Speech - IOSCO TC Conference 2009

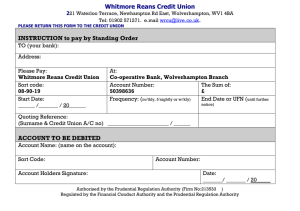

advertisement

Speech by Hans Hoogervorst, Chairman of the AFM Executive Board Iosco Technical Committee Conference, Basel, 9 oct. 2009 ____________________________________________________ Is there a conflict between the perspectives of investors and prudential concerns? I do not believe such is the case. Both investors and prudential regulators have a strong interest in healthy financial companies. And both parties need financial transparency to be able to judge the health of a bank or an insurer. These common interests are also found in the relationship between accounting standard setters and prudential regulators. In fact, they have a lot in common. To begin with, they both serve the public interest. The mission of accounting standard setters is to promote the reporting of unbiased and transparent information about the economic performance and condition of businesses. The mission of prudential regulators is to promote the safety and soundness of financial institutions and to reduce the risk of institutional failure. Both prudential regulators and accounting standard setters have a significant interest in market stability and economic growth. However, in some circumstances, differences in the focus of accounting standard setters and prudential regulators may create conflicts. Whereas the search for transparency is the natural focus of accounting standard setters, prudential regulators do not always have a penchant for openness. For example, transparency may not always be the best way to prevent a “run on the bank”. Paul Volcker – the greatest central banker of all times - still remembers with pride how he managed to hide the fact that the American banking sector was basically broken during the Latin American debt crisis. He is not a big fan of fair value accounting. Nevertheless, I believe the possible conflicts between these penchants for transparency and confidentiality are manageable as long as the independence of both accounting standard setters and prudential regulators is respected. Also, it is extremely important that there be intense communication between the two professions. Indeed, in the past two years the IASB has created many platforms for such communication with the prudential standard setters. There are direct talks with the Basel Committee, and there is ongoing communication in the Financial Stability Board and the Financial Crisis Advisory Group. Recently, the IASB established the Enhanced Technical Dialogue Mechanism in which prudential regulators play a major part. Just before the Pittsburgh G-20 meeting, the Basel Committee issued a press release stating its views on the ongoing review of the accounting standards for financial instruments. The Basel Committee stated – among others - that the IASB-proposals should not lead to an expansion of fair value accounting and that the new standard should allow banking transactions to reflect the underlying business model of a financial entity. I have two observations to make on this statement. First, the notion that the business model of a bank should be decisive for the question how a financial instrument should be accounted for puzzles me. For example, I do not think a CDO becomes any more or less toxic when it is held by Goldman Sachs or a German Landesbank. It is the economic substance of the financial instrument itself which should be decisive for the way it is accounted for. Secondly, although I agree with the Basel Committee that fair value accounting is in urgent need of improvement, I do not share the widely held view that currently IFRS is prone to pro-cyclicality. Let me explain why. The discussion on fair value already started when the first CDO’s started to be discounted in the market by 10 or 20%. Many banks found that very unfair. By now, it is clear that most of these assets are indeed highly toxic. The huge quantities of CDO’s issued in 2005 and 2006 suffer very high default ratios and very low recovery ratios. Undoubtedly, there are financial assets that were designed to circumvent the Basel rules and that should have never been held on the trading book to begin with. Some of these assets may indeed show exaggerated losses. The revision of IAS39 will deal with some of these problems. At the same time it is clear that the large majority of assets of most banks still consist of traditional loans. The loan-portfolio is still valued at amortized cost and is not required to be measured at fair value. Our Spanish colleagues from the CNMV have estimated that about 75% of the bank losses are related to traditional loans and have nothing to do with mark-to-market accounting. Also it is clear, that these traditional loan portfolios still contain a large amount of hidden losses. In fact, the IMF estimates that American and European banks still have to write down 1.5 trillion dollars, two thirds of which are loan losses. So overall, it is clear that overall bank assets are not being undervalued. Any possible pro-cyclical effect of fair value accounting is dwarfed by the losses that are still to be incurred on regular loans. Interestingly, both prudential and accounting standard setters seem to agree that the incurred loss model, by which losses on the loan-portfolio are recognized, may provide information on losses too late. The Basel Committee has encouraged the IASB to introduce an expected loss model, which should lead to a more timely recognition of loan losses. Prudential regulators hope it will lead to more conservative and accurate accounting. I agree that introduction of an expected loss model can be an improvement. Prudential regulators, however, should realize that an expected loss model, if properly executed, comes very close to fair value accounting! Imagine for one minute, what an expected loss model would do during an economic shock. After a sudden deterioration of the economy, such as the current crisis, an expected loss model could force banks to recognize immediately – at one go - the worsening quality of the loan portfolio. This is now being done step by step, while we all know that these losses are largely inevitable over time. My analysis thus far leads to the inescapable conclusion that both prudential and accounting standard setters basically agree that overall, current accounting rules have probably too lenient rather than too stringent. It is therefore risky that there is so much pressure on the accounting standard setters to be more lenient with fair value accounting immediately, while the adoption of an expected loss model will probably take a lot more time. In the short run, this might lead to decrease in the reliability of financial reporting of financial institutions and that is something neither prudential regulators nor accounting standard setters should want. So much for my comments on the press release of the Basel Committee. As far as I know, the accounting standard setters are not in the habit of publicly giving advice to the prudential regulators. Nevertheless I have been thinking of what a press statement on the ongoing work of the Basel Committee should say. First of all, it should state that prudential standard setters have a lot to gain by making their policies and requirements more transparent. In these days of intensely prying media, institutional investors and activist shareholders it is an illusion that you can keep real problems hidden for very long. Indeed, a perception that regulators may not be transparent about the true nature of the problems may serve to fuel undue unrest in the market. More specifically, I believe transparency can be served by making prudential criteria more aligned with general accounting rules. In the past years, there was an increasing distance between the risk-weighted Basel criteria and the tangible common equity figures as shown by plain accountancy rules. In hindsight it is clear that risk weights used to compute the capital ratios were not in line with the actual risks that banks were running. For example, the Basel ratios of the big US financial institutions that went broke were 50 to 100% above the minimums. In Europe it became normal for universal banks to become 30, 40 50 times levered or worse. They would be showing beautiful tier-1 ratios of about 10%, while their tangible common equity could be a frightfully low 2%. Therefore I think it is a big step forward that the Basel committee is improving the quality of its ratios. Most importantly, it will be introducing a new unweighted leverage ratio – a backstop ratio of 4% - which is much more closely aligned with the regular accountancy rules. At least this ratio will make the overall leveraging of a bank continuously visible to the market and the regulators. It is also closer to the benchmarks that the market and the IMF are currently already using to judge the health of financial companies. It is unfortunate this new leverage ratio apparently could not yet be used for the recent CEBS stress test of the European banks. At the same time, I must confess that a leverage ratio of 25 still seems pretty high to me. Certainly, a bank will never lend a penny to a customer who is levered 25 times over, at least that is what I hope. However, I am not a prudential regulator and, coming from a twin peaks supervisory model, I respectfully leave these considerations to my colleagues at the central bank. This brings me to my final observation, which is a plea for the twin peaks model of supervision. In Europe, we have many single regulators that are both prudential and securities regulators. They have to combine the penchant for confidentiality with their mission for transparency. This is not always easy. As I heard a single regulator recently say: we have two hearts beating in our chest. As a former Minister of Health I can assure you that having two hearts is very unhealthy, especially when they pump your blood in conflicting directions. During this crisis, I have become convinced that the Twin Peaks model is indeed the best way to solve the “two-hearts-in-one-chest”-problem. To be effective, a regulator should have a clear, focused sense of purpose. He should never be in a position where he is tempted to sacrifice the goal of transparency to prudential concerns or vice versa. It may be possible to manage the conflict between transparency and confidentiality, but it is better to prevent conflicts of interest than managing them. It is therefore better to give each heart its own chest.