Tutorial 5 sol

advertisement

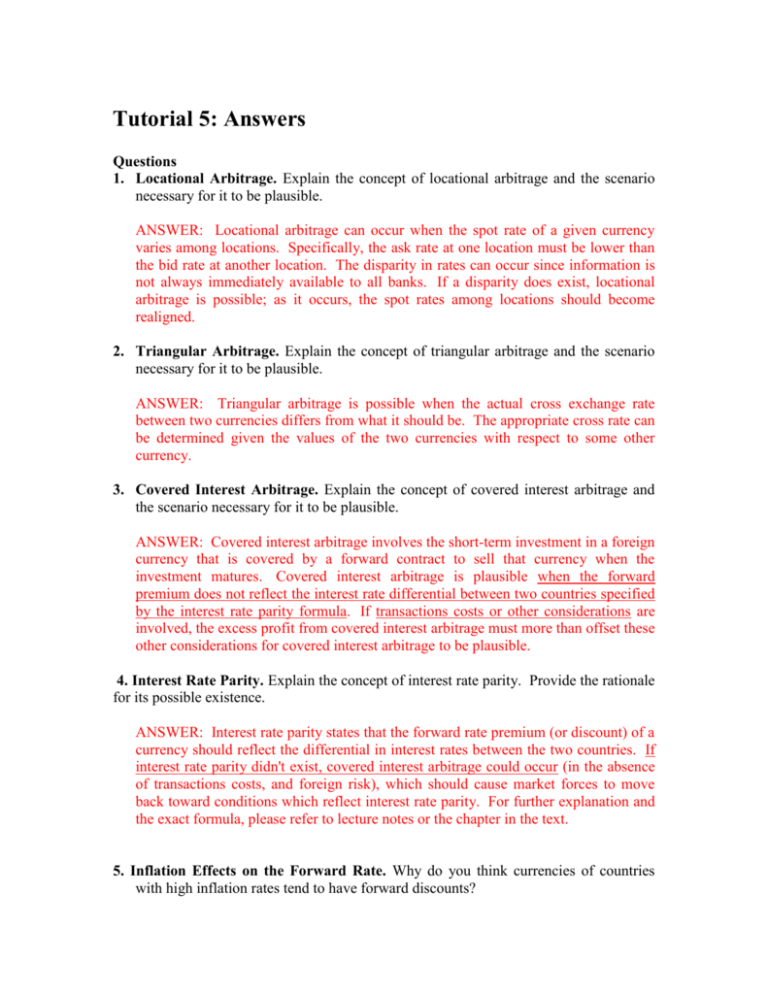

Tutorial 5: Answers Questions 1. Locational Arbitrage. Explain the concept of locational arbitrage and the scenario necessary for it to be plausible. ANSWER: Locational arbitrage can occur when the spot rate of a given currency varies among locations. Specifically, the ask rate at one location must be lower than the bid rate at another location. The disparity in rates can occur since information is not always immediately available to all banks. If a disparity does exist, locational arbitrage is possible; as it occurs, the spot rates among locations should become realigned. 2. Triangular Arbitrage. Explain the concept of triangular arbitrage and the scenario necessary for it to be plausible. ANSWER: Triangular arbitrage is possible when the actual cross exchange rate between two currencies differs from what it should be. The appropriate cross rate can be determined given the values of the two currencies with respect to some other currency. 3. Covered Interest Arbitrage. Explain the concept of covered interest arbitrage and the scenario necessary for it to be plausible. ANSWER: Covered interest arbitrage involves the short-term investment in a foreign currency that is covered by a forward contract to sell that currency when the investment matures. Covered interest arbitrage is plausible when the forward premium does not reflect the interest rate differential between two countries specified by the interest rate parity formula. If transactions costs or other considerations are involved, the excess profit from covered interest arbitrage must more than offset these other considerations for covered interest arbitrage to be plausible. 4. Interest Rate Parity. Explain the concept of interest rate parity. Provide the rationale for its possible existence. ANSWER: Interest rate parity states that the forward rate premium (or discount) of a currency should reflect the differential in interest rates between the two countries. If interest rate parity didn't exist, covered interest arbitrage could occur (in the absence of transactions costs, and foreign risk), which should cause market forces to move back toward conditions which reflect interest rate parity. For further explanation and the exact formula, please refer to lecture notes or the chapter in the text. 5. Inflation Effects on the Forward Rate. Why do you think currencies of countries with high inflation rates tend to have forward discounts? ANSWER: These currencies have high interest rates, which cause forward rates to have discounts as a result of interest rate parity. 6. Changes in Forward Premiums. Assume that the Japanese yen’s forward rate currently exhibits a premium of 6 percent and that interest rate parity exists. If U.S. interest rates decrease, how must this premium change to maintain interest rate parity? Why might we expect the premium to change? ANSWER: The premium will decrease in order to maintain IRP, because the difference between the interest rates is reduced. We would expect the premium to change because as U.S. interest rates decrease, U.S. investors could benefit from covered interest arbitrage if the forward premium stays the same. The return earned by U.S. investors who use covered interest arbitrage would not be any higher than before, but the return would now exceed the interest rate earned in the U.S. Thus, there is downward pressure on the forward premium. 7. Testing Interest Rate Parity. Describe a method for testing whether interest rate parity exists. Why are transactions costs, currency restrictions, and differential tax laws important when evaluating whether covered interest arbitrage can be beneficial? ANSWER: At any point in time, identify the interest rates of the U.S. versus some foreign country. Then determine the forward rate premium (or discount) that should exist according to interest rate parity. Then determine whether this computed forward rate premium (or discount) is different from the actual premium (or discount). Even if interest rate parity does not hold, covered interest arbitrage could be of no benefit if transactions costs or tax laws offset any excess gain. In addition, currency restrictions enforced by a foreign government may disrupt the act of covered interest arbitrage. Problems 1. Locational Arbitrage. Assume the following information: Bid price of New Zealand dollar Ask price of New Zealand dollar Beal Bank Yardley Bank $.401 $.398 $.404 $.400 Given this information, is locational arbitrage possible? If so, explain the steps involved in locational arbitrage, and compute the profit from this arbitrage if you had $1,000,000 to use. What market forces would occur to eliminate any further possibilities of locational arbitrage? ANSWER: Yes! One could purchase New Zealand dollars at Yardley Bank for $.40 and sell them to Beal Bank for $.401. With $1 million available, 2.5 million New Zealand dollars could be purchased at Yardley Bank. These New Zealand dollars could then be sold to Beal Bank for $1,002,500, thereby generating a profit of $2,500. The large demand for New Zealand dollars at Yardley Bank will force this bank's ask price on New Zealand dollars to increase. The large sales of New Zealand dollars to Beal Bank will force its bid price down. Once the ask price of Yardley Bank is no longer less than the bid price of Beal Bank, locational arbitrage will no longer be beneficial. 2. Triangular Arbitrage. Assume the following information: Value of Canadian dollar in U.S. dollars Value of New Zealand dollar in U.S. dollars Value of Canadian dollar in New Zealand dollars Quoted Price $.90 $.30 NZ$3.02 Given this information, is triangular arbitrage possible? If so, explain the steps that would reflect triangular arbitrage, and compute the profit from this strategy if you had $1,000,000 to use. What market forces would occur to eliminate any further possibilities of triangular arbitrage? ANSWER: Yes. The appropriate cross exchange rate should be 1 Canadian dollar = 3 New Zealand dollars. [US$/CAD x 1/(US$/NZD) = NZD/CAD] Thus, the actual value of the Canadian dollars in terms of New Zealand dollars is more than what it should be. One could obtain Canadian dollars with U.S. dollars, sell the Canadian dollars for New Zealand dollars and then exchange New Zealand dollars for U.S. dollars. With $1,000,000, this strategy would generate $1,006,667 thereby representing a profit of $6,667. [$1,000,000/$.90 = C$1,111,111 × 3.02 = NZ$3,355,556 × $.30 = $1,006,667] Start = US$1.000000 million End = US$1.006667 million Buy CAD @ US$0.90 Sell NZD @ US$0.30 Implied cross rate: Buy CAD @ NZD 3.00 NZ$3,355,556 Market cross rate: Sell CAD @ NZD3.02 C$1,111,111 The diagram shows that you are essentially buying CAD at the implied cross rate of NZD 3.00 and then selling it at the market cross rate of NZD 3.02. The value of the Canadian dollar with respect to the U.S. dollar would rise. The value of the Canadian dollar with respect to the New Zealand dollar would decline. The value of the New Zealand dollar with respect to the U.S. dollar would fall. [Note: You should be prepared to analyse and identify what would happen to the currency exchange rates as a result of this arbitrage. Basically, for each step of the transaction, imagine how the prices can get worse for the arbitrageur. For example, in the first step (USDCAD), the worst thing for the arbitrageur is if the CAD she is buying gets more expensive, relative to USD. This is likely what will happen to the prices as a result of arbitrage – prices get worse and worse from supply/demand until arbitrage is no longer profitable. At this point of no further arbitrage, the market reaches equilibrium.] 3. Covered Interest Arbitrage. Assume that the one-year U.S. interest rate is 11 percent, while the one-year interest rate in Malaysia is 40 percent. Assume that a U.S. bank is willing to purchase the currency of that country from you one year from now at a discount of 13 percent. Would covered interest arbitrage be worth considering? Explain. Calculate the yield from covered interest arbitrage for a US investor. Is there any reason why a US investor should not attempt covered interest arbitrage in this situation? (Ignore tax effects.) Please note that this question has been slightly modified. ANSWER: Since the interest rate differential 29% (40%-11%) is much higher than the one year forward rate discount 13%, covered interest arbitrage appears to be worth considering. By given, F ($/MY)= (1-0.13) x S($/MY) = 0.87 S($/MY) [Note: ‘F’ stands for forward, while ‘S’ stands for spot. The base currency is MYR. When we say the base currency is at a forward discount, that means the number of US$ being paid per 1 MYR on the forward (F) is 13% less than the spot (S) rate. ] Assuming a $1,000,000 initial investment by a US investor, the covered interest arbitrage would generate: $1,000,000 × 1/S($/MY) × (1.40) × [0.87 S($/MY)] = $1,218,000 Yield = ($1,218,000 – $1,000,000)/$1,000,000 = 21.8% Thus, covered interest arbitrage would be worth considering since the return would be 21.8 percent, which is much higher than the U.S. interest rate. However, if the funds would be invested in Malaysia, that could cause some concern about default risk or government restrictions on convertibility of the currency back to dollars. [Note: The worked example skips some logical steps. Step-by-step, the reasoning is: MYR is worth 13% less in one-year’s time (valued in USD) compared to today. On the other hand, investing in MYR for one year returns 40%-11% = 29% more than it costs to borrow USD. Hence you get more from the one-year interest difference (invest MYR, borrow USD) compared to the loss you face when you need to convert MYR back to USD in one year’s time. Therefore, you should do the following transaction: Deposit = MYR 1 million / S Receive = MYR [1 million / S] x (1.40) Forward exchange rate USD/MYR = F = S x (1-0.13) Spot exchange rate USD/MYR = S Borrow USD 1 million Receive = USD [1 million / S] x (1.40) x S (1-0.13) Pay = USD 1 million x (1.11) P&L = Receive –Pay = US 1 million x (1.218-1.11) Also note the following assumptions: No bid/ask spreads. No transaction costs. Very, very importantly – it just so happens that the holding period in this example is exactly one year so that you can directly compare the interest rate difference (% p.a.) versus the spot/forward difference (% absolute). In the more common case when the holding period is not one year, then you need to annualize the spot/forward differential in order to make it comparable to the interest rate differential. Alternatively, as in the next example, you can pro rata the annual interest rate to find the absolute interest rate per holding period. Once all the legs of this transaction are executed, there is no further market risk for the arbitrageur – P&L is locked in. Are there other kinds of risk, though? ] 4. Covered Interest Arbitrage in Both Directions. The following information is available: You have $500,000 to invest The current spot rate (S) of the Moroccan dirham is $.110. The 60-day forward rate (F) of the Moroccan dirham is $.108. The 60-day interest rate in the U.S. is 1 percent (i.e 6% pa) The 60-day interest rate in Morocco is 2 percent (i.e 12% pa) a. What is the yield to a U.S. investor who conducts covered interest arbitrage? Did covered interest arbitrage work for the investor in this case? b. Would covered interest arbitrage be possible for a Moroccan investor in this case? ANSWER: a. Covered interest arbitrage (for US based investor) would involve the following steps: 1. Convert dollars to Moroccan dirham: $500,000/$.11 = MD4,545,454.55 2. Deposit the dirham in a Moroccan bank for 60 days. You will have MD4,545,454.55 × (1.02) = MD4,636,363.64 in 60 days. 3. In 60 days, convert the dirham back to dollars at the forward rate and receive MD4,636,363.64 × $.108 = $500,727.27 The yield to the U.S. investor is $500,727.27/$500,000 – 1 = .15%. As the yield is smaller than the US interest rate 1%, the covered interest arbitrage did not work for the investor in this case. The lower Moroccan forward rate more than offsets the higher interest rate in Morocco. OR $500,000 invested in the US for 60 days will become $505,000 (=$500000 x 1.01) which is higher than the amount generated by covered interest arbitrage. b. Yes, covered interest arbitrage would be possible for a Moroccan investor. The investor would convert dirham to dollars, invest the dollars at a 1 percent interest rate in the U.S., and sell the dollars forward 60 days. Even though the Moroccan investor would earn an interest rate that is 1 percent lower in the U.S., the forward rate discount of the dirham more than offsets that differential. Verify? 5. Testing IRP. The one-year interest rate in Singapore is 11 percent. The one-year interest rate in the U.S. is 6 percent. The spot rate of the Singapore dollar (S$) is $.50 and the one year forward rate of the S$ is $.46. Assume zero transactions costs. Note: IRP states that: (1 + i$) / (1 + i¥) = F($/¥) / S($/¥) Or approximately: Interest rate differential (i$ - i¥) ≈ (F-S) / S = forward prem/discount (on¥ against $) [Note – substitute S$ for ‘¥’. The first equation is the exact IRP equation while the second is only an approximation. Also, be very careful – for the exact IRP formula, term currency interest rate is in the numerator, base currency interest rate is in the denominator.] a. Does interest rate parity exist? ANSWER: No, because if IRP holds, then 1.06 / 1.11 = 0.46/0.50 Or 0.9550 = 0.9200, which is not true. [Note: you can also use these results to answer part (b) and (c) below. The ‘trick’ is as follows: Left Hand Side (LHS) is too high relative to RHS, versus IRP. This means the numerator of LHS is too big, denominator of LHS is too small. i.e. term interest rate is too high, base interest rate is too low, relative to IRP. Therefore, you should borrow the base interest rate, and lend the term interest rate.] b. Can a U.S. firm benefit from investing funds in Singapore using covered interest arbitrage? ANSWER: No, because the discount on a forward sale [=(0.50-0.46)/0.50] exceeds the interest rate advantage (=0.11-0.06) of investing in Singapore. Alternatively, students can show that the rate of return achieved by the US firm from an investment in Singapore will be lower than interest rate in the US [i.e. use covered interest arbitrage to demonstrate that not profitable to borrow USD to invest in SGD and cover with the forward. Question – assuming no bid/ask spreads, does this mean NO covered interest arbitrage is possible at all?]. [Note: In other words, IRP and covered interest arbitrage (CIA) are directly related: If IRP equation is true No CIA is possible If CIA is possible IRP does not hold ] 6. Deriving the Forward Rate. Assume that annual interest rates in the U.S. are 4 percent, while interest rates in France are 6 percent. a. According to IRP, what should the forward rate premium or discount of the euro be? b. If the euro’s spot rate is $1.10, what should the one-year forward rate of the euro be? ANSWER: Using IRP conditions, we get: (1.04) 1 .0189 1.89% a. p (1.06) This suggests that if IRP holds, then euro will be at a forward discount of 1.89% against the US dollar. [note: this form of the exact IRP equation implies that the forward rate is defined as : F = S (1+p)] b. F $1.10(1 .0189) $1.079 This suggests that if IRP holds, then the one year forward rate of euro would be US$1.079. 7. Covered Interest Arbitrage in Both Directions. Assume that the annual U.S. interest rate is currently 8 percent and Germany’s annual interest rate is currently 9 percent. The euro’s one-year forward rate currently exhibits a discount of 2 percent. a. Does interest rate parity exist? ANSWER: No, because the discount on euro (= 2%) is larger than the interest rate differential (= 1%) b. Can a U.S. firm benefit from investing funds in Germany using covered interest arbitrage? ANSWER: No, because the discount on a forward sale exceeds the interest rate advantage of investing in Germany. c. Can a German subsidiary of a U.S. firm benefit by investing funds in the United States through covered interest arbitrage? ANSWER: Yes, because even though it would earn 1 percent less interest over the year by investing in U.S. dollars, it would be able to sell dollars for 2 percent more than it paid for them (it would be buying euros forward at a discount of 2 percent). [Note: these numbers are only rough, since they use the approximate form of the IRP equation. As an exercise, work out the exact P&L by doing covered interest arbitrage!]