V - University of Baltimore

advertisement

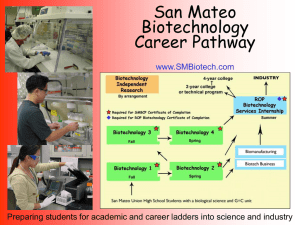

Baltimore and South Africa together to eliminate HIV/AIDS Presented By: Carlos Fernandez Chinwe Ekejiuba Godfrey I-Nwanze Nadine Moukouri Executive Summary This Paper focuses on the Biotechnology industry in the Baltimore region and the Biotechnology industry in South Africa. It highlights the various factors that have been instrumental in making the biotech industry in both regions successful and economically viable for global business opportunities. It also analyzes the weaknesses that exist in both regions and discusses about the feasibility, (given the strengths and weaknesses of both industries), of having a business venture between two participant from each region. This paper also discusses the cultural dimensions for both regions drawing upon Hofstede’s dimensions of power distance. The analysis covered in this paper for both the Baltimore region and South Africa highlights various issues such as: facts about Baltimore and SA’s industry strengths; the history and current market and economic conditions of both regions; and the strengths and weaknesses of each of both regions. Both regions are further examined using the Porter Model which is an analysis of Porter’s four determinants of competitive advantage. These determinants are as follows: 1) Factor Conditions – which looks at what factors (be it environmental, economic, coincidental, or planned) and conditions make South Africa a conducive environment for these industries to thrive, compete and succeed. 2) Demand Conditions – which examine the sophistication of the consumers in both industries as well as the potential users of the products. 3) Related and supporting industries – which focus on the industries that coexist and are a benefit to/of the activities of firms within these two industries. 4) Firm Strategy, Structure and Rivalry – shall focus on the examination of one of the leading companies or government heading each industry and analyze the firm’s/ government’s strategy within that industry, the intensity of competition and rivalry (if any). The paper also provides analysis of both Baltimore and South Africa’s cultural aspects drawing from Hofstede’s dimensions of power, distance, uncertainty avoidance, individualism, and masculinity. It suggests ways how any problems or synergies may be achieved as a result of combining or utilizing knowledge of each region’s cultural diversity through a cooperation or strategic partnership. The model for this partnership is discussed as well as its advantages. It also discusses the main risks that the new venture shall be faced with, i.e. political, legal, economic, cultural, etc. This paper also examines what key steps/efforts shall need to be taken in terms of strategic capabilities, leveraging knowledge, and managing across organizational boundaries/cross-culturally to have the greatest chance of success. Finally, this paper offers our opinions and conclusions about Baltimore’s role as a player on the global scene as well as what both regions offer each other’s citizens. II. Description and analysis of the Biotechnology in Baltimore as the industry with best potential for Global expansion A. Current market and economic conditions Baltimore’s biotech industry is an innovator industry that creates unique products in Biotherapeutics and Diagnostics. Its global potential is enormous due to the better quality of life that people around the world are searching for through its various applications. The Greater Baltimore region, which has grown to become one of the nation’s largest bioscience hubs, possesses an attribute termed ‘Smart Market’. This is given the fact that the Baltimore-Washington metro area is one of the most highly educated regions in the world. It ranks 1st among the 15 bioscience benchmark metros, with 18.5 percent of the population aged 25 and over holding advanced degrees. The numerous federal institutions, Universities and various Institutes that call the Baltimore region home include the Johns Hopkins University (JHU) and the University System of Maryland. The Washington-Baltimore region is one of the world’s leading centers for research and discovery. The region ranked 3 rd among the benchmark metro areas for annual National Institutes of Health (NIH) awards with $1.45 billion received in 2003. Johns Hopkins ranks 1st among universities for NIH awards, 3rd for biotech patents and 7th for biotech publications. Baltimore hosts some important regulatory agencies such as the Food and Drug Administration (FDA), The National Institute of Health, and 8% of the U.S. Bioscience market. It is a strategic physical location because new products applications and clinical trials can be delivered to the FDA labs efficiently. Also, Human resources are a source of strength for the Bioscience Industry with more 34,000 private sector employees, research universities, federal research institutions with 20 years of development and research. The FDA approves a product faster and easier than it would take for foreign regulatory agencies to approve the same product. The FDA’s base in the Baltimore region is a big pull factor for this region as it is highly recognized and trusted around the world. The good reputation of the health care system in Maryland around the world and the United States makes it feasible for end users (healthcare tourism) to come. Also, the Baltimore biotech industry’s increasingly good reputation lowers the barriers of entry into international markets for Biotherapeutics and diagnostic products. B. Industry leaders and key competitors The industry is considered by the North American Industry Classification System (NAICS) as one of Research and Development because their core business is to create new ways to prevent, treat or cure diseases. The industry leaders are innovators in Biotherapeutics and Diagnostics such as MedImmune, Human Genome Sciences, Celera, GenVec, Martek, Otsuka, BD Diagnostics, Digene, Invitrogen and Qiagen. As an example of their power of innovation, one of the leaders in the industry, MedImmune created Synagis® (palivizumab) that is the only monoclonal antibody approved by the FDA to help prevent an infectious disease. Also, they created FluMist® (Influenza Virus Vaccine Live, Intranasal) is the first and only nasal spray flu vaccine approved in the U.S. to help prevent influenza and is indicated for the active immunization. C. Strengths and weaknesses One of the strengths of Bioscience in Baltimore is that it has an exceptional workforce. Maryland is ranked first among U.S. states (25.7%) in percentage of professional and technical workers in the workforce. Also, it is ranked second in concentration of doctoral scientists and engineers, including first in Health Sciences and second in Bio and Agricultural Sciences. A second strength is location; Baltimore is located in a strategic spot in the Atlantic cost for easy access all the US Atlantic cost and Europe. Another strength is that Maryland is the presence of /access to leading R&D facilities in bioscience include federal powerhouses such as National Institutes of Health (NIH), FDA, National Institute of Standards and technology (NIST) and J. Craig Venter Institute (JVC), and Maryland institutions such as The Johns Hopkins University’s Applied Physics Laboratory (APL), University of Maryland Biotechnology Institute (UMBI) with all its divisions. Some of the Baltimore regions weaknesses include: (1) (2) (3) The need for greater access to funding and Venture Capital. A well planned strategy for developing and coordinating the activities of the Biotech industry. Lack of sufficient pull factors for world class researchers, scientists doctors and research industries, towards the Baltimore region from other parts of the world D. Analysis of the four Porter determinants of competitive advantage- Diamond Model Factor Conditions Factors leading to the development and growth of Bioscience/Biotechnology in Baltimore include: organic growth from within the Maryland market; connections to universities, research scientists or investors; attraction of international firms; small firms currently located in US metro areas that lack ‘critical mass’ in biosciences; and attraction of top scientists and research groups to area universities; financial investment and support; networking/connections. Venture Capital and other Funding: The Washington-Baltimore region ranks 6th among the top US bioscience regions for venture capital (VC) with over $990 million invested in biosciences over the past five years. In terms of both dollars and deals, the region ranks 1st among top bioscience markets for growth in VC investment. Over 85 percent of VC investments in the Baltimore-Washington region in the past five years went to firms based in Maryland. Universities and Institutes: Improved tech transfer and commercialization from the local universities has been critical to supporting the Bioscience/Biotech industry in Baltimore. As the home to a large number of federal institutions, The Johns Hopkins University (JHU) and the University System of Maryland, the Washington-Baltimore region is one of the world’s leading centers for research and discovery. The region ranked 3 rd among the benchmark metro areas for annual National Institutes of Health (NIH) awards with $1.45 billion received in 2003. Johns Hopkins ranks 1st among universities for NIH awards, 3rd for biotech patents and 7th for biotech publications. Physical Location: Surrounded by the most important regulatory agency in the industry, the FDA and federal agencies in Washington DC. The Baltimore port provides easy access to all the Atlantic US Coat and Europe by sea. Flexible and inexpensive space has been another very attractive feature of the Baltimore area for Bioscience/Biotech. Labor Capital: High educated workforce, being the leader in doctoral scientist make Baltimore an ideal place for this professional to apply their knowledge. Highly specialized pools of skills and scientific knowledge are developed and created in research centers in USM universities as well as public private sector laboratories. Top universities educate science doctorates and business people, among others. Demand Conditions Various governmental agencies including the FDA and NHA, Pharmaceutical drug manufacturing companies, biotech companies, as well as the numerous hospitals, USM universities and institutes are the customers of the biotech industry. There are a highly sophisticated group and their skill and educational level is usually high given that the consumers in this industry are doctors, researchers, scientists, manufacturers as well as some world class citizens who arrive in Baltimore to seek specialized healthcare treatment. The reputation of Baltimore as a leader in health care attracts patients that are looking for the best care and medical treatment in the United States and in the World (in certain medical specializations). In Baltimore, there is a high concentration of demand to find the cure for diseases that chemistry alone could not do. The end users in local hospitals and the worldwide reputation that in Baltimore, you will get cured creates high pressure for Research and Development of biomedical companies to try their best to meet the needs of people with incurable diseases by looking for a better and more comfortable treatment. Related and supporting industries The major industries that support the Biosciences/Biotechnology industry are the finance, education, healthcare, food and drug industries. The Biotech industry benefits from having a vibrant health care services sector and it is also evident that it provides support for service-related bioscience firms (such as those running clinical trials). Some of the Baltimore area’s supporting industries include 50 life science research- intensive federal institutions, several world-class academic institutions, and private research facilities. The biotech industry is also the recipient of $12.2 billion in federal Research & Development obligations and they are the suppliers of labor capital, and technology know-how. The patients supplied by the Baltimore area’s health care institutions make possible a constant and fast feedback while creating a mutual pressure to advance. For instance, newspaper ads and TV commercials in Baltimore ask for donors or volunteers to participate in medical trials. The proximity of suppliers and end users make this determinant of competitive advantage a very strong one. Strongly related industries in Baltimore such as Tourism, Financial Investment and Insurance make a cluster. Medical Tourism uses the well known spots in Baltimore as a way to attract this high pressure demand for the latest and newest treatments and cures from around the world. Big Financial institutions help to attract the venture capital that is necessary to fund research and development. Close relationship with Insurance industry make possible the coverage of new products for the end users. These three industries are strong and competitive in Baltimore. Together they formed the Maryland’s Bioscience cluster. Firm Strategy, structure and rivalry MdBio, a division of the Tech council of Maryland, is a private non-profit corporation that seeks to unify, empower and advance Maryland’s bioscience industry, providing comprehensive support services to its members and the broader community list in their website around 100 Bioscience companies in Maryland. It shows the intense competition in an area where rivalry pressures on companies to innovate and upgrade their research and development units to create new bioscience products. Bioscience is a global market from conception because everybody gets sick. This fierce competition, make the stronger companies to expand internationally. Bioscience firms view themselves as operating in a global market. They do not really view bioscience growth as a competition to attract new companies from other geographic regions, but as a Darwinian, organic process that leverages assets and relationships to generate growth and critical mass. The critical mass will develop over time and serve as a magnet to talent, new firms, venture capital, infrastructure and resources. Economic development, they believe, should be organized and funded in a logical way to capitalize on this reality. According to local bioscience leaders, the support functions most critical to bioscience firms are: • Financial investment and local government support; • Networking/connections; • And flexible, inexpensive space. • University commercialization and tech transfer; • Increased state investment and commitment; • And coordinated, effective marketing. III. Description and analysis of the Biotechnology in South Africa as the industry with best potential for Global expansion A. Current market and economic conditions South Africa has made huge strides in the development of agricultural biotechnology and is beginning to move actively into health biotechnology. Biotechnology in South Africa has, until recently, focused mainly on firstgeneration applications which have earned South Africa international recognition for its major contribution to development of genetically improved crops suited for African needs. There are well-developed industries involved in brewing and food production, and in particular, a high-profile wine industry. Today, post-apartheid South Africa is one of the leading sub-Saharan African countries in developing the capacity and capability for R&D in health biotechnology, especially through the New Partnership for African Development (NEPAD), a framework designed by African leaders to accelerate sustainable development in African countries. Recently, activities towards developing Biotechnology industries based on the chemical, biochemical and pharmaceutical markets have progressed rapidly, particularly with the advent of the government prioritization of Biotechnology and the establishment of a number of national and international collaborative research programs. Although research directed to address local needs, (such as in the agricultural field), while necessary and of major importance to national needs, tend to have lower international visibility and weight, major progress has also been made in developing research activity in the health sector in South Africa. The medical research community is engaged in a number of high-level programs addressing issues in a wide range of areas, including HIV-AIDS, TB, malaria and noninfectious diseases prevalent in South Africa. South Africa has had long-standing and productive research activity in the area of plant biotechnology and like many developing countries; its biodiversity provides a very valuable resource. International bio-prospecting companies have initiated programs investigating South Africa’s biodiversity. Linking the issues of biodiversity, conservation and medicine, innovative programs have been initiated in South Africa to explore and develop local indigenous knowledge of medicinal substances. However, the potential for successful drug discovery can only be realized if there are sufficiently effective mechanisms in place to take the discoveries from the forest to factory in a sustainable manner. SA requires the establishment of a stronger infrastructure for drug testing, technology transfer and marketing as well as primary research. Other major genomic resources (e.g., microbial diversity) are virtually unexplored. Given that 99% of existing microbial species in any environment have not yet been cultured, and that the environmental diversity of South Africa offers a huge range of microbial habitats. B. Key Competitors. South Africa has a strong presence of both national and multinational corporations, particularly in the manufacturing and distribution sectors. Most of the multinationals do not contribute heavily to the development of the local health biotechnology sector but take advantage of South Africa’s manufacturing base and clinical trials strength. Within SA’s biotech industry, the industry leaders and key competitors comprise of both pharmaceutical and biotechnology companies. Some of SA’s Industry leaders and key competitors include: GlaxoSmithKline SA, Syneca Life sciences, Pfizer Laboratories SA, Merck SA, Novartis SA, and Shimoda-Biotech (PTY) LTD. C. Industry Strengths and weaknesses Strengths The strengths of SA’s biotechnology industry include; Sophisticated and lengthy tradition of first generation biotechnology. South Africa has an advanced first generation biotechnology industry and its yeast, wine, and beer producers are amongst the finest in the world. World-class researchers and research institutions; in the private sector as well as in the tertiary education institutions, South Africa produces world-class researchers and products, and much intellectual property has been generated in its institutions. A pipeline of projects that could lead to new products or processes; SA has a well-developed agricultural industry, and the exceptional plant biodiversity provides significant opportunities for crop or product improvement and bio-prospecting. An unrivalled biodiversity and biological resource base; SA boasts of a rich plant, and associated microbial, diversity that can be tapped into for biotechnology applications. Indigenous medical knowledge; SA’s biodiversity and biological resource is based on a deep indigenous medical knowledge. Even today, approximately 80 – 85% of SA’s population relies on traditional medicines from traditional healers. Access to a large human genetic diversity pool; the country’s population consists of 90% of the genetic diversity in the world. Access to a high number of clinical samples for major infectious diseases; the high incidence of major infectious diseases in Africa has resulted in access to a large number of clinical and pathology samples with which to study these diseases and potential eradication strategies. Other strengths include; a relatively low cost base for research, product development and manufacturing, and a sound legal and regulatory framework and a world-class banking system and ICT infrastructure. Weaknesses There are many weaknesses in this industry that affect its growth and development, and also its global potential. A general lack of cohesion in research and a shortage of market-focused research in addition to a relatively low tendency among academics to commercialize research programs are two major weaknesses. Being that this industry is still very immature, South Africa has more of an institutional R&D focus rather than a market focus. In addition, scientists’ incentives in South Africa are based on their publication output, rather than on the commercial value of their work. Other weaknesses in this industry are the scarcity of suitably qualified R&D personnel and a severe shortage of entrepreneurial and technology transfer skills and mechanisms. Given the fact that there are only 7 researchers for every 100,000 South Africans, it is clear that SA is in desperate need of a skilled workforce. It’s the same situation in the entrepreneurial and technology field. The biotechnology industry in South Africa not only lacks the appropriate skills required for converting promising ideas and research into lucrative industries, but also lacks motivated workers to work on these projects. Having a relatively small market and insufficient public and private funding is another drawback. South Africa has only one venture capital firm funding local biotechnology companies and not enough money coming from the government. Another disadvantage in this industry is an overall lack of confidence in African governments, which affects foreign investment. Moreover, South Africa increasingly depends on imported products, machinery, equipment, materials and technologies instead of initiating global exports. Finally, the last major weakness in the Biotechnology industry is a lack of clear IP policies that are incentives for commercialization. In many cases, IP rights reside within universities, which have neither the means nor the incentives to develop, present, transfer or commercialize them. There are presently no Acts in SA to deal with issues relating to rights to IP generated from government-funded research. In addition, the protection of IP has been extremely inefficient, often due to the high costs involved, resulting in the loss of a large amount of it to foreign interests. D. Analysis of the four Porter determinants of competitive advantage- Diamond Model Factor Conditions Africa’s has an extremely high population growth rate, resulting in an increasing demand for food. Biotechnology has the potential to address food shortages through the development of crops with increased resistance to diseases and drought, increased tolerance to herbicides, increased nutritional benefits, and improved processing qualities. It also has the potential to impact forestry, particularly the improvement of tree production and wood quality. Plants are also now being engineered to produce biochemicals on a large-scale for application in the human health, animal health and industrial sectors. The varied climatic zones in SA enable the production of almost any kind of crop, which means that the country is capable of becoming self-sufficient in most of their major crops. The government’s visible support and encouragement for the development of biotechnology through various incentives and schemes is one way the industry has tried to develop their competitive advantage. This coupled with a well developed indigenous knowledge base and extensive genomic resources have been factors that have pushed South Africa towards achieving a competitive advantage in their biotech industry. South Africa’s HIV/Aids, TB and malaria crises/initiatives have also made it easier to perform clinical trials of newly developed drugs. Demand Conditions Some of the demand conditions that exist within the Biotech industry in SA include the demand for the implementation of biotechnology in other sectors such as agriculture, wine/distillery, pharmaceuticals, animal and human health, water treatment, and even in the educational sector where the latest technological advances and breakthroughs are expected to be taught to budding researchers and scientists. The sophistication of the consumers within SA’s biotechnology industry varies across the board from the farmer who has little formal education to scientist, researchers, businesses and the government; all of whom may be classified ad more advanced and knowledgeable consumers/utilizers of biotechnology. Related & Supporting Industries Other industries which are related to and support South Africa’s Biotech industry include: rural/urban schools & universities; the SA government; medical schools and laboratories; agriculture; wine/distillery; animal health. Firm Strategy, Structure, & Rivalry In 2001, recognizing the challenges it faced in developing a mature biotech industry, the South African government published its National Biotech Strategy and allocated R400 million (about $57 million) over a three year period towards its implementation. A key part of the new national strategy has been to create a number of biotechnology regional innovation centers (BRICs) in order to implement the National Biotech Strategy on both a regional and national scale by acting as focal points for the development of biotechnology platforms. The primary role of the BRICs is to implement the strategy by investing the allocated R400 million funding in start-up biotech companies and developing human capacity to support the growing industry through various capacity development programs. The BRIC activities will be overseen by the Biotechnology Advisory Committee (BAC), which will ensure development of the sector on a national level through the coordination and integration of the regional activities. Furthermore, by training local scientists in the field of biotechnology, South Africa will have a resource base to staff the industry as it develops in the future. One of the specified aims in the South African National Biotech Strategy is to direct some of the domestic biotech R&D effort towards areas of unmet medical need. This would allow it to become less dependent on outside research efforts. All BRICs are encouraged to invest in relevant projects and with the expectation that they will eventually attract foreign interest in their work. For example, there has been foreign interest in the bioinformatics approaches being used by South African research groups for areas such as AIDS, dengue fever, tuberculosis and other tropical diseases IV. South Africa Cultural Dimensions Analysis A. Description of Cultural dimensions of SAF The indexes in the Hofstede (1991) cultural dimensions for South Africa (SAF) could be different in 2008 because in the last two decades major political and social events have changed SAF in many ways. The relevant events are the following: Nelson Mandela was released and elected as the first Black South African president in 1994 in the first democratically elections and he took a number of steps towards racial reconciliation and the official end of Apartheid. In 1995, the Labor Relations Act (LRA) promoted collective bargaining, the Basic conditions of Employment Act (1997), The Employment Equity Act (1998) that removes unfair discrimination by establishing fair employment practices and to implement affirmative action to advance all people that were previously discriminated against of the grounds of color, gender and physical capability. Also, in 1998, the Truth and Reconciliation Commission was generally credited with achieving racial healing by the time of its final conclusions. In 1999, the prevention and Prohibition of Unfair dismissal Act, rapidly unfolded in the workplace. To gain a better perspective of post Apartheid South Africa and post Hofstede’s cultural dimensions indexes of 1991, other considerations should be in context of new legislation, pro human rights initiatives and social justice that have since been adopted in South Africa. In addition, it is important to consider that South Africa still possesses 4 main cultural groups because of the Apartheid- defined racial groups. The estimated population for South Africa is 47 million people ( census 2001) which is divided by race as follows: 80% Black People, 10%White People, 9% Coloured (Mixed Race) people, 1%Asian People. However, Hofstede Cultural dimensions shall be analyzed in the following lines. In the graph, position of 50 countries on Power Distance and Uncertainty Avoidance (Geert Hofstede, 1991, Cultures and Organizations) (See Exhibit 3), SAF is grouped with the Anglo countries such as New Zealand, USA, Canada, Australia, and Netherlands. It is explicable due to their Dutch and British heritages that dominate the country until recent years. Also, another similarity between these countries is that almost all of them have been a British colony. All the countries in the Anglo cluster have a relatively small power distance and medium uncertainty avoidance. Also, we observe in the graph that SAF goes towards the right approaching the Sub-Saharan Africa group. It means that East and West African culture influences towards a larger power distance than Anglo counterparts. B. Comparison between SAF and Baltimore To compare SAF and Baltimore, we use the Hofstede’s cultural dimension assigned to South Africa and United States. The major difference between SAF and USA is reflected by the Individualism - Collectivism where the USA is more individualistic than SAF. Also, to a minor degree, SAF has a higher power distance than USA. Both differences are based in the influence of Sub-Saharan Africa which is dominated by Communalism, Community sharing and High Hierarchies. In masculinity and Uncertain Avoidance dimensions, the two countries have a very close score. Individualism – Collectivism cultural dimension: (IDV 65) for SAF tell us about a moderate individualistic country. SAF ranks 35. However, SAF is less individualistic than USA (IDV 91) that is highly individualistic. Independence and responsibility for one's actions are valued in USA. Identity is based on individual. In U.S. organizations, successful leadership and management depends primarily on motivating individual achievement, although in recent years there is growing emphasis on teamwork. It is important to mention that Netherlands (IDV 80) and Great Britain (IDV 89) where the White Africans ascendants are from have a high score in Individualism as well. In SAF, we see the combination of cultures (Anglo and African) that makes SAF going towards being collectivistic. East Africa (IDV 27) and West Africa (IDV 20) have a low Individualistic score that put them under collectivistic societies. SAF is in between the two cultures. As Martin Gannon mentions in Understanding Global Cultures (2004, page 427) “African Cultures, while varying from country to country (or between ethnic groups), are collectivistic.” Small Power Distance - Large Power Distance: USA (PDI 40) ranks 38 and has relatively Small Power Distance. U.S. organizational leaders set overall strategic directions; decision-makers can be found at all levels. Superiors are accessible. Also, contracts are valued and adhered to. In this dimension, we find a small difference with a relatively medium power distance in SAF (PDI 49) ranks 37. It tells us that SAF has a larger power distance. As Martin Gannon tell us in Understanding Global Cultures (2004, page 429) “There may be a tendency among African Managers not to delegate or engage in participatory forms of engagement. Managers may be reluctant to share information with subordinates.” Risk Taking - Risk Adverse (Uncertainty Avoidance): In USA (UAI 46) ranks relatively low in place 43rd; uncertainty is inherent in life and should be accepted. Conflict and competition can be constructive. There should be as few rules as possible. Belief is placed in generalists and common sense. Similarly, SAF (UAI 49) ranks 40 th place. SAF is very close to USA in this dimension because both are part of the Anglo cluster. Both USA and SAF societies have organizations settings with less structuring activities, fewer written rules, more risk-taking by managers, high labor turnover, and more ambitions employers. Masculinity – Femininity: In USA (MAS 62) ranks 15th. Task achievement is valued by members of society. Performance is what counts. Traditionally, the emphasis has been "live to work". Materialism and money provide means of measuring achievement. Ambition provides drive. Taxes are relatively low. Traditionally, there have been relatively rigid roles for women and men to play in society; however, this is changing. Similarly, SAF (MAS 63) ranks only one rank below (14th). In both societies success, money and material things are dominant. C. Problems that might arise from the difference in Culture More synergies than problems may arise between Baltimore and SAF. Human rights movement occurred in the 90’s in SAF are similar in some extent to the American civil rights movement in the 60’s. We can see similarities between Nelson Mandela and Martin Luther King Jr. However, Black Africans are the great majority in SAF while being a minority in USA Being that the U.S. is a more individualistic country than SAF, this could conflict if South Africans may confuse competitiveness with rudeness or a lack of caring for others. Baltimoreans shall have to be aware about the sense of community that South Africans have. SAF Managers have to be cross culturally trained and understand that competition and individualism could help everybody at the end. True individualism is bringing the best of each individual that will benefit the group indirectly. In Power Distance, we have a small difference having SAF towards higher power distance. A Baltimorean Manager should indicate with a little more detail what to do to SAF subordinates. Also, Baltimorean has to be aware that promotion sometimes is based in seniority, not ability in SAF. A basic understanding on this dimension could avoid many misunderstandings between Baltimoreans and South Africans. D. Synergies that might arise from the differences in Culture Baltimorean managers have a competitive advantage as expatriates in SAF because they have an understanding about human rights and awareness about diversity at work. A partnership could help South African companies that are in transition between acquiring to the legislation about employment equity and work conditions. Having MAS and UAI close scores, Baltimore and SAF can capitalize these similarities by setting economic rewards to good performance because their scores in MAS indicates that they are materialistic. In addition, having high MAS scores, they both are task oriented and we can finish projects putting long hours and hard work having a common goal. Project management can count with both parties in order to achieve goals. Also, leaders should keep general and formal rules (not specifics) in order to encourage innovation and creation of new ideas in the workplace. It is possible because both are Risk Takers having a relatively low UAI score. V. Proposals for Global Business Ventures Recommendation for potential business opportunities between Baltimore and South Africa and Rationale for recommendation given the strengths and weaknesses of each region. Huge business opportunities exist in the Biotech and Healthcare arena for Baltimore and South Africa. Given the various assets that abound in both regions and after considering the various needs of both regions, we believe that both regions stand to benefit from each other if they combined the resources/advantages that exist in their respective biotech industries in both Baltimore & South Africa to address needs faced in their respective environments. This would be a better alternative than for each region to individually market whatever competitive advantages they possess to the other region for profit or trade. A joint venture would be the best means to achieve this as it would allow both parties to benefit not just in the short-term but in the long-term. A joint venture in the biotech sector between Baltimore and South Africa will allow both industries to capitalize on the strengths of one another and help to improve areas where either may have some weaknesses or disadvantages. The Baltimore Biotech Industry: A joint venture with the biotech industry in South Africa will enable the Baltimore Biotech industry to expand their knowledge base by capitalizing on South Africa’s plant and human biodiversity as well as their indigenous medical knowledge to find new cures for AIDS, Malaria, and TB. The industry in Baltimore shall also be able to have greater access to funding and Venture Capital (VC) Sources given that they have a multinational operation and a greater opportunity for realizing profits. Given that SA has only one biotech venture capital company, they could attract more companies into this sector and benefit from being among of the first companies to receive such funding from the new VC’s. It shall also create a pull factor for world class researchers, doctors and scientists towards the Baltimore region as it provides them with an opportunity to participate in world class research and development. The Baltimore biotech industry will be able to benefit from a lower cost base for research, product development and manufacturing as a result of the sound research infrastructure that SA possesses. The South African Biotech Industry For the biotech industry in South Africa, a joint venture shall enable it to use the expertise of their Baltimore counterparts to revamp and enhance their human biotech sector. They will be able to draw upon the skills of the biotech industry in Baltimore and learn how to develop their research programs with the aim of commercialization thus providing a focus for the biotech market. They shall also be able to gain help in enhancing current IP policies and laws to create incentives for commercialization within the industry. It shall help to reduce their dependence on imported products, machinery, equipment, and materials while enabling them to expand the size of the local market so that investors can take on projects that have both an export and import focus. More importantly, the SA biotech industry shall be able to address the severe shortage of entrepreneurial and technology transfer skills and mechanisms which is essential for the industry to be able to convert ideas and research into lucrative businesses and industries. This process shall in turn help to secure both public and private funding for research and product commercialization. Specific Companies Recommended Business Venture The Johns Hopkins Center for Global Research (JHCGH) The Johns Hopkins Center for Global Health is a unique collaboration between three institutions -- the Bloomberg School of Public Health, the School of Medicine, and the School of Nursing – that harnesses the expertise of its dedicated health and medical professionals to address a myriad of global health challenges: HIV/AIDS, malaria, tuberculosis, malnutrition, hepatitis and other threats to health, especially in developing countries. The Center for Global Health coordinates the integrated efforts of professionals in the clinical, research, programmatic, policy and educational domains and collaborates with an extensive network of international colleagues and collaborators in order to combat threats to health—especially in developing countries. The faculty at Johns’s Hopkins is involved in global health projects that include: research on HIV/AIDS, malaria, tuberculosis, avian flu, and other infectious diseases; communication and education programs aimed at changing behaviors to protect populations from disease; and clinical trials and laboratory research to test and perfect immunizations and antiretrovirals. Currently, 79% of John’s Hopkins' overseas projects are in developing countries and they continue to have a positive impact in the regions where they conduct their work. Recently, John’s Hopkins entered into some strategic business partnerships with some countries in order to help these countries develop their capabilities to meet health challenges. Several examples of these ventures include the signing of a long-term agreement between The Johns Hopkins Bloomberg School of Public Health and the Health Authority—Abu Dhabi (HAAD) to develop research, educational and public health programs in the Emirate of Abu Dhabi. Another is the recent signing of an agreement between The Johns Hopkins Bloomberg School of Public Health and the Education Development Corporation in Taiwan to create an Executive Master of Public Health (MPH) degree program for health professionals in the Asia-Pacific region. The John’s Hopkins Center for Global Health has great potential to make this business venture work given their vast experience in doing business overseas. They possess the knowledge (professional and technical), personnel, funds, skills, and innovative technology that are critical in the development and implementation of any/most health initiatives being sought after by both developed and developing countries alike. Also, John’s Hopkins suitability for this business venture is enhanced by the fact that Students in the Johns Hopkins Bloomberg School of Public Health come from over 83 different countries. This diversity increases the possibilities of a successful business venture as it will provide for a wider array of ideas and solutions to different problems and will also help improving the clout of the Institution in South Africa which has a diverse population as well. Biopad South Africa BioPAD (Biotech Partnerships and Development) is a Biotechnology Regional Innovation Centre established by the Department of Science and Technology (DST) on behalf of the South African Government. The centre was initiated in 2002 by a group of interested biotechnology stakeholders with the aim of boosting biotechnology development in the region. At the center of BioPAD’s objectives is ensuring the growth of the biotech sector through BioPAD interventions to expand the business of existing companies and spin off new commercial as outlined in the National Biotechnology Strategy of South Africa. The centre is governed as a Trust by highly qualified professionals with relevant experience in the Biotechnology field. In 2002 the DST approved BioPAD’s first business plan and subsequently the first CEO of BioPAD Mr. Butana Mboniswa was appointed. In 2003, 13 multi-institutional projects, amounting to R45million ($6.42 million), were selected and approved. These projects were in the areas of animal health and production, industrial, mining and environmental biotechnology. In 2004 BioPAD expanded its areas of operations to include Human Health and Bioprocessing. By the end of 2006 BioPAD’s investments in research projects and private companies were approaching R200 million (about $29 million). Since 2007, BioPAD has continued to seek out commercialization opportunities, mainly in the areas of both human and animal health and production. BioPAD is a well suited partner in this venture given its mandate and commitment to building the economic and social value of the industry through sustainable commercial entities locally and internationally within the focus areas of animal health and production, human health, mining biotech, industrial biotech, and environmental biotech. It is also a suitable partner given its unique position as the main vehicle in the Biotech Industry in South Africa, for optimizing the commercialization process through the optimization of its product / technology development process. BioPAD is also well suited to effectively source and manage the funds for R&D commercialization, commercial projects, platforms, research and human capital development initiatives. They manage overall project risk to improve return on funding investment by adhering to their investment strategy. Companies Collaborating with BioPAD Companies iSlices Product in market Manufacturing and distribution of iSlices products Inqaba (Genomics service business)Commercial services Primers and routine DNA sequencing, distributors of biotech reagents BioPAD infrastructure investment Commercial services High-throughput DNA sequencing service in partnership with Inqaba Mycoroot (manufacturing/sales) Product in market Manufacturing of mycorrhiza fertilizer Origin Source (nutraceuticals) Late-market launchSales and distribution of mushroom based nutraceuticals The AloeferoxCo Product in market Sales of aloesin API and formulated products Mbuyu (Biocatalysis and bioprocessing) Middle-late R&D Platform expression system technologies: immobilised enzymes, bacterial iThemba (Medicinal chemistry) Middle R&D synthesis Medicinal chemistry of leads targeting latent MTb; novel ARV Ribotech (Manufacturing/sales) Late-market Manufacturing and distribution/sales of clinical doses of rHuman G-CSF Commercialization Status and Outcomes of Projects undertaken by BioPAD: Completed projects Outcomes Commercialization status Molecular diagnostic kits for tick borne pathogens RLB kit /RT-PCR assay Kit in the market, tech transfer to OVI Biocatalytic value addition to aloe bitters refining Product Licensed to The Aloeferox Co Aquaculture Product Licensed to BaoBio (Pty) Ltd Production of food and perfumery flavours from microorganisms Product Available for licensing Beneficiation of plant products to improve animal Products and health/production publications Not yet commercialized Novel virus protein particles Patent filed/publications Not yet commercialized Microbial enzymes for Rooibos processing Patents filed In the process of commercialization Inoculation of bio-assisted heap leaching operations Patent filed Not yet commercialized Bioleaching for zinc sulphide Patent filed Not yet commercialized Reduction of sulphate in acid mine drainage Technical report Not yet commercialized The Rhodes BioSure process Technology package Licensed to ERWAT Best Model for the New Business The best model for the new business joint venture would be in the form of an International Public-Private Partnership (PPP). This partnership will be a strategic collaboration link forged on the basis of combining research needs and interests, with the purpose of advancing in research and development. This is based on the established belief that common problems and objectives can be solved and met more efficiently when research is conducted jointly. PPPs provide benefits by allocating the responsibilities to the party – either public or private – that is best positioned to control the activity that will produce the desired result. This is usually accomplished by specifying the roles, risks and rewards contractually, so as to provide incentives for maximum performance and the flexibility necessary to achieve the desired goals. The primary benefits of using a PPP as the model for the new business include: The expedited completion/establishment of projects compared to conventional project delivery methods; The huge Business/Project cost savings that can be achieved by the synergy that may be created; The ability to substitute private resources and personnel for constrained public resources; The ability for the new venture to market new products from national labs The Improved quality and system performance that will be derived from the use of innovative materials, technology, and management techniques; The ability to have continuous access to various sources of public/private capital. One fine example of this intended form of partnership is the Biovac Institute which is a public/private partnership with the Government of South Africa through the National Department of Health. Their chief aim is to develop a hi-tech infrastructure for vaccine research, development, and eventually production/commercialization – the only company in sub-Saharan Africa to have such a full- spectrum of operations. Like the Biovac Institute, we envision the Public-Private Partnership between the John’s Hopkins Center for Global Health and BioPAD to be one which shall come to develop its own processes for sourcing funds, developing infrastructure for vaccine research and development, and the production and commercialization of its new innovative products. This PPP shall be governed contractually and in the contractual agreements, coordination and financial controls shall also be set in place. In this instance, either JHCGH or BioPAD may be viewed as the major shareholder and/or managing partner of the new partnership given the amount of resources invested, or the amount of risk that either side is exposed to due to their commitment in the partnership. The PPP model shall enable both JHCGH and BioPAD to produce products complying with internationallyaccepted standards of quality and practice which are also relevant and affordable to local and regional health needs. The PPP framework also allows JHCGH to coordinate and organize their resources in South Africa while minimizing risks associated with government interference. Main risks and potential payoffs (economic, legal, political, cultural, etc.) to the venture As with any business venture, we expect and anticipate some major and minor risks to be associated with the proposed PPP between JHCGH and BioPAD. We believe that while some of these risks can be effectively managed; there are some aspects of it that are beyond the immediate control of either partner. We believe that some of these risks present with it an opportunity for huge payoffs. We believe that the huge socio-economic inequalities are one of the major risks that this PPP faces. South Africa has one of the highest rates of income inequality in the world. For this reason, crime is very high in South Africa. However, in the last years the crime rates has been decreasing. We also foresee (in the long term) the health conditions in the country as another major risk that the venture will need to confront in some form or another. Having more than 5.5 million people living with HIV, health is a main risk for everybody living in South Africa. It is estimated that one in every four persons is living with HIV. This statistic is prevalent among the younger generation and this poses a threat to the stability of the nation. We feel that through this venture, people shall be offered the chance of leading longer and more successful lives in the long term. In addition to the health crises being faced in the country, the current government has compounded the issue by discrediting the effectiveness of some treatments for HIV and publicly calling into question whether HIV is the cause of AIDS. This has led to some South Africans stigmatizing some people living with the disease and rejecting healthcare workers/providers as well as new and innovative treatments for the disease. We believe that Baltimore has an opportunity to help in turning around some of these perceptions and stigmas associated with these diseases through education and interaction. The years that Black South Africans spent under Apartheid has also created in some, a sense of distrust and intolerance for peoples not of their race and although this is not widespread, it is evident in certain instances. The effects of apartheid has left a significant number of the population uneducated and indisposed to social advancement. We also believe that the JHCGH has the opportunity to use its experience, diverse backgrounds, and advantage of living in a very diverse and equal-opportunity country to help shape/change these perceptions that may still exist for some. Economically, South Africa’s diverse, stable, and robust economy has positioned the country to be viewed favorably by investors locally and globally. It has a sound economic frame work and we believe that given the successful implementation of some of the new biotech initiatives, this shall lead to a boost in more investments by venture capital firms. We believe that given Baltimore’s biotech clusters, investments from banks and private equity firms shall be more easily available. Access to more funds Exploit biodiversity Address weaknesses Government generally not trusted Legal risk: IP concerns esp with govt funds Social: cultural dimensions Political Risk: Biotech viewed in SA negatively due to president’s stance on HIV Aids. Baltimore Risk: Social acceptance Financial: Chance that the revenues may not materialize/investment may not pay off. They shall also both be able to develop their capacity by empowering and equipping staff as well as by establishing a strong research and product development capability; They both shall be aby establishing strategic partnerships with leading scientists and institutions. To Build Our Business by creating a competitive and sustainable platform in South Africa that opens access to other markets. To Build the Nation and Continent by complementing the Government of South Africa in the realization of its healthcare obligations to the nation; by developing capacity to supply products to countries in the rest of Africa; by developing and retaining local vaccine production related skills to ensue that locally-developed products can be produced in South Africa. Actions needed in terms of strategic capabilities, leveraging knowledge, managing across organizational boundaries, and managing cross-culturally to have the greatest chance of success with this business venture Key factors to a successful business venture The structure of the Global business alliance is critical for the success and the implementation of Multidimensional capabilities in the alliance. In addition, Leveraging knowledge by cooperation and openness between coworkers will assure the creation of knowledge in the alliance. Synergy of knowledge is possible by technology exchange and mutual learning. It is the main focus of the business venture and the success of managing across organizational boundaries. For this reason, Baltimore and South Africa have to plan for every potential aspect of the venture including their future after the ending of the alliance. Successful alliances are the ones that end having mutual benefits. Also, managing cross-culturally to capitalize in the similar relatively low uncertainty avoidance, general goals and formal rules has to be created for the strategic alliance. We have to let the managers and scientists find their own way to achieve goals with creativity and innovation. Biotechnology is all about development and research in order to find cures, treatments and the best educational programs. Also, as Helen Epstein (2007) mentions in The Invisible Cure “ Like many newcomers to Africa, I learned early on that the most successful AIDS projects tended to be conceived and run by Africans themselves or by missionaries and aid workers with long experience in Africa- in other words, by people who really knew the culture. (Page xiv)”, we have to let the experts in South African culture lead the operations while adhering to the core values of the strategic alliance. Another action that shall need to be taken is to find similarities using Hofstede’s dimensions to take advantage in a relatively masculine society. Baltimorean Project managers can achieve their goals by counting on the hard work and long hours of employees whenever economic rewards are involved. Managers have to be aware of the differences between individualism and power distance. Given that Africans more collectivistic and higher power distance societies, we need to be careful when we delegate, share, and approach people. A special training focusing on the differences in these two dimensions is critical for both participants. By understanding these differences, we can avoid miscommunication and misunderstandings and create for a more effective Public-Private Partnership. Concluding comments A. Baltimore as a player on the global scene Baltimore has a great potential in the global arena. It enjoys a competitive advantage by being a leader in Health care worldwide. Also, all our research indicates that activity in the Health care industry will increase because people can spend more as they live longer years. It is a virtuous circle where better and more care is needed. United States is well recognized as a country leader in Health care and John Hopkins ranked 1st nationwide in many medical specialties. Hence, we can say that Baltimore is the best in the world in certain areas of medicine. Biotechnology is one cause of this achievement. The new cures and treatments found by Biotechnology make the Baltimorean Health care the leadership in the sector. Biotechnology is an important component of the main engine of the Baltimore economy, the health care system. A. What does working with the other country/region offer to Baltimore and its citizens? What does Baltimore offer to the citizens of the other country/region? Working together Baltimore and South Africa brings a technology exchange and mutual learning of new knowledge. Baltimore and its biotechnology could bring the vaccine/ treatment to more than 5.5 million HIV infected South Africans. Also, Baltimore brings experience in human rights practices and the importance and benefits of diversity in the workplace. On the other hand, South Africa opens the door to the Sub-Saharan African market of 800 million people in need of better health care and other basic needs. B. A final statement that sums up what you have learned about Baltimore's potential for global business Baltimore has an immense global potential. Leadership in health care and education situates Baltimore in competitive advantage in industries that are growing in the quality and quantity around the world. South Africa gives the opportunity to focus our expertise in the elimination of diseases in Africa. Basic health care and education are the pillars of advancement of nations. Also, the alliance between Baltimore and South Africa is an excuse to continue international business in other sectors where each region has competitive advantage. EXHIBITS Exhibit 1: OECD Science, Technology and Industry Scoreboard 2007 Particular technologies F-1. Biotechnology firms Number of firms active in biotechnology, 2003 Source: OECD (ORGANISATION FOR ECONOMIC CO-OPERATION AND DEVELOPMENT) Exhibit 2: OECD Science, Technology and Industry Scoreboard 2007 Total expenditures on biotechnology R&D by biotechnology-active firms, millions of USD PPP (current), 2003 Source: OECD (ORGANISATION FOR ECONOMIC CO-OPERATION AND DEVELOPMENT) Exhibit 3: REFERENCES References for Baltimore Region’s Biotechnology The financial history of Baltimore - by Jacob Harry Hollander – 1899 Economic Alliance of Greater Baltimore: Biosciences Report (November 2007) Economic Alliance of Greater Baltimore: Economic Development Progress Report (November 2007) Website: http://www.choosemaryland.org Website: http://www.baltimorecountymd.gov/Agencies/economicdev/gateway/workforce/index.ht ml The Primer – A biotechnology Guide for non-scientists, distributed by DBED – Maryland Maryland’s Department of Business Economic Development http://www.choosemaryland.org/ Taking Care of Business: Bioscience in Maryland 2007, publication of MdBio, a division of the Tech Council of Maryland, http://www.mdbio.org/ References for South Africa’s Biotechnology South Africa – Blazing a trail for African Biotechnology: NATURE BIOTECHNOLOGY VOLUME 22 SUPPLEMENT DECEMBER 2004 by Marion Motari,Uyen Quach,Halla Thorsteinsdóttir, Douglas K Martin,Abdallah S Daar & Peter A Singer Department of Science & Technology – Republic of South Africa http://www.dst.gov.za/r-d Organization for economic Co-operation and Development (OECD) http://www.oecd.org/document/47/0,3343,en_2649_34537_2673903_1_1_1_1,00.html National Biotech Survey 2003 by Dr. Michelle Mulder Africa Bio http://www.africabio.com/status.shtml Biotechnology 'roadmap' for South Africa unveiled: by Jonathan Spencer Jones http://www.scidev.net/en/news/biotechnology-roadmap-for-south-africa-unveiled.html References for South Africa’s Cultural Dimensions Transnational Management (5th ed.) ( 2008) by C.A. Bartlett, S. Ghoshal and P. Beamish. How Countries Compete: Strategy, Structure, and Government in the Global Economy (2007) by Richard H.K. Vietor. Executive Planet Website in South Africa Section http://www.executiveplanet.com/index.php?title=South_Africa http://en.wikipedia.org/wiki/Culture_of_South_Africa Culture and Organizations: Software of the mind by Geert Hofstede ( 1991) American cultural patterns by Edward C. Stewart and Milton J. Bennett ( 1991) Understanding Global Cultures: Metaphorical Journeys through 28 Nations, Clusters of Nations, and Continents (3rd Ed., 2004) by Martin J. Gannon International Management: Culture, Strategy and Behavior ( 4th Edition, 2000) by Richard M. Hodgetts and Fred Luthans Economic Imperatives and Ethical Values in Global Business: The South African Experience and International Codes Today (2001) by S. Prakash Sethi and Oliver F. Williams