Challenges and chances in the Retail Sector - Cedefop

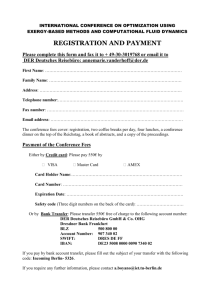

advertisement