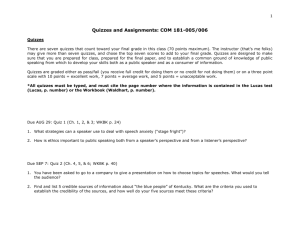

Advanced Placement Macroeconomics – Semester I

advertisement

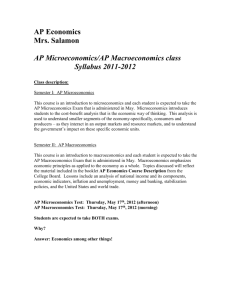

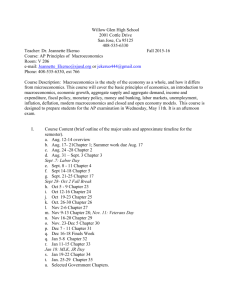

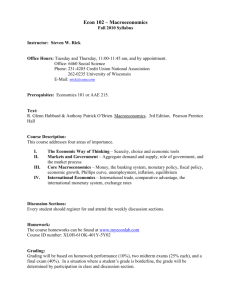

Advanced Placement Macroeconomics – Semester I Advanced Placement Microeconomics – Semester II Fact Sheet and Syllabus for 2010-2011 Instructor: Ms. Jennifer Nero (jnero@ransomeverglades.org – 305.460.8871) COURSE DESCRIPTION AND GOALS This course is divided into two main sub-disciplines of economics: macroeconomics and microeconomics. Its purpose is to develop your economic literacy and an understanding of the principles of economics. During the first semester the focus is on macroeconomics, the study of the principles of economics that offer a “birds-eye” view of the economy. This part of the course places emphasis on the study of national income and price determination; the financial sector; economic performance measures; stabilization policies; economic growth and international trade and finance. Some specific topics will include the macroeconomic problems of unemployment and inflation, as well as the fiscal and monetary problems that seek to address them. We will examine the banking system and the purpose of the Federal Reserve, and seek to unravel the role of interest rates. We will take a look at the effects of a globalized economy and how it impacts the international flows of capital. We will address these essential questions: What causes exchange rates to fluctuate? What influences the flow and quantity of imports and exports? Why do countries choose to specialize in the production of certain goods and services and then trade with others? Finally, we will examine competing macroeconomic theories – tenets held by the classical school and those held by the Keynesian school. During the second semester the focus is on microeconomics, which takes an up-close view of the individual decision-makers in the economy. Here are some of the essential questions we will seek to answer. How do consumers make decisions? What role does utility, sensitivity to price changes (elasticity), and income play in those decisions? How do producers make decisions about what to sell, how much to sell, and how to set prices? How do producers evaluate costs in their decision making in order to maximize profits? How do the various market structures – from highly competitive to monopolistic models – differ in their decisions about price and output determination? How can firms use resources most efficiently to minimize their costs and maximize their profits? Why do some workers earn higher wages than other? What role does the government play in addressing market failures? When and how does the public make choices about the production of “public goods.”? How do taxes create or hinder efficient economic outcomes. And, how is income distributed in our economy? In keeping with the school’s goal to “green” the campus, special attention will be given to the role of externalities or spillovers costs. These typically take the form of environmental impact. And to reduce our class’s carbon footprint, we will try to maximize use of online sources of news, blogs, and wikis. The reading assignments for this class will provide the background knowledge for economic understanding that is honed through class discussion. Special emphasis will be placed on the history of economic theory, especially early on in the course. Behold! This is not a finance or business class. Our focus will not include “get rich quick schemes” or analyses of the stock market. As you will soon learn, economics is an academic discipline which combines elements of mathematics, political science, and philosophy to create something all of its own. EXPECTATIONS 1. 2. 3. You are expected to adhere to the RE Honor Code as delineated in the Student Handbook. All assignments and tests must be pledged. All aspects of your conduct in this course – taking exams and quizzes, completing homework and projects, discussing exams and quizzes with other classmates – should be guided by the Honor Code. You are expected to complete all assignments on time, especially tests and quizzes. Repeated absences on quiz and test days will be frowned upon and could result in significant grade penalties. You must contact me ahead of time via email or telephone if you know you have to miss a test or quiz. You will be expected to be an active participant in class. Your assigned readings will include material that will supplement readings from the texts and the wiki page to this class. Most of our 4. 5. 6. 7. class time will be spent processing the assigned readings as a group. You will be encouraged to forge connections between the readings and to build on the ideas of your classmates, or even refute them in some cases. You are expected to keep yourselves informed about current economic issues through regular reading of the business section of the newspaper and this class’s wiki space. This practice will allow you to apply the principles to real world events. You are expected to check daily my online class page and for course updates and homework assignments. All students are required to take the AP exams in both macroeconomics and microeconomics in May. Most importantly: You will be expected to – as an individual and as a class – decide how we will use our knowledge, resources, and talents to save or enhance the lives of people suffering in poverty. Some of our class members have already started projects toward this end. For example: the club LEAP (Lending to End All Poverty) extends microloans to aspiring entrepreneurs in developing nations. ASSESSMENTS AND GRADING Student grades are based on performance on tests and quizzes (about three each per quarter) and semester projects. Other assignments may include problem sets, oral reports on journal articles, “Harkness Discussions”, and game simulations – projects that serve to put theories into real world context. All tests and assignments must be pledged according to the honor code. Grading Scale Tests = 60%* Quizzes= 30%* Discussion (in class and via wiki)= 10%* * The instructor may raise or lower this value depending on nature of the quarter’s material. Makeup Tests: All makeup tests and quizzes must be completed within the same number of days the student was absent. Students are required to schedule make-ups before planned absences. Repeated absences on test days may reflect poorly on your overall grade. TEXTS Summer reading: The Life You Can Save Economics: Principles, Problems & Policies 18th Ed., McConnell and Brue. McGraw- Hill/Irwin Study Guide to text New Ideas From Dead Economists Revised Edition, Buchholz AP Econ Wiki Page AP Macroeconomics – Semester I Course Syllabus/ 2010-2011 Test and Quiz schedules are subject to change MB denotes McConnell and Brue Unit I: Basic Economic Concepts Week 1 (Aug. 23 – 27) Topics A. Introduction to course B. Review of summer reading: The Life You Can Save C. Defining the study of economics – macro & micro D. Scarcity, choice, & opportunity costs E. Production Possibility Curve F. Marginal Analysis G. Graphs and their meaning Lessons 1. Review of syllabus 2. Discussion on The Life You Can Save 3. MB, chapter 1 and appendix Week 2 (Aug. 30- Sep. 3) Topics A. Characteristics of markets- private property, free enterprise, specialization B. Invisible Hand C. Command vs. Free Market Economies D. Circular Flow Model Lessons 1. MB 1 & 2 2. Quiz Week 3 (Sep. 7, 8, 10) Topic – Supply and Demand Labor Day & Rosh Hashanah A. B. C. D. E. Laws of Demand and Supply Change in quantity demanded vs. change in demand Market Equilibrium Surpluses and shortages Rationing function of prices Lessons 1. MB 3 2. Graphing exercises in class on Activ Board 3. Test on Ch. 1-3, multiple choice and free response Week 4 (Sep. 13 -17) Topic – Private and Public Sectors A. Households as spenders and receivers B. Forms of Businesses C. Role of government D. Circular Flow with Government added Lessons 1. MB 4 2. Lecture and discussion Week 5 (Sep. 20-24) Unit II -Open Economies and International Finance A. Trade patterns B. Comparative Advantage/Terms of trade C. Protectionism vs. Free Trade – impacts on producers and consumers D. Foreign exchange market E. Exchange rates/appreciation & depreciation F. Calculating Capital and Current Accounts/Balance of Payments Lessons 1. MB 5, 36 2. Dead Economists, ch. IV 3. Test – Ch. 4- 6: Multiple choice, free response Unit III: GDP, Growth, and Instability Week 6 (Sep. 27- Oct. 1) Topic – Introduction to Macroeconomics A. Modern Economic Growth B. Uncertaintly, Expectations, and Shocks Lessons 1. MB 23 Topic – Measuring Domestic Output and National Income A. Gross Domestic Product B. Expenditures Approach C. Income Approach D. Other National Accounts E. Nominal vs. Real GDP F. Shortcomings of GDP Lessons 1. MB 24 2. GDP Worksheets – Quiz? 3. Lecture and discussion Week 7 (Oct. 4 – Oct. 8) Oct. 8 = Last day of Q1 Topic – Economic Growth A. Structures that promote growth B. Ingredients of growth C. Accounting for growth Lessons 1. MB 25 2. Lecture and discussion Topic – Business Cycles, Unemployment, and Inflation D. Phase of the Business Cycle E. Measurement, definition, types of unemployment F. Measurement, types, consequences of inflation. Lessons 1. MB 26 2. Bureau of Labor Statistics site 3. Lecture and discussion 4. Quiz Unit IV- Macroeconomics and Fiscal Policy Week 8 (Oct. 11 – 15) Topic- Basic Macroeconomic Relationships Oct 11 – Faculty Work Day Oct.13 - PSAT A. B. C. D. Consumption and Saving Schedules Average and Marginal Propensities Interest Rate – Investment Relationship Multiplier Effect Lessons 1. MB 27 2. Wall Street Journal 3. Lecture and discussion 4. Dead Economists Week 9 (Oct. 18-22) Oct. 18 – Parent Conference Day Topic – Aggregate Demand & Aggregate Supply A. Explanation of slope of AD and AS B. Determinants of AD and AS C. Change of equilibrium output D. Short run and long run AS E. Sticky and flexible wages Lessons 1. MB 29 2. In class graphing exercises on Activ Board 3. Quiz – drawing AD and AS graphs 4. Lecture and discussion Week 10 (Oct. 25- 29) Topic – Fiscal Policy, Deficits, and Debt A. Expansionary and Contractionary Policies B. Automatic Stabilizers – how graphs show their effects C. Complications of fiscal policy – net export effects, crowding out D. The Public Debt – false and substantive concerns Lessons 1. MB 30 2. Lecture and discussion 3. US Treasury site 4. Exam Week 11 (Nov. 1- 5) Unit V –Financial Sector Topics - Money & Banking A. Definition of M1, M2, & M3 B. The Federal Reserve –History and Function C. Trends in Monetary Policy Lessons 1. MB 31 2. Video on The FED 3. In-class examination of currency and checks Topics – Money Creation D. Fractional Reserve System E. Transactions of Banks- accepting deposits, granting loans, buying and selling securities, clearance of checks F. Multiple-deposit expansion – money multiplier Lessons 1. Practice with balance sheets 2. MB 32 3. Quiz on money creation – balance sheet format Week 12 (Nov. 8- 12) Topics – Monetary Policy Interest rates and bond prices – relationship Demand for Money Graph Real vs. Nominal rates Tools of Monetary Policy – OMO, Reserve Ratio, Discount Rate – How do these work? E. Federal Funds Rate - targeting F. Supply of Money – Graphs show how it will change and impact interest rates G. Cause and Effects of Monetary Policy H. Evaluation of Monetary Policy A. B. C. D. Lessons 1. MB 33 2. Exam – multiple-choice/free response 3. Lecture and discussion Week 13 (Nov. 15 - 19) Topic – Financial Economics A. Financial Investment B. Present Value of Money C. Stocks, bonds, mutual funds D. Risk Lessons 1. MB 34 2. Lecture and discussion Week 14 (Nov. 23- 24) Nov. 24 - Day ends at 1:00 Topics –Extending the Analysis of Aggregate Supply A. From Short Run to Long Run B. Demand Pull and Cost Push Inflation C. Inflation –Unemployment Relationship D. Long run Phillips Curve E. Supply side – Laffer Curve Lessons 1. MB 35 2. Lecture and Discussion Week 15 (Nov. 29- Dec. 3) Topics – Disputes over Macro Theory A. Causes of macro instability B. Ability of economy to self-correct C. Quantity Theory of Money PQ=MV D. Discretionary vs. non-discretionary policies E. Monetary Rule Lessons 1. MB 36 2. Dead Economists – readings 3. Lecture and discussion Unit VI – International Economics Week 16 (Dec. 6 – 10) Dec. 10=St. Alban’s Day Topics- The Balance of Payments, Exchange Rates, and Trade Deficits A. International Financial Transactions B. Balance of Payments C. Flexible and Fixed Exchange Rates Lessons 1. MB 38 2. Lectures and Discussion Dec. 13 Review Day Week 17 (Dec. 15- 17 ) Midterm exams