Division of Business & Economic Development Accelerated Degree

advertisement

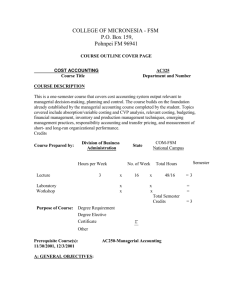

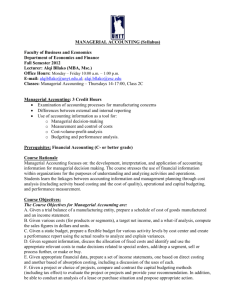

Division of Business & Economic Development Accelerated Degree Completion Program (ADCP) Course Syllabus – FALL 2011 Course Credit Meeting Time Classroom Faculty Office Hours Phone Textbook E-mail Managerial Accounting – ADCP 413 / X 3 Hours 6:00 p.m. - 10:00 - Thursday WWH Austin Emeagwai, CPA, Ph.D. 915 East McLemore Ave, Suite 201 (Across from Stax Muesum) Posted (901) 672-8420 Ext. 3 Accounting: What the Numbers Mean: Marshall – 9th edition (REQUIRED) austin_emeagwai@loc.edu or austin.Emeagwai@gmail.com COURSE DESCRIPTION: This course covers the study of accounting as it relates to managerial control. Topic studies include financial statement analysis, cost control, budgeting and quantitative accounting techniques for decision-making in management. STATEMENT OF COMPETENCIES: At the completion of this course, students should be able to: Understand how fixed and variable costs behave and how to use them to predict costs. Prepare and analyze income statement using the contribution format. Explain how changes in activity affect contribution margin an net operating income. Compute breakeven point in quantity and dollars Prepare and interpret a cost volume-profit (CVP) graph. Determine the level of sales desired to achieve a given level of profit. Determine the margin of safety and explain it significance. Explain how variable costing differs from absorption costing. Prepare income statements using both variable and absorption costing. Understand the advantaged and disadvantages of both variable and absorption costing. Identify relevant and irrelevant costs and benefits in a decision. Prepare an analysis showing whether a product line or a business segment should be dropped or retained. Prepare a make or buy analysis Discuss the recent financial statement fraud including Enron, Madoff Securities, MCI WorldCom, Explain why it is important for students to maintain strong ethical values Understand how to read and interpret financial statements and the limitations of financial statements. Explain comparative and common size ratios based on industry’s average. Understand most common fraud schemes including improper revenue recognition, improper disclosures, and manipulation of income, expenses, assets and liabilities. CLASS FORMAT: Class format includes lectures, discussions, interviews, debates, multimedia presentations, and expert guest speakers. USE OF TECHNOLOGY: Hardware and software use will include: Computers running Windows XP, Microsoft Word and PowerPoint for typing cases and presentation. The Internet will be used for researching law cases. E-mail and Internet chat will be used for communication. I have made course supplements available on-line on my web site. Please visit my web site periodically for updates. ADA STATEMENT If you have a documented disability as described by the Rehabilitation Act of 1973 (P.L. 933-112 Section 504) and Americans with Disabilities Act (ADA) that may require you to need assistance attaining accessibility to instructional content to meet course requirements, it is recommended that you contact the Director of Student Development in the Division of Student Affairs, Alma Hanson Student Center, Room 208 or call (901) 942-6205. It is then responsibility to contact and meet with the instructor. The Director of Student Development will assist you and the instructor in formulating a reasonable accommodation plan and provide support in developing appropriate accommodations for your disability. Course requirements will not be waived, but accommodations may be made to assist you in meeting the requirements. EXAM POLICY: No make-up exams will be given. A student's average will be calculated by doubling score earned on a future exam for any exam missed. ALL students must take the midterm and final exams. Failure to take the midterm or final exam will result in zero points for that exam. CONCEPT PAPER You are required to submit two type-written pages of the original article with 1 inch margin around. Paper should be double-spaced using 12 point Times New Roman font. The first page should be a synopsis of the original article. A synopsis is “a condensed version of a larger reading. A summary is not a rewrite of the original piece and does not have to be long nor should it be long. To write a summary, use your own words to express briefly the main idea and relevant details of the piece you have read. Your purpose in writing the summary is to give the basic ideas of the original reading. What was it about and what did the author want to communicate? While reading the original work, take note of what or who is the focus and ask the usual questions that reporters use: Who? What? When? Where? Why? How? Using these questions to examine what you are reading can help you to write the summary. Sometimes, the central idea of the piece is stated in the introduction or first paragraph, and the supporting ideas of this central idea are presented one by one in the following paragraphs. Always read the introductory paragraph thoughtfully and look for a thesis statement. Finding the thesis statement is like finding a key to a locked door. Frequently, however, the thesis, or central idea, is implied or suggested. Thus, you will have to work harder to figure out what the author wants readers to understand. Use any hints that may shed light on the meaning of the piece: pay attention to the title and any headings and to the opening and closing lines of paragraphs. In writing the summary, let your reader know the piece that you are summarizing. Identify the title, author and source of the piece. Remember: Do not rewrite the original piece. Keep your summary short. Use your own wording. Refer to the central and main ideas of the original piece. Read with who, what, when, where, why and how questions in mind. Do not put in your opinion of the issue or topic discussed in the original piece. Often, instructors ask students to put their opinions in a paragraph separate from the summary. Source: http://homepage.smc.edu/reading_lab/writing_a_summary.htm In the 2nd page, you are required to agree or disagree with the author’s opinion, by supporting or opposing the author’s idea. Finally, you are required to quote another expert that agrees or disagrees with your opinion. Please attach a copy of the article. Remember to cite other sources in your paper. GRADING CRITERIA – TOTAL POINTS PER PAPER- 30. Synopsis……………………………………………………………………… 10 points Citation, length, supporting article……………………………………………10 points Originality…………………………………………………………………… 5 points Supporting opinion…………………………………………………………. 5 points A minimum of 10 points will be deducted from all late papers COURSE GRADING: A high academic level will be maintained. Grades will be determined using the following factors: Attendance Exam 1 Points 10 100 Exam 2 100 Exam 3 100 3 Concept Papers (30 Points each) TOTAL 90 400 I will keep you informed of your grade during the semester. Complaints about points scored on assignments and quizzes will not be entertained if your paper is not presented to the instructor. LATENESS: Classes will begin on time. Please be in the classroom before the lecture starts. Entering the classroom late, disturbs the entire class, and shows lack of interest on the part of the late student. ATTENDANCE: Attendance is of paramount importance. Please schedule appointments and other engagements as not to conflict with class time. It is the responsibility of the student who was absent to check with another classmate or the instructor for assignments and materials covered. Being absent on the day homework was assigned is not an acceptable excuse for not turning in your assignment on time. If you participate in extra-curricular activities that may take you away from campus, please arrange to turn your assignment (s) in on time, or take any necessary quizzes or exams. WORK HABITS: Assignments, project or exams will be graded for English usage, neatness, clarity and accuracy. Credit will not be given for assignments not turned in on time. Cheating or plagiarism will result in having your grade in this course reduced at the discretion of the instructor. STUDENT AND FACULTY RESPONSIBILITIES: It is the responsibility of the student to familiarize himself or herself with the academic dishonesty policy of LeMoyne-Owen College. By enrolling in this class, you agree to observe all student responsibilities described in that document. By teaching this course, I have agreed to observe all faculty responsibilities described in the faculty handbook. If you disagree with the faculty on any issue, please present your complain in a professional and dignified manner first to the instructor. COURSE SCHEDULE WEEK ONE Chapter 12 - Managerial Accounting & Cost Profit Relationships Review all Chapter 12 Multiple Choice Questions WEEK TW0 Chapter 13 - Cost Accounting and Reporting Systems Review all Chapter 13 Multiple Choice Questions Submit Concept Paper #1 EXAM 1 WEEK THREE Chapter 14 - Cost Analysis for Planning Review all Chapter 14 Multiple Choice Questions Submit Concept Paper # 2 EXAM 2 WEEK FOUR Chapter 15 - Cost Accounting for Control Review all 15 Multiple Choice Questions Submit Concept Paper # 3 Exam 3 WEEK FIVE Chapter 16 - Financial Statement Analysis - Comprehensive CHAPTER OUTLINE - 12 I. Managerial Accounting Contrasted to Financial Accounting A. The Management Process 1. Variety of firm's objectives 2. Planning and Control B. Differences Between Financial and Managerial Accounting 1. Future orientation 2. Breadth of focus 3. Application of Generally Accepted Accounting Principles II. Cost Classifications A. Relationship of Cost to Volume of Activity 1. Cost behavior patterns a. Variable cost b. Fixed cost c. Mixed cost 2. Variable costs as activity changes a. Change in total as activity changes b. Constant per unit 3. Fixed costs as activity changes a. Fixed in total as activity changes b. Fixed per unit - never unitize fixed costs! III. Applications of Cost-Volume-Profit Analysis A. Cost Behavior Pattern: The Key 1. Assumptions a. Relevant range b. Linearity B. Estimating Cost Behavior Patterns 1. Scattergram 2. High-low method 3. Cost formula _____________________________________ CHAPTER OUTLINE - 13 I. Introduction A. Why Budgets are Useful B. Definition of Performance Reporting II. Cost Classifications A. Relationship of Cost to Volume of Activity 1. Variable cost 2. Fixed cost 3. Mixed cost B. According to a Time-Frame Perspective 1. Committed cost 2. Discretionary cost III. Budgeting A. The Budgeting Process in General 1. Usefulness of budgets-A function of management philosophy a. Budget as a guide to action b. Top management dictated, or participative approach 2. Starting point for budget a. Actual performance of current period b. Zero-based budgeting approach B. The Budget Time Frame 1. Single period 2. Multi-period, rolling budget 3. Different periods for different budgets C. The Budgeting Process 1. Broad assumptions about the economy, industry, and company 2. Operating budget a. Sales/revenue forecast b. Purchases/production budget c. Operating expense budget(s) d. Income statement budget ___________________________________ CHAPTER OUTLINE - 14 I. Introduction A. Why Budgets are Useful B. Definition of Performance Reporting II. Cost Classifications A. Relationship of Cost to Volume of Activity 1. Variable cost 2. Fixed cost 3. Mixed cost B. According to a Time-Frame Perspective 1. Committed cost 2. Discretionary cost III. Budgeting A. The Budgeting Process in General 1. Usefulness of budgets-A function of management philosophy a. Budget as a guide to action b. Top management dictated, or participative approach 2. Starting point for budget a. Actual performance of current period b. Zero-based budgeting approach B. The Budget Time Frame 1. Single period 2. Multi-period, rolling budget 3. Different periods for different budgets C. The Budgeting Process 1. Broad assumptions about the economy, industry, and company 2. Operating budget a. Sales/revenue forecast b. Purchases/production budget c. Operating expense budget(s) d. Income statement budget e. Cash budget and the timing of cash receipts and cash payments f. Balance sheet budget 3. Sales forecast is the key D. Illustration of the Purchases/Production Budget 1. Using the cost of goods sold model 2. Based on gross profit ratio E. Cost of Goods Sold Budget Discussion F. Operating Expense Budget Challenges G. Budgeted Income Statement Discussion H. Illustration of the Cash Budget I. Budgeted Balance Sheet Discussion IV. Standard Costs A. Standards Defined - A Unit Budget Allowance B. Using Standard Costs 1. For planning and control 2. Focus may be on dollar amounts and/or quantities C. Developing Standards 1. Ideal, or engineered, standards 2. Attainable standards 3. Past experience standards D. Costing Products with Standard Costs 1. A budget for each component 2. Illustration of product cost development E. Other Uses of Standards V. Budgeting for Other Analytical Purposes A. Other Important Resources 1. Personnel time 2. Utilization of productive capacity B. Other Functional Areas e. Cash budget and the timing of cash receipts and cash payments f. Balance sheet budget 3. Sales forecast is the key D. Illustration of the Purchases/Production Budget 1. Using the cost of goods sold model 2. Based on gross profit ratio E. Cost of Goods Sold Budget Discussion F. Operating Expense Budget Challenges G. Budgeted Income Statement Discussion H. Illustration of the Cash Budget I. Budgeted Balance Sheet Discussion IV. Standard Costs A. Standards Defined - A Unit Budget Allowance B. Using Standard Costs 1. For planning and control 2. Focus may be on dollar amounts and/or quantities C. Developing Standards 1. Ideal, or engineered, standards 2. Attainable standards 3. Past experience standards D. Costing Products with Standard Costs 1. A budget for each component 2. Illustration of product cost development E. Other Uses of Standards V. Budgeting for Other Analytical Purposes B. Other Important Resources 1. Personnel time 2. Utilization of productive capacity B. Other Functional Areas __________________________________________ CHAPTER OUTLINE - 15 I. Cost Classifications A. Relationship of Cost to Volume of Activity 1. Variable cost 2. Fixed cost 3. Mixed cost B. According to a Time-Frame Perspective 1. Controllable cost 2. Noncontrollable cost II. Performance Reporting A. Characteristics of the Performance Report 1. Column headings 2. Variances a. Reasons for reporting variances b. Management by exception principle 3. Issues in the design of performance reports B. The Flexible Budget 1. Required to have a meaningful performance report III. Analysis of Standard Cost Variances A. Components 1. Quantity variance 2. Cost per unit of input variance B. Favorable/Unfavorable Label 1. Arithmetic difference relative to budget 2. Label not necessarily synonymous with "good" or "bad" C. Name of Variance Related to the Input 1. Raw materials--usage and price 2. Direct labor--efficiency and rate 3. Variable overhead--efficiency and spending D. General Model for Calculating Variances E. Variance Calculations Illustrated F. Analysis of Fixed Overhead Variance 1. Budget variance 2. Volume variance IV. Contribution Margin A. Contribution Margin Format Income Statement 1. Functional cost categories reclassified to cost behavior categories 2. Analyzing impact of volume changes on net income B. Expanded Contribution Margin Model 1. Use of model to answer "what if" questions C. Contribution Margin Ratio 1. Determine the change in contribution margin and net income for a change in revenues 2. Determine the revenue increase needed to cover an increase in fixed expenses 3. Used when per unit revenue and variable expense data are not available D. Sales Mix 1. Average contribution margin ratio E. Break-Even Point Analysis 1. Sales volume in units and/or dollars 2. Graphical presentation F. Operating Leverage 1. Indifference point CHAPTER OULINE - 16 I. Cost Classifications A. Classifications for Other Analytical Purposes 1. Differential cost 2. Allocated cost 3. Sunk cost 4. Opportunity cost II. Short Run Decision Analysis A. Relevant Costs B. Irrelevant Costs C. The Sell or Process Further Decision D. The Special Pricing Decision 1. Under Conditions of Idle Capacity 2. When Operating at Full capacity E. The Target Costing Question F. The Make or Buy Decision G. The Continue or Discontinue a Segment Decision H. Short-Term Allocation of Scarce Resources III. Capital Budgeting A. Investment Decision Special Considerations 1. Time Value of Money. 2. Involvement of Board of Directors B. Cost of Capital C. Capital Budgeting Techniques 1. Methods that use present value analysis a. Net present value b. Internal rate of return 2. Some analytical considerations a. Estimates b. Cash flows far into the future c. Timing of cash flows within the year d. Investments made over a period of time e. Income tax effect of cash flows from the project f. Working capital investment g. Least cost projects 3. Methods that do not use present value analysis a. Payback b. Accounting rate of return D. The Investment Decision E. Integration of Capital Budget with Operating Budgets http://www.elisteincartoons.com/?cat=108 Management Accounting, July 1990 Posted by Eli on September 1st, 2007