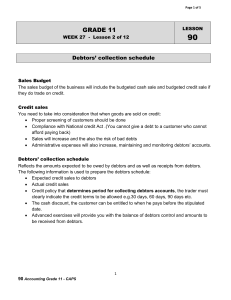

Page 1 of 5 GRADE 11 WEEK 27 - Lesson 3 of 12 LESSON 91 Cash

advertisement

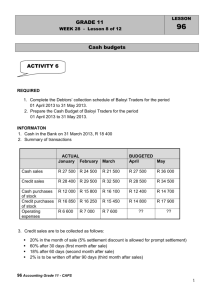

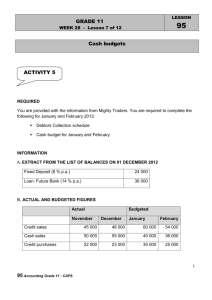

Page 1 of 5 LESSON GRADE 11 91 WEEK 27 - Lesson 3 of 12 Cash budgets : Debtors collection schedule Budgeted credit sales and Cash sales Example 1 Make use of the information provided below to draw up the Debtors collection period for the three month period 01January 2013 to 31 March 2013. Month Actual November 60 000 December 80 000 Budgeted January 50 000 February 52 000 March 60 000 Debtors usually settle their accounts as follows 60 % of debtors pay one month after the date of sale 20 % of debtors pay two months after the date of sale 15 % of debtors pay three months after the date of sale 5 % irrecoverable debts (bad debts) Note: Cash sales is 40% of total sales 1 91 - ACCOUNTING GRADE 11 CAPS Solution Debtors Collection Schedule Month Nov Credit sales Terms 36 000 × 60 % (Dec) × 20 % (Jan) Collection period January February 7 200 × 15 % (Feb) Dec 48 000 × 60 % (Jan) 5 400 28 800 × 20 % (Feb) 9 600 × 15 % (Mar) Jan 30 000 March 7 200 × 60 % (Feb) 18 000 × 20% (Mar) 6 000 × 15 % (Apr) Feb 31 200 × 60 % (Mar) 18 720 × 20 % (Apr ) × 15 % (May ) Mar 36 000 × 60% (Apr) × 20% (May) × 15% (June) Receipts from debtors 36 000 33 000 31 920 Calculations : always start with the actual sales followed by budgeted 2 91 - ACCOUNTING GRADE 11 CAPS How these figures appear The budgeted cash sales figure Extract from the Cash Budget January February March Cash Receipts Cash Sales 20 000 20 800 24 000 Receipts from debtor 36 000 33 000 31 920 The total projected sales figures Extract from the Projected Income Statement Sales Credit sales January February March 50 000 52 000 60 000 Budgeted cash sales November December January 60 000 x 60% = 36 000 80 000 x 60 % = 48 000 50 000 x 60% = 30 000 February March 52 000 x 60% = 31 200 60 000 x 60% = 36 000 January February March 50 000 x 40% = 20 000 52 000 x 40% = 20 800 60 000 x 40% = 24 000 3 91 - ACCOUNTING GRADE 11 CAPS ACTIVITY 2 REQUIRED Use the information provided below to prepare the Debtors collection schedule of Mzizi Traders for October, November, and December 2013. INFORMATION 1. Actual sales and expenses Month Cash Sales Credit sales Salaries Depreciation July 40 000 38 000 23 000 7 000 August 41 000 38 000 23 000 7 000 September 43 000 41 000 23 000 7 000 October 43 000 40 000 23 000 7 000 November 45 000 42 000 23 000 7 000 December 52 000 50 000 28 000 7 000 2. Budgeted sales and expenses Month Cash sales Credit sales Salaries Depreciation 3. The enterprise encourages the debtors to pay early by allowing a 5% discount for accounts settled within 30 days. Debtors are expected to pay as follows: 50% in the same month as transactions (receive 5 % discount) 30% in the following month 15% after two months 5% is written off as irrecoverable 4 91 - ACCOUNTING GRADE 11 CAPS ANSWER Collection period Debtors Schedule of Mzizi Traders Month Collection Credit sales Terms October November Extract from the Cash Budget of Mzizi Traders October November December December Cash Receipts Total Cash Receipts The business should always be consistent when applying the discount rate to specific classes of consumers – Consistency Principle 5 91 - ACCOUNTING GRADE 11 CAPS ANSWERS LESSON 91 Debtors Collection Schedule of MziziTraders Collection period Month Credit sales Terms October November August 38 000 × 15 % (Oct) 5 700 September 41 000 × 30 % (Oct) 12 300 × 15 % (Nov) October 40 000 Check calculations 6 150 19 000 × 30% (Nov) 12 000 × 15 % (Dec) November 6 000 42 000 Check calculations December 50 000 December 19 950 × 30 % (Dec ) 12 600 Check calculations 23 750 Receipts from debtors 37 000 38 100 42 350 Calculations October November December 40 000 × 50 % = 20 000 20 000 × (100 % – 5 %) 20 000 × 95 % = 19 000 42 000 × 50 % = 21 000 21 000 × (100 % - 5 %) 21 000 × 95 % =19 950 50 000 × 50% = 25 000 25 000 × (100 % - 5 %) 25 000 × 95 % = 23 750 6 91 - ACCOUNTING GRADE 11 CAPS Extract from the Cash Budget of MziziTraders October November December Cash Receipts Cash Sales 43 000 45 000 52 000 Receipts from debtor 37 000 38 100 42 350 Total Cash Receipts 80 000 83 100 94 350 23 000 23 000 28 000 Cash Payments Salaries Extract from Projected Income Statement of MziziTraders October Sales [Budgeted cash sales and credit sales] Operating expenses Salaries Depreciation November December 83 000 87 000 102 000 23 000 7 000 23 000 7 000 28 000 7 000 Note: Depreciation does not affect our Cash budget because there’s no outflow of cash The business should always be consistent when applying the discount rate to specific classes of consumers – Consistency Principle 7 91 - ACCOUNTING GRADE 11 CAPS