GM's Handling of Transactions

advertisement

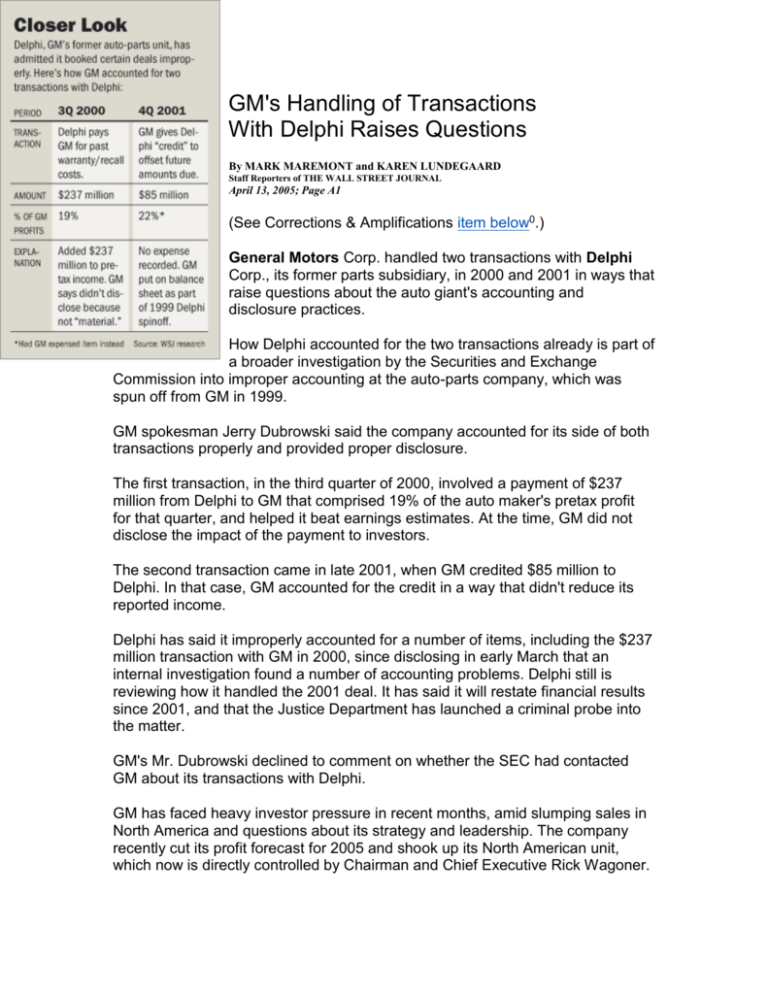

GM's Handling of Transactions With Delphi Raises Questions By MARK MAREMONT and KAREN LUNDEGAARD Staff Reporters of THE WALL STREET JOURNAL April 13, 2005; Page A1 (See Corrections & Amplifications item below0.) General Motors Corp. handled two transactions with Delphi Corp., its former parts subsidiary, in 2000 and 2001 in ways that raise questions about the auto giant's accounting and disclosure practices. How Delphi accounted for the two transactions already is part of a broader investigation by the Securities and Exchange Commission into improper accounting at the auto-parts company, which was spun off from GM in 1999. GM spokesman Jerry Dubrowski said the company accounted for its side of both transactions properly and provided proper disclosure. The first transaction, in the third quarter of 2000, involved a payment of $237 million from Delphi to GM that comprised 19% of the auto maker's pretax profit for that quarter, and helped it beat earnings estimates. At the time, GM did not disclose the impact of the payment to investors. The second transaction came in late 2001, when GM credited $85 million to Delphi. In that case, GM accounted for the credit in a way that didn't reduce its reported income. Delphi has said it improperly accounted for a number of items, including the $237 million transaction with GM in 2000, since disclosing in early March that an internal investigation found a number of accounting problems. Delphi still is reviewing how it handled the 2001 deal. It has said it will restate financial results since 2001, and that the Justice Department has launched a criminal probe into the matter. GM's Mr. Dubrowski declined to comment on whether the SEC had contacted GM about its transactions with Delphi. GM has faced heavy investor pressure in recent months, amid slumping sales in North America and questions about its strategy and leadership. The company recently cut its profit forecast for 2005 and shook up its North American unit, which now is directly controlled by Chairman and Chief Executive Rick Wagoner. Each of the transactions involves small amounts for a company of GM's size. GM last year posted profit of $2.8 billion on $193.5 billion in revenue. But four accounting experts who were asked to review the transactions by The Wall Street Journal said they raise questions about the quality of GM's reported earnings and disclosure to investors. The $237 million pretax payment in the third quarter of 2000 helped GM beat by one penny the earnings estimates of Wall Street, which already had been reduced from earlier estimates. Without it, the company would have fallen about 28 cents shy of the $1.54-a-share estimates of Wall Street analysts for that quarter. At the time, the auto giant was struggling with losses in Europe. For the quarter, GM reported net income of $829 million on sales of $42.7 billion, or $1.55 on a fully diluted per-share basis. Mr. Dubrowski said GM didn't need to disclose details about the payment to investors at the time because it wasn't material, adding that at the time GM provided less detail on warranty or recall costs. A GM spokeswoman, Toni Simonetti, said that GM reviewed its accounting of the transactions recently, after Delphi announced the probe of its accounting, and provided a report to the audit committee of its board of directors. "We were satisfied the accounting treatment was correct," she said. The $237 million payment arose from a dispute between the companies over who was responsible for warranty or recall costs associated with Delphiproduced parts. In an interview last month, Peter Bible, GM's chief accounting officer, said that when GM announces a recall, it typically allocates a share of the cost to any supplier whose parts played a role in the vehicle problem. But with Delphi, he said, "we had not done that," adding "we weren't certain they were going to honor those." After lengthy negotiations, Delphi in September 2000 agreed to pay GM to cover what Delphi has said were pre-spinoff warranty issues. GM declined to say if the parts were made by Delphi before the May 1999 spinoff, but said the recalls happened after the spinoff. Ms. Simonetti, the GM spokeswoman, said that GM had previously booked a cost for significantly more than $237 million to cover the recalls, depressing income in prior quarters. She said the payment from Delphi was simply a recovery of Delphi's share of those expenses. "This was a partial recovery of a recall expense from a supplier," she said. "It was not a gain." But the accounting experts contacted by the Journal said it appeared that the size of the payment was material to GM's earnings in that quarter and likely should have been reported separately. A one-time recovery from a supplier of 19% of pretax profits would be "way above the threshold of what's material" and should have been separately disclosed, said Paul R. Brown, chairman of the accounting department at New York University's Stern School of Business. Lori Holder-Webb, an accounting professor at the University of Wisconsin in Madison, said the payment was "unquestionably" a material amount that should have been disclosed. She said limited disclosure about one-time or nonoperating items has been an issue at many companies, and said, "I'm not sure they've done anything wholly improper." She also said spinoffs are unique occurrences, and that she would be more concerned if questions arose about the way GM accounted for day-to-day operations. GM's Mr. Dubrowski said the company has since shifted toward more disclosure of warranty and recall costs, adding that such a payment "would probably have been discussed" in today's climate of increased scrutiny and regulation of corporate accounting. 1 NEWSHOUND QUIZ Care to test your memory of recent news events in WSJ.com's weekly Newshound Quiz? Visit the page to sign up2, and then look for the quiz in your inbox Friday afternoons. Be the first to reply wi answers correct, and you can declare yourself Top Dog! Retired GM director Dennis Weatherstone, chairman of GM's audit committee in 2000 and the former chairman and CEO of J.P. Morgan & Co., said he doesn't recall any discussion of the $237 million payment. He said that doesn't mean a discussion didn't take place. When asked if a one-time payment over warranties that accounted for 19% of profits would be material, Mr. Weatherstone said, "I guess so." A spokeswoman for Deloitte & Touche LLP, GM's outside auditor then and now, declined to comment. The second transaction, at the end of 2001, involved a GM agreement to give Delphi an $85 million "credit," under which the auto-parts maker could offset certain amounts it owed GM. Delphi has described this transaction as "related" to the $237 million payment. GM's Mr. Dubrowski said it was distinct, but was part of the broader set of "negotiations that went on back and forth related to the separation." Though the credit was equivalent to a payment GM owed to Delphi, GM didn't record the sum as an immediate cost. Had it done so, GM's earnings of $255 million in the fourth quarter of 2001 would have been about 22% lower. GM booked the $85 million credit as though it were a continuation of the spinoff that had occurred in 1999. That resulted in an aftertax reduction of $56 million in GM's shareholder equity, but no charge to earnings. The cut in shareholders' equity was disclosed in a footnote in the 10-K annual report for 2001 that it filed with the SEC. In that quarter, GM reported net income of $255 million on sales of $45.9 billion, or 60 cents on a fully diluted per-share basis. Mr. Dubrowski said GM considered the $85 million credit to Delphi a payment to close outstanding retiree-benefit issues as part of the 1999 spinoff. GM said the credit "primarily" related to final tallying of amounts the companies owed each other for retiree benefits, dating to before the spinoff. The GM spokesman said the benefits issues were complex, adding: "It did take some time to reach resolution on this. Once resolution was reached, it was properly recorded." Again, accounting experts reached by the Journal questioned the matter. "I think the $85 million should have been a charge, or an expense," said Charles Mulford, an accounting professor at Georgia Institute of Technology in Atlanta. He said accounting rules typically allow companies one year to resolve outstanding issues after an acquisition or a divestiture. Though those rules don't specifically address spinoffs, he said he can't see a basis for counting a transaction 2½ years later as though it were part of the original spinoff. GM spun off Delphi to GM shareholders in May 1999 as part of a strategy to cut its fixed costs and give Delphi a better shot at selling to rival auto makers. With 185,000 employees, Delphi makes everything from satellite radios to steering components. Write to Mark Maremont at mark.maremont@wsj.com3 and Karen Lundegaard at karen.lundegaard@wsj.com4