Introduction - JurisImprudence

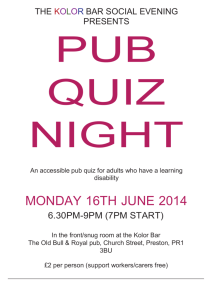

advertisement

Page 1 LEXSTAT 9-171 BANKING LAW § 171.02 Banking Law Copyright 2009, Matthew Bender & Company, Inc., a member of the LexisNexis Group. CHAPTER 171 Application Process 9-171 Banking Law § 171.02 § 171.02 Introduction Consumer credit application process subject to federal statutes and rules and state statutes; objectives of rules and statutes are to insure full disclosure of credit terms, prevent credit application discouragement of protected classes, and prevent eliciting of information to be used for discriminatory purposes; Truth in Lending, Fair Credit Reporting, Equal Credit Opportunity, and Fair Housing Acts apply to consumer credit application process The consumer credit application process is subject to several federal statutes and federal regulatory agency rules and regulations. In addition, state and local statutes afford protection to consumers against discriminatory application procedures.n1 Federal regulations affecting the consumer credit application process have one of three principal objectives: (1) to assure the timely, full and accurate disclosure of credit terms, and the costs associated with the credit transaction; (2) to prevent the discouragement of credit applications made by protected classes of citizens; and (3) to prevent the eliciting of information from an applicant that is not relevant to his creditworthiness, and may be used for unlawful discriminatory purposes. The principal federal statutes and regulations affecting the consumer credit application process are: Statutes (1) The Truth in Lending Act;n2 (2) The Equal Credit Opportunity Act;n3 (3) The Fair Credit Reporting Act;n4 Page 2 9-171 Banking Law § 171.02 (4) The Fair Housing Act;n5 (5) The Real Estate Settlement Procedures Act.n6 Regulations (1) Federal Reserve Board Regulation Z to the Truth in Lending Act;n7 (2) Federal Reserve Board Regulation B to the Equal Credit Opportunity Act;n8 (3) Regulations concerning nondiscrimination in real estate lending issued by the Department of Housing and Urban Development, Office of Thrift Supervision, Federal Deposit Insurance Corporation, Comptroller of the Currency, and National Credit Union Administration;n9 (4) Department of Housing and Urban Development Regulation X to the Real Estate Settlement Procedures Act.n10 Legal Topics: For related research and practice materials, see the following legal topics: Banking LawConsumer ProtectionGeneral Overview FOOTNOTES: (n1)Footnote 1. See, e.g., Ohio Rev. Code § 4112.021(B)(1)(a), that makes it an unlawful discriminatory practice to grant, withhold, extend or renew credit, or fix the rates, terms or conditions of any form of credit on the basis of race, color, religion, sex, ancestry, handicap or national origin. Moreover, Ohio Rev. Code § 4112.02(H)(8) prohibits the making of any inquiry, eliciting any information, making or keeping any record, or using any form of application which contains questions or entries concerning race, color, religion, sex, ancestry or national origin in connection with the loan of any money, secured or not, for the acquisition, construction, rehabilitation, repair or maintenance of housing. (n2)Footnote 2. Pub. L. No. 90-321, 82 Stat. 146 (1968), as amended by Pub. L. No. 93-495, 88 Stat. 1521 (1974), Pub. L. No. 94-240, 90 Stat. 257 (1976), Pub. L. No. 96-221, 94 Stat. 132 (1980), Pub. L. No. 100-533, 102 Stat. 2689 (1988), and Pub. L. No. 100-709, 102 Stat. 4725 (1988), 15 U.S.C. §§ 1601 et seq. (n3)Footnote 3. Pub. L. No. 93-495, 88 Stat. 1521 (1974), as amended by Pub. L. No. 94-239, 90 Stat. 251 (1976), 15 U.S.C. §§ 1691-1691f. (n4)Footnote 4. Pub. L. No. 91-508, 84 Stat. 1114 (1970), 15 U.S.C. §§ 1681-1681t. (n5)Footnote 5. Pub. L. No. 90-284, 82 Stat. 73 (1968), 42 U.S.C. §§ 3601-3619, 3631. (n6)Footnote 6. Pub. L. No. 93-533 (1974), as amended by Pub. L. No. 94-205, 89 Stat. 1157 (1976), and Pub. L. No. 98-181, 97 Stat. 1153 (1983), 12 U.S.C. § 2601 et seq. (n7)Footnote 7. 12 C.F.R. Pt. 226. (n8)Footnote 8. 12 C.F.R. Pt. 202, as amended Dec. 16, 1985, with compliance mandatory on Oct. 1, 1986. Page 3 9-171 Banking Law § 171.02 (n9)Footnote 9. 24 C.F.R. pts. 100-200 (Department of Housing and Urban Development); 12 C.F.R. Pt. 528 and § 571.24 (Office of Thrift Supervision); 12 C.F.R. Pt. 338 (Federal Deposit Insurance Corporation); 12 C.F.R. Pt. 27 (Comptroller of the Currency); and 12 C.F.R. § 701.31 (National Credit Union Administration). (n10)Footnote 10. 24 C.F.R. § 3500 et seq.