Economics 201

advertisement

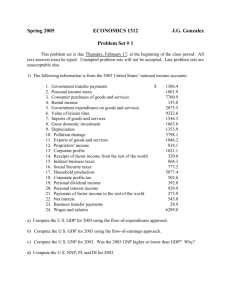

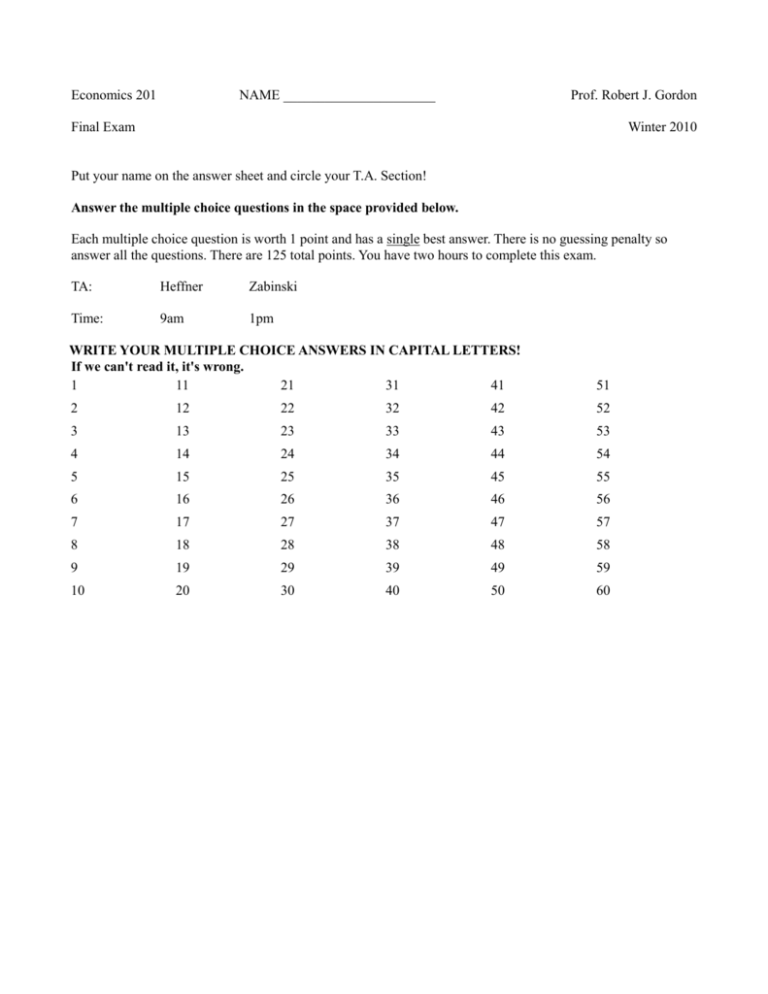

Economics 201 NAME ______________________ Prof. Robert J. Gordon Final Exam Winter 2010 Put your name on the answer sheet and circle your T.A. Section! Answer the multiple choice questions in the space provided below. Each multiple choice question is worth 1 point and has a single best answer. There is no guessing penalty so answer all the questions. There are 125 total points. You have two hours to complete this exam. TA: Heffner Zabinski Time: 9am 1pm WRITE YOUR MULTIPLE CHOICE ANSWERS IN CAPITAL LETTERS! If we can't read it, it's wrong. 1 11 21 31 41 51 2 12 22 32 42 52 3 13 23 33 43 53 4 14 24 34 44 54 5 15 25 35 45 55 6 16 26 36 46 56 7 17 27 37 47 57 8 18 28 38 48 58 9 19 29 39 49 59 10 20 30 40 50 60 Section 1: Multiple Choice (60 points) (In this section each question is worth 1 point) 1. In 2008, consumption spending is $7,000, government purchases are $2,000 and investment spending is $1,500. If GDP for 2008 is $10,300, then: A) exports are $400 and imports are $200. B) exports are $100 and imports are $200. C) exports are $500 and imports are $300. D) exports are $600 and imports are $800. 2 Which of the following major bubbles was NOT discussed in this course? A) Stock market bubble of 1927-29. B) Housing price bubble of 1975-79 C) Stock market bubble of 1996-2000 D) Housing price bubble of 2000-06 3 The short-run aggregate supply curve is positively sloped because: A) wages and other costs of production respond immediately to changes in prices. B) profit is lower when prices increase, so output decreases. C) workers are willing to work for lower wages rather than be laid off. D) higher prices lead to higher profit and higher output. 4 Federal funds are: A) government tax receipts B) loans made from the discount window C) loans between banks D) bank deposits at the Federal Reserve 5 In general, a change in the price level, all other things unchanged, causes: A) a shift of the aggregate demand curve. B) a movement along the aggregate demand curve. C) both a movement along the aggregate demand curve and a shift in the curve. D) no change in the purchasing power of assets. 6 Which of the following is the correct concept that shifts the AD curve to the right A) Increase in real net worth caused by decrease in price level B) Increase in real net worth caused by increase in nominal net worth C) Increase in real net worth caused by increase in the price level D) Increase in real net worth caused by an increase in liabilities 7 Other things being equal, investment spending __________ when __________. A) decreases; firms expect sales to fall B) increases; firms have excessive production capacity C) increases; the rate of growth of real GDP is low D) decreases; the obsolete or worn out physical capital increases 8 In the market for wooden furniture, if a country’s price in absence of international trade is lower than the price with trade, the country must: A) have absolute advantage in wooden furniture production B) import wooden furniture C) export wooden furniture D) have a surplus of wooden furniture 9 If the MPC is 0.8, t=0, and government spending decreases by $50 million, then equilibrium GDP will decrease by: A) $40 million B) $50 million C) $200 million D) $250 million 10 A course packet reading distinguished between “pocketbook” spending and total consumer spending Which of the following is NOT a component of pocketbook spending? A) Lumber bought at Home Depot B) A beer bought at Tommy Nevin’s pub C) A co-payment for a medical procedure D) Rent paid on owner-occupied housing 11 Inflation affects people adversely because: A) nominal income falls during inflation B) purchasing power tends to increase during inflation C) budget deficit increases during inflation D) inflation causes money to lose its value over time if the overall price level is rising 12 The main difference between a tariff and a quota is: A) a quota reduces imports more sharply than a tariff. B) a tariff will cause higher prices than a quota. C) a tariff will cause lower prices than a quota. D) a tariff generates tax revenue for the government, while a quota generates rents to the license-holders. 13 To fight inflation, the Fed should conduct ______ monetary policy to ______ interest rates and shift aggregate demand to the _______. A) contractionary; increase; right B) contractionary; increase; left C) expansionary; decrease; right D) expansionary; increase; left 14 Which of the following increased by the greatest percentage between 2007 and 2009? A) Monetary base B) Currency C) Excess reserves D) Total reserves 15 In an open economy suppose that GDP is $12 trillion. Consumption is $8 trillion and government spending is $2 trillion. Taxes are $0.5 trillion. Exports are $1 trillion and imports are $3 trillion. How much is national saving? A) $5.5 trillion B) $4 trillion C) $3.5 trillion D) $2 trillion 16 Discretionary fiscal policy involves: A) changing the money supply to change interest rates and investment spending B) using government spending or tax policy to affect aggregate demand C) lifting trade barriers on imports D) policy to raise the natural rate of unemployment Use the following to answer question 17: Figure: Circular Flow Model 17 What is GDP in this economy? A) $100 B) $400 C) $500 D) $600 18 If nominal wages fall, then the short-run aggregate: A) supply curve shifts to the right. B) supply curve shifts to the left. C) demand curve shifts to the right. D) demand curve shifts to the left. 19 Which of the following numbers is relevant to the back of the dollar bill, as discussed in the course packet and in class A) 3 B) 7 C) 11 D) 13 20 Potential output is: A) the level of real GDP that exists when the economy is experiencing only cyclical unemployment. B) the level of real GDP that exists when the actual rate of unemployment is zero. C) the level of real GDP that the economy would produce if all prices, including nominal wages, were fully flexible. D) the level of real GDP that the economy would produce if all prices, including nominal wages, were sticky. 21 A sale of bonds by the Fed: A) raises interest rates and increases the money supply B) raises interest rates and reduces the money supply C) lowers interest rates and reduces the money supply D) lowers interest rates and increases the money supply 22 Which of the following may lead to lower productivity because of a lack of incentives? A) a stable political system B) protection of property rights C) public education D) government subsidies 23 What is the “Great Unwinding” as argued by an op-ed writer in the course packet? A) Deleveraging B) Securitization C) Unwinding the system of welfare and unemployment benefits D) Unwinding the social security system 24 Crowding out is a phenomenon: A) where an increase in government's budget surplus decreases the overall investment spending B) where an increase in imports causes the overall domestic production to fall C) where overproduction in the goods market leads to a sharp drop in the aggregate price level D) where an increase in government's budget deficit causes the overall investment spending to fall 25 If the Federal Reserve wants to increase the monetary base, the Fed might: A) engage in an open market purchase of Treasury bills B) engage in an open market sale of Treasury bills C) purchase Treasury bills from the U.S. Treasury D) sell Treasury bills back to the U.S. Treasury 26 The Boeing Corporation buys $3 million worth of aluminum from the Aluminum manufacturers, $2.5 million worth of computerized hardware and software, and $1 million worth of mechanical tools to manufacture a certain model of aircraft. Boeing Corporation sells this particular model of aircraft at $10 million. The value-added by Boeing is equal to: A) $16.5 million. B) $15.5 million. C) $13 million. D) $3.5 million. 27 Mortgage loans granted almost quadrupled between 2000 and 2003. In the course packet readings, which of the following is NOT cited as a cause of this remarkable event? A) Bush tax cuts B) Monetary policy C) Tax-free capital gains for sales of residential property D) Lowered lending standards 28 The aggregate demand curve is negatively sloped in part because of the impact of: A) the wealth effect on consumption. B) a changing exchange rate on potential output. C) the stickiness of nominal wages and salaries. D) the flexibility of nominal wages and salaries. 29 We hold money to A) earn interest B) increases transaction costs C) reduce transaction costs D) protect out purchasing power 30 The official unemployment rate reported by the government may tend to understate the amount of unemployment by: A) including discouraged workers in the calculations. B) including people over 65 who aren't retired in the calculations. C) excluding discouraged workers who are not actively seeking employment. D) excluding teenagers from the calculations. 31 If your disposable income increases from $10,000 to $15,000 and your consumption increases from $9,000 to $12,000, your MPC is A) 0.2 B) 0.4 C) 0.6 D) 0.8 32 Which of the following is NOT a factor of production in the expanded production function of the lecture that is missing in the production function of the textbook? A) Political capital B) Infrastructure capital C) Geography D) Human capital. 33 In the "paradox of thrift": A) firms that are pessimistic about the future lay off the most savings-conscientious workers B) when families and business are feeling pessimistic about the future, they spend more today C) increased saving by individuals increases their chances of becoming unemployed D) profligate or squandering behavior during economic tough times has large negative consequences for society 34 When financial institutions assemble pools of loans and sell shares in the income from these pools, this process is known as: A) loan funding B) securitization C) diversification D) sharing the wealth 35 The lecture highlighted __________ as an example of a country that had converged and ________ and __________ as examples of countries that had not converged A) Korea, Venezuela, Argentina B) Hong Kong, Korea, Argentina. C) United States, Taiwan, Argentina D) Argentina, United States, Hong Kong 36 A business should decide to borrow to fund its project if: A) the rate of return on the project is less than the interest rate on the loan B) the project will produce a good or service that is in high demand C) it is going to be a project where minimum efficient scale is attained D) the rate of return on the project is at least as great as the interest rate on the loan 37 If real GDP rises while nominal GDP falls, then prices on average have: A) fallen. B) risen. C) stayed the same. D) Real GDP can not rise when nominal GDP falls. 38 In the notation of the class handout, which of the following is true? A) KI = I B) KI = I – NS C) KI = IM – X D) KI = X – IM E) B) and C) F) B) and D) 39 A capital inflow into a country is associated with: A) a decreased source of funds available for domestic investment B) imports exceeding exports C) imports equaling exports D) imports less than exports 40 A bank run can “break a bank” because: A) borrowers default on their loans, and the bank's assets become worthless B) banks can not convert quickly illiquid loans into liquid assets without facing a large financial loss C) depositors' panic spreads to borrowers, who want to take additional loans from the bank D) the bank's reserves kept with the Federal Reserve are in the form of illiquid U.S. Treasury bonds 41 If the aggregate consumption equals $100,000,000 + .75*YD, then the marginal propensity to consume is: A) 0.75 B) 0.25 C) $75,000,000.00 D) $100,000,000.00 42 Which of the following terms discussed in the course lectures IS related to the conduct of monetary policy over the last two years? A) Zero lower bound B) Saving glut C) Irrational exuberance D) Obama stimulus 43 An expansionary fiscal policy: A) usually decreases a government budget deficit or increases a government budget surplus B) may include decreases in government spending C) may include increases in taxes D) may include decreases in taxes 44 The lecture’s solution to global warming and the environment was A) Maintain the status quo B) Emulate what Europe has already achieved C) Emulate what China has already achieved D) Set new standards to require higher fuel efficiency for American cars 45 All of the following are factors that drive productivity growth EXCEPT: A) growth convergence B) physical capital C) technological progress D) human capital 46 Monetary neutrality implies that in the long run: A) monetary policy determines potential output B) aggregate supply is independent from monetary policy C) changing the money supply does not have any effect on the aggregate price level D) aggregate demand is independent from monetary policy E) both B) and D) 47 Human capital is: A) not as important as physical capital B) the improvement in labor created by education and knowledge that is embodied in the work force C) the machinery and tools that each individual owns D) robots that can perform tasks that only humans could do in the past 48 If interest rates on bonds rise, holding other things constant, stock prices will: A) increase B) decrease C) not change D) it is impossible to say how stock prices will change 49 Which one of the following is correct? A) Unemployment Rate = Unemployed / Employed B) Unemployment Rate = Unemployed / Population C) Unemployment Rate = Employed / Labor Force D) Unemployment Rate = Unemployed / Labor Force 50 When the short-term interest rate ______, the opportunity cost of holding money _____, and the quantity of money individuals want to hold ______. A) falls; falls; falls B) falls; falls; rises C) rises; falls; falls D) rises; falls; rises 51 Which of the following (according to the Economist article) is not a “myth” of the Great Depression? A) It was caused by the stock market crash B) Policy was passive C) The New Deal made matters worse D) It was caused by high tariffs imposed in 1930 52 Which of the following is NOT a determinate of consumer spending? A) current disposable income B) expected future disposable income C) investment spending D) wealth 53 The largest source of federal tax revenues is: A) property taxes B) personal income taxes C) corporate income taxes D) sales taxes 54 The trough of the business cycle: A) comes right after the expansion phase B) comes right before the recession phase C) is a temporary maximum level of real GDP D) is a temporary minimum level of real GDP 55 Which equivalence best helps to understand the relationship between the income multiplier of Chapter 11 and the money-creation multiplier of Chapter 14? A) MPC = rr B) MPC = 1-rr C) MPS = 1-rr D) 1-MPS = rr 56 A downward shift in the consumption function can be caused by: A) a decrease in disposable income B) an increase in disposable income C) a decrease in wealth D) expectations of higher permanent income 57 Honduras exports clothing to the United States, and the United States exports bulldozers to Honduras. Proponents of the Heckscher-Ohlin model would explain this pattern of trade by stating that: A) Honduras has an advantage in the technology used in clothing production, while the United States has an advantage in the technology used in bulldozer production. B) Honduras has a climate that is more conducive to producing clothing, while the United States has a climate more conducive to producing bulldozers. C) Honduras has a relatively larger endowment of factors of production that are suited to making clothing, while the United States has a relatively larger endowment of factors of production that are suited to making bulldozers. D) Honduras has a factor intensity in capital and the United States has a factor intensity in labor. 58 The primary difference between M1 and M2 is that: A) the dollar amount of M1 is much larger than the dollar amount of M2 B) M1 includes checkable deposits, but M2 does not C) M2 includes checkable deposits, but M1 does not D) M2 includes savings deposits and time deposits, but M1 does not 59 Which of the following terms discussed in the course lectures is most closely related to the term “under water”? A) NINJA B) Trade deficit C) Fiscal deficit D) Household saving rate E) None of the above 60 Which of the following does NOT come under the rubric of fiscal policy? A) taxes B) government transfers C) government purchases of goods and services D) changes in the money supply Section 2: Short Answer (65 points) Question 1: 10 points total International Trade Suppose the United States has a domestic demand for helicopters described by the equation p = 1000 – q. Furthermore suppose domestic supply is described by p = q. Suppose the world price is 300 and the U.S. economy is open. You can use the following space provided to sketch a graph. It won’t be graded. a) (1 pt.) With international trade, how many helicopters will be produced by the United States? Qs=300 b) (1 pt.) With international trade, how many helicopters will be imported? Qd=700 so IM=400 c) (2 pts.) In this economy, total consumer surplus is ____________ and total producer surplus is ____________. 700^2/2=245,000 300^2/2=45,000 d) (1 pt.) Throughout the rest of this question, suppose the U.S. imposes a $100 tariff on helicopters. How many helicopters will be bought by U.S. consumers in total? Qd=600 e) (1 pt.) How many helicopters will be made in the United States with the $100 tariff? Qs=400 f) (1 pt.) What are the government’s revenues from the $100 tariff? 200*100=20,000 g) (3 pts.) What is the deadweight loss associated with the $100 tariff? ((400-300)/2+(700-600)/2)*100=10,000 Question 2: 10 points total Aggregate Supply and Aggregate Demand A) P B) P Y C) P Y D) P Y Y For each of the following questions clearly label all the curves you draw. All your curves can be drawn as straight lines. a) (3 pts.) In panel (A), draw an economy that is initially in long-run equilibrium. Label your curves AD1, SRAS1 and LRAS1 and the equilibrium point 'A'. b) (2 pt.) In panel (B), replicate your drawing from panel (A) and draw the effect of a negative supply shock. Label your new short-run equilibrium point 'B'. (Be sure to clearly show which curve you are shifting) (1 pt.) What type of gap is the economy experiencing? ___________________________ c) (2 pts.) In panel (C), replicate your drawing from panel (B) and draw the effect of the long-run self-correcting mechanism, label your resulting equilibrium point 'C'. (Be sure to clearly show which curve you are shifting) d) (2 pts.) In panel (D), replicate your drawing from panel (B) and draw the effect on equilibrium if the government were to intervene through the use of fiscal or monetary policy to try to close the gap. Label your resulting equilibrium point 'D'. (Be sure to clearly show which curve you are shifting) Solutions: a) Vertical LRAS, downward-sloping AD, upward sloping SRAS, all intersecting at point A. b) SRAS shifts to the left, point B has higher P and lower Y. There's a recessionary gap. c) Self-correcting mechanism shifts SRAS back to its original position. Point A = point C. d) Active policy shifts AD to the right, point D has higher P and Y is back to Ypotential. Question 3: 13 points total Monetary Policy The monetary base of Canada is $45 billion. Of this, $30 billion is in currency. The required reserves-to-deposits ratio is 10% (r = 0.1). There are no excess reserves. a) (1 pt.) How much money is held as reserves at the central bank? R=MB-C=$15 billion b) (2 pts.) How much money is deposited at banks in Canada? D=R/rr=$150 billion c) (1 pt.) What is the money supply of Canada? MS=C+D=$180 billion d) (1 pt.) The money demand equation is either M = 240 + 20*i or M = 240 - 20*i, where the interest rate i is measured in percent. Circle the correct one. e) Suppose the Bank of Canada, Canada's central bank, moves the money supply to $160 billion. (i) (2 pts.) To accomplish this, to what level does it set the monetary base? Assume the desired currency-todeposits ratio doesn't change. c=30/150; MonMult=1.2/0.3=4; MB=160/4=40 billion (ii)(1 pt.) What is the new level of deposits? MB=(c+rr)D so D=40/0.3=133.33 billion f) (3 pts.) By how much does the interest rate change as a result of this monetary policy action? If MS=180, i=3; if MS=160, i=4 so d(i)=+1% g) (2 pts.) According to the currency-to-deposits ratio, if you get paid $100 in cash, how much are you going to deposit in the bank and how much are you keeping in cash? C=c/(1+c)*100=$16.66 and D=83.33 Question 4: 6 points total Aggregate Demand and the Income Expenditure Model a) (1 pt.) Panel A refers to the Income-Expenditure diagram. Suppose the level of autonomous aggregate expenditure is 150 and that the equilibrium level of GDP is 450. Draw the planned aggregate expenditure line for this economy. Label the equilibrium point “E1”. (Don't forget to write down the level of AAE on the vertical axis and of income in the horizontal axis.) A line with y-intercept at 150 and crossing the 45 line at 450. b) (1 pt.) Based on the information in (a), what is the multiplier for this economy? Mult=3 c) (1 pt.) One of the determinants of the planned aggregate expenditure line is the price level. Suppose that the aggregate expenditure line you drew in (a) corresponds to a price level of 100. Plot the (Y, P) combination in panel B and label it “E1”. (Don't forget to write down the level of aggregate prices on the vertical axis and of income in the horizontal axis.) dY=3*(-50) so Y=300 d) Suppose that the price level rises to 120. Show the effect of this on this on planned aggregate expenditures by doing the following: (i) (1 pt.) Assume that the change (in absolute terms) in AAE is equal to 50. Find the new level of equilibrium GDP. (Hint: remember that you know what the multiplier for this economy is.) New AEp line with y-intercept at 100 and crossing 45 line at 300. (ii) (1 pt.) In panel A, draw the new planned aggregate expenditure line. Label the new equilibrium point “E2”. (Don't forget to write down the level of AAE on the vertical axis and of income in the horizontal axis.) Question 4 continues on next page e) (1 pt.) Plot the new (Y-P) combination in panel B and label it “E2”. (Don't forget to write down the level of aggregate prices on the vertical axis and of income in the horizontal axis). Finally, connect E1 and E2 to derive the aggregate demand curve. Properly labeled downward-sloping demand curve. Question 5: 7 points total GDP and the GDP Deflator a) (4 pts.) Complete the following table. Nominal GDP Constant-2007 dollar GDP Constant-2008 dollar GDP GDP Deflator (base = 2007) GDP Deflator (base = 2008) 2007 2008 60 85 60 80 75 85 100 106.25 80 100 b) (2 pt.) What is the percentage change in the chained GDP deflator between 2007 and 2008? Calculate using natural logs and round to the hundredth percentage point. 14.19% =(ln(106.25/100) + ln(100/80))/2 c) (1 pt.) If from 2000 to 2008, nominal GDP grew an average of 4% per year, how much was nominal GDP in 2000? Calculate using the natural log formula and round to the hundredth (2 decimal places). 85*exp(-0.04*8)=61.72 Question 6: 15 points total Income-Expenditure Equilibrium Suppose the following holds for the economy of Albania. All currency amounts are given in billions of lekë, the currency of Albania. Currently there are no other taxes in place. Autonomous consumption 10 Planned investment 3 Government purchases 2 Exports 1.5 Imports 1 Autonomous taxes 5.5 MPC 0.8 a) (1 pts.) What is the multiplier for the Albanian economy? 5 b) (3 pts.) What is equilibrium GDP for the Albanian economy? AAE=11.1 so y*=55.5 billion lekë c) (2 pts.) Suppose that oil is discovered in the Adriatic Sea off the coast of Albania, and exports increase by 3 billion lekë. What is the change in GDP resulting from this export boom? dy=3x5=15 billion lekë Now, suppose that the tax structure of Albania had been different. Instead of an autonomous tax amount of 5.5 billion lekë, suppose that the Albanian government levied a proportional tax rate of 10% (t = 0.1). d) (2 pts.) What is the multiplier for the Albanian economy under this new tax scheme (give answer to three decimal places)? 3.571 e) (3 pts.) What is the change in GDP resulting from the same oil export boom from before under this new tax scheme (give answer to three decimal places)? dy=3.571x3=10.714 billion lekë (f) (1 pt.) In this example, the more progressive tax scheme entailed a ______________(smaller/larger) response of GDP to the export boom. Question 6 continues on next page (g) (3 pts.) Calculate the effect of the oil-induced export boom on the Budget Balance for each of the two tax regimes? Regime 1: dBB=0; Regime 2: dBB=t*dY=0.1*10.714=1.07 billion leke. POSSIBLE NEW QUESTION: Question 7: 4 points total Loanable Funds and Crowding Out The graph show the loanable funds market for the economy of Imprudentland. One of the loanable funds demand curves is for last year (Y0), while the other is for this year (Y1). The supply of loanable funds remained constant over the period, as did private demand for them. This year, the Imprudentland government budget deficit (financed by borrowing) is $150 billion, whereas the government budget was balanced last year. (a) (1 point) On the graph above, clearly label this last year's loanable funds demand curve Y0, and this year's loanable funds demand curve Y1. LOWER DEMAND IS Y0 AND HIGHER DEMAND IS Y1 (b) (3 points) How much private investment has been crowded out this year as a result of Imprudentland's government budget deficit? Y1 INTEREST RATE IS 4% AND PRIVATE DEMAND OF FUNDS IS 100. SO CROWDING OUT = 200 -100 = 100.