File

advertisement

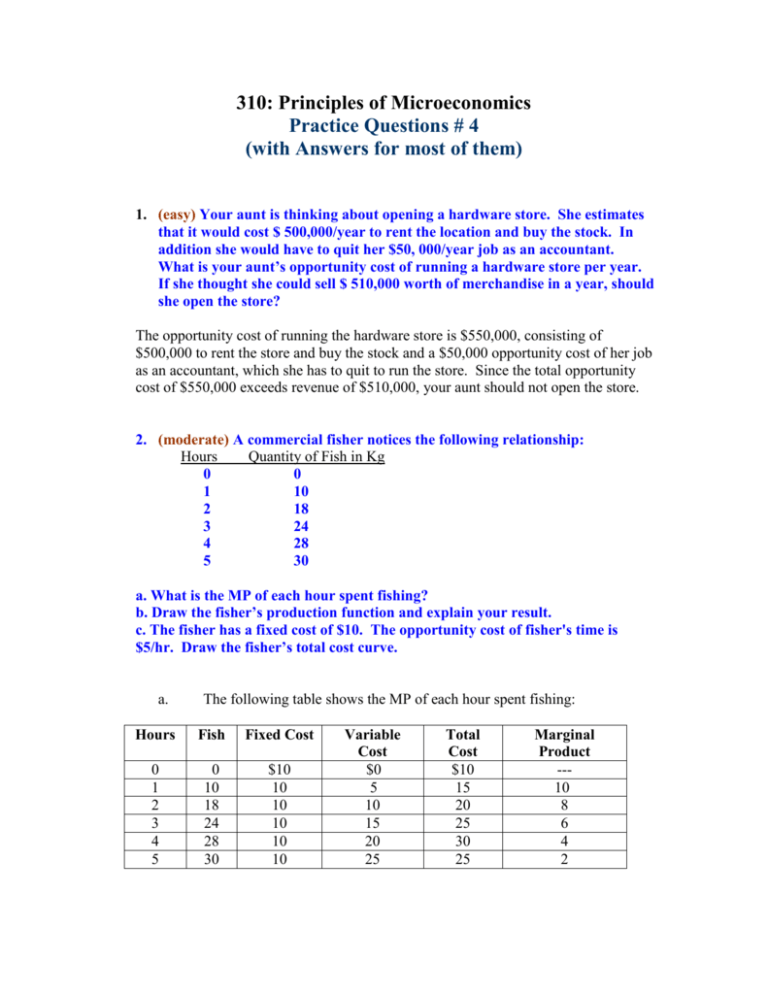

310: Principles of Microeconomics Practice Questions # 4 (with Answers for most of them) 1. (easy) Your aunt is thinking about opening a hardware store. She estimates that it would cost $ 500,000/year to rent the location and buy the stock. In addition she would have to quit her $50, 000/year job as an accountant. What is your aunt’s opportunity cost of running a hardware store per year. If she thought she could sell $ 510,000 worth of merchandise in a year, should she open the store? The opportunity cost of running the hardware store is $550,000, consisting of $500,000 to rent the store and buy the stock and a $50,000 opportunity cost of her job as an accountant, which she has to quit to run the store. Since the total opportunity cost of $550,000 exceeds revenue of $510,000, your aunt should not open the store. 2. (moderate) A commercial fisher notices the following relationship: Hours Quantity of Fish in Kg 0 0 1 10 2 18 3 24 4 28 5 30 a. What is the MP of each hour spent fishing? b. Draw the fisher’s production function and explain your result. c. The fisher has a fixed cost of $10. The opportunity cost of fisher's time is $5/hr. Draw the fisher’s total cost curve. a. The following table shows the MP of each hour spent fishing: Hours Fish Fixed Cost 0 1 2 3 4 5 0 10 18 24 28 30 $10 10 10 10 10 10 Variable Cost $0 5 10 15 20 25 Total Cost $10 15 20 25 30 25 Marginal Product --10 8 6 4 2 b. The production function becomes flatter as the number of hours spent fishing increases, illustrating diminishing marginal product. c. The fisherman's total-cost curve slopes up because catching additional fish takes additional time. The curve is convex because there are diminishing returns to fishing timeeach additional hour spent fishing yields fewer additional fish. (Note however that the derivation of the cost function is complicated in this case. If the cost is $5 per unit of production, then C = 10 + 5Q). 3. (easy) Bob’s lawn-mowing service is a profit maximizing competitive firm. His mows lawns for $ 27 each. His total cost each day is $280, of which $30 is a fixed cost. He mows 10 lawns a day. What can you say about his short-run decision regarding shut down and long run decision on exit? Since fixed cost is $30, average variable cost is ($280 - $30)/10 = $25, which is less than price, so Bob won’t shut down in the short run. Bob can cover more than the variable cost of production by staying in the business. However in the long run, Bob should exit the industry since his average total cost is $280/10 = $28 is greater than the price. 4. (very hard) Suppose that the Canadian Textile Industry is competitive, and there is no international trade in textile. In long-run equilibrium, the price per unit of cloth is $30. a. Describe the equilibrium using graphs for the entire market and for an individual producer. Now suppose that textile producers in other countries are willing to sell large quantities of cloth in Canada for only $25 per unit. b. Assuming that Canadian textile producers have large fixed costs, what is the short-run effect of these imports on the quantity produced by an individual producer and on profits? Explain with graph(s). c. What is the long-run effect on the number of Canadian firms in the industry? a. With no international trade, the market is in long-run equilibrium. Supply intersects demand at quantity Q1 and price $30, with a typical firm producing output q1. b. The effect of imports at $25 is that the market supply curve follows the old supply curve up to a price of $25, then becomes horizontal at that price. As a result, demand exceeds domestic supply, so the country imports textiles from other countries. The typical domestic firm now reduces its output from q1 to q2, incurring losses, since the large fixed costs imply that average total cost will be much higher than the price. c. In the long run, domestic firms will be unable to compete with foreign firms because their costs are too high. All the domestic firms will exit the industry and other countries will supply enough to satisfy the entire domestic demand. 5. (hard) Assume that the gold-mining industry is competitive. a. Illustrate a long-run equilibrium using diagrams for the gold market and for the representative gold mine. b. Suppose that an increase in jewelry demand induces a large surge in the demand for gold. Using your diagrams, show what happens in the short run to the gold market and to each gold mine? c. If the demand for gold remains high, what would happen to price over time (i.e., in long run)? (This question is for your practice) 6. (moderate) The Best Computer Company just developed a new computer chip on which it acquires a patent. a. Draw a diagram that shows the CS and PS in the market for this chip. b. What happens to CS and PS and the total surplus if the firm can perfectly price discriminate? a. The patent gives the company a monopoly, as shown in figure below. At a quantity of QM and price of PM, consumer surplus is area A + B, producer surplus is area C + D, and total surplus is area A + B + C + D. b. If the firm can perfectly price discriminate, it will produce quantity QC and extract all the consumer surplus. Consumer surplus is zero and producer surplus is A + B + C + D + E, as is total surplus. Deadweight loss is reduced from area E to zero. There is a transfer of surplus from consumers to producers of area A + B. 7. (easy) Larry, Curly and Moe run a only drink store in town. Larry wants to sell as many drinks as possible without losing money. Curly wants to maximize revenue and Moe wants to maximize profits. Using a single diagram of the store’s demand and cost curves, show the price and quantity combinations favored by each of these partners. Larry wants to sell as many drinks as possible without losing money, so he wants to set quantity where price (demand) equals average cost, which occurs at quantity QL and price PL. Curly wants to bring in as much revenue as possible, which occurs where marginal revenue equals zero, at quantity QC and price PC. Moe wants to maximize profits, which occurs where marginal cost equals marginal revenue, at quantity QM and price PM. 8. (easy) A small town is served by many competing supermarkets, each of which has a constant MC. a. Using a diagram of the market for groceries, show PS and CS. b. Now suppose that all of these supermarkets combine into one giant superstore. Use a new diagram to show new PS and CS. Relative to your answers in (a) what happens to PS and CS and the total surplus? (This question is for your practice) 9. (moderate) Consider a trade relation between Canada and Mexico with the following payoffs. Mexico’s Decision Low Tariff High Tariff Canada’s Decision Low Tariffs High Tariffs 25, 25 10, 30 30, 10 20,20 a. What is the dominant strategy for Canada? For Mexico? Explain. b. Find the Nash equilibrium of the above game. c. If Mexico moves first, what is the equilibrium outcome? a. If Mexico imposes low tariffs, then Canada is better off with high tariffs, since it gets $30 billion with high tariffs and only $25 billion with low tariffs. If Mexico imposes high tariffs, then also Canada is better off with high tariffs, since it gets $20 billion with high tariffs and only $10 billion with low tariffs. So Canada’s dominant strategy is: high tariffs. Similarly, if Canada imposes low tariffs, then Mexico is better off with high tariffs, since it gets $30 billion with high tariffs and only $25 billion with low tariffs. If Canada imposes high tariffs, then Mexico is better off with high tariffs, since it gets $20 billion with high tariffs and only $10 billion with low tariffs. So Mexico’s dominant strategy is also high tariffs. b. Since both countries dominant strategy is high tariff, (High Tariff, High Tariff) is the Nash equilibrium of this trade game. 10. (moderate) Suppose each of the two airline companies (Air Canada and West Jet) can charge either high or low price for its tickets. If one airline charges $100, it earns low profits provided the other airline also charges $100 but earns higher profits if the other airline charges $200. On the other hand, if the airline charges $200, it earns very low profits if the other airline charges $100, and the medium profits if the other company charges $200 also. a. Draw the decision box of the game (payoff matrix). b. What is the Nash equilibrium in this game? c. Is there an outcome that would be better than the Nash equilibrium? a. The decision box for this game is: West Jet Air Canada b. $100 $200 $100 Low, Low Very Low, High $200 High, Very Low Medium, Medium If West Jet sets $100, Air Canada will set $100. If West Jet sets $200, Air Canada will set $100. So no matter what West Jet does, the best strategy for Air Canada is to set $100, and so its dominant strategy is to set $100. For a similar reason, West Jet’s dominant strategy is to set $100. Since both have a dominant strategy to set $100, the Nash equilibrium is for both to set $100. c. A better outcome than the Nash equilibrium would be for both airlines to set $200; then they would both get higher profits. But that outcome could only be achieved by cooperation (collusion). If that happened, consumers would lose because prices would be higher and quantity would be lower. 13. Assume the following profile for three consumers and one firm selling both Widgets and Gadgets where MC=2 for each item. Bart Lisa Homer Widgets 5 3 1 Reservation prices Gadgets 1.5 3 4.5 a. If the firm chooses the strategy of pure bundling, what should be the profit-maximizing price of the bundle? b. Calculate the maximum profits under pure bundling strategy. (for your practice)