About us - Services Offered eFiling offers the facility to submit a

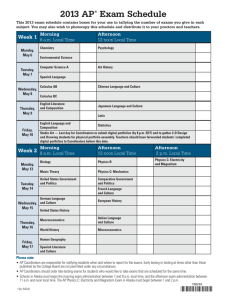

advertisement

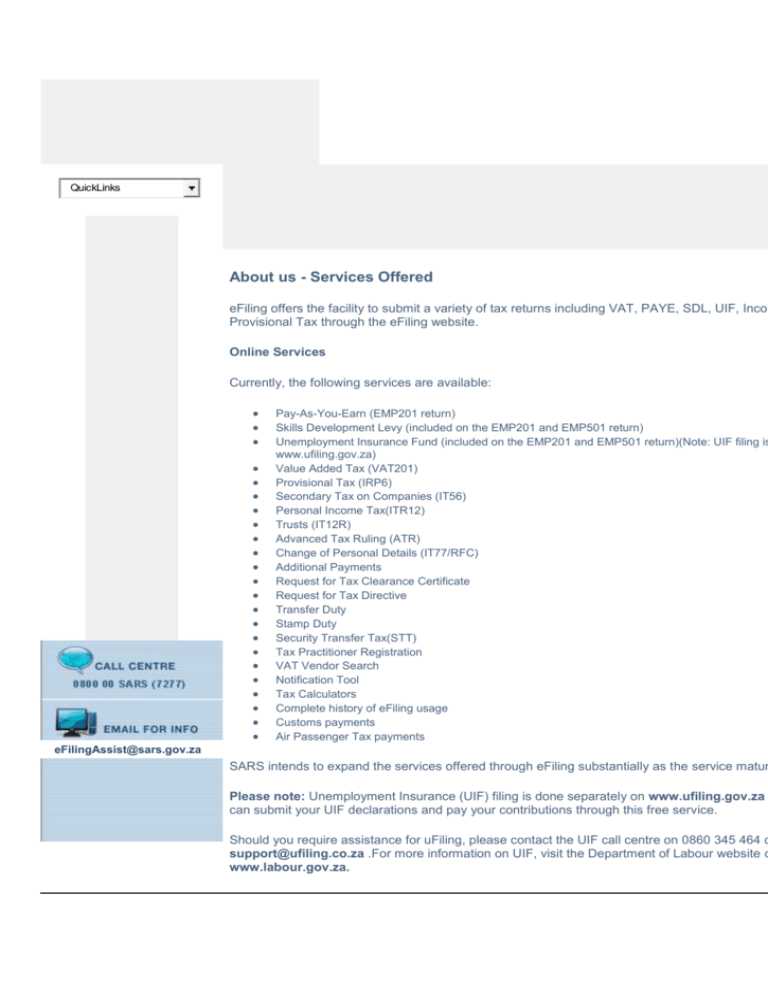

QuickLinks About us - Services Offered eFiling offers the facility to submit a variety of tax returns including VAT, PAYE, SDL, UIF, Incom Provisional Tax through the eFiling website. Online Services Currently, the following services are available: Pay-As-You-Earn (EMP201 return) Skills Development Levy (included on the EMP201 and EMP501 return) Unemployment Insurance Fund (included on the EMP201 and EMP501 return)(Note: UIF filing is www.ufiling.gov.za) Value Added Tax (VAT201) Provisional Tax (IRP6) Secondary Tax on Companies (IT56) Personal Income Tax(ITR12) Trusts (IT12R) Advanced Tax Ruling (ATR) Change of Personal Details (IT77/RFC) Additional Payments Request for Tax Clearance Certificate Request for Tax Directive Transfer Duty Stamp Duty Security Transfer Tax(STT) Tax Practitioner Registration VAT Vendor Search Notification Tool Tax Calculators Complete history of eFiling usage Customs payments Air Passenger Tax payments eFilingAssist@sars.gov.za SARS intends to expand the services offered through eFiling substantially as the service matur Please note: Unemployment Insurance (UIF) filing is done separately on www.ufiling.gov.za can submit your UIF declarations and pay your contributions through this free service. Should you require assistance for uFiling, please contact the UIF call centre on 0860 345 464 o support@ufiling.co.za .For more information on UIF, visit the Department of Labour website o www.labour.gov.za. Terms & Conditions | Privacy Policy | Disclaimer Manual on the Promotion of Access to information Act 2000 All information, content and data on SARS websites and associated facilities, including but not limited to software, hyperlinks and databases, is the property of or licensed to SARS and is protected under applicable South African laws. Unauthorised usage of content and/or information is strictly prohibited. No person, business or web site may reproduce this site, contents, information or any portion thereof.