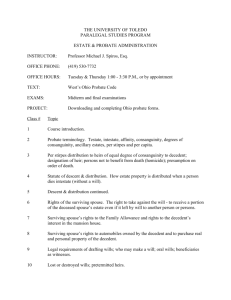

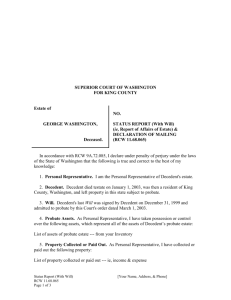

File

advertisement