraph 11C which deems certain amounts to be remuneration for the purposes of calculating the PAYE that is to be deducted and paid over to SARS each month. By virtue of the fact that a bonus was paid in the 2002 tax year this will result in the amount of remuneration being inflated in the 2003 tax year particularly where the director does not in fact receive a bonus in that year. In this regard the salaried director is in fact worse off than been a normal employee and should in my view seriously consider relinquishing both in fact and in law their position as a director so as to prevent this from happening in the future. In the event that the person resigns as a director PAYE will be required to be deducted from an amount of R11 100,00 per month only and in the event that a bonus is ever paid PAYE would then be deducted from the amount as and when it is paid as opposed to in advance of the amount being received. 02198ACH.BJC bjc/ach/1d/0e/07032016 Page 8 The future of Provisional Tax All directors of private companies and members of close corporations are required to be registered for provisional tax purposes and in the case of a salaried director it would appear that no provisional tax would be required to be paid in the event that the salaried director does not receive investment income in excess of the exempt amounts such as interest, rentals or other forms of income not subject to PAYE. The owner/manager director will in all likelihood remain liable to pay provisional tax at the various dates, that is in August and February of each year. Provisional tax will remain payable on actual income whereas PAYE would have been deducted from historic earnings as opposed to current earnings. It is clear though that companies and close corporations will need to review their payroll systems so as to ensure that they can comply with the new provisions that come into force on 1 March 2002 and that they can perform the necessary calculations required in order to determine the amount of PAYE to be paid over for directors on a monthly basis. Skills Development Levy By virtue of the fact that the definition of “remuneration” will be amended from 1 March 2001, all amounts subjected to PAYE will from that date also become liable to the skills development levy. This means that employers will incur additional costs in that the skills development levy of 1% will be required to be paid over on amounts of remuneration paid to the company director and member of a close corporation. UIF Contributions It must be noted that the contributions payable to the Unemployment Insurance Fund are under review. It is more than likely that the administration of the UIF will pass over to the Commissioner: South African Revenue Service. More importantly the definition of 02198ACH.BJC bjc/ach/1d/0e/07032016 Page 9 “remuneration” contained in the Fourth Schedule of the Act will be relied upon as the term to be used in determining contributions payable to the UIF. It is also intended that UIF will become payable on remuneration payable to directors up to a maximum amount per annum. This will also go to increase the cost incurred by an employer in the future. The company would be obliged to pay over 1% of remuneration payable to directors and members of close corporations up to a maximum ceiling of remuneration per annum. In addition the directors of companies will themselves be required to contribute 1% of remuneration to the UIF also. Conclusion It is important that directors of companies and members of close corporations are aware that the changes dealt with above will take effect from 1 March 2002. Directors and their companies will therefore need to manage their cashflows so as to ensure that the companies that they manage and own are in a position to pay the PAYE over on a monthly basis, failing which interest and penalties will become payable. Beric Croome Director: EDWARD NATHAN & FRIEDLAND (PTY) LTD