i-ch9 - Haas School of Business

advertisement

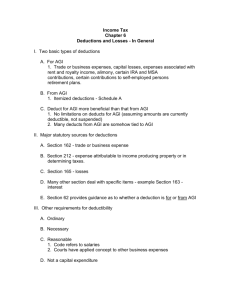

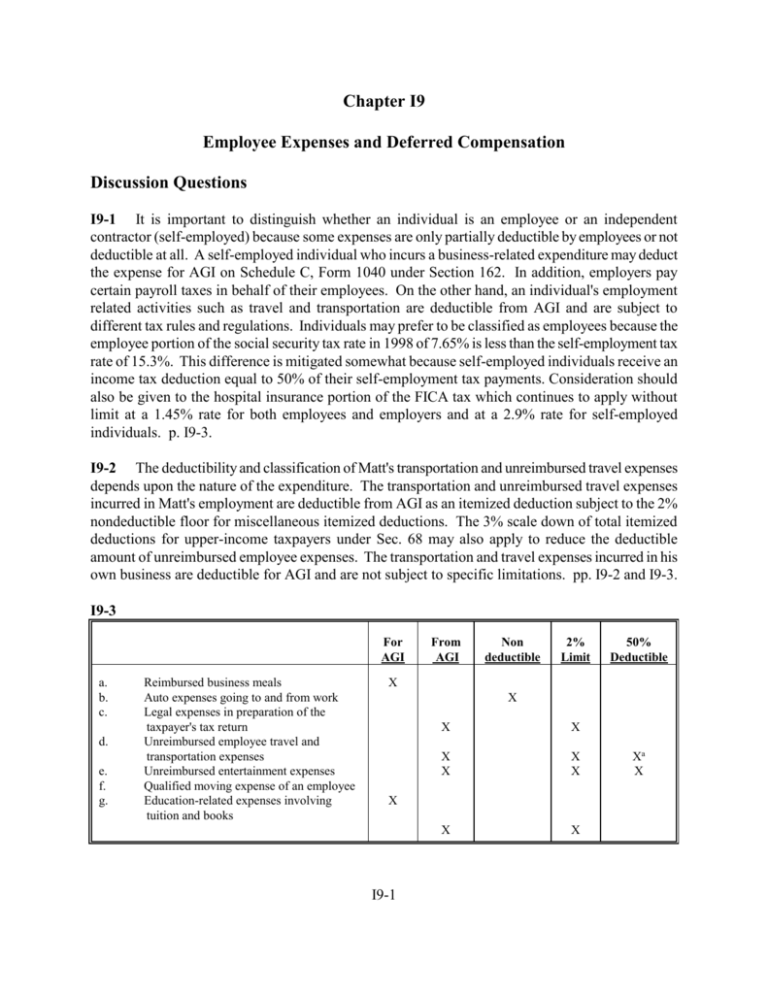

Chapter I9 Employee Expenses and Deferred Compensation Discussion Questions I9-1 It is important to distinguish whether an individual is an employee or an independent contractor (self-employed) because some expenses are only partially deductible by employees or not deductible at all. A self-employed individual who incurs a business-related expenditure may deduct the expense for AGI on Schedule C, Form 1040 under Section 162. In addition, employers pay certain payroll taxes in behalf of their employees. On the other hand, an individual's employment related activities such as travel and transportation are deductible from AGI and are subject to different tax rules and regulations. Individuals may prefer to be classified as employees because the employee portion of the social security tax rate in 1998 of 7.65% is less than the self-employment tax rate of 15.3%. This difference is mitigated somewhat because self-employed individuals receive an income tax deduction equal to 50% of their self-employment tax payments. Consideration should also be given to the hospital insurance portion of the FICA tax which continues to apply without limit at a 1.45% rate for both employees and employers and at a 2.9% rate for self-employed individuals. p. I9-3. I9-2 The deductibility and classification of Matt's transportation and unreimbursed travel expenses depends upon the nature of the expenditure. The transportation and unreimbursed travel expenses incurred in Matt's employment are deductible from AGI as an itemized deduction subject to the 2% nondeductible floor for miscellaneous itemized deductions. The 3% scale down of total itemized deductions for upper-income taxpayers under Sec. 68 may also apply to reduce the deductible amount of unreimbursed employee expenses. The transportation and travel expenses incurred in his own business are deductible for AGI and are not subject to specific limitations. pp. I9-2 and I9-3. I9-3 For AGI a. b. c. d. e. f. g. Reimbursed business meals Auto expenses going to and from work Legal expenses in preparation of the taxpayer's tax return Unreimbursed employee travel and transportation expenses Unreimbursed entertainment expenses Qualified moving expense of an employee Education-related expenses involving tuition and books From AGI Non deductible 2% Limit 50% Deductible X X X X X X X X X X X I9-1 Xa X a Business meals are subject to the 50% deduction limit. pp. I9-3 through I9-24. I9-4 Are subject to 2% nondeductible floor a. b. c. d. e. f. g. h. Investment counseling fees Tax return preparation fees Unreimbursed professional dues for an employee Gambling losses (to extent of winnings) Interest on personal residence Unreimbursed employee travel expense Reimbursed employee travel expenses Safe deposit box rental expenses for an investor Not subject to 2% nondeductible floor X X X X X X X X pp. I9-3 and I9-4. I9-5 a. Marilyn may deduct the travel expenses including air fare, lodging and meals for AGI. (Note: the business meal portion of this expense is reduced by 50%.) b. Reimbursed travel expenses are generally deductible for AGI. However, since the reimbursements are made pursuant to an accountable plan, Marc will not report the reimbursement in his gross income and cannot deduct the expenses. c. Marc may deduct unreimbursed expenses from AGI subject to the 2% nondeductible floor. d. Kay may deduct travel expenses for AGI. Any business meals are reduced by 50%. pp. I9-4 through I9-8, I9-15 through I9-17. I9-6 Kelly may deduct $750 before applying the 2% nondeductible floor. The deduction is computed as follows: Total business meals expenses Minus: lavish and extravagant expenses Deductible amount p. I9-6 I9-2 $2,000 ( 500) $1,500 x 0.50 $ 750 I9-7 a. All expenses except personal clothing (e.g., transportation, meals and lodging) are deductible from AGI and are subject to the 2% nondeductible floor. The meal costs of $1,000 must be reduced by 50%. Thus, the total deductible amount is $8,500 ($9,000 - $500) (subject to the 2% nondeductible floor). Note that the 3% scaledown of total itemized deductions for upper-income individuals may also apply if her AGI is in excess of $124,500 (1998). b. None would be deductible. Note that the airfare en route to the new job location may be deductible as a moving expense if the requirements of Sec. 217 are met. c. The travel expenses would continue to be nondeductible because the employment is treated as indefinite if the position of the IRS in Rev. Rul. 93-86 is upheld by the courts. pp. I9-5 through I9-8. I9-8 The travel expenses related to attending the seminars are not deductible for AGI since they are related to the production of rental income under Sec. 212. The registration fees are deductible for AGI since they are not travel expenses and are related to the rental activity under Sec. 212. p. I9-8. I9-9 It is necessary to allocate a portion of the total reimbursement to each expense category because the various unreimbursed amounts would be subject to various limitations such as the 2% floor and 50% business meal rule. Reimbursed expenses are fully includible in gross income and are deductible for AGI subject to the accountable plan rules. pp. I9-15 through I9-17. I9-10 An employee may deduct the difference between the standard mileage rate and the reimbursed rate as a miscellaneous itemized deduction subject to the 2% nondeductible floor. An alternative way of claiming the deduction would be for the employee to record actual automobile expenses and deduct those in excess of reimbursed expenses. pp. I9-10 through I9-12. I9-11 The actual expense method may be used in subsequent years. However, MACRS under the regular method may not be used for computing depreciation (straight-line method is required) and the basis of the automobile must be reduced by 12 cents per mile for years 1994-1997 (11.5 cents per mile for years 1992 and 1993) of business usage. p. I9-10. I9-12 The employee should have adequate records substantiating expenses incurred in connection with his/her employment. In other words the employee must keep a record including receipts of amounts, dates, places of expenditure, business purpose, to support the amounts claimed on the tax return. The expenses are treated as miscellaneous itemized deductions, subject to the 2% of AGI floor, and are reported on Form 2106. pp. I9-15, I9-16 and I9-42 through I9-45. I9-13 a. The employee must submit a detailed statement on the tax return of the reimbursements and expense items. The reimbursements are included in gross income and the expenses are deductible from AGI as miscellaneous itemized deductions (subject to the 2% nondeductible rule) under a nonaccountable plan. b. No reporting is required under an accountable plan. I9-3 c. No reporting is required for expenses equal to the reimbursement under the accountable plan rules. The excess expenses are deductible from AGI as miscellaneous itemized deductions. d. No reporting is required under an accountable plan assuming that the excess amount is repaid. pp. I9-15 through I9-17. I9-14 Distance and time requirements were imposed to differentiate non-deductible personal motivated moves from employment-related moves. The underlying rationale for the deduction is that such moves are similar to a business expenditure because the move is often necessary to obtain employment or is an employment-related job transfer. pp. I9-17 and I9-18. I9-15 Yes, qualifying moving expenses are not deductible if they are incurred by an unemployed or a retired individual. To be deductible, qualifying moving expenses must be incurred by an employee or a self-employed individual. p. I9-18. I9-16 a. The moving expenses are deductible for AGI so that it does not matter whether Len uses the standard deduction. The reimbursement is used to reduce the amount of the otherwise allowable deduction. Thus, no amount would be reported on Len's tax return. b. The excess reimbursement of $1,000 ($3,000 - $2,000) must be included in gross income. p. I9-19. I9-17 The recordkeeping requirements are strict due to the widespread abuse of entertainment expense deductions. Code Sec. 274 includes classification rules, restrictive tests, and specific record-keeping requirements to prove that the expenditures are not lavish or extravagant and are business-related. p. I9-12. I9-18 a. These amounts are reported on Louis's return as follows: Since the reimbursement is pursuant to an accountable plan, neither the $3,000 reimbursement is included in gross income nor are the expenses of $3,000 deductible. They are netted together and not reported on Louis's return. The remaining $500 [($4,000 - $3,000) x 0.50] is deductible from AGI as a miscellaneous itemized deduction (subject to 2% floor). b. If Louis is unable to provide adequate documentation of the expenditures during the course of an IRS audit on his tax return, all of the deductions will be disallowed. p. I9-13. I9-19 a. To be deductible the expenditure must be either (1) "directly related to" the active conduct of a trade or business or (2) "associated with" the active conduct of a trade or business. b. If there is some business benefit expected to be received, the entertainment of clients should be classified as "directly related" expenses. Entertainment of potential clients constitutes "associated with" entertainment. pp. I9-12 and I9-13. I9-20 a. $3,000 ($6,000 x 0.50) is deductible and subject to the 2% nondeductible floor. Amounts are classified as deductions from AGI. The 3% scaledown of total itemized deductions may also apply if the taxpayer's AGI exceeds $124,500 (in 1998). I9-4 b. Liz would not include the $6,000 in gross income nor deduct the $6,000 of expense since an adequate accounting is made and the reimbursement procedures constitutes an accountable plan. Her employer can deduct $3,000 of the expenses ($6,000 x 0.50), as a trade or business expense. pp. I9-11 through I9-15. I9-21 No, they are business fringe benefits under Sec. 132 and are not subject to the 50% limit. p. I9-12. I9-22 No, the business meal expenditure does not qualify as entertainment expenses. Even though there is a reasonable expectation of business benefit, no business is discussed prior to, during, or after the meal. p. I9-13. I9-23 None, the club dues are considered to be a personal, nondeductible expense despite the fact that the use of the facility is primarily for business. Specific business expenses (e.g., entertainment of customers) are deductible subject to the 50% disallowance rule. pp. I9-14 and I9-15. I9-24 Bass may deduct $450 in 1997. The deduction is computed as follows: $ 900 [The deduction is limited to the face value of the tickets] x 0.50 (Then the 50% limit is applied) $ 450 Deduction. p. I9-15. I9-25 a. An employee reimbursement plan is treated as an accountable plan if it meets two requirements: 1. The employee must make an adequate accounting of expenses to his employer. An adequate accounting is simply the substantiation of expenses by the employee to his employee via an expense report or some other reporting method, and 2. Within a reasonable period of time, the employee is required to return to the employer any portion of the reimbursement in excess of the substantiated expenses. b. Under an accountable plan, neither the reimbursement nor the expenses are reported on the employee's return. However, because the expenses are substantiated to the employer, this treatment for accountable plans is intended to simplify the reimbursed expense area for employees and employers. The general treatment of reimbursed expenses is to include the reimbursement in the employee's gross income and the expenses are deductible by the employee as a deduction for AGI. c. Under a nonaccountable plan, the employee expenses are treated as unreimbursed expenses. Therefore, the reimbursement must be included in the employee's gross income and the expenses are deductible by the employee as a miscellaneous itemized deduction subject to the 2% nondeductible floor. pp. I9-15 through I9-17. I9-5 I9-26 $400 expense incurred for the CPA Review Course is nondeductible because these expenses were incurred to meet minimum standards for entry into the profession. The $4,000 incurred for law school tuition and books is nondeductible because these expenses qualify the taxpayer for a new trade or business. $500 [$400 + (0.50 x $200)] of continuing education expenses are deductible from AGI, subject to the 2% floor. The $200 of travel related to meals is subject to the 50% limit. pp. I9-19 through I9-21. I9-27 Public school teachers may generally deduct educational expenses from AGI as a miscellaneous itemized deduction because the expenditures are incurred to meet the requirements imposed by law for retention of employment. In addition, the expenditures are incurred to maintain or improve skills required by the individual in his employment, trade, or business and are deductible. pp. I9-20 and I9-21. I9-28 a. Yes, Maggie is entitled to an office-in home deduction because the office is used exclusively on a regular basis as the principal place of business for a trade or business and it is used as a place for meeting or dealing with patients, clients, or customers in the normal course of business. Additionally, her office is the most significant place for the conduct of her business activities. b. No, Marty must prove that working at home is for the convenience of his employer and that it is not merely helpful or appropriate to work at home. An employee must also meet the other requirements described in part a. c. For years after 1998, Bobby would be permitted to deduct office in home expenses. Under the TRA 1997, an office in home qualifies as a taxpayer’s principal place of business if (1) the office is used by the taxpayer for administrative or management activities of the taxpayer’s trade or business, and (2) there is no other fixed location of the trade or business where the taxpayer conducts substantial administrative or management activities of the trade or business. Since Bobby does not have an office at another location and conducts substantially all of his administrative and management activities from his office in his home, he will be able to deduct office in home expenses. pp. I9-22 through I9-24. I9-29 Employer contributions to a qualified plan are immediately deductible (subject to specific limitations upon contribution amounts) and such amounts are not taxable to an employee until the pension payments are received. If an employee contributes to the qualified plan, such amounts are generally treated as having been made from after-tax earnings. Thus, when pension payments are received, the employee's portion of the contributions is treated as a tax-free return of capital to prevent double taxation of such amounts. Under a nonqualified deferred compensation plan (such as a restricted property plan), the employee is taxed upon the FMV of the property contributed at the earliest date when the property is no longer subject to risk of forfeiture or when the property is transferable. The employer receives a corresponding compensation deduction at that time. pp. I9-25 through I9-31. I9-6 I9-30 In a defined contribution plan, fixed amounts (e.g., 8% of each participant's salary) are contributed for each participant to a separate account. The retirement benefits for that participant are based on the value of the participant's account at the time of retirement. Defined benefit plans establish in advance the value of the retirement benefits and a contribution amount is established based on actuarial tables to fund this amount (e.g., 40% of an employee's average salary for the five years prior to retirement). A distinguishing feature of a defined benefit plan is that forfeitures of nonvested amounts (e.g., due to employee resignations) must be used to reduce the employer contributions that would otherwise be made under the plan. In a defined contribution plan, however, the forfeitures may either be reallocated to the other participants in a nondiscriminatory manner or used to reduce future employer contributions. pp. I9-25 and I9-26. I9-31 The plan is discriminatory because it favors highly compensated employees. As a result the plan should be considered to be a nonqualified plan by the IRS. The employer should not be able to receive the immediate tax deduction for pension contributions. Under a nonqualified plan the employer's deduction is generally deferred until the employee recognizes income. p. I9-26. I9-32 No, generally employer-provided benefits must be 100% vested after five years of service. p. I9-27. I9-33 a. Fully taxable when the payment is received. b. The employee's portion of the contribution is treated as a tax-free return of capital under the Sec. 72 annuity rules. pp. I9-27 and I9-28. I9-34 Limitations include: · Defined contribution plan contributions are limited to the smaller of $30,000 or 25% of the employee's compensation. · Defined benefit plans are restricted to an annual benefit to an employee equal to the greater of $90,000 or 100% of the participant's average compensation for the highest three years. · An overall maximum annual employer deduction of 15% of compensation paid or accrued to plan participant's is placed upon profit sharing and stock bonus plans. If an employer has more than one qualified plan (e.g., a defined pension plan and a profit sharing plan), a maximum deduction of 25% of compensation is allowed. pp. I9-27 and I9-28. I9-35 Nonqualified deferred compensation plans are particularly well-suited for use in executive compensation arrangements because they are not subject to the same restrictions which are imposed upon qualified plans such as the nondiscrimination and vesting rules. pp. I9-28 and I9-29. I9-7 I9-36 Yes, he should make the election because he will pay a higher tax when the restrictions lapse due to the substantial appreciation. If the employee does not make the Sec. 83(b) election the tax consequences from the stock transfer are deferred for both the employee and the corporation until the lapse of the nontransferability or forfeiture restrictions. If the election is made, the employee will be taxed on the fair market value of the stock today and the corporation will receive a deduction for the same amount immediately. The reduction of capital gain rates to 20% may increase the attractiveness of this option because capital gain treatment is accorded upon the eventual sale of the stock and the marginal tax rates for high-income taxpayers were increased from 31% to 36% (or 39.6% for taxpayers with taxable income in excess of $278,450 for 1998). pp. I9-29 and I9-30. I9-37 ISO requirements include: · The option price must be equal to or greater than the FMV of the stock on the option's grant date. · The option must be granted within 10 years of the date the plan is adopted and the employee must exercise the option within 10 years from the grant date. · The option must be exercisable only by the employee and is nontransferable except in the event of death. · The employee cannot own more than 10% of the voting power of the employer corporation's stock immediately prior to the option's grant date. · The total FMV of the stock options that become exercisable in any one year to an employee may not exceed $100,000 (e.g., an employee can be granted ISO's to acquire $200,000 of stock in one year provided that no more than $100,000 is exercisable in any one year). · Other procedural requirements must be met (e.g., shareholder approval of the plan, etc). If an employee meets the requirements of an ISO, no tax consequences occur on the grant date (except that the excess of the FMV over the option price is a tax preference item) and LTCG or loss is recognized when the stock is sold. Under a nonqualified stock option arrangement, ordinary income is recognized either on the grant date or on the exercise date (depending upon whether the option has a readily ascertainable FMV). LTCG treatment should favor the ISO for the employee's tax consequences because the spread between the 28% capital gain rate and the highest rate on ordinary income has increased (i.e., from 31% to 36% or 39.6%). However, the employer is more favorably treated under the nonqualified stock option rules because the employer receives a tax I9-8 deduction for the amount of compensation that is recognized by the employee. pp. I9-31 through I933. I9-38 If a nonqualified stock option has a readily ascertainable FMV on the grant date, the employee recognizes ordinary income on the grant date equal to the difference between FMV and the option price. The employer receives a compensation deduction on the grant date equal to the same amount that is recognized by the employee. In such case, no tax consequences occur on the date the option is exercised and the employee recognizes capital gain or loss upon the sale or disposition of the stock. If a nonqualified stock option has no readily ascertainable FMV, no tax consequences occur on the grant date. On the exercise date, the employee recognizes ordinary income equal to the spread between the FMV and the option price and the employer receives a corresponding compensation deduction. pp. I9-32 and I9-33. I9-39 Yes, a self-employed individual who is covered by an employer's qualified pension plan is eligible to establish an H.R. 10 or an SEP plan relative to self-employment income. pp. I9-33 and I934. I9-40 For a defined contribution H.R. 10 plan, a self-employed individual may contribute the lesser of $30,000 or 25% of earned income up to a maximum of $160,000 (1998) (before the H.R. 10 plan contribution but after the deduction for one-half of self-employment taxes paid) from the self-employment activity. The full-time employees must be covered, as required in the rules for qualified plans. p. I9-34. I9-41 Most tax advisers would be more favorably inclined to advise the 50 year old to establish a traditional deductible IRA since he could take advantage of the IRA deduction and would only have to wait 9 1/2 years to withdraw from the IRA without penalty. The 30 year old would have to wait considerably longer. The same applies to nondeductible IRA's only that such contribution amounts are nontaxable when withdrawn because such amounts were previously subject to tax. However, the benefit for a 30-year-old individual is that the funds in the IRA have a much longer investment horizon. p. I9-35. I9-42 The essential differences between a traditional IRA and a Roth IRA are, first, amounts contributed to a traditional IRA are tax-deductible whereas amounts contributed to a Roth IRA are not tax-deductible. However, upon withdrawal of amounts from the IRA’s at retirement, the withdrawn amounts are fully taxable from a traditional IRA but not taxable from a Roth IRA. Second, Roth IRA’s are available to many more taxpayers as the AGI limits are much higher for Roth IRAs than for traditional IRAs. pp. I9-35 through I9-38. I9-9 I9-43 If Charley rolls his traditional IRA into a Roth IRA, he must include the rollover in his gross income and pay income taxes on such amount. If he rolls over the amount on or before December 31, 1998, he can include the rollover amount ratably over four years. The principal benefit of doing the rollover is that when Charley withdraws amounts from his Roth IRA at retirement, no further taxes will be due. While a precise analysis should be performed, since Charleys marginal tax rate at retirement will be no higher than his present rate and he has the funds outside of his IRA to pay the tax, most analysis conclude that Charley will be better off to do the rollover and pay the tax now. The principal economic benefit is that the rollover funds in the Roth IRA are able to grow tax-free and be ultimately withdrawn tax-free. Thus, in Charley’s case, he should be advised to rollover his traditional IRA into a Roth IRA. pp. I9-37 and I9-38. I9-44 Since Sally’s AGI of $60,000 is still too high to deduct contributions to a deductible traditional IRA (maximum AGI of $40,000 for single taxpayers who are active participants in an employer-sponsored plan), she is certainly eligible to contribute up to $2,000 to a Roth IRA as the AGI limit is $95,000 before the phase-out begins. She also is eligible to contribute to a nondeductible IRA, but the Roth IRA is much superior to the nondeductible IRA. pp. I9-35 through I9-38. I9-45 a. An SEP offers small business owners the opportunity to provide retirement benefits for its employees that are comparable with qualified pension and profit-sharing plans with reduced administrative compliance costs (i.e., reduced paperwork and need for actuaries and CPA tax specialists in the pension area to assure that the plan qualification requirements are met). b. A sole proprietor of a small business may establish an SEP for himself rather than using an H.R. 10 plan. c. Yes. A salary reduction agreement permits employees to make additional contributions from before-tax dollars (i.e., their gross income is reduced (up to $10,000 in 1998) by the amount of their individual contributions. p. I9-39. Issue Identification Questions I9-46 The principal issue is whether Georgia is entitled to deduct travel expenses for the 11 month period. To be deductible she must be away from her tax home. The IRS's position in Rev. Rul. 9386 is that the initial realistic expectation of a 15 month assignment controls despite the fact that the assignment lasts only 11 months. Therefore, the assignment is for an indefinite period (more than one year) and the expenses are not deductible because her tax home shifts to the new location. Another ancillary issue is the classification of the expenses, if deductible, as for AGI or from AGI. pp. I9-5 and I9-6. I9-47 The tax issues include the following: (1) (2) the treatment of reimbursements, in particular for any reimbursements in excess of allowable moving expenses. the types of moving expenses (i.e., direct and indirect) which are deductible. I9-10 (3) (4) the reporting of the reimbursements on Jeremy's form W-2 and withholding requirements. the classification of deductible moving expenses and the reporting of excess reimbursements on Jeremy's tax return. pp. I9-17 through I9-20. I9-48 The principal tax issue is whether Juan may deduct office in home expenses and if so the proper classification of such expenses. To make this determination it is necessary to apply two tests. Initially the "relative important" test is applied (e.g., in this fact pattern it appears that the most significant activities are performed by Juan at the hospitals rather than his home). If this test is inconclusive, a "time" test is then applied to determine whether Juan can deduct office in home expenses. The Supreme Court's decision in Solimon settled many questions regarding the deductibility of a home office. The TRA of 1997 will greatly liberalize these rules for persons like Juan beginning in 1999. Since he performs substantial administrative and management duties at his home office and has no other fixed location to perform such duties, his office in home expenses will be deductible for years beginning after December 31, 1998. pp. I9-22 and I9-23. I9-49 The major issues that David must address are as follows: 1. 2. Does the education qualify David for a new trade or business? If so, the education expense would be nondeductible. However, the courts have generally ruled favorably on the deductibility of education expenses for an MBA degree. Is the education in connection with David's employment or trade or business? Since David is not employed, the IRS may attempt to assert that the education expenses are not deductible because the taxpayer does not have a current trade or business. However, some courts have held that education expenses are deductible if the education is deemed to be only a temporary cessation of a business activity. pp. I9-19 through I9-22. Problems I9-50 a. Matt's deduction for employment-related expenses is $3,750 which is computed as follows: Subject to 2% floor: Automobile expenses $1,000 Entertainment ($2,000 x 0.50) 1,000 Travel (excluding meals) 2,000 Meals ($500 x 0.50) 250 Professional dues 500 Total $4,750 The moving expenses are deductible for AGI, thus Matt's AGI is $99,000. $99,000 AGI x 0.02 = $1,980 nondeductible expenses I9-11 due to limit $4,750 - $1,980 = $2,770 deductible expenses + 1,000 moving expenses for AGI not subject to limit $3,770 deductible expenses The 3% scaledown of total itemized deductions does not apply because Matt's AGI is not in excess of $124,500 (1998). b. Moving expenses are deducted for AGI whereas the remaining items are deducted from AGI on Schedule A. pp. I9-2 through I9-4, and I9-18. I9-51 a. Travel Business meals ($1,000 x 0.50) Transportation Entertainment ($2,000 x 0.50) Total deductible expenses $4,000 500 2,000 1,000 $7,500 Commuting expenses are not deductible. b. Each of these items are classified as a for AGI deduction. c. If Monique is an employee then these employment-related expenses are deductible from AGI (subject to the 2% limitation on miscellaneous itemized deductions). pp. I9-2 through I95, and I9-12. I9-52 a. The total amount of Mary's deductible expenses is $2,560. The 3% scaledown of Mary's total itemized deductions is not applicable because her AGI is not in excess of $124,500 (1998). The deduction is computed as follows: Subject to 2% nondeductible floor: Air fare Taxi (transportation) Business meals ($200 x 0.50) Laundry Lodging Entertainment ($500 x 0.50) Investment counseling fees Tax return preparation fees Total expenditures Minus: 2% of $40,000 AGI Total deductible expenses $1,000 100 100 50 150 250 1,000 500 $3,150 ( 800) $2,350 I9-12 b. The deductible expenses are classified as a from AGI deduction. pp. I9-2 through I9- 5. I9-53 a. b. The following expenses are deductible by Marilyn: Airfare ($800 + 6,200) Rent Meals ($8,500 x 0.50) Entertainment ($2,000 x 0.50) Total $ 7,000 7,000 4,250 1,000 $19,250 Expenses are classified as from AGI and are subject to the 2% of AGI nondeductible floor. c. $18,050 is deductible computed as follows: $60,000 x 0.02 = $1,200 nondeductible $19,250 - $1,200 = $18,050 deductible. The 3% scaledown of total itemized deductions is not applicable because Marilyn's AGI is not in excess of $124,500 (1998). d. The airfare for weekend trips, apartment rent and meals would be personal nondeductible expenses. A portion of the airfare might qualify as a moving expense under Sec. 217. e. Only the expenses associated with the first ten months would be deductible if the position of the IRS is upheld by the courts. The $10,000 of expenses for the last seven months are not deductible because the move is indefinite for the extended period. pp. I9-4 through I9-6, and I912. I9-54 a. Mike may only deduct his business-related expenses. Since Mike's business- related employee expenses are fully reimbursed, the reimbursed expenses are deductible for AGI and are offset by the reimbursement. Because the trip is primarily business, all of the air fare is deductible. The 2% nondeductible floor does not apply because there are no unreimbursed employee expenses. Therefore, Mike's deductible expenses are as follows: airfare, $450; meals, $45 ($90 x 50%); hotel, $180; entertainment, $250 ($500 x 50%). If Mike was able to obtain excursion airfare rates due to travel extending over Saturday night because of the vacation, the incremental expenses of one night's lodging and one day's meals would be deductible as an unreimbursed employee expense. If reimbursed, these expenses would not be taxable to Mike and would be deductible by the employer (subject to the 50% limit). b. No amount of income or expense is reported by Mike (assuming that an adequate accounting has been made) because the employee expenses were fully reimbursed pursuant to an accountable plan. c. No, only 50% of the meals (3 X $30 per day x 0.50 = $45) and 50% of the entertainment ($500 x 0.50 = $250) are deductible by Mike's employer. pp. I9-6 and I9-7. I9-55 a. Since the reimbursement is less than the expenses, an allocation is required. The $3,000 reimbursement is prorated to the various expenses based upon the amount reimbursed to the total expenditures (3,000/5,000 = 60%). The deductible amounts are shown below. I9-13 Expense Professional dues and subscriptions Airfare and lodging Local transportation Entertainment Totals For AGI (60%) $1,000 2,000 1,000 1,000 $5,000 600 1,200 600 600 $3,000 From AGI (40%) 200 (400 x 50%) $1,800 b. The $3,000 of reimbursed expenses are deductible for AGI and the $1,800 ($200 + $1,600) of unreimbursed expenses are from AGI subject to the 2% of AGI nondeductible floor. Because Maxine has other miscellaneous itemized deductions of $1,000, the $1,800 of unreimbursed employee expenses are deductible ($2,800 miscellaneous itemized deductions - [0.02 x $50,000 AGI] = $1,800). The 3% scaledown of Maxine's total itemized deductions is not applicable because her AGI is not in excess of $124,500 (1998). c. If Maxine received a $6,000 reimbursement, the $5,000 of employment-related expenses are fully deductible for AGI and Maxine must include the $1,000 excess amount in miscellaneous income. pp. I9-15 through I9-17. I9-56 a. b. $4,900 miscellaneous itemized deductions are computed as follows: Subject to 2% nondeductible floor: Safety deposit box rental Tax return preparation fees Unreimbursed employee expenses Unreimbursed employee expenses (for business meals)($400 x 0.50) Miscellaneous itemized deductions Minus: 0.02 x $100,000 Total Total itemized deductions of $19,900 are computed as follows: Other itemized deductions Plus: Miscellaneous itemized deductions Total itemized deductions $ 200 500 6,000 200 $6,900 (2,000) $4,900 $15,000a 4,900 $19,900 a moving expenses are deductible for AGI. c. Miscellaneous itemized deductions (before 2% scale down) Minus: 0.02 x $150,000 AGI Miscellaneous itemized deductions Other itemized deductions Total itemized deductions (before 3% phase-out) Minus: 3% x ($150,000 - $124,500) I9-14 $ 6,900 ( 3,000) $ 3,900 15,000 $18,900 ( 765) Total itemized deductions $18,135 pp. I9-3 and I9-4. I9-57 a. $5,000. The transportation expenses for trips within the metropolitan area are deductible because Jose has a regular work location at his employers office. b. From AGI as a miscellaneous itemized deduction. c. $5,000 for AGI. The transportation expenses from Jose's home to clients within the metropolitan area are deductible because his residence is his principal place of business (i.e., office in home). pp. I9-8 and I9-9. I9-58 a. $4,600 of the unreimbursed expenses are deductible from AGI computed as follows: 20,000 miles x 32.5 cents/mile unreimbursed = Plus: parking and tolls Total expenditures Minus: Reimbursement (20,000 miles x 10 cents/mile) Deductible from AGI b. $6,500 + 100 $6,600 (2,000) $4,600 Under the actual cost method, $1,640 is deductible from AGI computed as follows: Expenses (excluding parking and tolls) Business use Parking and tolls Total expenses Minus: employer's reimbursement Deduction $5,900 x 0.60 $3,540 100 $3,640 (2,000) $1,640 pp. I9-10 and I9-11. I9-59 a. Deductible Expenses include: Dues to the local chamber of commerce Entertainment ($2,000 x 0.50) Entertainment of clients ($1,500 x 0.50) Total $1,000 1,000 750 $2,750 The business meals are not deductible because bona fide business discussions must be conducted. The country club dues are not deductible despite the fact that the club was used exclusively for business. Dues to the chamber of commerce are not subject to the club disallowance rules. b. For AGI pp. I9-11 through I9-15. I9-15 I9-60 $5,400 is deductible in the current year computed as follows: Football tickets Skybox (30 x $40/seat x six events) Total Limitation Deduction $ 3,600 (limited to face value) 7,200 $10,800 x 0.50 $ 5,400 p. I9-15. I9-61 a. 1. Since the Cooper Company maintains an accountable plan and the reimbursement is equal to the expenses, Latrisha will not report the reimbursement or deduct the expenses. Cooper Company may deduct the amount of $9,400 on its return, computed as follows: Airfare $5,850 Lodging 1,800 Meals ($1,200 x 50%) 600 Entertainment ($2,400 x 50%) 1,200 $9,450 2. The reimbursement is less than the expenses, so a proration of expenses is required. The reimbursement is equal to 80% of the expenses ($9,000/11,250) EXPENSES Airfare Lodging Meals Entertainment TOTAL 80% FOR AGI $ 5,850 1,800 1,200 2,400 $11,250 $4,680 1,440 960 1,920 $9,000 20% FROM AGI $1,170 360 120 (240 x 50%) 240 (480 x 50%) $1,890 Latrisha will not report the $9,000 reimbursement or the $9,000 of deductions for AGI (accountable plan). She will report the $1,890 as miscellaneous itemized deductions. Cooper Company may deduct $7,560 on its return [$4,680 + 1,440 + (960 x 50%) + (1,920 x 50%)]. 3. Since the reimbursement is greater than the expenses, Latrisha is required to return the excess ($14,000 - 11,250 = 2,750) to Cooper Company. In addition, she will not report the $11,250 reimbursement as gross income or deduct the expenses. If Latrisha does not return the excess reimbursement (even though she is required to under the plan), she must report the excess of $2,750 as gross income. I9-16 b. Under a nonaccountable plan, any reimbursement is included in gross income and the deductions are treated as miscellaneous itemized deductions. Thus, Latrisha would include the reimbursements ($11,250, 9,000, or 14,000) in her gross income and deduct the following as miscellaneous itemized deductions: Airfare Lodging Meals ($1,200 x 50%) Entertainment ($2,400 x 50%) $5,850 1,800 600 1,200 $9,450 pp. I9-15 through I9-17. I9-62 a. Michael's moving expense deduction is $2,100 computed as follows: Direct Moving Expenses Automobile expenses Moving van rental Total deductible expenses $ 100 2,000 $2,090 None of the other expenses qualify as moving expenses under Sec. 217. The points paid to acquire the new residence should qualify as interest expense if Michael itemizes his deductions. b. The moving expenses are deductible for AGI. c. $2,090 of the reimbursement is used to offset the otherwise deductible moving expenses. The excess reimbursed amount of $6,910 ($9,000 - $2,090) is included in Michael's gross income. pp. I9-17 through I9-19. I9-63 a. b. c. d. e. No Yes, for AGI (except that only $100 of meals [$200 x 0.50] are deductible) Yes, from AGI (assuming the business executive is an employee) Yes, from AGI No. pp. I9-19 through I9-22. I9-64 a. Total deductible expenses are $1,200. The for AGI deduction is computed as follows: Allocable to office: Real estate taxes $2,000 Plus: Mortgage interest 5,000 $7,000 Percent of house used for business x 0.10a Allocable to the office $ 700 a The den is not allowed because it is not used exclusively as the principal place of business. I9-17 Other Office-in-Home Expenses Insurance Depreciation Repairs and utilities Percent of house used for business Other expenses $ 500 3,500 1,000 $5,000 x 0.10 $ 500 Nancy's home office expenses (other than mortgage interest and real estate taxes) are limited to $37,300 [$40,000 gross income - ($2,000 of expenses directly related to the business + $700 mortgage interest and real estate taxes)]. Thus, the full amount of $1,200 deductible expenses is allowed. Allocable to office Other office in home expenses Total $ 700 500 $1,200 $1,800 of real estate taxes ($2,000 - $200) and $4,500 ($5,000 - $500) of mortgage interest are deductible as itemized deductions. b. Yes, because Nancy's home office expenses (other than mortgage interest and real estate taxes) are limited to $0 ($2,500 gross income - [$2,000 of expenses directly related to the business + $700 mortgage interest and real estate taxes]). Nancy may deduct $2,000 of real estate taxes and $5,000 of mortgage interest as itemized deductions. None of the insurance, depreciation, and repair and utilities expense is allowed. Thus, $500 of the other in home office expense for insurance, depreciation and repairs and utilities is disallowed and is carried forward to a succeeding year. The carryforward amounts are subject to the same gross income limitations for the carryforward year. Note that operating expenses are deductible before any depreciation is allowed. pp. I9-22 through I9-24. I9-65 a. $7,600. $6,000 directly related expenses plus $1,600 (0.10 x $16,000) home office expenses. Dawn meets both the "relative importance" test and the "time" test as promulgated in Rev. Rul. 94-24. b. Only the $6,000 of directly related expenses would be deductible because the most important activity is sales and 70% of her time is devoted to selling activities at non-home office locations. pp. I9-26 and I9-27. I9-66 a. b. c. d. e. qualified profit sharing plan qualified pension plan defined benefit plan nonqualified plan employee stock ownership plan. pp. I9-25 through I9-33. I9-18 I9-67 a. $1,000/month x 12 months = $ 12,000 annual payments $12,000/year x 15 year life expectancy = $180,000 Employee contributions = Expected proceeds $30,000 = 1 exclusion ratio $180,000 6 1/6 x $12,000/yr = $ 2,000 excludable $12,000 - $2,000 excludable = $10,000 taxable income Note: Under the Small Business Protection Act of 1996, a new simplified method of determining the taxability of annuity distributions was enacted. The exclusion ratio is fixed based on the taxpayer's age at the annuity starting date. Since Pam's age is not given in the problem, the new method is not used. See Chapter I3 for details. b. If the plan is noncontributory, the pension payments are fully taxable, i.e., 12,000 per year. c. Pam's final return (in 1998) will include a $26,000 ($30,000 - $4,000) itemized deduction. This amount represents Pam's unrecovered investment in the contract. d. The total amount that may be excluded is limited to the amount of the employee's contributions to the plan. Therefore, if Pam outlives her 15-year life expectancy, the entire amount of the pension payments are taxable in year 16 and subsequent years. pp. I9-27 and I9-28. I9-68 a. The tax consequences from the stock transfer are deferred for both employee Patrick and Bear Corporation until the lapse of the nontransferability and forfeiture restrictions in year 2003. Thus, Patrick recognizes no compensation income on the receipt of the stock in 1998 and Bear receives no deduction. b. Patrick must recognize $1,000 (100 shares X $10) of ordinary income subject to tax. Bear Corporation receives a $1,000 deduction. c. 1. No effect to Patrick despite the fact that he was previously taxed. Bear must include $1,000 in gross income because it received tax benefit due to the prior deduction. 2. No tax effect d. 1. There is no tax effect 2. Patrick reports income of $10,000 and Bear receives a $10,000 deduction (100 shares x $100). e. 1. $120/share x 100 shares = $12,000 - $1,000 basis = $11,000 LTCG for Patrick. No effect to Bear. 2. $120/share x 100 shares = $12,000 - $10,000 basis = $2,000 LTCG for Patrick. No effect to Bear. pp. I9-29 and I9-30. I9-69 a. Phong may deduct $1,800 of the contribution for tax year 1998. (The $30,000 ceiling is exceeded by $1,000 so 10% of the contribution is not deductible. b. The deduction is for AGI. I9-19 c. Phong must pay a nondeductible 10% penalty tax and pay income tax on the $1,800 deductible contribution and on the $150 of accrued interest. d. Phong may then deduct $2,000 because the special income limitations in a. do not apply if taxpayer is not an active participant in a qualified plan. e. $4,000 would then be deductible since Phong's AGI does not exceed the $50,000 married joint return limit and Phong's spouse has no earned income. The extra $2,000 is allowable because of the spousal IRA rules. pp. I9-35 through I9-37. I9-70 a. The full $4,000. b. 1998 c. For AGI d. No change since their joint AGI does not exceed $50,000. e. Yes, nondeductible contributions to an IRA are permitted to the extent that an individual is ineligible to make deductible contributions. However, total IRA deductions (to all types of IRAs, traditional deductible and nondeductible, and both IRAs) may not exceed $2,000. f. No IRA deduction because combined AGI exceeds the $60,000 limit for married couples, and Phil is an active participant in an employer sponsored plan. pp. I9-35 through I9-37. I9-71 a. Paula must provide comparable coverage for her nurse who is an eligible full-time employee. If she contributes 25% of her earned income, a comparable benefit rate must be contributed based upon the salary payments to the nurse. b. For AGI. The maximum amount of contribution for Paula is $20,000 (Earned income = x = $100,000 - .25x: x = $80,000; therefore Paula can contribute .25 x $80,000 = $20,000) as a for AGI deduction. c. Yes, because she is a full-time employee. d. If the contributions were deductible then they are taxable when the funds are withdrawn and a nondeductible 10% penalty tax is imposed upon the amounts withdrawn unless one of the exceptions provided in Sec. 72(t) applies such as death, or disability of the taxpayer. pp. I9-33 through I9-35. I9-72 a. January 1, 1998 - no effect April 1, 2000 - no effect except for a $200 [($100 - $80) x 10 shares] tax preference item for purposes of the alternative minimum tax. May 1, 2002 - $400 long term capital gain is recognized by Peggy, computed as follows: Sale price Minus: Basis LTCG $ $1,200 ($120 x 10 shares) ( 800) ($80 x 10 shares) 400 Bell Corporation does not receive a corresponding compensation deduction. I9-20 b. Peggy would recognize $200 ordinary income on the sale date equal to the spread between the option price and the exercise price [($100 - $80) x 10 shares = $200] ordinary income on May 1, 2000. Bell Corporation is permitted a $200 deduction for compensation on May 1, 2000. On the sale date Peggy also recognizes a STCG of $200 [$1,200 - ($100 x 10 shares)]. pp. I9-31 through I9-33. I9-73 a. January 1, 1998 Penny recognizes ordinary income of $200 [($100 - $80) x 10] shares on the grant date equal to the difference between FMV and option price. Bender Corporation receives a compensation deduction of $200. January 1, 1998 There is no tax effect on the exercise date. January 1, 2001 Penny recognizes long-term capital gain of $1,000 computed as follows: Selling price ($200 x 10 shares) Minus: Basis ($100 x 10 shares) LTCG recognized by Penny $2,000 (1,000) $1,000 No tax effect to Bender Corporation. b. January 1, 1998 There are no tax consequences on the grant date. January 1, 1999 Penny recognizes ordinary income of $700 [($150 - $80) x 10 shares]. Bender Corporation receives a compensation deduction of $700. January 1, 2001 Penny recognizes long-term capital gain of $500 computed as follows: Selling price ($200 x 10 shares) Minus: Basis ($80 x 10 shares) + $700 ordinary income reported LTCG recognized by Penny pp. I9-31 through I9-33. I9-21 $2,000 (1,500) $ 500 Tax Form/Return Preparation Problems I9-74 (See Instructor's Guide) I9-75 (See Instructor's Guide) Case Study Problems I9-76 (See Instructor's Guide) I9-77 (See Instructor's Guide) Tax Research Problem I9-78 (See Instructor's Guide) I9-22