Chapter 19: Earnings per Share

advertisement

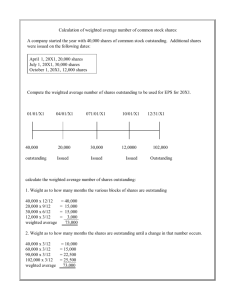

Chapter 19: Earnings per Share Assignment 19-5 Case A Time Period 1 January, shares outstanding 1 January to 28 February 1 March, stock dividend 1 March to 31 May 1 June, retired shares 1 June to 31 July 1 November, shares issued but backdated to 1 August (contingency cleared) 1 November to 31 December Total Actual Shares 2,860,000 2,860,000 286,000 3,146,000 (200,000) 2,946,000 Retroactive Adjustment Months Outstanding Shares x 1.10 x 2/12 = 524,333 x 3/12 = 786,500 x 2/12 = 491,000 x 5/12 = 1,394,167 3,196,000 400,000 3,346,000 Case B Time Period 1 January, shares outstanding 1 January to 28 February 1 March, sold add’l shares 1 March to 30 June 1 July, retired shares 1 July to 31 October 1 November, stock dividend 20% (640,000/3,200,000) 1 November to 31 December Total Actual Shares 3,000,000 3,000,000 400,000 3,400,000 (200,000) 3,200,000 Retroactive Adjustment Months Outstanding Shares 1.20 x 2/12 = 600,000 1.20 x 4/12 = 1,360,000 1.20 x 4/12 = 1,280,000 x 2/12 = 640,000 3,880,000 640,000 3,840,000 Case C Time Period 1 January, shares outstanding 1 January to 31 December Actual Shares Retroactive Adjustment 6,950,000 6,950,000 x 1/4* Months Outstanding Shares x 12/12 = 1,737,500 Total 1,737,500 * Split occurred in the next fiscal year, but before the financial statements were issued for this year, and thus must be is included for this year. Assignment 19-18 Earnings available to common shareholders Basic EPS: Net earnings Preferred shares (30,000 x $.50) Weighted average number of shares Earnings per Share $366,000 (15,000) $351,000 Shares outstanding 150,000 x 6/12 450,000 x 5/12 516,000 (1) x 1/12 75,000 187,500 43,000 305,500 Basic EPS $1.15 (1) ($600,000/$1,000 x 110) + 450,000 Individual effect: Preferred shares Dividend avoided Shares issued 30,000 x 2 Actual conversion: Interest avoided $47,250 x (1-.3) Shares issued ($600,000/$1,000) x 110 x 11/12 Diluted EPS: Basic EPS Preferred shares Dividend avoided Shares issued 30,000 x 2 Actual conversion: Interest avoided Shares issued Diluted EPS 15,000 60,000 $0.25 60,500 $0.55 $351,000 305,500 $1.15 15,000 ______ 366,000 60,000 365,500 1.00 60,500 426,000 $0.94 33,075 33,075 $399,075 Assignment 19-22 Earnings available to common shareholders Basic EPS Net earnings $600,000 Note: preferred dividends are already deducted from net earnings _______ 600,000 Shares outstanding 48,000* x 3/12 60,000 x 9/12 Weighted average number of shares Earnings per Share 12,000 45,000 57,000 Basic EPS $10.53 * Bonds: ($1,500,000 / 1,000) x 8 = 12,000; 60,000 – 12,000 = 48,000 Individual effect: Actual conversion, 12% debentures Bond interest $48,000 x (1-.4) Shares 12,000 x 3/12 12% debentures outstanding Interest ($624,000 - $48,000) x (1-.4) Shares: ($4,500,000 / $1,000) x 8 12.4% debentures Interest ($450,000) x (1-.4) ($3,000,000 / $1,000) x 8 28,800 3,000 $9.60 36,000 9.60 24,000 $11.25 345,600 $270,000 The options are anti-dilutive because exercise price is greater than market value. The individual effect of the 12% debenture items are identical and their order is irrelevant. The 12.4% debenture is anti-dilutive. Diluted EPS: Basic EPS Actual conversion: Bond interest Shares 12% debentures Interest Shares Diluted EPS 600,000 57,000 $10.53 28,800 3,000 345,600 ______ $974,400 36,000 96,000 $10.15 Assignment 19-30 Earnings available to common shareholders Basic: Net earnings Preferred dividends 600,000 x $.20 Weighted average number of shares Earnings per Share $18,000,000 ( 120,000) $17,880,000 Average shares 3,300,000 x 12/12 3,320,000 (1) x 0/12 Basic EPS 3,300,000 0 $5.42 (1) 10,000 x 2 = 20,000 shares issued on conversion 31 December 20x6 Individual effect of: 1. Preferred shares $.20 x 600,000 = $120,000 = $.20 600,000 600,000 2. Options Shares issued: 500,000 Shares retired: ($53 x 500,000)/$75 = 353,333 3. Debentures [($9,000,000 x .10) + ($20,000 x .9)] (1 - .4) = $550,800 = $3.06 (9,000,000 / 100) x 2) 180,000 4. Debentures, converted [($1,000,000 x .10) + ($20,000 x .1)] (1 - .4) = (1,000,000 / 100) x 2) $61,200 20,000 = $3.06 Earnings available to common shareholders Diluted: Basic, above Options Shares issued Shares retired Preferred shares Dividends/Shares Actual conversion of debentures Earnings Shares Debentures Interest; Shares Diluted EPS Weighted average number of shares Earnings per Share $17,880,000 3,300,000 $5.42 _________ $17,880,000 500,000 (353,333) 3,446,667 $5.19 120,000 $18,000,000 _600,000 4,046,667 $4.45 61,200 20,000 ___550,800 $18,612,000 _180,000 4,246,667 $4.38