Fin 3322: Cashman

advertisement

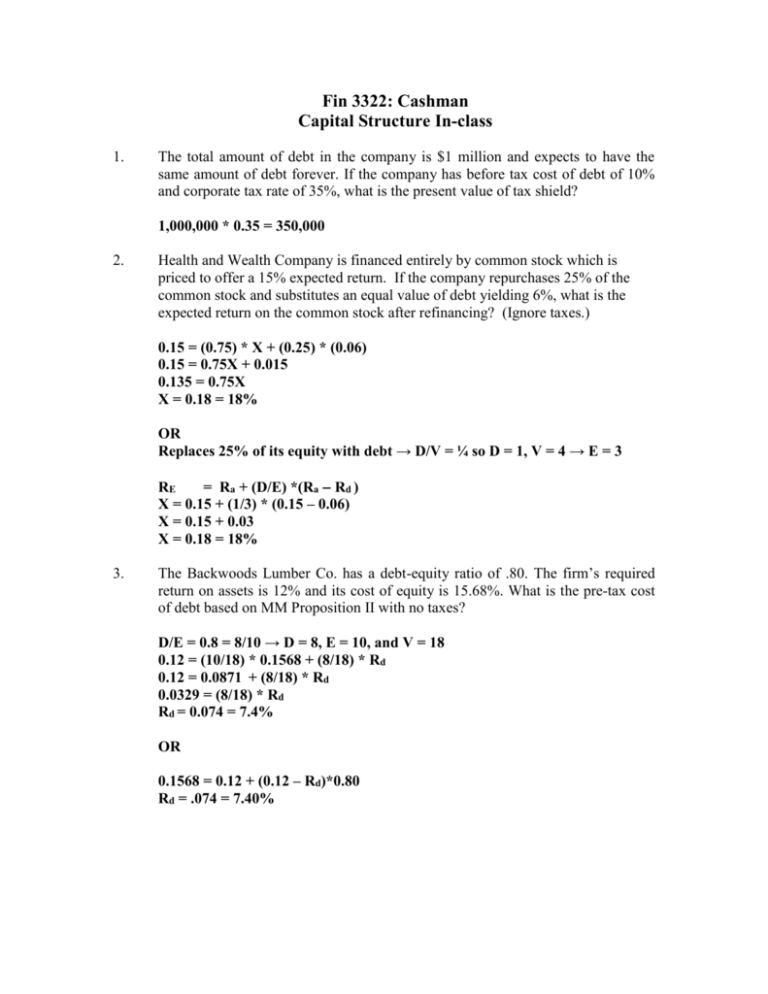

Fin 3322: Cashman

Capital Structure In-class

1.

The total amount of debt in the company is $1 million and expects to have the

same amount of debt forever. If the company has before tax cost of debt of 10%

and corporate tax rate of 35%, what is the present value of tax shield?

1,000,000 * 0.35 = 350,000

2.

Health and Wealth Company is financed entirely by common stock which is

priced to offer a 15% expected return. If the company repurchases 25% of the

common stock and substitutes an equal value of debt yielding 6%, what is the

expected return on the common stock after refinancing? (Ignore taxes.)

0.15 = (0.75) * X + (0.25) * (0.06)

0.15 = 0.75X + 0.015

0.135 = 0.75X

X = 0.18 = 18%

OR

Replaces 25% of its equity with debt → D/V = ¼ so D = 1, V = 4 → E = 3

RE

= Ra + (D/E) *(Ra Rd )

X = 0.15 + (1/3) * (0.15 – 0.06)

X = 0.15 + 0.03

X = 0.18 = 18%

3.

The Backwoods Lumber Co. has a debt-equity ratio of .80. The firm’s required

return on assets is 12% and its cost of equity is 15.68%. What is the pre-tax cost

of debt based on MM Proposition II with no taxes?

D/E = 0.8 = 8/10 → D = 8, E = 10, and V = 18

0.12 = (10/18) * 0.1568 + (8/18) * Rd

0.12 = 0.0871 + (8/18) * Rd

0.0329 = (8/18) * Rd

Rd = 0.074 = 7.4%

OR

0.1568 = 0.12 + (0.12 – Rd)*0.80

Rd = .074 = 7.40%

4.

Gail’s Dance Studio is currently an all equity firm that has 80,000 shares of stock

outstanding with a market price of $42 a share. The current cost of equity is 12%

and the tax rate is 34%. Gail is considering adding $1 million of debt with a

coupon rate of 8% to her capital structure. The debt will be sold at par value.

What is the levered value of the equity?

VU = 80,000 * 42 = 3,360,000

VL = 3,360,000 + (0.34 * 1,000,000) = 3,700,000

VLe = VLe - VLd = 3,700,000 – 1,000,000 = 2,700,000

5.

Scott’s Leisure Time Sports is an unlevered firm with an after-tax net income of

$86,000. The unlevered cost of capital is 10% and the tax rate is 34%. What is the

value of this firm?

86,000 / 0.10 = 860,000

6.

A firm has zero debt in its capital structure. Its overall cost of capital is 9%. The

firm is considering a new capital structure with 40% debt. The interest rate on the

debt would be 4%. Assuming that the corporate tax rate is 34%, what would its

cost of equity capital with the new capital structure be?

RE

RE

RE

RE

7.

=

=

=

=

Ra + (D/E) * (1 Tc)*(Ra Rd )

0.09 + (0.4/0.6) (1 – 0.34) (0.09 - 0.04)

0.09 + 0.022

0.112 = 11.2%

Hey Guys!, Inc. has debt with both a face and a market value of $3,000. This debt

has a coupon rate of 7% and pays interest annually. The expected earnings before

interest and taxes is $1,600, the tax rate is 34%, and the unlevered cost of capital

is 10%. What is the firm’s cost of equity?

VL = VU + TS

VU = {1,600 ( 1-0.34)} / 0.10 = 10,560

TS = 3,000 * 0.34 = 1,020

VL = 10,560 + 1,020 = 11,580

RE

RE

RE

= Ra + (D/E) * (1 Tc)*(Ra Rd )

= 0.10 + (3,000/8,580) (1 – 0.34) (0.10 - 0.07)

= 0.10692 = 10.692%

8.

Given the following information how much will $1 of debt increase firm value.

Corporate Taxes: 45%

Personal income tax rate: 35%

Personal income on equity: 25%

Vl = Vu + D {1-[(1-Tc)(1-Te)/(1-Td)]}

Only adding $1 of debt so the increase in firm value is:

D {1-[(1-Tc)(1-Te)/(1-Td)]}

1*{1-[(1-0.45)(1-0.25)/(1-0.35)]}

1*{1-[(0.55)(0.75)/(0.65)]}

1*{1-[0.63462]}

1*{0.36538}

$0.36538