203834 - William Paterson University

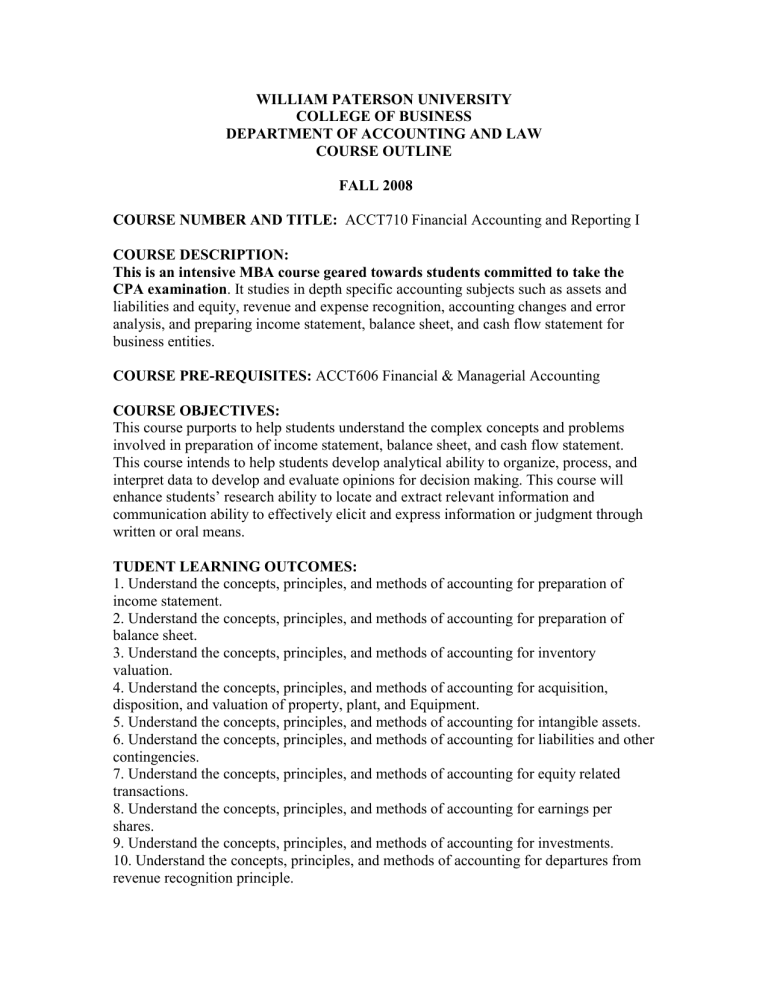

WILLIAM PATERSON UNIVERSITY

COLLEGE OF BUSINESS

DEPARTMENT OF ACCOUNTING AND LAW

COURSE OUTLINE

FALL 2008

COURSE NUMBER AND TITLE: ACCT710 Financial Accounting and Reporting I

COURSE DESCRIPTION:

This is an intensive MBA course geared towards students committed to take the

CPA examination . It studies in depth specific accounting subjects such as assets and liabilities and equity, revenue and expense recognition, accounting changes and error analysis, and preparing income statement, balance sheet, and cash flow statement for business entities.

COURSE PRE-REQUISITES: ACCT606 Financial & Managerial Accounting

COURSE OBJECTIVES:

This course purports to help students understand the complex concepts and problems involved in preparation of income statement, balance sheet, and cash flow statement.

This course intends to help students develop analytical ability to organize, process, and interpret data to develop and evaluate opinions for decision making. This course will enhance students’ research ability to locate and extract relevant information and communication ability to effectively elicit and express information or judgment through written or oral means.

TUDENT LEARNING OUTCOMES:

1. Understand the concepts, principles, and methods of accounting for preparation of income statement.

2. Understand the concepts, principles, and methods of accounting for preparation of balance sheet.

3. Understand the concepts, principles, and methods of accounting for inventory valuation.

4. Understand the concepts, principles, and methods of accounting for acquisition, disposition, and valuation of property, plant, and Equipment.

5. Understand the concepts, principles, and methods of accounting for intangible assets.

6. Understand the concepts, principles, and methods of accounting for liabilities and other contingencies.

7. Understand the concepts, principles, and methods of accounting for equity related transactions.

8. Understand the concepts, principles, and methods of accounting for earnings per shares.

9. Understand the concepts, principles, and methods of accounting for investments.

10. Understand the concepts, principles, and methods of accounting for departures from revenue recognition principle.

11. Understand the concepts, principles, and methods of accounting for changes in accounting estimates, changes in accounting principles, and error analysis.

12. Understand the concepts, principles, and methods of accounting for preparing cash flow statement.

13. Understand the concepts, principles, and methods of disclosing financial accounting information in the notes accompanying basic financial statements.

TOPICAL OUTLINE OF THE COURSE CONTENT:

1.

Current Assets, Current Liabilities and Contingencies

2.

Valuation of Inventories

3.

Acquisition and Disposition of Property, Plant and Equipment

4.

Depreciation, Impairments and Depletion

5.

Intangible Assets

6.

Long Term Liabilities

7.

The Income Statement and Related Information

8.

The Balance Sheet

9.

Accounting Changes and Error Analysis

10.

Stockholder’s Equity

11.

Dilutive Securities and Earnings Per Share

12.

Investments

13.

Revenue Recognition

14.

Statement of Cash Flows

15.

Full Disclosure in Financial Reporting

GUIDELINES/SUGGESTIONS FOR TEACHING METHODS AND STUDENT

LEARNING ACTIVITIES:

As an intensive MBA course targeted at highly motivated students who intend to take the

CPA examination, this class will be very demanding, challenging, and time-consuming.

Students must study the topic in advance and understand the accounting concepts and principles before class. Class lectures will be devoted not to the basics of the subject matter, but to the complicated logical analysis of the issues and how to solve difficult problems, as seen in the CPA exam. This course requires a very significant time commitment. It is imperative that students complete all assigned work on a timely basis and actively participate in class discussions.

STUDENT ASSESSMENT:

1. Homework & Class participation: 25%

2. Group Mini-tests: 25%

3. Exams: 50%

SUGGESTED READINGS, TEXTS

Kieso, Weygandt, and Warfield, Intermediate Accounting 12th Edition, Wiley, 2007

Nikolai, Bazley, and Jones, Intermediate Accounting, 10th Edition, South-Western, 2007

Contact: Sia Nassiripour, Ph.D., CPA

Office : Valley Road Building, Room 4073

Telephone number : 973-720-2241

Email : nassiripours@wounj.edu

Office Hours : T 10:30-2:00

W 10:30-11:00

TH 10:30-12:15 & 2:00-6:45

![FORM 0-12 [See rule of Schedule III]](http://s2.studylib.net/store/data/016947431_1-7cec8d25909fd4c03ae79ab6cc412f8e-300x300.png)