Treasury Management Exam 2004

advertisement

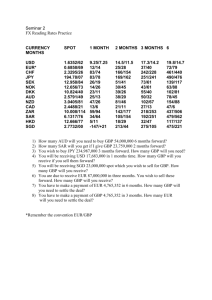

Treasury Management Exam 2004 Guideline Answers Q1) i) ii) Companies need written policies so that there are benchmarks, agreed procedures (by the board), performance evaluation and continuity for new personnel. Companies need to protect against fraud, theft, data leakage, data contamination and human error. (Each would need to be fleshed out e.g. what is contamination etc etc) The process would be as follows Segregation of duties Co dealer logs details on TMS + competitive quotes. Also logs in ERP system Company back office authorised Authorised deal by FD, treas etc Both parties send confirmations and reconcile Limits on Bank Limits on company Deal done done Dealer Dealer limits Bank Authorised/ Mandates Confirmation Bank dealer logs details Settlement to standard settlement instructions Segregation of duties Conversation recorded Security/ controls on settlement Internal audit, Physical access, Dual input, Pre formatted payment details, Passwords, Encryption, Authorisations, Answer back, Reconciliation iii) Physical security issues may be difficult to maintain e.g. for restricting access to computers if there is a space problem or hardware rationing. Dual entry may be a problem with limited staff and also when staff are on holiday, also maybe keeping passwords and access codes a secret. Same for dual authorisation. Segregation of duties may be impossible in a small department. Treasury Management Exam 2004 1 Q2) i) Translation Exposure. This arises through the need to translate overseas assets and liabilities into the base currency for reporting purpose. Affects the P&L and the Balance Sheet. A few areas may give problems. The first would be any fixed assets overseas e.g. are overseas offices rented or owned, as for the second, any currency loans taken on to fund these assets, or assets elsewhere. The third area might be the aircraft, depending on how they are carried on the books and whether they are bought or leased. Economic Exposure. This arises through the appreciation of a company’s cost base relative to that of its competition through the movement of exchange rates. Depending where the airline flies and where the customer base is, then there are two areas of economic risk. The first is the overall economic environment that will effect the whole of the airline industry, i.e. ticket sales. The second is the relative strength or weakness of the various currencies of the countries the airline flies to or from and how this affects the direction and volume of tourist traffic and business traffic. Many costs in the airline industry will be dollar based, e.g. aircraft but there will still be differences in local costs such as aircrew, head office etc Transaction. Transaction exposure arises through the effects of exchange rate movement on transactions that have to be done. This will arise from a number of areas; ticket sales, fuel costs, aeroplane purchase/ loan repayments, operations in other countries, on-flight sales, other purchases (e.g. meals). ii) Translation – depends on the size of the problem but probably not a big issue. Maybe some currency loans to match assets but would not spend shareholders money on forwards, options etc to ‘cosmeticise’ the balance sheet. There may be issues with covenants or earnings/performance and this might influence me. Would not use too much debt as excess borrowings could lead to - Thin cap issues – performance issues (measurement) – increased interest cost- local management problems ref the balance sheet if borrowing done in country Economic – little that can be done in the treasury area. Would not undertake any FX deals of a ‘speculative nature’. Would advise on issues of sourcing into other currencies for supplies but there may be restricted availability etc. At strategic level, would look to arrange destinations to pick up traffic both ways. Treasury to advise on this and strategic alliances. 1) 2) 3) 4) 5) 6) Transaction. Would use a mixture of techniques: As much internal hedging as possible i.e. local costs matched by local ticket sales with mismatches in time managed via currency accounts and borrowing. Forwards where there are large known exposures, i.e. purchase and financing of aeroplanes and fuel. Options – might use options, especially to ‘mop up’ fluctuations in fuel usage/spot price fluctuations or for covering uncertain purchases e.g. aircraft purchases Borrowing Swaps to cover mismatches in time Look at leading and lagging supplier payments Treasury Management Exam 2004 2 Q3) i) Cash Management is important to; ensure liquidity/cash is available maximise interest earnings/minimum interest costs control cost of working capital (float) ensure balance sheet looks well managed for creditors, analysts and rating agencies, customers good ratios (current, acid for creditor comfort) Fx risk management Minimise transaction costs/charges Cash cycle illustrates the importance of generating cash as well as making profit. Inventory £40 Labour etc £20 Purchases £20 Sales £80 Cash ?? -40 to +80 ii) Float is the time lost between a payer making a payment and it being recognised as good value funds on your account. This is a narrow definition of bank float. The concept can be extended to include any delay in the order to good value process. Float has a cost. Principal x days lost x int = float cost/gain 365/360 Treasury Management Exam 2004 3 250,000,000 x .06 x 39/365 = 1,602,740 assuming 30 days credit have been costed in and based on a receivables days of 47,260,270/250,000,000 x 365 = 69 Float may be occurring, in no particular order, in the following areas: Invoicing – why batch? Average payment is £700,000 so invoicing once a month will give average number of days of 45, i.e. 15 more, cost = £ 700,000 x .06 x 15 = £1,726 (note: the extra 15 days will not be picked up in receivables figures). So, invoice as delivered saving £1,726 Delivery. Customers will probably, at the least take 30 days from delivery, no matter what the invoice date. With high value, low weight/volume products, why not send by courier? Say, saves 4 or 5 days Then 700,000 x .06 x 5/365 = £575. It is unlikely to cost this much. Internal order to delivery process, cannot comment. Can encourage to change by; Offering discount to pay early but ensure it is reasonable Method of payment. Instructions on invoice to pay by eft – may not work but costs ‘nothing’. Offer to absorb extra cost of eft etc. Know your customers paying habits Refuse supply but effect on relationship Payment in advance or use post dated cheque where allowed, illegal in some countries Take legal action but costly potentially and may ruin relationship Apply penalties but may not be able to collect them Savings will depend on what costs are involved versus float saved, but could save; 75% by cheque. Assuming 2-3 days in post and 2 days clearing (in UK), longer for cheques drawn on Europe, say, 75% of payments taking 10 days longer than eft then: 250,000,000 x .06 x .75 x 10/365 = £308,219 or for those paying by cheque 700,000 x .06 x 10 /365 = 1,151 per invoice. Float loss through clearing cheques back to Europe. For those who will stick with cheques then Open a/cs in Europe to cut down on post and clearing times. Treasury Management Exam 2004 4 Q4) .040625 i) Total at T91 a) UK on own 950,000 x 4 1/16 x 91/365 = 9,622 = 959,622 b) Dkr on own 970,000 x 1 27/32 x 91/360 = 4,521 = 974,521 .0184375 Swap into GBP Sell Dkr 970,000 @11.1880 Buy GBP 86,700 Buy Dkr Sell GBP 974,521 @ 11.1240 87,605 43 /16 Total to invest 1,036,700 x .041875 x 91/365 = 10,823 = 1,047,523.22 Sell GBP 87,605 to leave GBP 959,918.22 Net overall again in GBP: 296.20 Swap into Dkr. 950,000 sell GBP @11.1895 10,630,025 Buy Dkr Buy GBP 960,032 @ 11.1280 Sell Dkr 10,683,232 1 31/32 Total Dkr to invest 11,600,025 x .0196875 x 91/360 = 57,728 = 11,657,753.4 Leave Dkr 974,521 in Denmark, sell balance of 10,683,232 @ 11.1280 to give £ 960,032 959,622. Surplus over GBP on individual basis 410.00 which is GBP 113.8 better than swapping into GBP so Swap to Dkr. b) Opportunities elsewhere – transaction costs – tax/inter-company loan implications time vs return – certainty of funds for 91 days – other investment types – policyaccess to markets – view of rates etc. ii) Certainty of exposure as to timing, actuality and amount. If uncertain may go ahead for flexibility of option. View of the future both expected spot vs current forward and view on volatility. iii) Discussion as to – Buy Puts or Calls – dictated by exposure. How many contracts- dictated by amount tempered by desire to over/under hedge via options. Treasury Management Exam 2004 5 Strike price – tempered by view on expected spot, current underlying and premiums. In, at or out of the market. Expiry Date – tempered by view on movement in volatility and decay of time value vs exposure date and increased premiums for longer period. European or American, OTC or traded iv) a) Calls b) 1,365,000 = 21.84 so, 21 or 22 62,500 c) either 21 x 62,500 x 1.84/100 = $24,150 or 22 x = $25,300 1.5800 a call, therefore add premium. 184 1.5984 Call, GBP at discount, therefore spot of 1.5911 Sell. Buy GBP at 1.5875 less 1 cent gained 100 Effective rate 1.5775 d) e) f) Q5) i) Benefits of netting are; Reduced funds movement, therefore float savings and reduced system risk. Reduced number of fx sales and purchases Reduced fx margins due to expertise and market amounts Guaranteed payment dates, therefore better cashflow forecasting for subs Some fx management available Eliminates need for subs to hold currency accounts Better and more timely management information Reduced administration in the group Increased control and sorting of inter-company disputes. ii) Payer Sub A GBP Sub A GBP Sub B SGD Sub C CHF Sub B SGD 2,581.5 Treasury Management Exam 2004 2,359.3 Sub C CHF 3,000 Sub D EUR 1,500 322.6 Total 4,500 2,904.1 2,359.3 6 Sub D EUR Total UNIT Sub A GBP Sub B SGD Sub C CHF Sub D EUR 3,993.6 6,575.1 PAYMENTS 6,575.1 2,359.3 3,000 1,822.6 13,757 2,359.3 Q5) iii) 1,822.6 RECEIPTS NET FLOW 4,500 2,904.1 2,359.3 3,993.6 13,757 (2,075.1) 544.8 (640.7) 2,171.0 - 2,715.8 + 2,715.8 Savings. Transfers: from six to four, therefore, 2 @ GBP 20 Float, from 13,757 to zero 13,757,000 x .055 x 2/365 FX saving at 1% 11,041,200 x .01 Therefore, annual 3,000 = 40 = 4,146 3,993.6 13,757.0 FLOWS ELIMINATED 4,500.0 2,359.3 2,359.3 1,822.6 11,041.2 = 110,412 114,598 = 1,375,176 Which companies are involved? Payables or receivables driven? Who does central bank reporting? Third party flows included? Other financial flows included? Who operates netting (in house, bank, managed) Netting centre location What FX rates? Spots – forwards – budget. Country level netting? Currencies? – To be used for billing and in netting Credit Period Settlement dates Rules, Regs and Permissions. Which countries allow netting Schedule e.g. invoice submission- pre net run- dispute resolution etc Interco loans/tax issues Motivational issues Frequency of netting Treasury Management Exam 2004 7 Q6) i) Riding the yield curve means trading one time period against another. E.g. assuming upward sloping yield curve. 5 3/4 5 5/8 Interest Rate 5½ 5¼ 3 Mo 6 Mo Time Bank could lend for 6 months 5 ¾ and fund itself 3 months at 5 ½ and hopefully, rollover funding after 3 months for further 3 months at 5 ½ thus making ¼ %. Risks are twofold. 1) Liquidity risk. Can the bank re-finance after 3 months and 2) Interest rate risk. i.e. will rates have moved up (as indicated by yield curve) in 3 month period say to 6.00? ii) a) Forward forward To T3 T6 4 5/16 Dept 6 Mo Borrow 3 Mnth Therefore, fwd fwd = 4 3/8 4.3125 x 6 = 25.875 4.375 x 3 = 13.125 12.75 divide by 3 = 4.25 Treasury Management Exam 2004 8 b) FRA rate would be 3-6 and therefore 4 ¾ 1,000,000 x 0.475 x 90/365 = 11,712.33 interest. = 1,011,712.33 total Actual 1,000,000 x .05 x 90/365 = 12,328.77 Difference 616.44 Therefore, compensation paid by ‘You’ to the bank. 616.44 = 90 1+ (.05 x /365) 616.44 = 608.94 1.0123286 Proof. (not asked for) Deposit: 999,391.1 x .05 x 90/365 = 12,321.26 = 1,011,712.33 total iii) a) implied rate is 100-95.49 = 4.51% b) worried rates may fall; buy today, to sell in future, therefore buy a contract today at: sell at 95.49 95___ 49 basis point loss 49 x 25 = $1,225 loss but 1,000,000 at 4.00% = 1,000,000 x .04 x 90/360 = 10,000 1,000,000 at 4.5 = 1,000,000 x .045 x 90/360 = Gain = Net gain = iv) 11,250 1,250 25 They are different instruments. The future is to a specific expiry date and therefore is likely to be different to an FRA and Fwd Fwd to the exact date the treasurer wants. The FRA and Fwd Fwd, at any one time, in theory should be the same but the FRA is a better instrument for the bank as it does not take up the balance sheet and so may quote a finer rate while for a ‘home made’ fwd fwd other costs will affect the comparability. E.g. spread on borrowing while FRA is based on Libor. Treasury Management Exam 2004 9 v) These are short term exposures so interest rate swaps are not really relevant. Other relevant ones would be options related either a floor?!! or a cylinder etc. Floor: higher premium but gives all topside potential, as period short premium may not be too large. Collar: Low premium, even zero depending on where buy and sell margins are set. Would use if do not want premium cost and prepared to give away partial topside potential or do not think rate will reach the top level anyway. Maybe critical to reach a certain level of return to meet availability but additional return not so important. Treasury Management Exam 2004 10